Digestive & Intestinal Remedies Market Size, Share, Trends, Industry Analysis Report: By Type, Age Group, Distribution Channel (Offline and Online), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5282

- Base Year: 2024

- Historical Data: 2020-2023

Digestive & Intestinal Remedies Market Overview

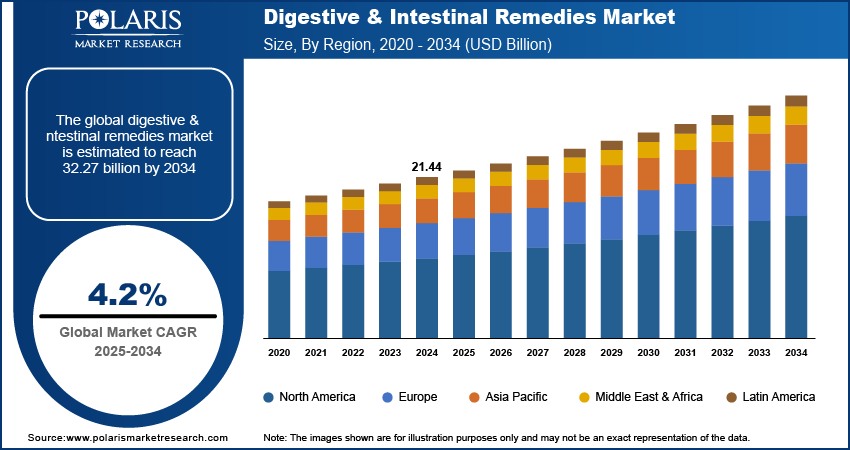

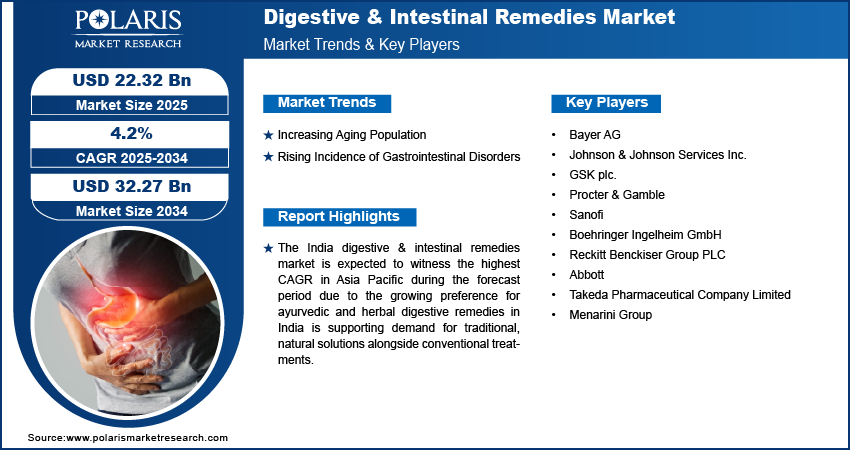

The digestive & intestinal remedies market size was valued at USD 21.44 billion in 2024. The market is projected to grow from USD 22.32 billion in 2025 to USD 32.27 billion by 2034, exhibiting a CAGR of 4.2% during 2025–2034.

Digestive and intestinal remedies are treatments or medications aimed at improving issues related to the digestive system, including the stomach, intestines, and other parts of the gastrointestinal tract. Digestive and intestinal remedial products help manage symptoms such as bloating, gas, indigestion, heartburn, constipation, diarrhea, and other discomforts associated with digestive health. The shift toward preventive health has led individuals to adopt digestive remedies proactively to maintain gut health and avoid chronic conditions. This trend is boosting the demand for probiotics, digestive enzymes, and fiber-based products, further fueling the digestive and intestinal remedies market expansion. Furthermore, the growth in pharmacies, online retail channels, and supermarkets is making digestive remedies more accessible to a broader audience, thereby contributing to the market growth.

Rising demand for natural and organic products, such as herbal remedies (ginger, peppermint, and others), is driving the digestive & intestinal remedies market demand. Moreover, increased healthcare spending, particularly in emerging markets, is allowing for greater access to over-the-counter and prescription digestive treatments, which is contributing to the market growth.

To Understand More About this Research: Request a Free Sample Report

Digestive & Intestinal Remedies Market Trend Analysis

Increasing Aging Population

The geriatric population is prone to gastrointestinal issues such as constipation, acid reflux, and irritable bowel syndrome (IBS). The World Health Organization (WHO) forecasts that the global population of those aged 60 and above will reach ∼1.4 billion by 2030, up from 1 billion in 2020. This demographic shift is leading to an increased demand for digestive remedies specifically designed for older adults. Products such as fiber supplements, gentle laxatives, and antacids are seeing higher adoption rates among the elderly to address these common digestive concerns. Digestive and intestinal remedies are formulated to be safe and effective for seniors, who often have more sensitive digestive systems. Thus, the growing aging population, particularly in developed regions, would boost the demand for products tailored to manage their digestive issues, which is expected to drive the digestive and intestinal remedies market expansion during the forecast period.

Rising Incidence of Gastrointestinal Disorders

There is a significant increase in the incidence of digestive issues such as acid reflux, constipation, irritable bowel syndrome (IBS), and inflammatory bowel diseases (IBD). This surge in gastrointestinal conditions is prompting consumers to seek effective solutions, including antacids, laxatives, and probiotics, to manage and alleviate symptoms.

The digestive and intestinal remedies market outlook reveals that as the prevalence of gastric disorders continues to rise globally, there will be a rising adoption of digestive health products. The National Institute of Diabetes and Digestive and Kidney Diseases estimates that 1% to 6% of the US population has peptic ulcers. Similarly, increasing awareness of gut health's role in overall well-being has led to a higher demand for preventive and therapeutic solutions. Therefore, the rising incidence of gastrointestinal disorders is expected to drive the digestive and intestinal remedies market development in the coming years.

Digestive & Intestinal Remedies Market Segment Insights

Digestive & Intestinal Remedies Market Assessment by Type Outlook

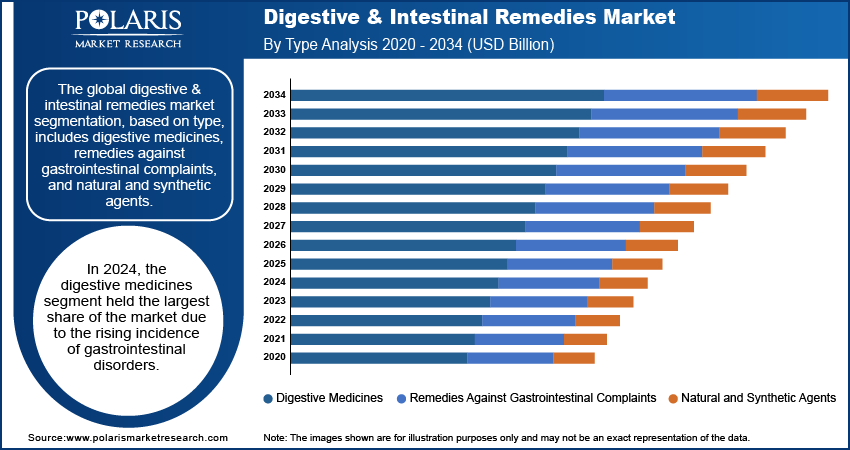

The global digestive & intestinal remedies market segmentation, based on type, includes digestive medicines, remedies against gastrointestinal complaints, and natural and synthetic agents. In 2024, the digestive medicines segment held the largest share of the market due to the rising incidence of gastrointestinal disorders. The increasing awareness among consumers about the importance of managing digestive health with medically proven remedies has contributed to the growth of the digestive medicines segment. The availability of a wide range of over-the-counter (OTC) products, including antacids, laxatives, and digestive enzymes, along with prescription medications for more chronic conditions drives the market revenue.

Digestive & Intestinal Remedies Market Evaluation by Distribution Channel Outlook

The global digestive & intestinal remedies market segmentation, based on distribution channel, includes offline and online. The online segment is projected to register a higher growth rate due to the convenience of e-commerce platforms, which give consumers easy access to a variety of digestive health products along with comparisons and reviews. Additionally, the growth of health and wellness e-commerce has led to the availability of specialized digestive remedies, including probiotics, antacids, and digestive enzymes, often at competitive prices. Moreover, the increasing presence of digital pharmacies and partnerships between digestive remedy brands and e-commerce giants are boosting the visibility and accessibility of these products, driving significant growth of the online segment.

Digestive & Intestinal Remedies Market Regional Analysis

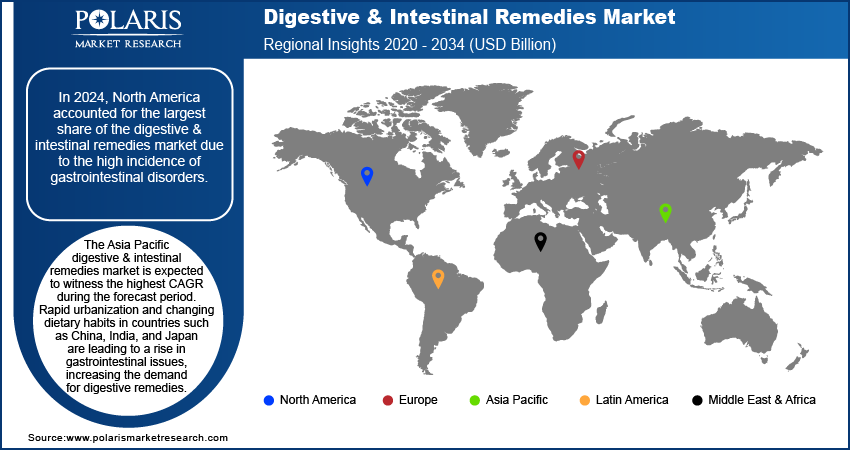

By region, the study provides digestive & intestinal remedies market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the market due to the high incidence of gastrointestinal disorders. For instance, gastrointestinal diseases impact around 70 million Americans each year, significantly surpassing the 34.2 million affected by diabetes. Annual direct healthcare costs for these disorders are estimated at USD 136 billion in the US. Increasing consumer awareness of gut health and its link to overall wellness has encouraged the adoption of various remedies, including probiotics, antacids such as esomaprazole, and fiber supplements.

The US accounted for the largest share of the digestive & intestinal remedies market due to advanced healthcare infrastructure, high healthcare spending, and the strong presence of major pharmaceutical and nutraceutical companies in the US.

The Asia Pacific digestive & intestinal remedies market is expected to witness the highest CAGR during the forecast period. Rapid urbanization and changing dietary habits in countries such as China, India, and Japan are leading to a rise in gastrointestinal issues, increasing the demand for digestive remedies. The expanding middle-class population, rising disposable incomes, and increasing healthcare spending also contribute to higher adoption rates of these remedies. Furthermore, improved access to healthcare and the growth of e-commerce platforms tend to make digestive health products more accessible, especially in rural and remote areas in the region, which drives the market growth in Asia Pacific.

The India digestive & intestinal remedies market is expected to witness the highest CAGR in Asia Pacific during the forecast period. The growing preference for ayurvedic and herbal digestive remedies in India is supporting the demand for traditional, natural solutions alongside conventional treatments. In May 2021, Dabur India Ltd, an Ayurveda based company, enhanced its Hajmola range with the launch of ‘Dabur Hajmola LimCola’.

Digestive & Intestinal Remedies Market – Key Players and Competitive Analysis Report

The competitive landscape of the digestive and intestinal remedies market is characterized by a mix of global pharmaceutical giants, regional players, and specialized companies offering a wide array of products to meet diverse consumer needs. Key players are focusing on innovation, product differentiation, and portfolio expansion to address the rising incidence of gastrointestinal disorders such as acid reflux, constipation, and irritable bowel syndrome (IBS). Many companies are investing heavily in research and development to introduce advanced formulations, including probiotics, digestive enzymes, and fiber supplements that cater to different age groups and health concerns.

There is an increasing trend toward natural and herbal digestive remedies, driving companies to explore ayurvedic, herbal, and organic product lines to attract health-conscious consumers. The rise of e-commerce platforms has enabled large and small players to expand their reach, with online sales channels allowing consumers greater access to a variety of digestive health products. Strategic partnerships and mergers and acquisitions are also common as companies seek to expand their market presence and gain a competitive edge. A few key major players are Bayer AG, Johnson & Johnson Services Inc., GSK plc, Procter & Gamble, Sanofi, Boehringer Ingelheim GmbH, Reckitt Benckiser Group PLC, Abbott, Takeda Pharmaceutical Company Limited, and Menarini Group.

Bayer AG is a multinational conglomerate with core competencies in Life Sciences, encompassing healthcare and agriculture. The company has developed into a prominent global entity with a broad range of products and solutions aimed at addressing various health and societal challenges. In April 2024, Bayer introduced Iberogast in the US, a botanical treatment for gastrointestinal disorders, providing an evidence-based approach for managing conditions that affect millions of individuals.

Procter & Gamble Company is engaged in consumer-packaged goods, diverged into five segments—grooming; health care; beauty; fabric & home care; and baby; feminine & family care. In the health care segment, P&G offers a range of products, including oral care solutions such as Crest and Oral-B toothbrushes and toothpaste. The portfolio also features gastrointestinal aids (Metamucil), pain relief (Pepto-Bismol), respiratory products (Vicks), and nutritional support (Neurobion and vitamins), highlighting the company's focus on effective healthcare solutions. For instance, in June 2020, Procter & Gamble Align Probiotic launched a new product to relieve fussiness and crying in infants. Formulated with advanced probiotic strains, it supports gut health and aims to improve digestive balance, addressing common gastrointestinal issues that cause distress in infants.

Key Companies in Digestive & Intestinal Remedies Market

- Bayer AG

- Johnson & Johnson Services Inc.

- GSK plc.

- Procter & Gamble

- Sanofi

- Boehringer Ingelheim GmbH

- Reckitt Benckiser Group PLC

- Abbott

- Takeda Pharmaceutical Company Limited

- Menarini Group

Digestive & Intestinal Remedies Market Developments

In October 2023, Sanofi and Teva Pharmaceuticals collaborated to co-develop and commercialize TEV’574, currently undergoing Phase 2b trials for Ulcerative Colitis and Crohn's Disease.

In September 2020, Reckitt Benckiser Group plc launched Bodi-Ome, a pioneering microbiome brand available on Amazon. This line includes five probiotic dietary supplements formulated with clinically proven strains aimed at supporting digestive health, immune function, cardiovascular health, vaginal balance, and mood enhancement.

Digestive & Intestinal Remedies Market Segmentation

By Type Outlook (Revenue, USD Billion; 2020–2034)

- Digestive Medicines

- Remedies Against Gastrointestinal Complaints

- Natural and Synthetic Agents

By Age Group Outlook (Revenue, USD Billion; 2020–2034)

- Adult & Geriatric

- Pediatric

By Distribution Channel Outlook (Revenue, USD Billion; 2020–2034)

- Offline

- Online

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digestive & Intestinal Remedies Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 21.44 billion |

|

Market Size Value in 2025 |

USD 22.32 billion |

|

Revenue Forecast by 2034 |

USD 32.27 billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 21.44 billion in 2024 and is projected to grow to USD 32.27 billion by 2034.

The global market is projected to register a CAGR of 4.2% during the forecast period.

In 2024, North America dominated the digestive & intestinal remedies market share due to the high incidence of gastrointestinal disorders.

A few key players in the market are Bayer AG, Johnson & Johnson Services Inc., GSK plc, Procter & Gamble, Sanofi, Boehringer Ingelheim GmbH, Reckitt Benckiser Group PLC, Abbott, Takeda Pharmaceutical Company Limited, and Menarini Group.

In 2024, the digestive medicines segment held the largest share of the digestive & intestinal remedies market revenue due to the rising incidence of gastrointestinal disorders.

The online segment is expected to witness a higher CAGR during the forecast period due to the increasing convenience of e-commerce platforms.