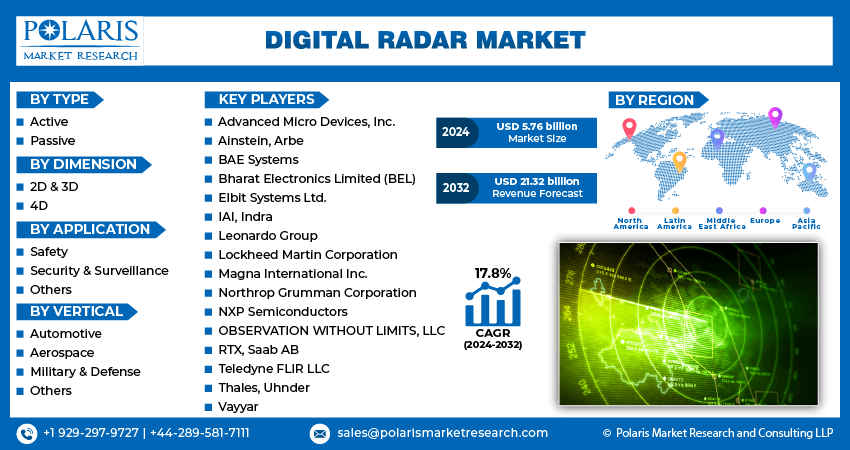

Digital Radar Market Size, Share, Trends, Industry Analysis Report: Information By Type (Active, Passive), By Dimension, By Application, By Vertical, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 120

- Format: PDF

- Report ID: PM5016

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Global digital radar market size was valued at USD 4.90 billion in 2023. The industry is projected to grow from USD 5.76 billion in 2024 to USD 21.32 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 17.8% during the forecast period (2024 - 2032).

Digital radar is an advanced radar system that utilizes digital signal processing (DSP) technology to enhance the detection, tracking, and imaging of objects. It converts received signals into digital data, which allows for more refined processing and analysis. The growth of the digital radar market is being fueled by increased security concerns across the country's borders. The geopolitical tensions and illegal activities such as smuggling, human trafficking, and unauthorized border crossings are increasing globally, which creates a threat to national security. For instance, in April 2024, U.S. Customs and Border Protection (CBP) reported 247,837 encounters across the country, with 179,725 occurring at the Southwest border (SWB). The data represents a 5% increase in Southwest border encounters compared to April 2021. Furthermore, nearly 2 million known gotaways have managed to evade U.S. Border Patrol. These increasing incidences of unauthorized border activities have created a need for highly efficient surveillance solutions. As a result, digital radar systems equipped with advanced detection capabilities and precision are essential for ensuring effective border security. These systems offer real-time data and high-resolution imaging, empowering effective monitoring and thereby fueling the growth of the digital radar market.

To Understand More About this Research:Request a Free Sample Report

Furthermore, the private sector investment in radar technology is driving the digital radar market. Companies from various industries, such as automotive, aerospace, and telecommunications, have recognized the advantages that advanced radar systems offer and have started investing in radar technologies. For instance, in March 2024, Telechips agreed to invest in Aura Intelligent Systems, a radar technology solution development firm based in Boston, USA. The strategic investment aimed to bolster Telechips' footprint in the advanced driver-assistance system and autonomous driving semiconductor market. These investments from the private sector are fueling research and development efforts, leading to innovations and enhancements in radar technology. Thus, the influx of private capital is accelerating technological advancements and expanding the digital radar market.

Digital Radar Market Trends

Technologically Advanced Product Launches are Driving the Market Growth

Innovations in digital radar technology, such as high-resolution imaging and integration with artificial intelligence, have resulted in precise, reliable, and versatile radar systems. The market players are introducing innovative radar solutions with the aforementioned technologies to meet the growing demand from diverse industries, including automotive and aerospace. For instance, Uhnder, a company specializing in digital imaging radar technology for automotive and next-generation mobility applications, launched a 4D Digital Imaging Radar designed for advanced driver assistance systems, autonomous vehicles, and automated mobility applications. These launches of technologically advanced products are generating significant interest and investment that accelerates the development and adoption of digital radar solutions. As a result, the growing technological product launches are propelling the sales of digital radar, thereby driving the growth of the market.

Growth of the Automotive Sector is Driving the Market Size

The automotive industry is growing across the globe due to an increase in vehicle sales that possesses advanced technologies. For instance, according to the Alliance for Automotive Innovation, the automotive ecosystem contributes over USD 1 trillion to the U.S. economy annually, accounting for 4.9% of the GDP. Additionally, in 2021, new vehicle sales reached 14.9 million units, generating USD 618 billion in revenue. This growth in the automotive sector is increasing the demand for advanced driver-assistance systems and self-driving cars. Thus, automakers are striving to enhance vehicle safety, efficiency, and user experience by integrating digital radar systems that provide critical functions such as adaptive cruise control, collision avoidance, lane-keeping assistance, and blind-spot detection. Therefore, the expansion of the automotive sector is directly fueling the growth of the digital radar market.

Digital Radar Market Segment Insights

Digital Radar Application Insights

The global digital radar market segmentation, based on application, includes safety, security & surveillance, and others. In 2023, the safety segment accounted for the largest revenue share in the digital radar market due to the increasing emphasis on safety features in various industries, particularly automotive and aerospace. In the automotive sector, the integration of radar-based safety systems is becoming standard practice because of stringent safety regulations and growing consumer demand for safer vehicles. Thus, mobility solution suppliers are developing and introducing innovative safety packages for use in vehicles. For instance, in January 2022, DENSO, a major player in the mobility industry, introduced Global Safety Package 3, an advanced active safety system focused on enhancing vehicle safety through high-sensitivity environmental awareness. The system harnesses the collective potential of a millimeter-wave radar sensor and a vision sensor to provide the driver with comprehensive support in safely operating the vehicle. Consequently, the heightened focus on safety across industries and advancements in radar technology contributed to the dominance of the safety segment in the global digital radar industry.

Digital Radar Vertical Insights

The global digital radar market segmentation, based on vertical, includes automotive, aerospace, military & defense, and others. The military & defense segment of the digital radar market is expected to grow with a significant CAGR due to the increased governmental spending on defense capabilities. Governments worldwide are investing substantial amounts of funds for operation, maintenance, and R&D activities. For instance, in the fiscal year 2021, the U.S. federal government allocated USD 307.7 billion of its national defense budget to operations and maintenance expenditures. These significant investments are enabling the development and deployment of advanced radar systems that enhance surveillance, target detection, and overall defense capabilities. Consequently, the military & defense segment is anticipated to grow significantly over the forecast period in the global digital radar market.

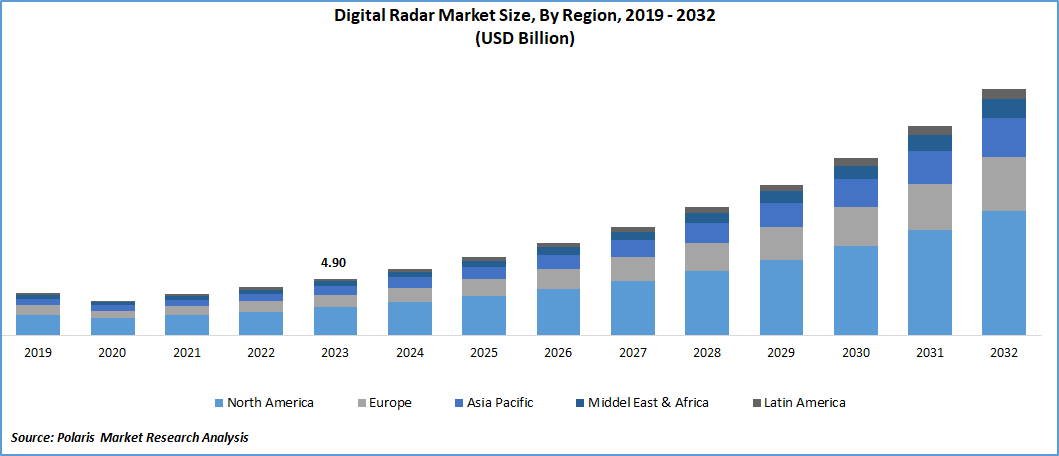

Global Digital Radar Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Digital Radar Regional Insights

By region, the study provides the digital radar market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America digital radar market held the highest revenue share due to the growing applications of radars in UAVs (Unmanned Aerial Vehicles) and drones. The region is experiencing an increase in the number of drones, including commercial drones and recreational drones. For instance, as of May 2021, the U.S. Department of Transportation recorded a total of 782,203 registered drones. The figure comprised 383,302 commercial drones and 392,468 recreational drones. This widespread adoption of drones is for various purposes, such as delivery services, agricultural monitoring, and aerial photography, that drive the demand for advanced radar systems. Thus, the increased applications and demand for radar systems for drones have contributed to the dominance of North America in the global digital radar market.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Global Digital Radar Market, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

The Asia Pacific digital radar market is anticipated to grow significantly due to the business presence of several manufacturers, including Indra, Advanced Micro Devices, Inc., Magna International Inc., Bharat Electronics Limited (BEL), and Leonardo Group. These companies are driving technological advancements and innovation in radar systems, contributing to the region's market growth.

Moreover, the China digital radar industry is expected to grow significantly due to the rising government initiatives and projects to enhance the country's defense sector. For instance, in February 2023, China commenced phase-II construction of a comprehensive radar system aimed at enhancing defense capabilities against potential near-Earth asteroid impacts. The radar system involved the deployment of 25 radars, each equipped with a 30-meter aperture, enabling the system to detect and image asteroids at distances exceeding 10 million kilometers. Thus, these types of projects and investments to improve the country's defense capabilities are driving the growth of the digital radar market.

Digital Radar Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product portfolio, which will help the digital radar market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the digital radar industry must offer cost-effective solutions.

The market is experiencing rapid advancements and robust competition among key players. Major companies are dominating the market and leveraging technological expertise, research, and development capabilities to offer innovative radar solutions. Major players in the digital radar market include Advanced Micro Devices, Inc., Ainstein, Arbe, BAE Systems, Bharat Electronics Limited (BEL), Elbit Systems Ltd., IAI, Indra, Leonardo Group, Lockheed Martin Corporation, Magna International Inc., Northrop Grumman Corporation, NXP Semiconductors, OBSERVATION WITHOUT LIMITS, LLC, RTX, Saab AB, Teledyne FLIR LLC, Thales, Uhnder, and Vayyar.

Northrop Grumman Corporation is an aerospace and defense technology company that operates globally, with a focus on the Asia Pacific, United States, and Europe. The company's aeronautics systems segment specializes in the development, design, integration, manufacturing, and maintenance of advanced aircraft systems. Additionally, its defense systems segment is dedicated to the development, design, integration, and production of tactical weapons and missile defense solutions. Northrop Grumman's mission systems segment focuses on developing advanced command, control, communications and computers, intelligence, surveillance, and reconnaissance systems. Also, the company's space systems segment is engaged in the production of subsystems, satellites, spacecraft systems, sensors, and payloads, along with missile defense systems, ground systems, and interceptors. In March 2024, Northrop Grumman Corporation received a contract to manufacture the initial production units of radar warning receivers, AN/APR-39E(V)2, for the U.S. Army. The AN/APR-39E(V)2 is a digital radar warning receiver, boasting instantaneous bandwidth and comprehensive frequency coverage to safeguard against highly advanced radar threats.

Observation Without Limits (O.W.L.) is a subsidiary of Dynetics and is based in Huntsville, Alabama. The company boasts over 3,000 staff members and operates research and development as well as manufacturing facilities. It specializes in integration, radar technology, and customer deployment to design, produce, and maintain the OWL GroundAware series of 3D and 2D digital beamforming radar solutions. These solutions are widely utilized by government customers and critical infrastructure, including integrators and end-users, globally for various low-altitude airspace surveillance. In March 2023, the company introduced the new GA7360 3D Digital Radar System, offering extended-range tracking, 360° detections, and classification of both manned aircraft and drones.

Key companies in the digital radar market include

- Advanced Micro Devices, Inc.

- Ainstein

- Arbe

- BAE Systems

- Bharat Electronics Limited (BEL)

- Elbit Systems Ltd.

- IAI

- Indra

- Leonardo Group

- Lockheed Martin Corporation

- Magna International Inc.

- Northrop Grumman Corporation

- NXP Semiconductors

- OBSERVATION WITHOUT LIMITS, LLC

- RTX

- Saab AB

- Teledyne FLIR LLC

- Thales

- Uhnder

- Vayyar

Digital Radar Industry Developments

- July 2024: Furuno USA launched the new FAR2XX8MK2 series of commercial radars aimed at optimizing bridge operations and improving safety and reliability at sea. The radar series is specifically engineered to deliver enhanced radar images for improved situational awareness.

- April 2023: Fisker Inc. introduced digital radar technology into a production vehicle, bringing advanced safety features to the Fisker Ocean all-electric SUV.

- July 2021: Magna and Uhnder collaborated to create ICON Radar technology. The innovative system performs continuous four-dimensional environmental scanning, delivering superior resolution and contrast compared to traditional radar systems.

Digital Radar Market Segmentation

Digital Radar Type Outlook

- Active

- Passive

Digital Radar Dimension Outlook

- 2D & 3D

- 4D

Digital Radar Application Outlook

- Safety

- Security & Surveillance

- Others

Digital Radar Vertical Outlook

- Automotive

- Aerospace

- Military & Defense

- Others

Digital Radar Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Radar Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 4.90 billion |

|

Market Size Value in 2024 |

USD 5.76 billion |

|

Revenue Forecast in 2032 |

USD 21.32 billion |

|

CAGR |

17.8% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global digital radar market size was valued at USD 4.90 billion in 2023 and is projected to grow to USD 21.32 billion by 2032.

The global market is projected to grow at a CAGR of 17.8% during the forecast period, 2024-2032.

North America had the largest share of the global market.

The key players in the market are Advanced Micro Devices, Inc., Ainstein, Arbe, BAE Systems, Bharat Electronics Limited (BEL), Elbit Systems Ltd., IAI, Indra, Leonardo Group, Lockheed Martin Corporation, Magna International Inc., Northrop Grumman Corporation, NXP Semiconductors, OBSERVATION WITHOUT LIMITS, LLC, RTX, Saab AB, Teledyne FLIR LLC, Thales, Uhnder, and Vayyar.

The safety segment held the highest share in the digital radar market in 2023

The military & defense category had the highest CAGR in the global market.