Digital Art Authentication Blockchain Platforms Market Size, Share, Trends, Industry Analysis Report: By Technology Type [Non-Fungible Tokens (NFTs), Smart Contracts, and Others], Application, Platform Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5452

- Base Year: 2024

- Historical Data: 2020-2023

Digital Art Authentication Blockchain Platforms Market Overview

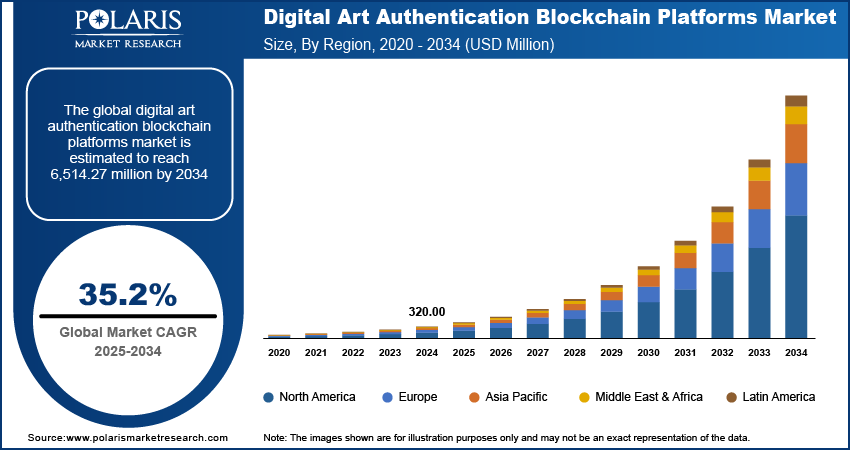

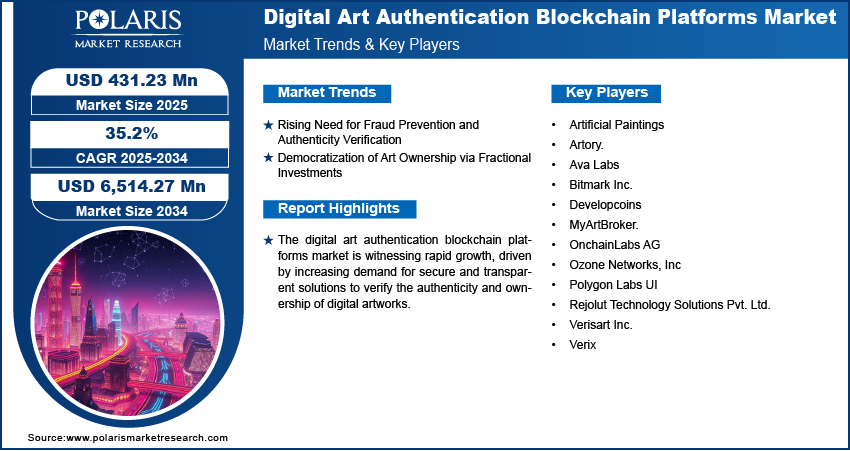

The global digital art authentication blockchain platforms market size was valued at USD 320.00 million in 2024. It is expected to grow from USD 431.23 million in 2025 to USD 6,514.27 million by 2034, at a CAGR of 35.2% during 2025–2034.

Digital art authentication blockchain platforms are decentralized systems leveraging blockchain technology to verify the authenticity, ownership, and history of digital artworks. One of the drivers propelling the adoption of these platforms is the demand for improved transparency and provenance tracking. These platforms allow a transparent record of the creation, ownership transfers, and sales history of digital art, mitigating risks of counterfeiting and unauthorized reproduction by utilizing immutable ledgers. In early 2021, the NFT market reached USD 1.5 million in trading, growing 2,627% from the previous quarter, as per a February 2022 US Treasury report. This exponential growth highlights the increasing reliance on blockchain for secure and transparent art transactions. The built-in transparency of blockchain assures that every transaction is permanently recorded and publicly accessible, fostering trust among buyers, sellers, and artists. As a result, digital art authentication platforms serve as a reliable solution to verify authenticity and uphold the integrity of the art market.

To Understand More About this Research: Request a Free Sample Report

Another driver propelling the digital art authentication blockchain platforms market demand is the empowerment of artists through royalties and ownership rights. Blockchain-based authentication platforms allow artists to set smart contracts into their artworks, allowing them to receive royalties each time their art is resold in secondary markets. For instance, in July 2022, Art Group Limited launched ARTRACX Curator, ENTITLE App, and Starter Kit, enabling artists and galleries to create blockchain-based digital identities for art using W3C-endorsed decentralized ID and verifiable credentials, addressing IP theft and copyright infringement in the art industry. The ability to automate royalty payments improves financial fairness and incentivizes artists to adopt these platforms. Consequently, the integration of smart contracts in digital art authentication systems has transformed how artists manage and monetize their work, boosting the digital art authentication blockchain platforms market development.

Digital Art Authentication Blockchain Platforms Market Dynamics

Rising Demand for Fraud Prevention and Authenticity Verification

Fraud prevention and authenticity verification are crucial drivers for the adoption of digital art authentication blockchain platforms as these platforms leverage blockchain’s immutable and decentralized ledger to combat the proliferation of counterfeit art. In January 2025, MY, E.G., Services Berhad collaborated with MyDigital ID Solutions to launch Malaysia’s MyDigital ID Superapp, a blockchain-based digital identity ecosystem. Built on Malaysia's blockchain infrastructure, it improves online security, combats fraud, and supports interoperable digital standards for businesses and users. These platforms provide verifiable authenticity, assuring that buyers can trust the origin and legitimacy of the digital art they acquire by recording each artwork’s provenance and transaction history on an incorruptible ledger. The transparency and tamper-proof nature of blockchain technology particularly reduce the risk of forgery and fraud, making it a vital tool for safeguarding both artists and collectors. This capability to deliver irrefutable proof of authenticity improves confidence in the digital art market, fostering greater participation and investment. Thus, rising demand for fraud prevention and authenticity verification drives the digital art authentication blockchain platforms market expansion.

Democratization of Art Ownership via Fractional Investments

Blockchain technology authorizes the division of digital artworks into fractional ownership tokens, allowing a broader audience to invest in high-value art without needing to purchase entire pieces. For instance, in November 2023, the WISeKey (WISe.ART) subsidiary launched the Renaissance Coin, a regulated art security token linking physical art to digital assets. The initiative includes digitizing Italian Renaissance art, enhancing global access, and assuring secure, compliant art investments through blockchain technology. This model lowers the financial barrier for art investment and also diversifies the investor base, making art ownership more accessible and inclusive. Additionally, fractional investments, secured and transparently managed through blockchain, empower small investors to participate in the art market while assuring artists and original owners retain appropriate rights and royalties. As a result, this democratization of art ownership expands the market’s reach and inclusivity, driving the digital art authentication blockchain platforms market demand.

Digital Art Authentication Blockchain Platforms Market Segment Insights

Digital Art Authentication Blockchain Platforms Market Assessment by Technology Type Outlook

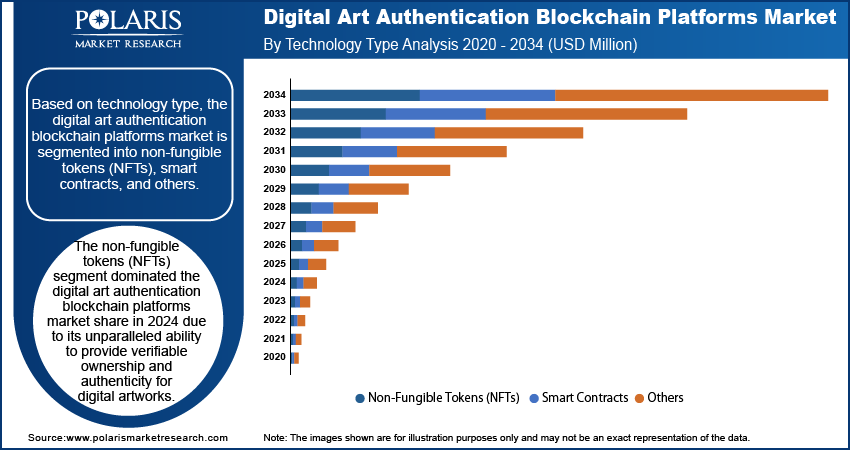

The global digital art authentication blockchain platforms market segmentation, based on technology type, includes non-fungible tokens (NFTS), smart contracts, and others. The non-fungible tokens (NFTS) segment dominated the digital art authentication blockchain platforms market share in 2024 due to its unparalleled ability to provide verifiable ownership and authenticity for digital artworks. NFTs leverage blockchain’s unchangeable ledger to create unique digital certificates of ownership that cannot be duplicated, assuring that each piece of digital art retains its originality and value. This capability has resonated strongly with both artists and collectors, driving widespread adoption of NFTs as the preferred technology for art authentication. Additionally, the integration of smart contracts within NFTs allows for automated royalty payments to artists, improving their appeal and reinforcing their dominance in the market.

Digital Art Authentication Blockchain Platforms Market Evaluation by Application Outlook

The global digital art authentication blockchain platforms market segmentation, based on application, includes ownership verification, provenance tracking, copyright protection, fraud detection, and others. The provenance tracking segment is expected to witness the fastest growth during the forecast period due to the rising importance of verifying an artwork’s history and origin. Provenance tracking utilizes blockchain’s transparent and tamper-proof ledger to chronicle the ownership and transaction history of digital art, assuring that each transfer of ownership is authenticated and publicly accessible. This capability tackles a key challenge in the art market, which is verifying an artwork's lineage. It also builds trust among collectors and reduces fraud risk. Thus, as the demand for authenticated digital assets grows, provenance tracking is increasingly recognized as a critical application driving the digital art authentication blockchain platforms market expansion.

Digital Art Authentication Blockchain Platforms Market Regional Analysis

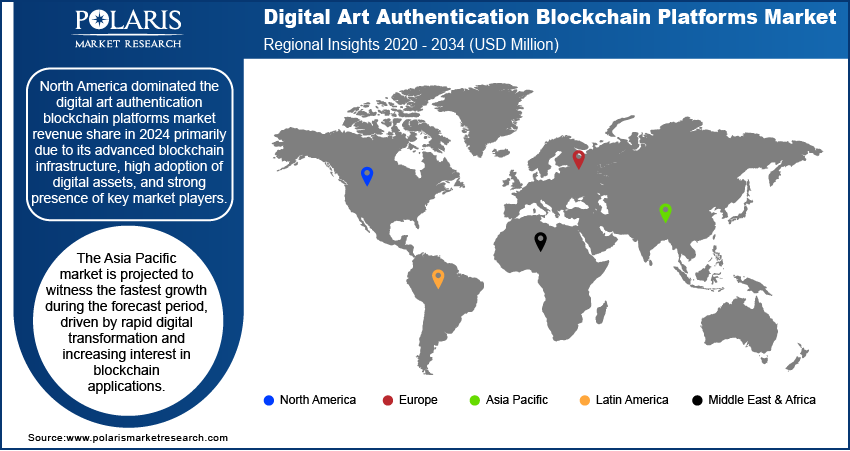

By region, the report provides the digital art authentication blockchain platforms market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the digital art authentication blockchain platforms market revenue in 2024 primarily due to its advanced blockchain infrastructure, high adoption of digital assets, and strong presence of key market players. The region's robust legal frameworks and intellectual property regulations further support the adoption of authentication platforms, providing a secure environment for artists and collectors. For instance, in January 2025, eight state-level blockchain associations in North America united to form the North American Blockchain Association, aiming to solidify the region's leadership in digital asset innovation. This collaboration highlights North America's commitment to advancing blockchain infrastructure and fostering a secure environment for digital art authentication platforms. Moreover, the high disposable income and a thriving digital art community in the US and Canada have accelerated investments in blockchain-based solutions, reinforcing North America's leadership in the market.

The Asia Pacific digital art authentication blockchain platforms market is projected to witness the fastest growth during the forecast period, driven by rapid digital transformation and increasing interest in blockchain applications. Countries such as China, Japan, and South Korea are leading in blockchain adoption, supported by substantial investments and favorable government policies. The growing population of tech-savvy consumers and a rising number of digital artists are fueling the demand for secure and transparent authentication solutions. Additionally, the expanding use of NFTs and the increasing focus on intellectual property protection are anticipated to boost the adoption of digital art authentication platforms.

Digital Art Authentication Blockchain Platforms Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for the digital art authentication blockchain platform market share through innovation, strategic alliances, and regional expansion. Global players leverage strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, addressing the growing demand for secure and transparent authentication systems. Digital art authentication blockchain platforms market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Meanwhile, regional companies address localized needs by offering cost-effective solutions and capitalizing on regional market dynamics. Competitive benchmarking in the market includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative and reliable authentication solutions. The market is experiencing technological advancements, such as AI integration and cross-platform interoperability, reshaping industry ecosystems. Companies are investing in supply chain management, security protocols, and sustainability practices to align with market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are essential for identifying opportunities and driving long-term profitability. In conclusion, the growth of the digital art authentication blockchain platforms market is driven by technological innovation, market adaptability, and regional investments. Major players emphasize strategic developments and market penetration to navigate economic and geopolitical shifts in a highly competitive global market. A few key major players are Artificial Paintings; Artory; Ava Labs; Bitmark Inc.; Developcoins; MyArtBroker; OnchainLabs AG; Ozone Networks, Inc; Polygon Labs UI; Rejolut Technology Solutions Pvt. Ltd.; Verisart Inc.; and Verix.

Verisart Inc., established in 2015, leverages blockchain technology to provide immutable and verifiable Certificates of Authenticity (COAs) for artworks and collectibles, addressing issues of forgery and provenance in the art market. The company allows artists, collectors, and businesses to create, manage, and customize COAs through its platform and Shopify app, offering features such as NFT minting, secure QR stickers linking physical and digital assets, and inventory management. Its blockchain-based system ensures a permanent, tamper-proof record of ownership while protecting user identity. Verisart’s solutions cater to individual creators as well as galleries and auction houses, with notable partnerships such as the P8Pass for auction markets. The platform has gained traction with over 60,000 users globally and continues to innovate by integrating digital and physical art through tools such as holographic QR codes. Verisart has become a trusted name in the art world for improving trust in digital art transactions while fostering creator engagement and community building with its focus on transparency, security, and accessibility.

Ozone Networks, Inc., recognized as the parent company of OpenSea, specializes in the digital art authentication blockchain platforms market. Founded in 2017, Ozone Networks revolutionized the digital art ecosystem through its marketplace for Non-Fungible Tokens (NFTs), allowing artists and collectors to buy, sell, and trade digital assets seamlessly. The platform assures transparency, authenticity, and ownership verification of digital artworks leveraging blockchain technology. OpenSea operates on decentralized blockchain networks such as Ethereum and Polygon, offering a secure environment for transactions while empowering creators with royalties on secondary sales. The company’s robust infrastructure allows for provenance tracking and fraud prevention, addressing key challenges in the digital art market. Ozone Networks facilitates automated ownership transfers and tamper-proof records of authenticity by integrating smart contracts and cryptographic hashing. Its user-friendly interface and interoperability with multiple blockchain platforms have positioned it as a dominant force in the NFT space. Ozone Networks continues to innovate by expanding its offerings to include advanced authentication tools and integration with emerging Web3 technologies as blockchain adoption grows. Making it a cornerstone of the digital art authentication landscape, driving accessibility and trust in the burgeoning NFT economy.

List of Key Companies in Digital Art Authentication Blockchain Platforms Market

- Artificial Paintings

- Artory.

- Ava Labs

- Bitmark Inc.

- Developcoins

- MyArtBroker.

- OnchainLabs AG

- Ozone Networks, Inc

- Polygon Labs UI

- Rejolut Technology Solutions Pvt. Ltd.

- Verisart Inc.

- Verix

Digital Art Authentication Blockchain Platforms Industry Developments

December 2024: The BSV Blockchain Association collaborated with AWS to enhance global blockchain adoption. The collaboration focuses on deploying BSV technologies, including Teranode, through AWS’s cloud infrastructure, enabling scalable, cost-efficient solutions and fostering enterprise adoption of blockchain innovations.

September 2024: Asahi Kasei and TIS launched Akliteia, a digital anti-counterfeiting platform, for art authentication. The platform ensures accurate verification while prioritizing artwork protection, offering tamper-resistant labels, and providing various size and color options to maintain the artwork's integrity.

Digital Art Authentication Blockchain Platforms Market Segmentation

By Technology Type Outlook (Revenue, USD Million, 2020–2034)

- Non-Fungible Tokens (NFTs)

- Smart Contracts

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Ownership Verification

- Provenance Tracking

- Copyright Protection

- Fraud Detection

- Others

By Platform Type Outlook (Revenue, USD Million, 2020–2034)

- Public Blockchain Platforms

- Private Blockchain Platforms

- Hybrid Blockchain Platforms

By End User Outlook (Revenue, USD Million, 2020–2034)

- Digital Artists

- Art Collectors

- Galleries and Museums

- Auction Houses

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Art Authentication Blockchain Platforms Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 320.00 million |

|

Market Size Value in 2025 |

USD 431.23 million |

|

Revenue Forecast in 2034 |

USD 6,514.27 million |

|

CAGR |

35.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global digital art authentication blockchain platforms market size was valued at USD 320.00 million in 2024 and is projected to grow to USD 6,514.27 million by 2034.

The global market is projected to register a CAGR of 35.2% during the forecast period

North America dominated the market revenue share in 2024.

The Asia Pacific digital art authentication blockchain platforms market is projected to witness the fastest growth during the forecast period.

A few of the key players in the market are Artificial Paintings; Artory; Ava Labs; Bitmark Inc.; Developcoins; MyArtBroker; OnchainLabs AG; Ozone Networks, Inc; Polygon Labs UI; Rejolut Technology Solutions Pvt. Ltd.; Verisart Inc.; and Verix.

The solutions segment dominated the market share in 2024.

The provenance tracking segment is expected to witness the fastest market growth during the forecast period.