Digital Pathology Market Share, Size, Trends, Industry Analysis Report, By Application (Drug Discovery & Development, Academic Research, Disease Diagnosis); By End-Use (Hospitals, Biotech & Pharma Companies, Diagnostic Labs, Academic & Research Institutes); By Product; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 114

- Format: PDF

- Report ID: PM2056

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

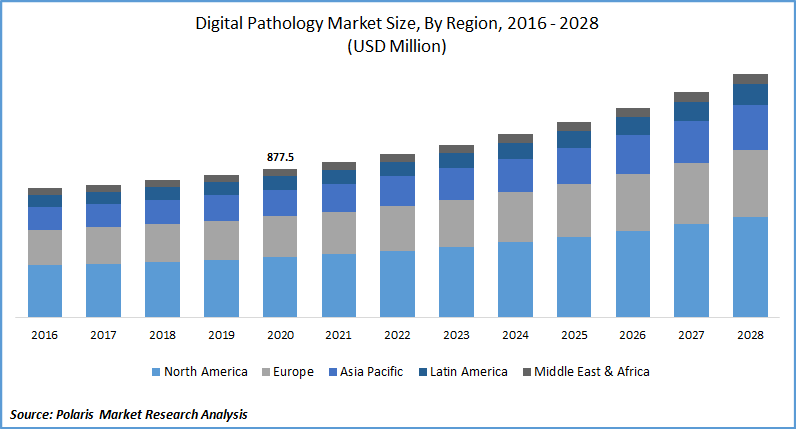

The global digital pathology market was valued at USD 877.5 million in 2020 and is expected to grow at a CAGR of 6.7% during the forecast period. Increased focus of companies to improve workflow efficiency for better and accurate diagnostic capability, rise in prevalence of chronic diseases, and clinical urgency to adopt digital initiatives to improve patient outcome and enables cost reductions are the most prominent and pivotal factors responsible for the market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Rapid technological advancements in digital pathology systems are one of the key factors that escalated the adoption of these systems. Market growth in computerization, microscopy techniques, digital imaging and analysis, development of in-silico simulation tools, and fiber optic communications are the ancillary factors that contributed to the global growth. Whole side imaging in comparison to conventional microscopes has more operational capabilities, which is expected to favor the market in the coming years.

Digital Pathology Market Report Scope

The market is primarily segmented on the basis of product, application, end-use, and geographic region.

|

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The device segment accounted for the largest revenue share in 2020 of the digital pathology market. Mostly consumed product types include scanner and slide management systems. Enhanced resolution and surge in research activities are few segment drivers that boosted the growth. Advancements in magnification and scanning capabilities of the slides towards the Z-axis, such as whole slide imaging also boosted the segment’s growth prospects.

The storage systems segment of the digital pathology market is projected to witness a lucrative growth rate over the assessment period. Increased spending on storage capabilities, rising demand in online storage platforms, and advancements in cloud data storage for easy interoperability are the few factors favoring the segment’s market growth. Online and cloud storage has more advantages such as cost reduction, data reliability, image lifecycle management with better patient outcomes.

Know more about this report: request for sample pages

Insight by Application

In 2020, the academic research segment accounted for the largest share of the digital pathology industry. This high share is attributed to its wide applicability in several research processes including tumor morphological studies and biomarker profiling. The disease diagnosis market segment of the digital pathology industry is projected to witness lucrative growth over the assessment period, owing to the rising prevalence of chronic diseases.

Manufacturers in the market focus on developing rapid diagnostic techniques and enabling digital technologies in improving diagnostic delays to share information between two departments. The market segment is also driven by a rise in cancer detection as rising cases of cancer cases across the globe and ongoing research activities.

Insight by End-Use

In 2020, the hospital market segment accounted for the largest share. This is due to the fact; hospitals are better equipped with the adoption of digital scanning technologies for real-time diagnosis and better patient outcomes driving the digital pathology industry.

Biotech companies’ segment is anticipated to register the fastest growth rate over the assessment period. This is due to the rise in digital pathology in several other fields such as clinical trials, pre-clinical studies, and drug discovery. The rising cancer cases and better treatment options are also expected to fuel the of digital pathology industry segment growth prospects.

Geographic Overview

In 2020, North America accounted for the largest revenue share of the global market. Supportive government policies increased research and development investments towards its diagnostic ability, and the presence of prominent market players in the region are expected to drive its growth. Moreover, favorable reimbursement policies and the rising use of digital pathology systems for the early diagnosis of disease are projected to fuel the region’s market growth prospects for digital pathology.

Asia Pacific of the digital pathology industry is projected to register a lucrative growth rate over the assessment period. This is due to the rising penetration of digital imaging in the low- and middle-income countries, a huge population base with untapped growth opportunities, and the growing presence of international firms operating in the marketplace with small booming indigenous start-ups. The rising demand for novel treatment options, rising laboratory expenses, and better healthcare facilities are expected to drive the regional market of the digital pathology industry.

Competitive Insight

The prominent players operating in the market include 3DHISTECH Ltd., Apollo Enterprise Imaging Corp., ContextVision AB., Corista, Danaher, Glencoe Software, Inc, Hamamatsu Photonics, Inc., Huron Digital Pathology, Indica Labs, Inspirata, Inc., KONFOONG BIOTECH INTERNATIONAL CO., LTD, Koninklijke Philips, Leica Biosystems Nussloch GmbH, Mikroscan Technologies, Objective Pathology Services, Olympus Corporation, OptraScan, Proscia Inc., Roche Ltd., Sectra AB, Visiopharm A/S, and XIFIN, Inc.

Digital Pathology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 877.5 million |

|

Revenue forecast in 2028 |

USD 1.44 billion |

|

CAGR |

6.7% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 – 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

3DHISTECH Ltd., Apollo Enterprise Imaging Corp., ContextVision AB., Corista, Danaher, Glencoe Software, Inc, Hamamatsu Photonics, Inc., Huron Digital Pathology, Indica Labs, Inspirata, Inc., KONFOONG BIOTECH INTERNATIONAL CO., LTD, Koninklijke Philips, Leica Biosystems Nussloch GmbH, Mikroscan Technologies, Objective Pathology Services, Olympus Corporation, OptraScan, Proscia Inc., Roche Ltd., Sectra AB, Visiopharm A/S, and XIFIN, Inc. |