Digital Risk Protection Market Share, Size, Trends, Industry Analysis Report, By Offering (Solution and Services); By Solution Type; By Security Type; By Organization Size; By Deployment Mode; By Vertical; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4748

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

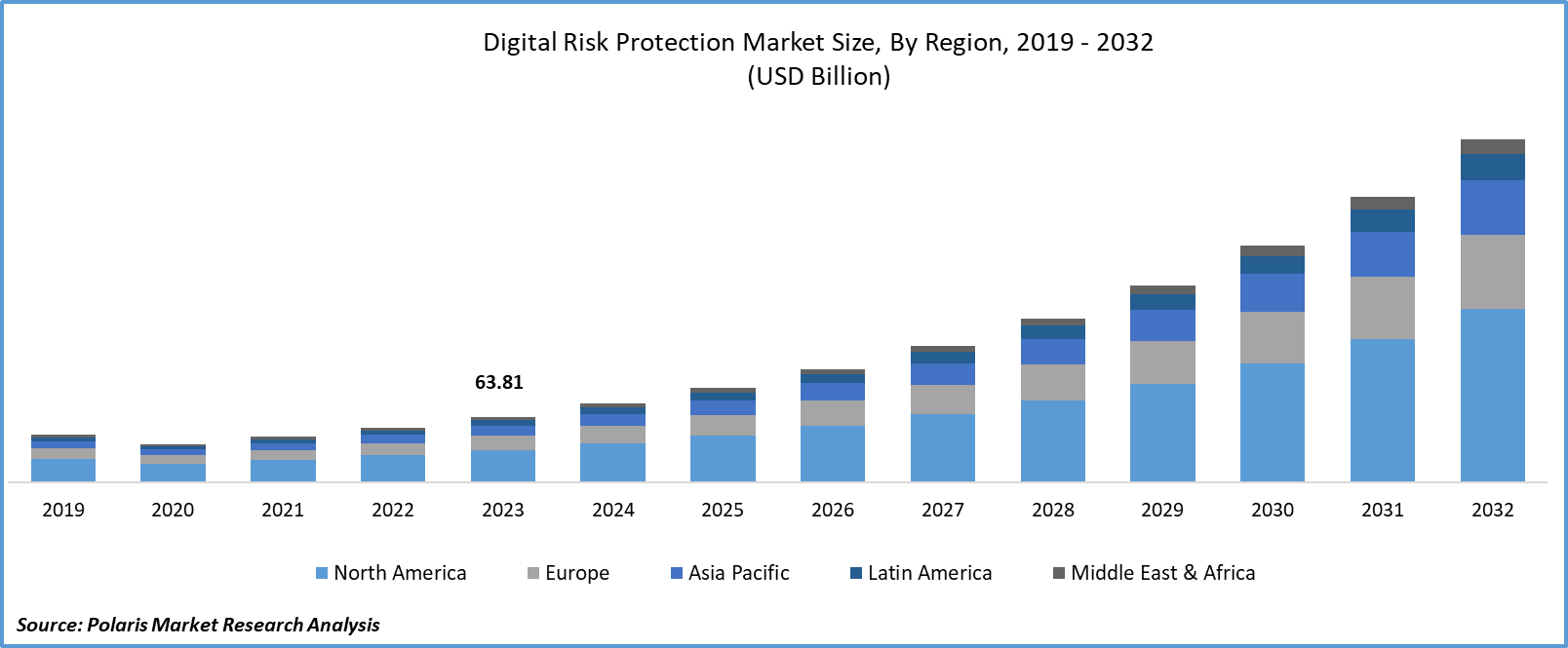

Global digital risk protection market size was valued at USD 63.81 billion in 2023. The market is anticipated to grow from USD 76.57 billion in 2024 to USD 333.44 billion by 2032, exhibiting the CAGR of 20.2% during the forecast period.

Industry Trend

The digital risk protection platform market highlights the growing trend of businesses expanding their online presence through websites and intellectual property storage. Additionally, the market is witnessing a significant shift driven by the implementation of advanced multi-layered security systems. Digital risk protection solutions play a crucial role in safeguarding digital transformations against cyber threats and data breaches. Unlike conventional cybersecurity strategies, these solutions adopt a proactive approach by addressing the dimensions and origins of potential threats.

The digital risk stems from unforeseen consequences, often manifested as cyber threats that necessitate proactive prevention measures. Digital risk protection software is tasked with a range of functions, including cybersecurity, cloud technology management, data leak prevention, compliance enforcement, resilience enhancement, process automation, and data security. The escalating incidence of cyberattacks, including database breaches and social media threats, is compelling both individuals and corporations to prioritize the adoption of digital risk protection services.

To Understand More About this Research: Request a Free Sample Report

In response to the heightened threat landscape, businesses are making substantial investments to fortify their defenses against cyberattacks. This entails the deployment of advanced digital risk protection platforms aimed at maximizing security and bolstering the protection of business and customer data. The increasing reliance on cloud-based services across various domains, such as enterprise resource planning, data backups, customer relationship management, collaboration, and email services, has further underscored the need for robust digital risk protection measures. As a result, the adoption of digital risk protection software is on the rise to mitigate the impact of cyber threats on critical cloud-based services and drive the digital risk protection market.

The collaboration landscape in the digital risk protection market is characterized by increasing partnerships and alliances among organizations aiming to enhance cybersecurity measures and mitigate digital risks collectively. As businesses face ever-evolving cyber threats such as data breaches, phishing attacks, and brand impersonation, collaboration has become essential for comprehensive risk management. Key players in the market are introducing innovative security software platforms, contributing significantly to the growth of the Digital Risk Protection (DRP) market. These platforms are designed to effectively manage and mitigate digital risks, safeguarding organizations from various cyber threats and vulnerabilities. The introduction of new and advanced security software platforms serves as a driving force for the expansion of the digital risk protection market.

For instance, in February 2024, G2 introduced a novel category known as Digital Risk Protection (DRP) Platforms, positioned within the overarching parent category of System Security Software. This specific category is designed to encompass products that assist organizations in securing their digital assets against external threats, extending beyond the traditional boundaries of their security perimeter.

In response to the heightened threat landscape, businesses are making substantial investments to fortify their defenses against cyberattacks. This entails the deployment of advanced digital risk protection platforms aimed at maximizing security and bolstering the protection of business and customer data. The increasing reliance on cloud-based services across various domains, such as enterprise resource planning, data backups, customer relationship management, collaboration, and email services, has further underscored the need for robust digital risk protection measures. As a result, the adoption of digital risk protection software is on the rise to mitigate the impact of cyber threats on critical cloud-based services

Key Takeaway

- North America dominated the largest market and contributed to more than 36% of share in 2023.

- Asia Pacific region projected to grow at fastest growing CAGR during the forecast period.

- By Offering category, service segment accounted for the largest market share in 2023.

- By vertical category, the BSFI segment is projected to grow at fastest CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Digital Risk Protection Market?

Increasing Cybersecurity Threats

The increasing cybersecurity threats serve as a significant growth driver for the Digital Risk Protection (DRP) market. The evolving nature of cyber threats, including sophisticated malware, phishing attacks, and ransomware, poses a constant challenge to organizations. As cyber threats become more advanced and diverse, there is a growing need for robust DRP solutions that can effectively identify, monitor, and mitigate these risks.

Data breaches involving unauthorized access to sensitive information are becoming more prevalent and severe. Exposure to personal data, trade secrets, financial information, and intellectual property can lead to substantial financial losses, reputational damage, and legal liabilities for organizations. DRP solutions become crucial in preventing, detecting, and responding to data breaches.

Phishing attacks, leveraging deceptive tactics to trick individuals into divulging sensitive information, are widespread. Social engineering techniques continue to evolve, making it challenging for organizations to defend against such threats. DRP solutions play a crucial role in identifying and mitigating phishing attacks to protect individuals and organizations from identity theft and unauthorized access. With the growing reliance on digital platforms and cloud services, organizations expand their attack surface. The broader attack surface increases the likelihood of cyber threats, making it essential for organizations to implement comprehensive DRP strategies to safeguard their digital assets.

Which Factor Is Restraining the Demand for Digital Risk Protection?

The Perceived Complexity and Cost Associated with Their Implementation and Maintenance

The inherent complexity of DRP solutions may result in usability issues, posing difficulties for organizations to harness the capabilities of these technologies fully. This can lead to underutilization or improper configuration of DRP solutions, potentially compromising their effectiveness in mitigating cyber risks. Furthermore, certain organizations may view DRP solutions as non-essential investments or prioritize alternative cybersecurity initiatives over digital risk protection. This perspective may arise from a need for more awareness regarding the significance of digital risk protection or a misconception that existing cybersecurity measures suffice to address all cyber threats, impacting the adoption of DRP solutions in the market.

Moreover, as a constraint for the digital risk protection market, the implementation and management of DRP solutions often demand substantial investments in both financial resources and skilled personnel. Organizations may encounter challenges in comprehending the intricacies of diverse DRP technologies and effectively integrating them into their existing IT infrastructure. Additionally, the ongoing maintenance and updates required to align DRP solutions with evolving cyber threats can be resource-intensive and time-consuming.

Report Segmentation

The market is primarily segmented based on offering, solution type, security type, organization size, deployment mode, vertical, and region.

|

By Offering |

By Solution Type |

By Security Type |

By Organization Size |

By Deployment Mode |

By Vertical |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Offering Insights

Based on offering analysis, the market is segmented into solutions and services. The service segment held the largest market share in 2023. Organizations often require tailored solutions to address their unique cybersecurity needs. Service providers offer customization services to adapt DRP solutions to the specific requirements of each client. This customization may include configuring software, integrating with existing systems, and providing training to employees. Many organizations need more expertise and resources to develop and implement comprehensive DRP strategies on their own.

Service providers offer consulting and advisory services to help clients assess their digital risk exposure, develop risk management strategies, and select appropriate DRP solutions. Outsourcing DRP functions to managed security service providers (MSSPs) allows organizations to access specialized expertise and resources without the need for in-house investment. Managed services may include continuous monitoring, threat detection and response, incident management, and compliance reporting. MSSPs leverage advanced technologies and threat intelligence to identify and mitigate digital risks proactively, providing organizations with greater peace of mind and operational efficiency.

By Vertical Insights

Based on vertical analysis, the market has been segmented on the basis of BFSI, IT & ITeS, government, healthcare, retail and e-commerce, media and entertainment, and other verticals. The BFSI segment is expected to witness the fastest-growing CAGR during the forecast period. The BFSI sector is undergoing significant digital transformation, with banks, financial institutions, and insurance companies increasingly adopting digital technologies to enhance customer experiences, streamline operations, and improve efficiency. This digitalization trend is driving the adoption of digital risk protection solutions to safeguard sensitive financial data, transactions, and customer information from cyber threats.

The BFSI sector is a prime target for cybercriminals due to the high value of financial assets and sensitive information held by banks, financial institutions, and insurance companies. With the growing sophistication and frequency of cyber threats such as data breaches, phishing attacks, ransomware, and fraud, there is a heightened need for robust digital risk protection measures within the BFSI sector to mitigate these risks and protect against financial losses, reputational damage, and regulatory penalties.

Regional Insights

North America

North America accounted for the largest market share in 2023 due to experiencing a significant increase in cyber threats, including data breaches, ransomware attacks, phishing scams, and insider threats. These cyber-threats pose a significant risk to organizations across various industries, driving the demand for robust digital risk protection solutions to safeguard sensitive data, intellectual property, and customer information.

North America is home to stringent data protection and privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States. These regulations impose legal obligations on organizations to protect the privacy and security of personal data, driving the adoption of digital risk protection solutions to ensure compliance and avoid regulatory penalties. North America is home to some of the world's largest and most technologically advanced organizations across various sectors, including finance, healthcare, retail, and technology. These organizations are prime targets for cybercriminals due to the high value of their assets and sensitive information. As a result, there is a heightened focus on cybersecurity and risk management, due to increased investments in digital risk protection solutions.

Asia Pacific

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. The Asia Pacific region is undergoing rapid digital transformation across various industries, driven by factors such as increasing internet penetration, smartphone adoption, and government initiatives to promote digitalization. As organizations in the region embrace digital technologies to enhance operational efficiency, improve customer experiences, and drive innovation, there is a growing need to protect digital assets and sensitive information from cyber threats through the adoption of digital risk protection solutions.

The region's expanding digital footprint and interconnectedness make it a lucrative target for cybercriminals seeking to exploit vulnerabilities in organizations' cybersecurity defenses. This heightened cybersecurity threat landscape is driving the demand for advanced digital risk protection solutions to mitigate risks and safeguard critical digital assets. Organizations are required to comply with these regulations, such as the Personal Data Protection Act (PDPA) in Singapore and the Personal Information Protection Law (PIPL) in China, by implementing robust digital risk protection measures to ensure the security and privacy of personal data. This regulatory compliance requirement is driving the adoption of digital risk protection solutions in the region.

Competitive Landscape

The digital risk protection market demonstrates fragmentation, characterized by competition from numerous players. Key service providers in this sector consistently improve their technologies to stay ahead, focusing on efficiency, reliability, and security. To achieve a significant market presence, these companies highlight the importance of strategic partnerships, continual product improvements, and collaborative efforts to outperform industry rivals.

Some of the major players operating in the global market include:

- BrandShield

- Broadcom

- Cisco

- Cofense

- CrowdStrike

- CybelAngel

- CyberArk

- CyberInt

- Darktrace

- Digital Shadows

- Exabeam

- Forcepoint

- Fortinet

- Kaspersky

- Microsoft

- Palo Alto Networks

- PhishLabs

- Proofpoint

- Rapid7

- RSA Security

- SafeGuard Cyber

- ZeroFOX

Recent Developments

- In February 2024, Rapid7, Inc., a prominent company in threat and comprehensive risk detection, introduced a new Managed Digital Risk Protection (DRP) service. This service enhances external threat monitoring and remediation, preventing attacks earlier in the threat life cycle, to bolster visibility and response capabilities across both attack surfaces.

- In July 2022, Bolster, Inc., the automated digital risk protection company, introduced four new platform modules for Digital Risk Protection Capabilities: social media, app store, marketplace, and dark web monitoring. With these enhancements, Bolster becomes the pioneer in providing a comprehensive digital risk protection solution within a single platform.

Report Coverage

The digital risk protection report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offering, solution type, security type, organization size, deployment mode, vertical and their futuristic growth opportunities.

Digital Risk Protection Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 76.57 billion |

|

Revenue forecast in 2032 |

USD 333.44 billion |

|

CAGR |

20.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Offering, By Solution Type, By Security Type, By Organization Size, By Deployment Mode, By Vertical and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Digital Risk Protection Market are BrandShield, Broadcom, Cisco, Cofense, CrowdStrike, CybelAngel, CyberArk, CyberInt, Darktrace

Digital risk protection market exhibiting the CAGR of 10.2% % during the forecast period.

The Digital Risk Protection Market report covering key segments are offering, solution type, security type, organization size, deployment mode, vertical and region.

key driving factors in Digital Risk Protection Market are increasing cybersecurity threats

Digital Risk Protection Market Size Worth $333.44 Billion By 2032