Digital Printing Market Size, Share, Trends, Industry Analysis Report: By Print-Head Type (Inkjet, Laser, and Other), Application, Ink Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5211

- Base Year: 2024

- Historical Data: 2020-2023

Digital Printing Market Overview

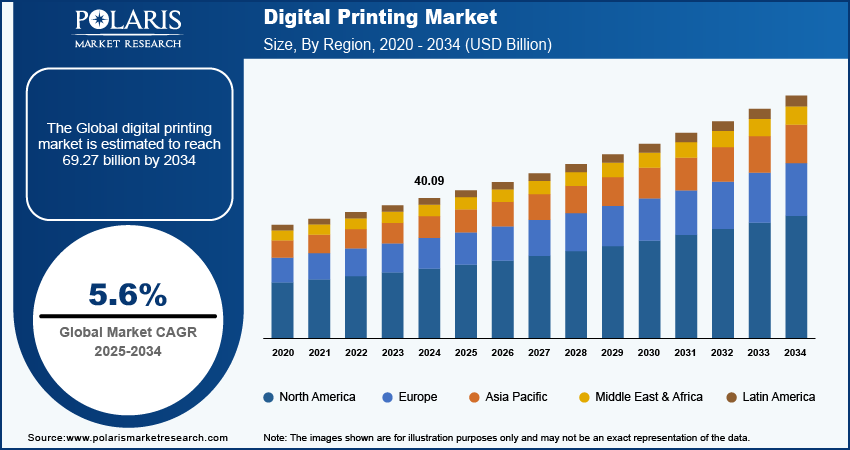

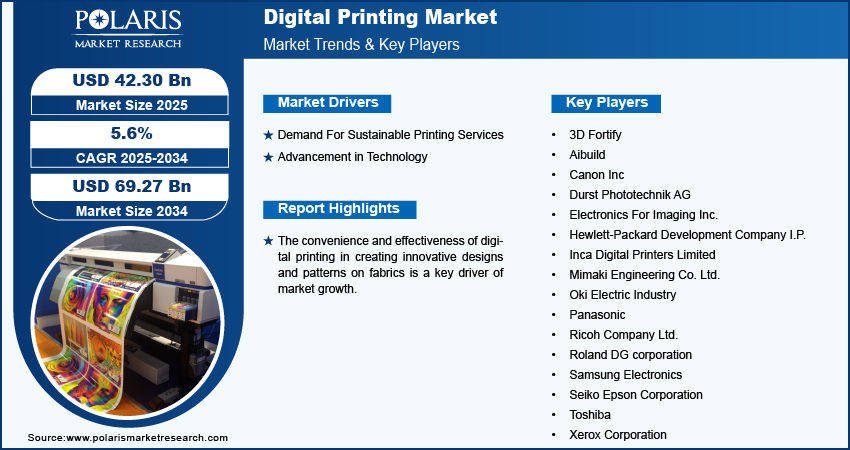

The digital printing market size was valued at USD 40.09 billion in 2024. The market is projected to grow from USD 42.30 billion in 2025 to USD 69.27 billion by 2034, exhibiting a CAGR of 5.6% from 2025 to 2034.

Digital printing is a printing method that involves transferring digital files, such as PDFs and JPEG images, onto printing material. The digital printing technique is particularly prevalent in the textile industry, where it is applied to create a wide range of designs on items such as t-shirts, shirts, dresses, and others.

The growing number of businesses in the textile industry has led to an increased demand for diverse designs that reflect emerging trends in the market. Further, the convenience and effectiveness of digital printing in creating innovative designs and patterns on fabrics is a key driver of market growth.

To Understand More About this Research: Request a Free Sample Report

Digital Printing Market Trends and Driver Analysis

Demand For Sustainable Printing Services

The increasing environmental concerns are driving the demand for eco-friendly alternatives in the printing industry. Besides, sustainability is gaining significance in the printing sector as businesses seek to minimize their environmental impact and improve economic sustainability. Various sustainable printing techniques, such as UV printing, carbon-balanced printing, and direct-to-film (DTF) printing, are being adopted to reduce rising environmental issues. DTF printing is favored due to its environmentally friendly nature compared to traditional screen printing methods. This technique allows for fabric printing using digital technology, reducing the requirement for water, chemicals, and energy compared to traditional methods. Additionally, DTF printing enables efficient utilization of raw materials, minimizing waste and driving market growth.

Advancement in Technology

The rapid progression of technology is driving the digital printing market. The integration of artificial intelligence in digital printing systems and equipment facilitates the development of automated printing processes capable of error detection and self-adjustment, which enhances print quality and boosts demand for digital printing products. The incorporation of AI in digital printing also facilitates predictive maintenance of equipment, allowing for early detection of machine failures and reducing breakdown costs. Moreover, key companies in the market are developing and introducing AI-integrated digital printing software, which is estimated to propel the global market further. For instance, Aibuild has launched AI-powered 3D printing software to enhance and accelerate innovations in the manufacturing sector.

Digital Printing Market Segment Analysis

Digital Printing Market Breakdown by Print-Head Type Insights

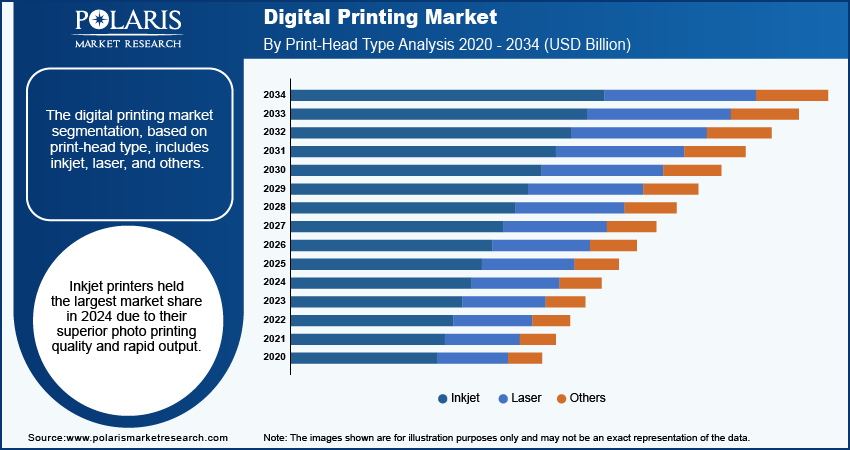

The digital printing market segmentation, based on print-head type, includes inkjet, laser, and others. Inkjet printers held the largest market share in 2024 due to their superior photo printing quality and rapid output. These printers offer versatility, allowing printing on various surfaces such as plastic, paper, and fabric. Their compact size and weighing also enhance portability, which increases their adoption. In addition, inkjet printers feature a wide color palette, which is advantageous for high-quality photo printing in business applications. Moreover, inkjet printers are affordable and cheaper, encouraging businesses to invest in these printers.

Digital Printing Market Breakdown by Ink Type Insights

The digital printing market segmentation, based on ink type, includes UV-cured ink, aqueous ink, solvent ink, latex ink, and dye sublimation ink. The aqueous ink segment is expected to dominate the market from 2025 to 2034 due to the increasing demand for eco-friendly and sustainable alternatives. Aqueous inks, which are water-based, are gaining popularity due to their safety and lack of unpleasant odors. Additionally, they are cost-effective and versatile, which makes them suitable for printing on a wide range of surfaces. Furthermore, several printer manufacturers are currently working on water-based inks that deliver high-quality and vibrant photos. For instance, Inktec has developed Power Chrome K3 Inks, which feature three distinct black colors designed to enhance photo quality, particularly for black and white images.

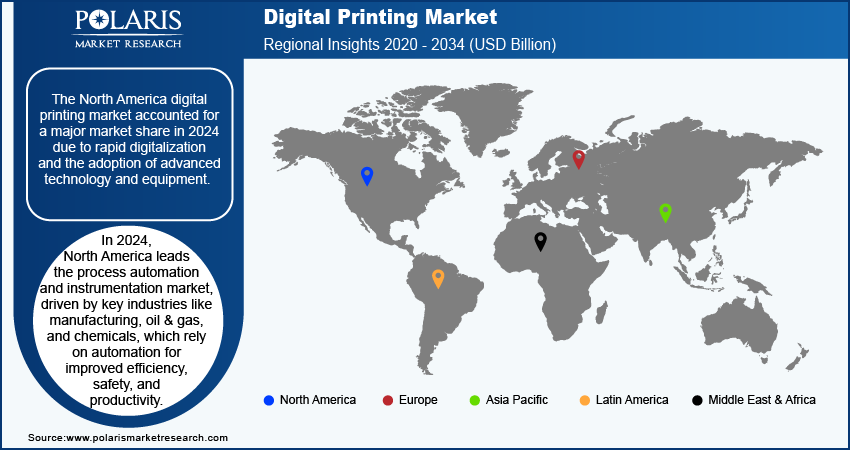

Digital Printing Market Breakdown by Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America digital printing market accounted for a major market share in 2024 due to rapid digitalization and the adoption of advanced technology and equipment. In addition, the presence of major companies such as Hewlett-Packard Development Company I.P., Xerox Corporation, and Electronics For Imaging Inc. offering their services further strengthens the market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

Asia Pacific is expected to grow at a significant (CAGR) in the coming years, owing to increased developmental activities and rapid economic progress. Japan is at the forefront of transforming the printing industry through the introduction of advanced data-driven business models, digital platform solutions, and digitized value-creation chains that enhance digital printing techniques. The growing presence of digital printing manufacturers in Japan is also contributing to the overall market revenue expansion across Asia Pacific.

Digital Printing Market – Key Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their product lines, which will help the digital printing market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the digital printing market must offer innovative solutions.

The global key market players are Hewlett-Packard Development Company I.P., Canon Inc, Ricoh Company Ltd., Mimaki Engineering Co. Ltd., Roland DG Corporation, Xerox Corporation, Seiko Epson Corporation, Durst Phototechnik AG, Samsung Electronics, Panasonic, 3D Fortify, Toshiba, Oki Electric Industry, Inca Digital Printers Limited, and Aibuild Electronics For Imaging Inc.

Seiko Epson Corporation, headquartered in Japan, is a leading manufacturer in the printing industry. The company offers a wide range of services across various segments, including printing solutions, visual communication, and manufacturing related to wearables. Epson's product line includes inkjet printers for both office and home use, dot matrix printers, 3LCD projectors, industrial robots, microinjection molders, PCs, and other related products. Epson Connect, also referred to as the Epson Email Print service, enables printing from home over a VPN connection. Additionally, Epson Connect facilitates encrypted communications, thereby mitigating the risk of information leakage.

Canon is a leading manufacturer of cameras, printers, lenses, scanners, and other imaging products. The company is headquartered in Tokyo, Japan. Canon's printer range includes home printers, office printers, MegaTank printers, and wireless printers. Canon provides its services through various applications and software, such as the Canon Print Inkjet/SELPHY app and Easy-Photo Print Editor. Its Maxify office printers are designed to improve print quality over Wi-Fi. These printers feature integrated ink tanks that are cost-effective and help businesses reduce overhead expenses. The Maxify series includes models such as Maxify MB2150 and Maxify MB2140.

List of Key Companies in Digital Printing Industry Outlook

- 3D Fortify

- Aibuild

- Canon Inc

- Durst Phototechnik AG

- Electronics For Imaging Inc.

- Hewlett-Packard Development Company I.P.

- Inca Digital Printers Limited

- Mimaki Engineering Co. Ltd.

- Oki Electric Industry

- Panasonic

- Ricoh Company Ltd.

- Roland DG corporation

- Samsung Electronics

- Seiko Epson Corporation

- Toshiba

- Xerox Corporation

Digital Printing Industry Developments

January 2024: Roland DG introduced the ER-641 64 eco-solvent inkjet printer to enhance productivity and image quality. The ER-641 features high-speed data control technology for improved operational efficiency.

May 2024: Canon U.S.A., Inc. expanded its range of production inkjet printers and entered the B2 Sheetfed Inkjet Press market with the Canon varioPRESS iV7. varioPRESS iV7 is designed to offer high quality, productivity, and support for various types of media.

December 2023:Hewlett-Packard Development Company(HP) collaborated with Canava to offer specialized design-to-print services aimed at improving customer experience and extending their market presence.

Digital Printing Market Segmentation

By Print-Head Type Outlook (Revenue, USD Billion; 2020–2034)

- Inkjet

- Laser

- Other

By Ink Type outlook (Revenue, USD Billion; 2020–2034)

- UV-cured Ink

- Aqueous Ink

- Solvent Ink

- Latex Ink

- Dye Sublimation Ink

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Paper

- Textile

- Glass

- Plastic film

- Thick Cardstock

- Other

By End Use Outlook (Revenue, USD Billion; 2020–2034)

- Publishing

- Clothing

- Packaging and Labelling

- Others

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Printing Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 40.09 Billion |

|

Market size value in 2025 |

USD 42.30 Billion |

|

Revenue Forecast in 2034 |

USD 69.27 Billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical data |

2020–2023 |

|

Forecast period |

2020-2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The digital printing market size was valued at USD 40.09 billion in 2024 and is projected to grow at USD 69.27 billion in 2034.

The digital printing market is projected to grow at a CAGR of 5.6% from 2025 to 2034.

North America is anticipated to dominate the digital printing market.

The global key market players are Hewlett-Packard Development Company I.P., Canon Inc, Ricoh Company Ltd., Mimaki Engineering Co. Ltd., Roland DG Corporation, Xerox Corporation, Seiko Epson Corporation, Durst Phototechnik AG, Samsung Electronics, Panasonic, 3D Fortify, Toshiba, Oki Electric Industry, Inca Digital Printers Limited, and Aibuild Electronics For Imaging Inc.

The aqueous ink segment is anticipated to dominate the market in the coming years.

The inkjet segment had the largest share of the global market in 2024.