Digital Radiography Market Size, Share, Trends, Industry Analysis Report: By Product, Type (Retrofit Digital System and New Digital System), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5314

- Base Year: 2024

- Historical Data: 2020-2023

Digital Radiography Market Overview

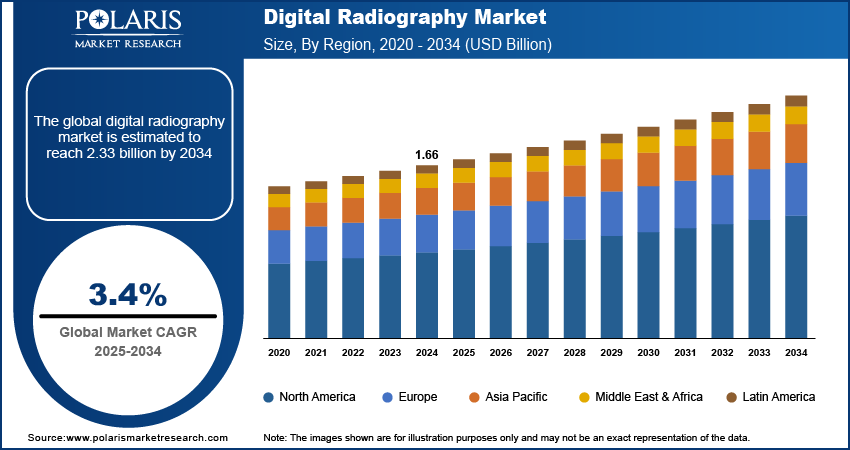

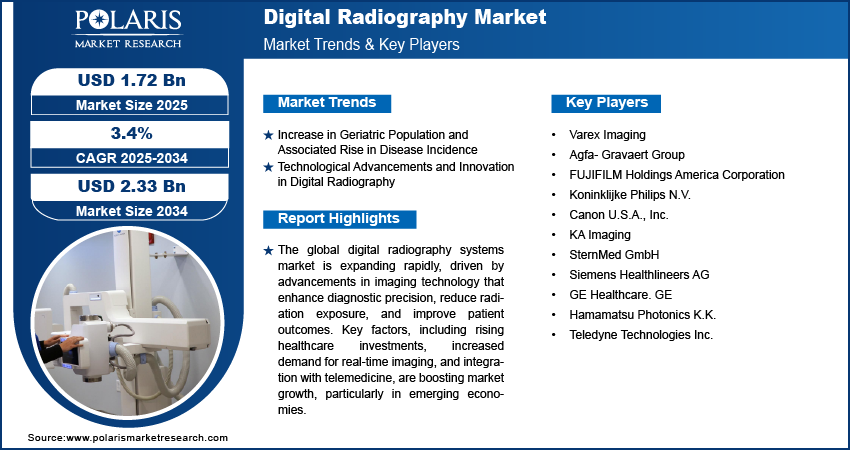

The digital radiography market size was valued at USD 1.66 billion in 2024. It is projected to grow from USD 1.72 billion in 2025 to USD 2.33 billion by 2034, exhibiting a CAGR of 3.4% during the forecast period.

Digital radiography is an advanced imaging technique that captures X-ray images directly in digital form using electronic sensors instead of traditional film. This technology allows faster image processing, improved image quality, and reduced radiation exposure for patients, making it widely used in medical diagnostics.

The digital radiography market is experiencing rapid expansion, driven by continuous advancements in imaging technology that enhance diagnostic accuracy and improve patient outcomes. The increasing need for advanced and efficient diagnostic workflows in clinical environments is boosting the adoption of digital radiography systems, which offer real-time image acquisition, analysis, and seamless distribution across healthcare networks. Key benefits of digital radiography, such as lower radiation exposure, superior image resolution, and compatibility with existing digital health infrastructures, have made it essential for remote consultations and telemedicine, particularly in settings where patient access to specialized care is limited.

To Understand More About this Research: Request a Free Sample Report

Governmental initiatives and rising healthcare investments, especially in emerging economies, are accelerating the implementation of digital radiology technologies in hospitals, outpatient clinics, and imaging centers. The competitive landscape of the digital radiography market remains extreme as leading manufacturers focus on innovation, forge strategic partnerships, and deepen their regional insights to improve their global market presence. For instance, in June 2024, FUJIFILM India’s Healthcare Division, in partnership with NM Medical Mumbai, launched its Fujifilm Skill Lab. This facility is dedicated to providing specialized training in full-field digital mammography (FFDM) technology for radiologists and radiographers, aiming to advance skills in diagnostic imaging. These developments collectively highlight the dynamic digital radiography market growth.

Digital Radiography Market Dynamics

Increase in Geriatric Population and Associated Rise in Disease Incidence

The rising geriatric population is a significant driver for the digital radiography market due to the boosted exposure of older adults to chronic conditions, such as osteoporosis, cancer, and cardiovascular diseases. The 2023 report from the American Cancer Society reveals that the United States is expected to see 1,958,310 new cancer cases and 609,820 cancer-related deaths, underscoring the urgent need for improved diagnostic imaging methods in this population. Additionally, the ACS projects that men aged 65 and older will experience the most significant rise in cancer-related deaths by 2050, with an estimated increase of 117% in this age group.

These diseases necessitate frequent diagnostic imaging and the positioning of advanced radiography systems as critical tools in clinical practice. The increasing majority of age-related health issues have increased the demand for imaging solutions that are both efficient and accurate, capabilities that digital radiography systems deliver through high-resolution imaging combined with reduced radiation exposure.

Technological Advancements and Innovation in Digital Radiography

Technological advancements in the digital radiography market, particularly in image resolution, portability, and the integration of artificial intelligence, are improving diagnostic precision and operational efficiency. For instance, in November 2023, Carestream Health launched cost effective HORIZON X-ray System, which delivers high fidelity imaging to optimize clinical results. This system is designed with user-friendly functionalities to improve productivity. It is particularly targeted at small to midsize imaging centers, orthopedic facilities, urgent care centers, and hospitals, addressing the need for budget friendly and reliable imaging solutions. These technological innovations are improving patient outcomes and enabling broader adoption in various healthcare settings, such as hospitals, outpatient clinics, and diagnostic centers. Furthermore, the evolution of image processing software and the capability for real-time remote diagnostics are boosting the telemedicine sector, thus expanding the overall digital radiography market landscape.

Digital Radiography Market Segment Insights

Digital Radiography Market Assessment by Product Outlook

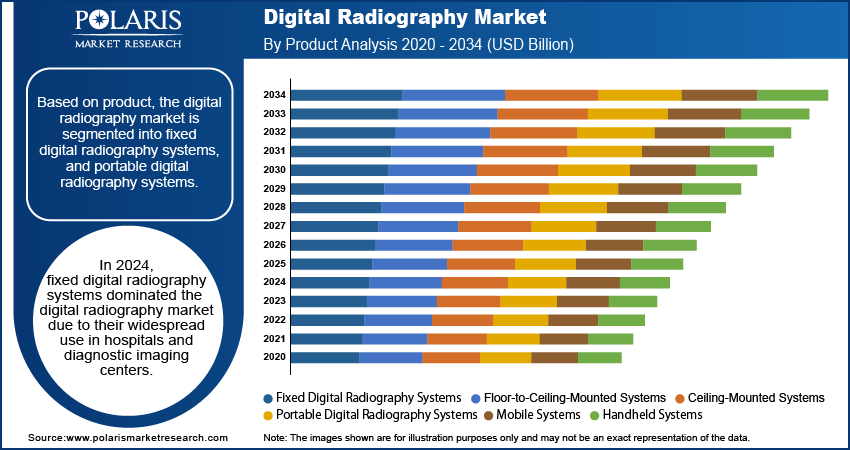

The global digital radiography market segmentation, based on product, includes fixed digital radiography systems and portable digital radiography systems. Fixed digital radiography systems are further bifurcated into floor-to-ceiling-mounted systems and ceiling-mounted systems. Additionally, portable digital radiography systems are further sub-segmented into mobile systems and handheld systems. In 2024, fixed digital radiography systems sector dominated the market due to their widespread use in hospitals and diagnostic imaging centers. These systems offer high image quality, durability, and reliability, making them ideal for routine imaging procedures. Additionally, fixed systems are known for their advanced features, such as better image resolution and reduced radiation doses, which contribute to more accurate diagnostics. The increased demand for reliable and efficient imaging systems in clinical settings, along with their ability to handle a higher volume of patients, further drives the preference for fixed digital radiography systems. As healthcare institutions prioritize technological advancements and cost-efficiency, fixed systems continue to lead the market.

Digital Radiography Market Assessment by Application Outlook

The global digital radiography market segmentation, based on application, includes chest imaging, cardiovascular imaging, orthopedic imaging, pediatric imaging, and other applications. Chest imaging is projected to grow with a strong CAGR during the forecast period due to the increasing prevalence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD) and lung cancer. The rising incidence of these conditions, coupled with technological advancements in digital radiography that enhance diagnostic accuracy and speed, is driving digital radiography market demand for chest imaging. Additionally, the growing adoption of early screening programs and telemedicine in pulmonology supports this trend, allowing for faster diagnosis and treatment planning. As healthcare systems prioritize early detection and improved patient outcomes, the chest imaging segment is expected to expand significantly.

Digital Radiography Market Regional Outlook

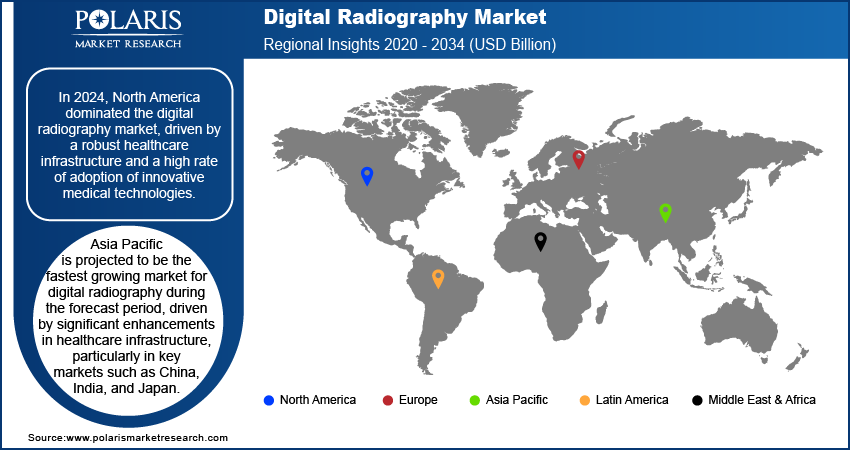

By region, the study provides digital radiography market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market, driven by a robust healthcare infrastructure and a high rate of adoption of innovative medical technologies. In North America, the US accounts for the highest market share due to its comprehensive healthcare policies and a dense network of hospitals and imaging facilities, creating a substantial market demand for advanced diagnostic solutions.

The region's emphasis on early disease detection and precision medicine has further accelerated the integration of digital radiography technologies. Moreover, government initiatives and strategic investments focused on enhancing healthcare accessibility have also played a vital role in driving market expansion. Additionally, increasing awareness regarding the advantages of digital imaging modalities continues to support this upward trajectory in the market. For instance, in July 2022, Fujifilm launched a hybrid C-arm and portable X-ray solution in the US, designed specifically for hospitals. This dual-function system is the world’s first two-in-one to combine fluoroscopic and radiographic imaging into one platform, eliminating the need for separate imaging devices for critical image-guided procedures.

Asia Pacific is projected to be the fastest growing market for digital radiography during the forecast period, driven by significant enhancements in healthcare infrastructure, particularly in key markets such as China, India, and Japan. The growing need for advanced diagnostic tools is due to the increase in chronic diseases and the aging population, which are major reasons why digital radiography systems are becoming more widely used. Furthermore, increased healthcare investments and proactive government initiatives aimed at enhancing healthcare accessibility are enabling market expansion.

For instance, in July 2024, Siemens Healthineers announced the local manufacturing of its Multix Impact E digital radiography X-ray machine in India, improving healthcare access, particularly for diagnosing diseases such as tuberculosis and chronic obstructive pulmonary disease (COPD) in low-resource settings, while ensuring patient safety with low-dose radiation. The rise in medical tourism and the demand for efficient, cost-effective diagnostic solutions are boosting digital radiography adoption in Asia Pacific. Additionally, ongoing urbanization and the need for improved healthcare in rural areas are further driving digital radiography market growth.

Digital Radiography Market – Key Players and Competitive Insights

The competitive landscape of the digital radiography industry is shaped by both global leaders and regional players competing for market share through continuous innovation, strategic partnerships, and regional expansion. Leading companies in digital radiography, such as Koninklijke Philips N.V.; Canon U.S.A., Inc.; and others, leverage strong R&D capabilities and extensive distribution networks to deliver advanced imaging solutions tailored to the needs of healthcare providers and diagnostic centers. These key players focus on enhancing image quality, reducing radiation dose, and improving workflow efficiency to address the demands of sectors such as hospitals, clinics, and diagnostic imaging centers. In contrast, smaller regional firms are cutting out places by offering specialized digital radiography products, often customized for local healthcare requirements. Competitive strategies in this market include mergers and acquisitions, collaborations with technology providers, and the expansion of product portfolios, which strengthen market presence across diverse geographical regions and drive adoption in the fast-evolving digital radiography industry. A few key major players are Varex Imaging; Agfa-Gevaert Group; FUJIFILM Holdings America Corporation; Koninklijke Philips N.V.; Canon U.S.A., Inc.; KA Imaging; SternMed GmbH; Siemens Healthineers AG; GE Healthcare; Hamamatsu Photonics K.K.; Teledyne Technologies Inc.

GE Healthcare is a subsidiary of GE founded in 1994, head quartered in the US. The company operates in four major segments: healthcare, aviation, energy, and power. The company is one of the major industrial companies. The company offers solutions across more than 170 countries. The company has manufacturing and services operations located across 94 countries, particularly in the US, and around 190 manufacturing plants based out in 37 countries. The healthcare segment offers biopharmaceutical manufacturing technologies, patient monitoring and diagnostics, digital solutions, drug discovery, performance enhancement solutions, and medical imaging.

Koninklijke Philips N.V., commonly recognized as Philips, is a company that operates in various industries, including healthcare technology, consumer electronics, and lighting. It provides medical equipment, software, and services in healthcare, including imaging systems, patient monitoring systems, and clinical informatics solutions. The company provides a range of other medical imaging and diagnostic solutions, including ultrasound systems, MRI scanners, CT scanners, and nuclear medicine systems. Philips operates in more than 100 countries worldwide.

Key Companies in Digital Radiography Market

- Varex Imaging

- Agfa- Gravaert Group

- FUJIFILM Holdings America Corporation

- Koninklijke Philips N.V.

- Canon U.S.A., Inc.

- KA Imaging

- SternMed GmbH

- Siemens Healthlineers AG

- GE Healthcare. GE

- Hamamatsu Photonics K.K.

- Teledyne Technologies Inc.

Digital Radiography Market Developments

May 2024: Carestream launched its Image Suite MR 10 Software to boost productivity and streamline workflows in radiographic imaging. This software upgrade supports both Computed Radiography (CR) and Digital Radiography (DR) systems. It features an intuitive interface, enhanced measurement tools, and optional Mini-PACS integration for more efficient diagnostic processes in clinical settings.

July 2022: Canon Inc. launched its CXDI-Pro series of wireless digital radiography (DR) devices, including the CXDI-703C Wireless sensor, for markets outside Japan. These devices are tailored to various medical applications, enhancing imaging capabilities in healthcare facilities.

Digital Radiography Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Fixed Digital Radiography Systems

- Floor-to-Ceiling-Mounted Systems

- Ceiling-Mounted Systems

- Portable Digital Radiography Systems

- Mobile Systems

- Handheld Systems

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Retrofit Digital System

- New Digital System

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Chest Imaging

- Cardiovascular Imaging

- Orthopedic Imaging

- Pediatric Imaging

- Other Applications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Diagnostic Imaging Centers

- Orthopedic Clinics

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Radiography Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.66 billion |

|

Market Size Value in 2025 |

USD 1.72 billion |

|

Revenue Forecast by 2034 |

USD 2.33 billion |

|

CAGR |

3.4% from 2024 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global digital radiography market size was valued at USD 1.66 billion in 2024 and is projected to grow to USD 2.33 billion by 2034.

The global market is projected to register a CAGR of 3.4% during the forecast period

In 2024, North America dominated the digital radiography market.

A few key players in the market are Varex Imaging; Agfa-Gevaert Group; FUJIFILM Holdings America Corporation; Koninklijke Philips N.V.; Canon U.S.A., Inc.; KA Imaging; SternMed GmbH; Siemens Healthineers AG; GE Healthcare; Hamamatsu Photonics K.K.; Teledyne Technologies Inc

Fixed digital radiography systems dominated the digital radiography market in 2024.

Chest imaging is projected to grow with a strong CAGR during the forecast period.