Digital Identity Verification Blockchain Solutions Market Size, Share, Trends, Industry Analysis Report: By Technology, Application (Identity Authentication, Fraud Prevention, Data Privacy Management, and Others), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5429

- Base Year: 2024

- Historical Data: 2020-2023

Digital Identity Verification Blockchain Solutions Market Overview

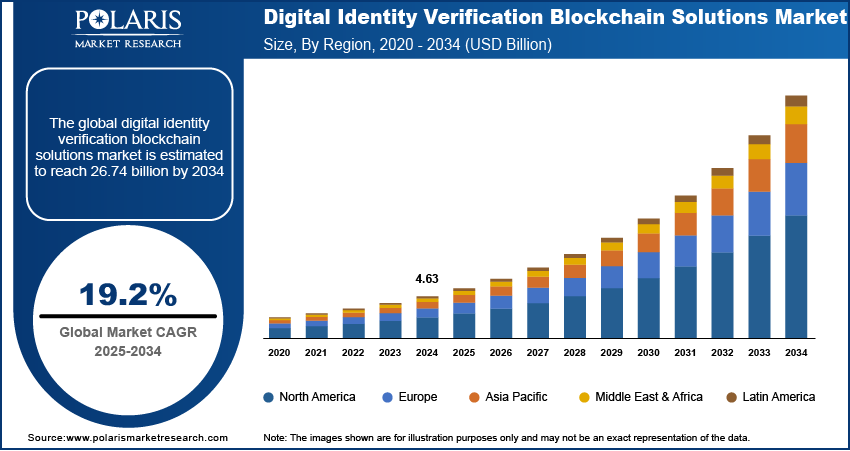

The global digital identity verification blockchain solutions market size was valued at USD 4.63 billion in 2024. The market is projected to grow from USD 5.51 billion in 2025 to USD 26.74 billion by 2034, exhibiting a CAGR of 19.2% during 2025–2034.

Digital identity verification blockchain solutions refer to the use of blockchain technology to securely and efficiently confirm and manage individuals' identities online. These solutions distribute identity information across a network of computers, making it significantly harder for hackers to access or alter the data. Blockchain solutions in digital identity verification utilize smart contracts to streamline identity checks, making them faster and reducing the chances of human error.

The increasing incidence of data breaches globally is propelling the digital identity verification blockchain solutions market growth. According to the Identity Theft Resource Center, there were 3,122 publicly reported data breaches worldwide in 2023, representing a rapid increase from previous years. Data breaches expose the vulnerabilities of traditional identity verification solutions, leading to financial fraud, identity theft, and regulatory penalties for businesses. This has encouraged companies to invest in blockchain-based identity verification solutions, as they provide immutable records, cryptographic security, and decentralized control, making it harder for hackers to manipulate or steal identity data. As data breaches continue to grow, businesses and governments are increasingly investing in blockchain-based verification systems to enhance security, ensure compliance, and restore consumer trust in digital interactions.

To Understand More About this Research: Request a Free Sample Report

The digital identity verification blockchain solutions market demand is driven by the growing digitalization worldwide. Digitalization expands online transactions, remote services, and digital interactions, creating the need for secure and seamless identity verification. This drives companies and government agencies to integrate blockchain-based digital identity verification solutions into their traditional identity management system to reduce fraud, streamline user authentication, and enhance trust in digital ecosystems.

Digital Identity Verification Blockchain Solutions Market Dynamics

Increasing Adoption of Smartphones Worldwide

Smartphone adoption has led to a rise in online services such as banking, e-commerce, and more. For instance, according to the GSMA’s annual State of Mobile Internet Connectivity Report 2023 (SOMIC), over half (54%) of the global population, or ~4.3 billion people, own a smartphone. These services require secure digital identity authentication to provide adequate security against phishing and identity theft. This drives the demand for blockchain-based identity verification solutions, as they enhance mobile identity verification by offering decentralized, tamper-proof credentials that users control directly from their smartphones. Therefore, the rising adoption of smartphones is boosting the digital identity verification blockchain solutions market revenue.

Rising Investments in Smart Cities

With increasing investments in smart cities globally, governments are prioritizing the integration of advanced technologies, including secure identity verification systems. For instance, the Government of India allocated USD 19.03 billion to develop 100 smart cities across the country. Smart cities integrate digital services such as e-governance, intelligent transportation, digital payments, and IoT-based public infrastructure, all of which require seamless and fraud-resistant identity verification. This has encouraged governments and private companies to prioritize blockchain-based identity verification solutions to enhance security, protect citizen data, and prevent identity fraud in smart city ecosystems. As a result, blockchain-driven authentication solutions are becoming essential for fostering trust, transparency, and interoperability in these rapidly developing environments.

Digital Identity Verification Blockchain Solutions Market Segment Insights

Digital Identity Verification Blockchain Solutions Market Evaluation by Application Insights

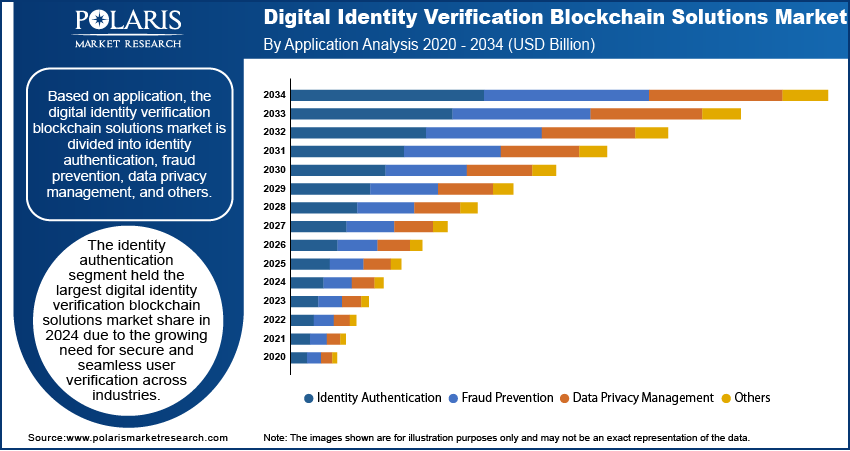

Based on application, the digital identity verification blockchain solutions market is divided into identity authentication, fraud prevention, data privacy management, and others. The identity authentication segment held the largest market share in 2024 due to the growing need for secure and seamless user verification across industries. Businesses and government agencies are prioritizing strong identity authentication solutions to prevent unauthorized access, comply with stringent regulations, and enhance user trust. The rapid expansion of digital banking, e-commerce, and remote work has increased the demand for secure authentication, including identity authentication. Companies are increasingly adopting blockchain-based identity authentication solutions to eliminate reliance on vulnerable centralized databases, offering users greater control over their personal information. Additionally, rising cyber threats and data breaches have pushed organizations to implement blockchain-based identity authentication solutions that provide cryptographic security and tamper-proof verification processes.

Digital Identity Verification Blockchain Solutions Market Assessment by End User Insights

In terms of end user, the digital identity verification blockchain solutions market is segregated into BFSI, healthcare, government, and others. The BFSI segment dominated the market in 2024 due to the high demand for secure identity verification and fraud prevention. Financial institutions are facing rising threats from identity theft, account takeovers, and money laundering, prompting them to adopt blockchain-based verification solutions for enhanced security. Banks and payment service providers are integrating decentralized identity systems to comply with stringent regulatory requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. The increasing shift toward digital banking and mobile payment platforms has further accelerated the need for secure and seamless authentication, such as block-based identity verification solutions.

Digital Identity Verification Blockchain Solutions Market Regional Analysis

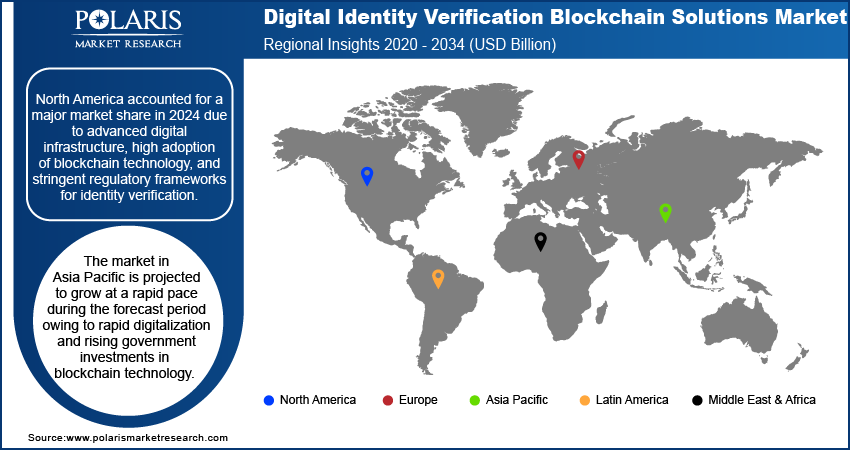

By region, the report provides the digital identity verification blockchain solutions market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major market share in 2024 due to advanced digital infrastructure, high adoption of blockchain technology, and stringent regulatory frameworks for identity verification. The increasing frequency of cyber threats, data breaches, and financial fraud incidents has prompted businesses and government agencies to implement blockchain-based identity verification solutions for enhanced security. The financial sector, healthcare providers, and e-commerce platforms in the US and Canada are prioritizing blockchain-based verification to comply with Know Your Customer (KYC) regulations. The presence of major blockchain technology providers and continuous investments in cybersecurity innovation further contribute to regional market dominance.

The Asia Pacific digital identity verification blockchain solutions market is projected to grow at a rapid pace during the forecast period, owing to rapid digitalization and rising government investments in blockchain technology. Countries such as China, India, and Japan are dominating the adoption of blockchain-based identity solutions to enhance cybersecurity, support digital payment ecosystems, and streamline public service delivery. The expansion of e-commerce, fintech services, and remote work solutions has created the need for secure identity verification across industries in the region. Governments in the region are implementing blockchain-based national identity programs and digital ID frameworks to improve transparency, reduce fraud, and facilitate secure cross-border transactions. Additionally, increasing smartphone penetration in the region is propelling the demand for blockchain-based digital identity verification solutions. For instance, as per the data published by the Groupe Speciale Mobile Association (GSMA), mobile penetration in Asia Pacific is expected to reach 70% by 2030.

Digital Identity Verification Blockchain Solutions Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the digital identity verification blockchain solutions market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The digital identity verification blockchain solutions market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Antier Solutions, Oracle, IBM, VMware, Cloudsigma, SoluLab, Blockchain Helix, Civic Technologies, Evernym, and ValidatedID.

Validated ID is a company specializing in digital identity verification through its innovative platform, VIDidentity. Founded in 2012 and based in Barcelona, Spain, Validated ID focuses on providing a secure, decentralized solution for managing digital identities. The VIDidentity platform enables users to create and manage self-sovereign identities, allowing individuals to control their personal information. Validated ID also integrates advanced technologies such as blockchain and distributed ledger technology (DLT), which add layers of security and traceability to the identity verification process.

Blockchain Helix is a German technology company founded in 2016, specializing in digital identity solutions that leverage blockchain technology. The company's flagship product, helix ID, combines a Smart ID Wallet for regulatory compliance with a WEB3 Wallet, allowing users to manage their digital identities securely while also handling crypto assets and NFTs. Blockchain Helix operates across various sectors, including finance, healthcare, and public services, addressing the growing need for reliable digital identity verification.

List of Key Companies in Digital Identity Verification Blockchain Solutions Market

- Antier Solutions

- Blockchain Helix

- Civic Technologies

- Cloudsigma

- Evernym

- IBM

- Oracle

- SoluLab

- ValidatedID

- VMware

Digital Identity Verification Blockchain Solutions Industry Developments

January 2025: MY E.G. Services Berhad partnered with MyDigital ID Solutions to develop a blockchain-powered digital identity ecosystem to improve online security and combat digital fraud.

October 2024: Argentina introduced QuarkID, an innovative blockchain-based digital identity system to enhance privacy and security for its 3.6 million citizens in Buenos Aires.

Digital Identity Verification Blockchain Solutions Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Blockchain Technology

- Public Blockchain

- Private Blockchain

- Consortium Blockchain

- Verification Technology

- Biometric Verification

- Document Verification

- Knowledge-based Verification

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Identity Authentication

- Fraud Prevention

- Data Privacy Management

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Healthcare

- Government

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Identity Verification Blockchain Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.63 billion |

|

Revenue Forecast in 2025 |

USD 5.51 billion |

|

Revenue Forecast by 2034 |

USD 26.74 billion |

|

CAGR |

19.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 4.63 billion in 2024 and is projected to grow to USD 26.74 billion by 2034.

The global market is projected to register a CAGR of 19.2% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Antier Solutions, Oracle, IBM, VMware, Cloudsigma, SoluLab, Blockchain Helix, Civic Technologies, Evernym, and ValidatedID.

The identity authentication segment dominated the market in 2024.