Global Digital Mining Market Size, Share, Trends, Industry Analysis Report: Information By Technology (Automation & robotics, Real-time analytics, Cybersecurity, Other), By Application, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 117

- Format: PDF

- Report ID: PM4991

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

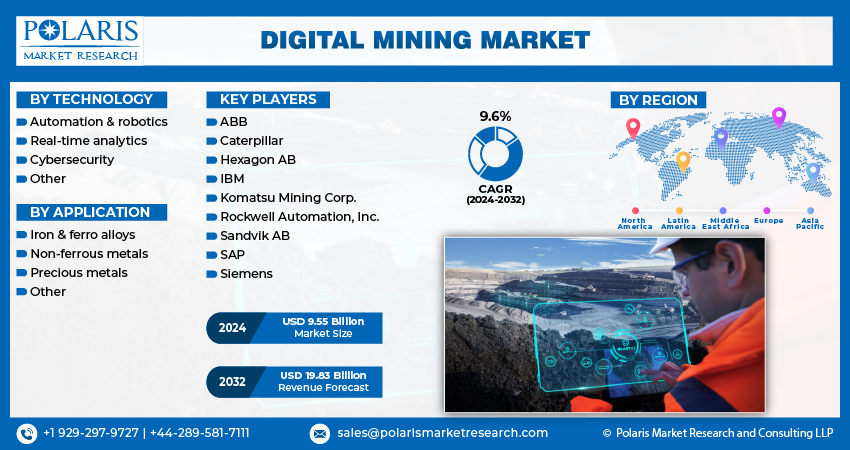

Global digital mining market size was valued at USD 8.78 billion in 2023. The digital mining industry is projected to grow from USD 9.55 billion in 2024 to USD 19.83 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.6% during the forecast period (2024 - 2032).

The digital mining market encompasses technologies and practices utilizing digital solutions such as IoT, AI, and data analytics to optimize operations, enhance safety, and improve efficiency in mining activities. The digital mining market is driven by various factors, such as the growing need for sustainable mining practices, regulatory policies to minimize ecological footprints, and the significant growth in the mining sector. In February 2024, Canada planned to speed up its critical mineral mining to enhance energy security by reducing the time needed to develop new critical mineral mines by almost a decade, using improved permitting processes.

Furthermore, the integration of digital and automated solutions in the mining process enhances the optimization and safety standards. Technologies such as artificial intelligence (AI), data analytics, robotics, and the Internet of Things (IoT) significantly boost production capabilities and process efficiencies while reducing the environmental impact. Thus, the collaborative projects on digital integration are propelling the growth of the market industry. In February 2024, Meglab, an experienced company in the mining sector, planned to integrate 5G network solutions into the Canadian mining sector in partnership with Bell. This collaboration aimed to set a new standard for operational efficiency and technological advancement.

To Understand More About this Research: Request a Free Sample Report

In addition, there are abundant opportunities for unexplored mineral and metal deposits. As a result, governments around the world are creating appropriate regulations to improve the business environment and attract investments. This, in turn, is expected to further boost the digital mining market. For example, in May 2024, the federal government launched the Nigeria Mineral Resources Decision Support System (NMDSS) through the Ministry of Solid Minerals Development to improve transparency in the mining sector. This initiative is part of a marketing strategy aimed at enhancing the business environment in the solid minerals sector.

Digital Mining Market Trends

A Significant Boost in the Mining Sector is Driving Market Growth

Market growth in digital mining is driven by increasing demand from sectors such as infrastructure, energy, construction, automotive, and machinery across the globe. For instance, in May 2024, India's mining sector grew by 7.5% in FY24, with the production of iron ore and limestone recording the highest growth.

Additionally, governments are supporting the mining sector to reduce ecological footprints and accelerate clean energy developments, which further propel the growth of the digital mining market. For instance, in March 2024, the US Department of Energy (DOE) announced to invest USD 475 Mn for funding in 5 projects in Arizona, Kentucky, Nevada, & Pennsylvania.

Rising Adoption of New Digital Solutions to Drive Market Demand

digital mining market is currently witnessing substantial growth due to the increasing use of advanced digital solutions in mining processes. These solutions are making mining operations more efficient and safer while reducing downtime. As a result, companies are working together on various projects to streamline processes and offer innovative solutions. For instance, in April 2024, Tech Mahindra collaborated with the AVEVA to establish the Global Center of Excellence (CoE) to accelerate digital adoption. The solutions will cover the entire industrial lifecycle, from conceptual engineering to the operations & supply chain.

In addition, digital solutions allow mining companies to collect and analyze vast amounts of data from mining operations. This data can be used to make informed decisions regarding production planning, resource allocation, and risk management, ultimately enhancing productivity and profitability and driving the digital mining market revenue.

Digital Mining Market Segment Insights

Digital Mining Technology Insights:

The global digital mining market segmentation, based on technology, includes automation & robotics, real-time analytics, cybersecurity, and others. The automation & robotics segment dominated the market in 2023. Automation in mining involves the use of autonomous vehicles, drones, and robotic machinery to perform various tasks such as drilling, blasting, hauling, and exploration activities. These automated systems are equipped with sensors and AI algorithms to operate efficiently in challenging environments, thereby driving the automation and robotics segment in the digital mining market industry outlook.

Digital Mining Application Insights:

The global digital mining market segmentation, based on application, includes iron & ferroalloys, non-ferrous metals, precious metals, and others. In 2023, the precious metal segment generated the highest revenue due to increased demand from various industries such as energy, construction, and automotive industry. As a result, many companies are engaging in mergers and acquisitions to take advantage of global opportunities. For example, in December 2023, Dundee Precious Metals (DPM) signed an agreement to acquire Osino Resources Corp and its gold mines in Namibia.

Furthermore, the digital mining sector for precious metals attracts significant investment in technologies. Companies are continuously innovating to gain competitive advantages through the development of new extraction methods, implementation of autonomous mining equipment, and adoption of blockchain technology.

Global Digital Mining Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

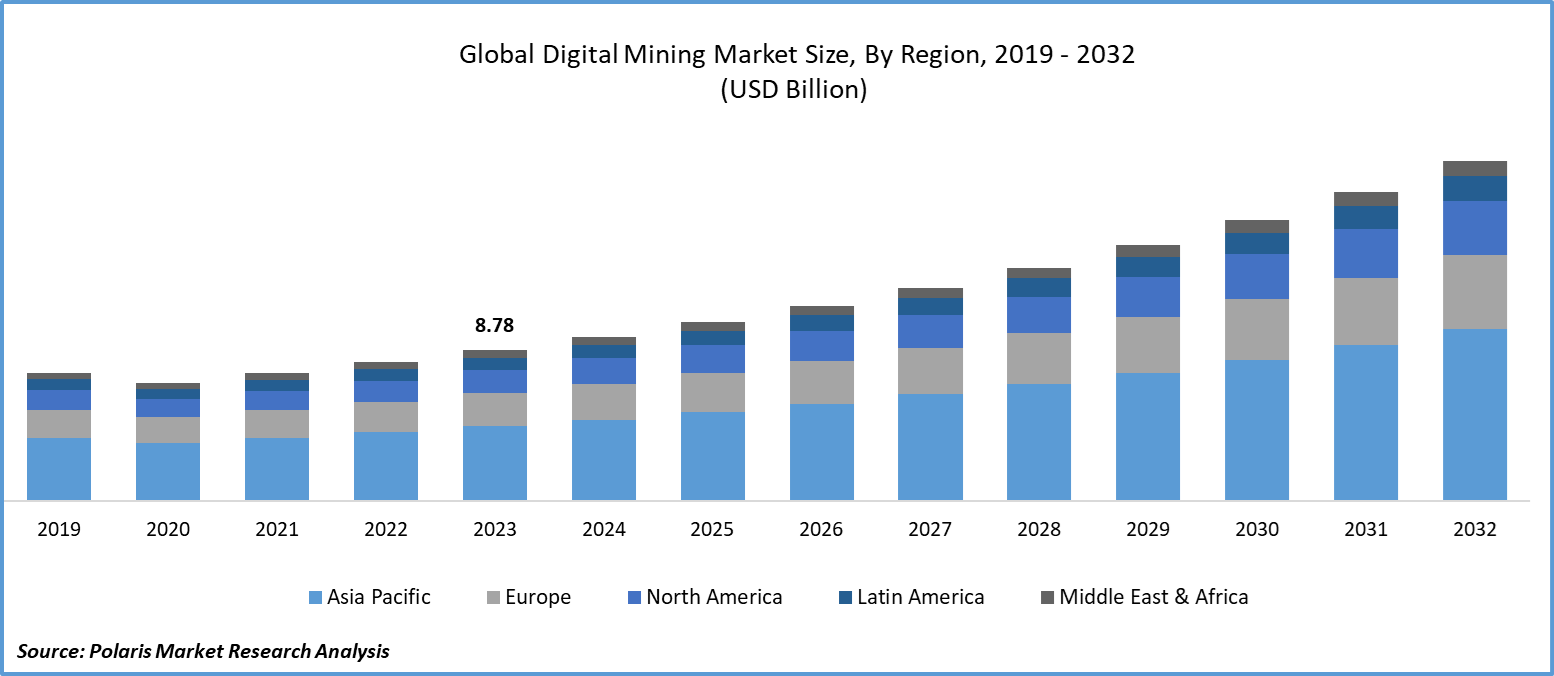

Digital Mining Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The Asia Pacific digital mining market held the dominant share in 2023 due to the presence of abundant mineral reserves in various countries across the Asia Pacific region, such as Australia, Indonesia, and Mongolia. Moreover, these countries are embracing advanced technologies in mining, including automation, remote monitoring, and data analytics, to enhance productivity, safety, and environmental sustainability. The untapped opportunities and the growing use of digital solutions in the mining sector are further driving the growth of the digital mining market in the Asia Pacific region.

Further, the major countries studied in the market report are US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Europe digital mining market is anticipated to account for significant growth during the forecast period due to continuous technological advancements and pioneering research efforts. A notable initiative within the European Union is underway in Sweden, focusing on the X-mine project. This project aims to revolutionize mining sustainability and efficiency through cutting-edge technologies. Specifically, it integrates innovative sensing technologies that combine 3D vision and X-ray capabilities. This advancement is expected to significantly lower energy consumption and reduce carbon dioxide emissions associated with mining operations.

The North America digital mining market is expected to grow at the fastest CAGR from 2024 to 2032. This is due to the higher adoption of digital solutions in mining, favorable regulatory framework, and the presence of major mining companies in the region. Growing focus on automation and data analytics to improve process efficiency and the already existing precious metal market is further propelling the growth of the region. For instance, in November 2023, A&S investment Holding successfully acquired 3 mining companies in Canada & 1 in the United States.

Global Digital Mining Market Regional Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Digital Mining Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the digital mining market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the digital mining industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global digital mining industry to benefit clients and increase the market sector. In recent years, the digital mining industry has witnessed some technological advancements. Major players in the digital mining market include ABB, Caterpillar, Hexagon AB, IBM, Komatsu Mining Corp., Rockwell Automation, Inc., Sandvik AB, SAP, and Siemens.

ABB Ltd is a manufacturer and distributor of electrification, automation, robotics, and motion products. It serves industries with renewable power solutions, electric vehicle charging, industrial robots, autonomous mobile robotics, drives, generators, motors, and advanced process control software. ABB supports sectors including automotive, mining, oil and gas, and power generation, offering comprehensive solutions from distribution automation to cybersecurity services. In January 2024, ABB introduced ABB Ability Smart Hoisting, enhancing mine hoist performance with advanced monitoring, predictive maintenance, and improved operational reliability for the mining industry.

Caterpillar Inc. is a multinational corporation that provides machinery, engines, and financial services. The company specializes in designing, manufacturing, marketing, and selling various products, including construction and mining equipment, industrial gas turbines, forestry equipment, diesel-electric locomotives, and diesel & natural gas engines. Caterpillar serves in construction, mining, electric power, transportation, and oil and gas industries. In December 2023, Caterpillar demonstrated its expanding portfolio of sustainable underground solutions, including a battery electric prototype mining truck and advancements in autonomy, to Newmont and industry leaders in Tasmania, Australia.

Key companies in the digital mining market include:

- ABB

- Caterpillar

- Hexagon AB

- IBM

- Komatsu Mining Corp.

- Rockwell Automation, Inc.

- Sandvik AB

- SAP

- Siemens

Digital Mining Industry Developments

- January 2024, Epiroc acquired a multi-year order of value of around USD 32.6 million for its digital solutions from Chile-based mining company Codelco.

- January 2024, Gold Fields implemented ABB's digital operations & fleet management system (FMS) to support the latest Industry 4.0 inter-operability standards.

- November 2023: Orica and Caterpillar collaborated to enhance mining operations through integrated data exchange and workflow optimization across the value chain, aiming to improve safety, productivity, and sustainability outcomes in the industry.

- September 2023: Gold Fields deployed ABB's digital platform at Granny Smith mine in Western Australia to enhance production scheduling, operational efficiency, and decision-making through integrated operations management.

Digital Mining Market Segmentation:

Digital Mining Technology Outlook

- Automation & robotics

- Real-time analytics

- Cybersecurity

- Other

Digital Mining Application Outlook

- Iron & ferro alloys

- Non-ferrous metals

- Precious metals

- Other

Digital Mining Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Mining Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 8.78 billion |

|

Market Size Value in 2024 |

USD 9.55 billion |

|

Revenue Forecast in 2032 |

USD 19.83 billion |

|

CAGR |

9.6% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global digital mining market size was valued at USD 8.78 billion in 2023 and is projected to grow to USD 19.83 billion by 2032.

The global market is projected to grow at a CAGR of 9.6% during the forecast period, 2024-2032.

Asia Pacific had the largest share of the global market

The key players in the market are ABB, Caterpillar, Hexagon AB, IBM, Komatsu Mining Corp., Rockwell Automation, Inc., Sandvik AB, SAP, and Siemens.

The automation & robotics category dominated the market in 2023

The precious metal segment had the largest share of the global market