Digital Pharmacy Market Size, Share, Trends, Industry Analysis Report: By Product, Drug Type, Platform (Application Based, and Web Based), and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM2786

- Base Year: 2023

- Historical Data: 2019-2022

Digital Pharmacy Market Overview

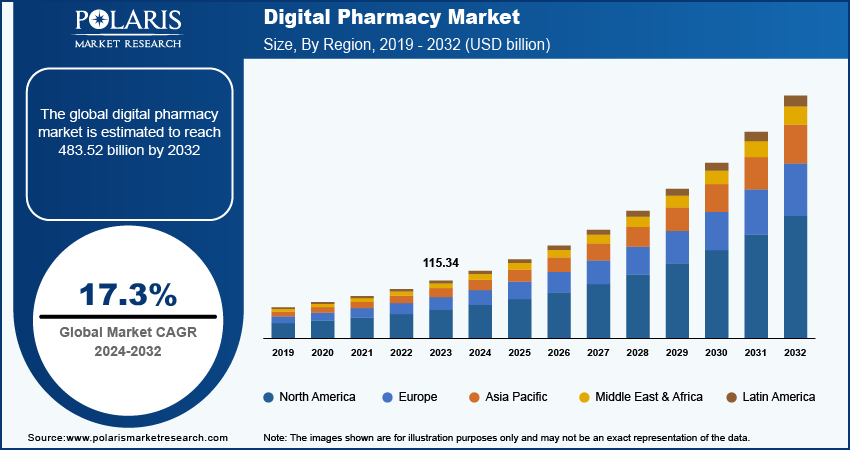

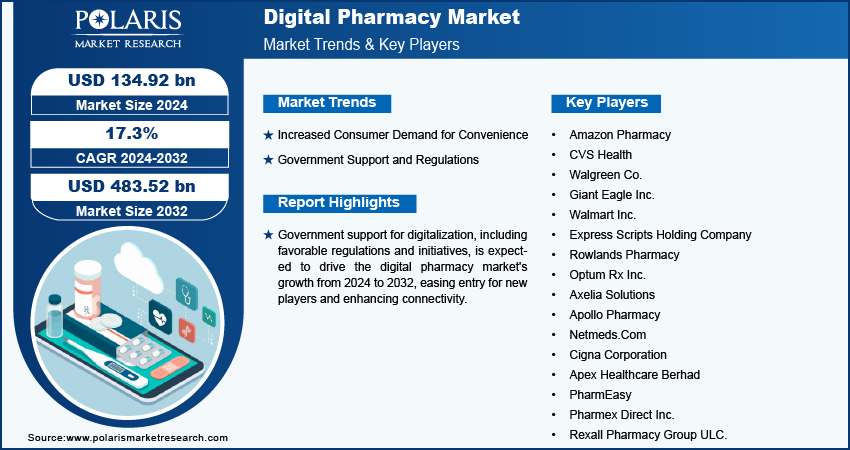

The digital pharmacy market size was valued at USD 115.34 billion in 2023. The market is projected to grow from USD 134.92 billion in 2024 to USD 483.52 billion by 2032, exhibiting a CAGR of 17.3% from 2024 to 2032.

A digital pharmacy is a licensed pharmacy that provides a platform and software for medication services and medicine delivery. The market for digital pharmacy is primarily driven by the increasing internet connectivity and the growing number of internet users worldwide. The expanding internet and broadband services have led to a rise in internet users, resulting in the quick adoption of digital platforms by the general population. For instance, according to the World Bank, the proportion of internet users in North America has significantly increased over the past decade, from 71% of the total population having internet access in 2011 to 93% in 2021. In 2021, 92% of citizens in the United States and 93% of the total population in Canada had internet access. This growing internet user base has led to the development and advancement of software in various domains that offers easy-to-understand user interfaces, increasing adaptability among the general population. This rapid digitalization is expected to have a positive impact on the digital pharmacy market growth during the forecast years.

To Understand More About this Research: Request a Free Sample Report

The digital pharmacy market is expected to grow due to the increased adoption of telemedicine. The rising use of telemedicine has led to higher demand for remote prescription and medication management. For instance, according to Rock Health, 80% of the population in the United States has already used telemedicine once in their life. As of 2022, live phone teleconsultation was adopted by 64% of the US population. As the adoption of telemedicine increases, the digital pharmacy market is expected to register a substantial CAGR in the study years.

Digital Pharmacy Market Drivers

Increased Consumer Demand for Convenience

The growing emphasis on convenience among consumers globally is projected to substantially fuel the expansion of the digital pharmacy market. For instance, according to National Retail Federation, ∼83% of US consumers prioritize convenience over any other factor while purchasing goods. Consumers view convenience as the most critical factor in their purchasing decisions, often willing to pay a higher price for a more streamlined and efficient shopping experience. As the demand for ease and accessibility in various aspects of daily life intensifies, digital pharmacies are poised to meet these needs by offering a seamless, user-friendly approach to obtaining medications and health-related products. The ability to order prescriptions, consult with pharmacists, and receive deliveries directly to one's doorstep aligns perfectly with the modern consumer's preference for hassle-free solutions. This trend is not confined to the US alone; globally, as internet penetration and digital literacy increase, more consumers are expected to turn to digital pharmacies for their healthcare needs. Consequently, the digital pharmacy sector is likely to see significant growth, driven by the evolving consumer expectations for convenience and efficiency in their healthcare experiences.

Government Support and Regulations

Increasing government support for the digitalization of multiple sectors is anticipated to fuel the digital pharmacy market in the forecast years. Governments worldwide are imposing favorable regulations and initiatives to support the e-commerce industry and accelerate digitalization to reach the unmet population of the country. For instance, according to Invest India, in order to increase broadband connectivity in rural areas, the Indian government has started the Digital India Program. Also, to benefit and increase the number of players in the e-commerce and quick commerce industry, the government has started providing tax benefits, easier compliance, and IPR-fast tracking for small and medium businesses. Foreign direct investment limit for e-commerce and quick commerce industry has increased in order to expand the market. Similar supportive regulations and initiatives are provided by governments of major countries, which are expected to ease the entry of new players and boost the digital pharmacy market growth from 2024 to 2032.

Digital Pharmacy Market Segment Insights

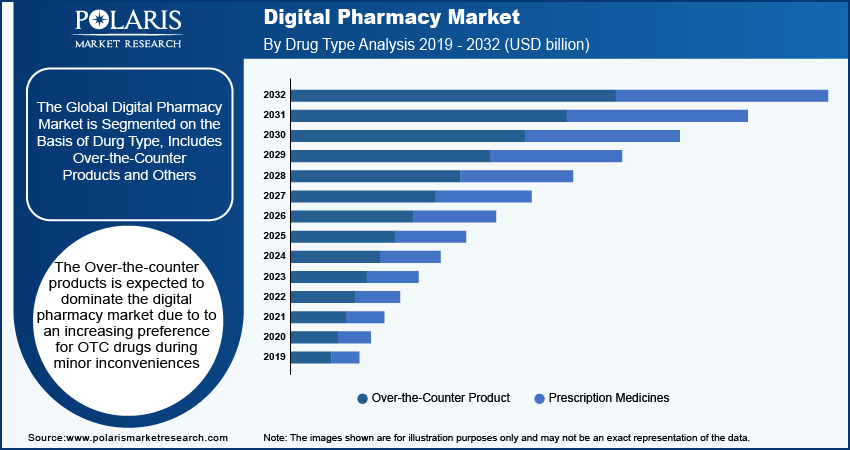

Digital Pharmacy Market Breakdown by Drug Type Insights

The digital pharmacy market segmentation, based on drug type, includes prescription medicine and over-the-counter drugs. The over-the-counter products segment is expected to experience significant growth in the global market. This is due to increasing awareness and knowledge of common acute diseases among the general population. The rising preference for over-the-counter drugs among young people for minor inconvenience has resulted in growing demands for OTC drugs. For instance, according to the American Consumer Heatlhcare Product Association, 93% of American youth prefer OTC drugs for minor inconveniences before consulting a doctor. Thus, the OTC drug type segment is expected to record significant growth in the digital pharmacy market during the study period.

Digital Pharmacy Market Breakdown by Platform Insights

The digital pharmacy market segmentation, based on platform, includes application-based and web-based. The application-based segment is expected to dominate the digital pharmacy market during the forecast period. This growth can be attributed to the the expanding internet connectivity and increasing number of smartphone users globally. For example, accordin to Indian News Express, percentage of Indian households with smartphones increased from 36% to 75% in 2022, and this number is expected to continue growing significantly in the coming years. The surge in global smartphone users is expected to lead to the development of various software applications across a wide range of domains, resulting in the growth of app-based platforms in the digital pharmacy market.

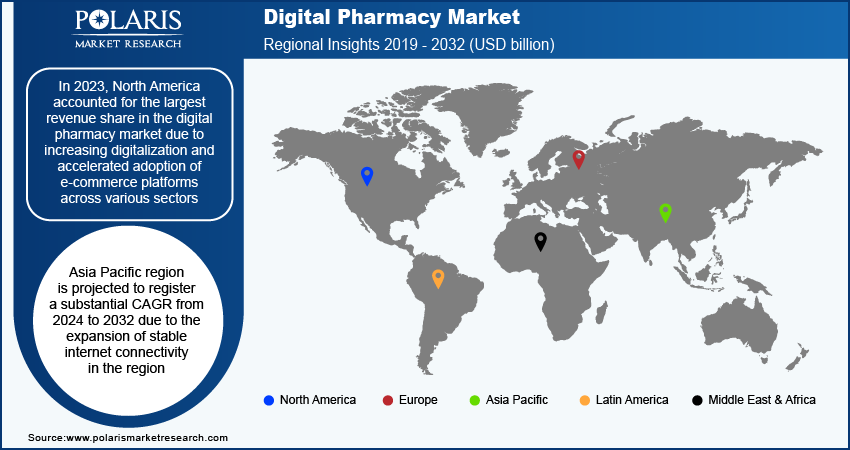

Digital Pharmacy Market Breakdown by Regional Insights

By region, the study provides digital pharmacy market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, North America accounted for the largest revenue share in the digital pharmacy market due to increasing digitalization and accelerated adoption of e-commerce platforms across various sectors. This rapid growth of the e-commerce industry is driven by rising demand for convenience and increasing mergers and acquisitions within the industry. For instance, according to statistics, the e-commerce industry in North America employed 24 million small, mid, and large size businesses in 2023, operating in a range of sectors. The increasing number of e-commerce businesses has intensified competition among major players, who are constantly striving to expand their consumer base. This competition has led to the introduction of user-friendly interfaces and quick deliveries, resulting in the speedy adoption of e-commerce platforms by the general population. Additionally, digitalization in various sectors due to stable internet connection in most areas of North America is expected to fuel the digital pharmacy market in the region.

Asia Pacific region is projected to register a substantial CAGR from 2024 to 2032 due to the expansion of stable internet connectivity in the region. The increasing number of internet users has boosted the adoption of digital platforms across various sectors. For instance, according to the Asia Pacific Internet Research Alliance, 99% of Korean citizens had internet access in 2023. Also, both Malaysia and Korea achieved broadband usage of 100%. This increase in internet connectivity has led to the growing adoption of digital platforms.

The digital pharmacy market in India is poised for significant growth due to the Indian government's forthcoming national e-commerce policy. This policy is designed to foster a supportive environment for digital businesses by addressing key trader concerns and establishing a comprehensive regulatory framework. The initiative aims to streamline operations and enhance the overall efficiency of digital transactions, which is expected to impact the market for digital pharmacies positively. By creating clear guidelines and ensuring a structured approach to e-commerce, the government is facilitating a more secure and user-friendly platform for consumers to access pharmaceutical services online. This move is anticipated to not only boost consumer confidence but also encourage increased adoption of digital pharmacies across the country. Additionally, with enhanced regulatory oversight and improved infrastructure, digital pharmacies will likely see accelerated growth, offering a wider range of services and improving accessibility to medications and health products. As a result, the Indian digital pharmacy market is expected to grow, driven by both consumer demand and supportive government policies

.

Digital Pharmacy Market – Key Players & Competitive Insights

The digital pharmacy market is always evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development capabilities, advanced software technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative medical devices and meeting the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings and new drug types, greater emphasis on sustainability, and the rising requirement for tailor-made single-use products across diverse industries. Major players in the digital pharmacy market include Amazon Pharmacy; CVS Health; Walgreen Co.; Giant Eagle Inc.; Walmart Inc.; Express Scripts Holding Company; Rowlands Pharmacy; Optum Rx Inc.; Axelia Solutions; Apollo Pharmacy; Netmeds.Com; Cigna Corporation; Apex Healthcare Berhad; PharmEasy; Pharmex Direct Inc.; and Rexall Pharmacy Group ULC.

Apollo Pharmacy, part of the Apollo Hospitals Group, is a leading retail pharmacy chain based in India. Established in 1987, it operates a network of over 4,000 pharmacies across the country. The company provides a broad range of pharmaceutical products, including prescription medications, over-the-counter drugs, and health and wellness items. Apollo Pharmacy offers services such as online ordering and home delivery to enhance accessibility and convenience for its customers. The company plays a significant role in India's healthcare sector, contributing to the overall accessibility of pharmaceutical products and services throughout the region. In 2024, Apollo Pharmacy touched revenue of 120 million USD by online sales of medicines.

Netmeds.com is a prominent online pharmacy based in India, providing a convenient platform for purchasing pharmaceutical products. The company offers a wide range of medications, including prescription drugs, over-the-counter medicines, and health and wellness products. Through its user-friendly website and mobile app, Netmeds.com facilitates online ordering and home delivery services, catering to the needs of customers across the country. It ensures the quality and authenticity of the products it sells by partnering with reputable pharmaceutical suppliers and adhering to industry standards. Netmeds.com also provides additional services such as medication reminders and health information resources to support its customers' healthcare needs. The company's focus on accessibility and efficiency aims to simplify the process of obtaining essential medications and health products, contributing to the broader landscape of online healthcare services in India.

Key Companies in Digital Pharmacy Market

- Amazon Pharmacy

- CVS Health

- Walgreen Co.

- Giant Eagle Inc.

- Walmart Inc.

- Express Scripts Holding Company

- Rowlands Pharmacy

- Optum Rx Inc.

- Axelia Solutions

- Apollo Pharmacy

- Netmeds.Com

- Cigna Corporation

- Apex Healthcare Berhad

- PharmEasy

- Pharmex Direct Inc.

- Rexall Pharmacy Group ULC.

Digital Pharmacy Market Developments

January 2024: Eli Lilly and Company launched LillyDirect™, a new digital healthcare service designed to enhance patient experience in managing obesity, migraine, and diabetes in the US. This platform provides access to independent healthcare providers, personalized support, and home delivery of select Lilly medications through third-party pharmacies. LillyDirect aims to streamline disease management and improve outcomes by offering convenient, digital access to healthcare resources and medication delivery, addressing the complexities of the US healthcare system.

December 2023: Cipla announced an investment of Rs. 5.7 million in GoApptiv, a digital pharmacy platform specializing in medicine delivery. With this investment, Cipla’s stake in GoApptiv increased to 22.99% on a fully diluted basis. This marked Cipla’s third investment in the company, conducted through a mix of equity shares and compulsorily convertible preference shares, underscoring its commitment to advancing digital solutions in the pharmaceutical industry.

September 2021: Zeno Health acquired Kolkata-based startup Tablt Pharmacy as part of its expansion strategy. This merger will enhance Zeno Health's presence in West Bengal, Odisha, Bihar, and Jharkhand. Tablt, an online pharmacy startup known for its cost-effective distribution model, operates nearly 300 franchises in Eastern India and has served over 200,000 consumers. The acquisition aligns with Zeno Health's mission to democratize healthcare and reduce costs, aiming to reach one crore consumers monthly and improve access to generic medicines

Digital Pharmacy Market Segmentation

By Product Outlook

- Medicine & Treatment

- Diabetic Care

- Heart Care

- Oncology

- Other

- Vitamins & Supplements

- Personal Care Products

- Others

By Drug Type Outlook

- Prescription Medicines

- Over-the-counter Products

By Platform Outlook

- Application Based

- Web Based

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Pharmacy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 115.34 billion |

|

Market Size Value in 2024 |

USD 134.92 billion |

|

Revenue Forecast in 2032 |

USD 483.52 billion |

|

CAGR |

17.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Platform |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The digital pharmacy market size was valued at USD 115.34 billion in 2023 and is projected to grow to USD 483.52 billion by 2032.

The market is projected to grow at a CAGR of 17.3% from 2024 to 2032.

North America had the largest share of the market in 2023.

The key players in the market are Amazon Pharmacy; CVS Health; Walgreen Co.; Giant Eagle Inc.; Walmart Inc.; Express Scripts Holding Company; Rowlands Pharmacy; Optum Rx Inc.; Axelia Solutions; Apollo Pharmacy; Netmeds.Com; Cigna Corporation; Apex Healthcare Berhad; PharmEasy; Pharmex Direct Inc.; and Rexall Pharmacy Group ULC.

The over-the-counter product type segment is anticipated to experience substantial growth in the global market. This growth is due to an increasing preference for OTC drugs during minor inconveniences.

The application based segment accounted for the largest revenue share in 2023 due to an increase in the number of smartphone users and growing internet connectivity