Diffractive Optical Element Market Size, Share, Trends, Industry Analysis Report: By Type, Component (Binary/Multilevel Doe, Diffractive Lenses, Diffusing Materials, and Gratings), Application, Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2024–2032)

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5133

- Base Year: 2023

- Historical Data: 2019-2022

Diffractive Optical Element Market Overview

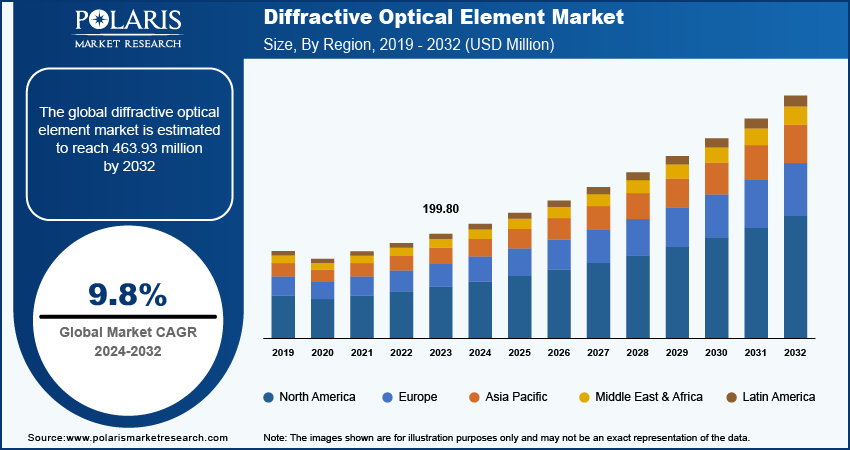

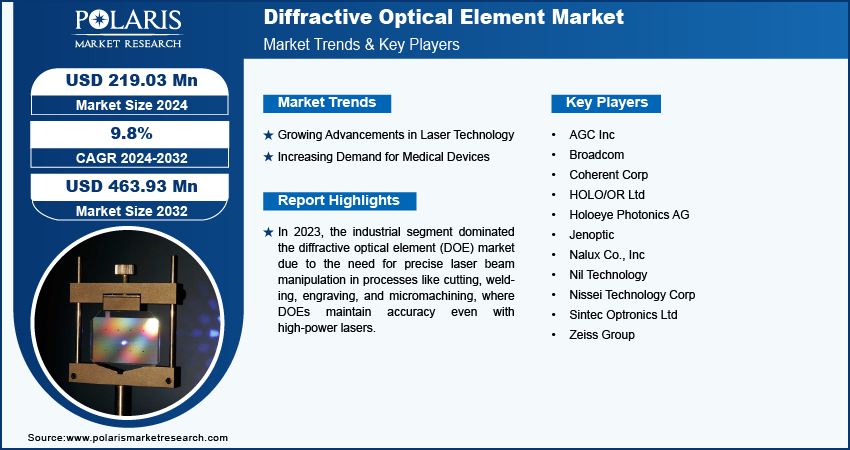

The diffractive optical element market size was valued at USD 199.80 million in 2023. The market is projected to grow from USD 219.03 million in 2024 to USD 463.93 million by 2032, exhibiting a CAGR of 9.8% during the forecast period.

The diffractive optical element market is experiencing significant growth due to the increasing demand for advanced optical solutions in industries such as telecommunications, healthcare, automotive, and semiconductor manufacturing. DOEs play a crucial role in manipulating light for various applications, including beam shaping, optical testing, holography, and 3D sensing technologies. The ability of diffractive optical elements to efficiently control light without the assistance of bulky optical components makes them a preferred choice for high-performance optical system design. The market is driven by continuous advancements in photonic technologies and the need for more efficient, compact, and cost-effective optical solutions. The demand for diffractive optics has been boosted by emerging technologies such as augmented reality (AR), virtual reality (VR), and laser-based communication systems, since these elements enable high-precision control over light that are essential for innovations in imaging, sensing, and data transmission. Moreover, with the ongoing innovation and the increasing adoption of optical systems across industries, the DOE market is set for continued expansion. Furthermore, major players in the industry are focusing on various parameters such as strategic partnerships, product innovations, and geographic diversification to maintain their competitive edge. For instance, in June 2023, Coherent Corp. introduced a next-generation 65 W pump laser diode for fiber lasers-based applications. The diodes are based on a reliable 6-inch gallium arsenide platform, available in 915 nm and 975 nm variants. The feature of the product includes the use of Coherent’s proprietary E2 front mirror passivation to prevent damage under high power. In addition, the 65 W diodes will be commercialized in different formats such as bare dies or ceramic surmounts during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Diffractive Optical Element Market Trends

Growing Advancements in Laser Technology

The demand for components that can manipulate and shape laser beams, such as DOEs, has grown significantly with the evolution of laser technology such as precision, powerful, and adaptability. These DOE elements allow various operational functions such as splitting, focusing, and shaping laser beams into complex patterns, which improves the performance of modern laser systems across various industries. The continuous development of high-power lasers, ultrafast lasers, and compact laser sources has further driven innovation in DOE applications, particularly in sectors such as telecommunications, medical devices, industrial manufacturing, and consumer electronics. In August 2020, SCANLAB GmbH's parent company, TechInvest Holding AG, acquired HOLO/OR Ltd., an Israel-based company specializing in developing diffractive optical elements for industrial applications. By integrating innovative micro-optical components, such as beam shapers, into SCANLAB's scanning solutions, the collaboration expanded the range of applications for SCANLAB's products. The partnership will enable the companies to improve precision and efficiency in sectors such as laser material processing, where beam shaping technology plays a critical role. Thus, advancements in laser technology would boost the growth of the diffractive optical element (DOE) market during the forecast period.

Increasing Demand for Medical Devices

Diffractive optical elements (DOE) are used in various medical applications such as optical coherence tomography (OCT) systems, laser eye surgery, and diagnostic imaging equipment due to their ability to manipulate laser beams with high precision. As healthcare technology is advancing, there is a growing demand for highly accurate, noninvasive diagnostic tools and treatment methods. DOEs, therefore, offer better light control and efficiency that improve the performance of these medical devices. This trend is boosted by the rising global focus on improving healthcare infrastructure and offering innovative solutions for patient care, which has led to increased investments in advanced medical technologies. Thus, rising demand for medical devices is expected to drive the diffractive optical elements market growth during the forecast period.

Diffractive Optical Element Market Segment Insights

Diffractive Optical Element Market Breakdown by Type Outlook

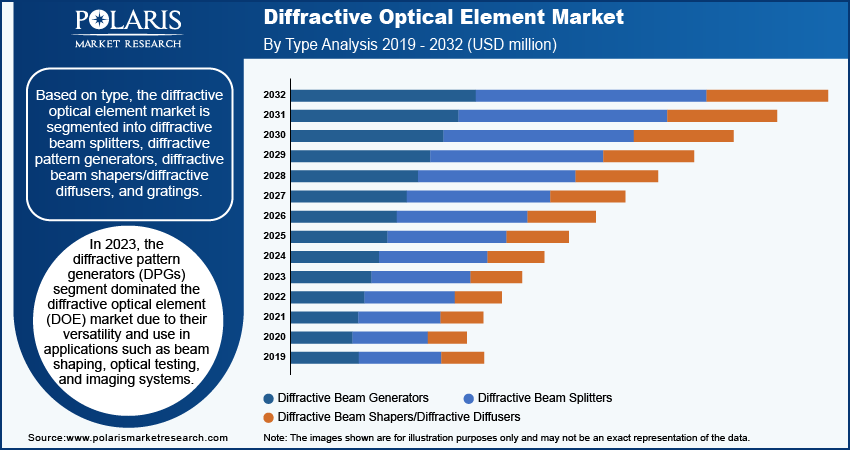

The global diffractive optical element market segmentation, based on type, includes diffractive beam splitters, diffractive pattern generators, and diffractive beam shapers/diffractive diffusers. In 2023, the diffractive pattern generators (DPGs) segment dominated the market due to their versatility and applications in beam shaping, optical testing, and imaging systems. DPGs are valued for generating specific patterns and complex light fields, essential in fields such as bio photonics, spectroscopy, and optical computing. Moreover, DPGs ability to produce efficient light patterns in compact designs-based technologies such as AR/VR, 3D sensing, holography, and others. They are also integral to semiconductor lithography and laser systems, driving their dominance in the market.

Diffractive beam splitters are poised for significant growth due to rising demand from technologies such as augmented reality (AR), virtual reality (VR), and autonomous vehicles. These splitters are essential for splitting light into multiple beams, which is crucial for 3D imaging and laser-based systems. As photonics and imaging technologies advance, their role in improving optical performance makes them a key component in the diffractive optical elements (DOE) market, with projected growth driven by AR and VR developments.

Diffractive Optical Element Market Breakdown by Industry Outlook

The global diffractive optical element market segmentation, based on industry, includes telecommunication, industrial, healthcare, electronics and semiconductors, energy, and others. In 2023, the industrial segment dominated the diffractive optical element (DOE) market due to the need for precise laser beam manipulation in processes like cutting, welding, engraving, and micromachining, where DOEs maintain accuracy even with high-power lasers. Additionally, the increasing demand for minimization, microfabrication, and high-quality surface treatments in material processing drive DOE adoption, reinforcing the industrial sector's market leadership. In telecommunications, diffractive optical elements are crucial for optical communication systems, improving data transmission rates and network performance. In electronics and semiconductors, DOEs are used in lithography and optical sensing applications. The energy sector uses DPGs for laser-based systems in renewable energy technologies. The demand for precision optics in these industries, combined with advancements in technologies such as 5G, optical computing, and laser systems, has driven the industrial segment to dominate the market.

The healthcare sector is expected to grow rapidly in the coming years, driven by the increasing demand for medical imaging and diagnostic devices. Diffractive optical elements (DOE) play an important role in improving the resolution and performance of advanced medical instruments. As the industry moves toward more precise and noninvasive diagnostic methods and focuses on personalized medicine and advanced imaging systems, the adoption of DOE technologies is expected to grow rapidly in the healthcare sector during the forecast period.

Diffractive Optical Element Market Breakdown, by Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, North America dominated the diffractive optical element (DOE) market due to the strong presence of advanced technology industries, leading research institutions, and substantial investments in optical and photonic technologies. The US and Canada lead in the development and adoption of high-precision optical components for telecommunications, healthcare, electronics, and aerospace, supported by major players such as Apple, Google, and Intel. These major companies are advancing technologies such as AR, VR, and imaging, all dependent on diffractive optics. Additionally, government-backed initiatives from organizations such as the NIH and NSF drive photonics research and development. The innovation-focused environment, supported by substantial R&D funding and strong industrial infrastructure, ensures North America's dominance in the DOE market. For instance, in January 2024, Jenoptik unveiled a new diode laser and presented an exhibition of advanced photonic solutions at the SPIE BiOS and Photonics West event in San Francisco, California. The company highlighted its extensive range of high-performance optical components and systems, addressing emerging trends in sectors such as medical technology, laser systems, optoelectronics, semiconductor equipment, data transmission, and imaging.

The Asia Pacific DOE market is experiencing rapid growth due to increased demand for high-precision optics in industries such as semiconductor manufacturing, telecommunications, and healthcare. The regional market growth is mainly driven by the expansion of industries such as healthcare, energy, and others and the rising research and development initiatives in countries such as China, Japan, and South Korea. Moreover, increasing investments in next-generation technologies such as 5G communication, laser-based medical devices, and LIDAR systems for autonomous vehicles in the automotive sectors boost the growth of the diffractive optical element market in the region. Furthermore, the presence of major semiconductor manufacturers in the region has boosted demand for optical elements in high-speed data transmission and integrated circuits.

Diffractive Optical Element Market – Key Players and Competitive Insights

The competitive landscape of the diffractive optical element (DOE) market is marked by a combination of global leaders and regional players competing for market share through innovation, strategic collaborations, and regional expansion. Major companies in the industry leverage their strong R&D capabilities and broad distribution networks to deliver advanced DOE solutions that cater to applications across sectors such as telecommunications, healthcare, automotive, and industrial manufacturing. These leading players emphasize product innovation, focusing on improving optical performance, efficiency, and scalability to meet the demands of industries such as AR/VR, 3D sensing, and telecommunications. Meanwhile, smaller regional firms are emerging with niche DOE products tailored to specific local markets, which offer unique solutions and customized applications. Competitive strategies in this market include mergers and acquisitions, partnerships with technology firms, and expanding product portfolios to expand market presence in key geographic regions. A few key major players are Zeiss Group; AGC Inc; Coherent Corp; Jenoptic; HOLO/OR Ltd; Broadcom; Nalux Co., Inc; Holoeye Photonics AG; Nissei Technology Corp; Sintec Optronics Ltd; and Nil Technology.

HOLOEYE provides advanced spatial light modulators (SLMs) for phase and amplitude modulation, along with standard diffractive optical elements (DOEs). The company specializes in offering tailored solutions for academic research and industrial R&D and delivering high-performance LCOS micro display components for projection systems. In January 2020, HOLOEYE introduced ten new standards DOEs, each with distinct patterns and specifications, such as the 1-Dot Truly-Random, 3-Line rectangular pattern, and multiple dot arrays. These new elements cater to a variety of applications across different wavelengths, making them suitable for advanced projection and imaging systems.

NIL Technology is an optical solutions company specializing in the design, development, and manufacturing of optical elements using high-precision nanoscale features. NILT is renowned for providing advanced nanostructured masters for replication technologies such as nanoimprint and injection molding. In October 2021, NILT expanded its focus to technologies for head-mounted displays and optical components for 3D sensing, particularly in the AR/VR/MR industries. NILT’s expertise in diffractive optical elements (DOE) and meta optical elements (MOE) enables precise and energy-efficient 3D sensing, which is essential for future AR applications.

Key Companies in Diffractive Optical Element Market

- AGC Inc

- Broadcom

- Coherent Corp

- HOLO/OR Ltd

- Holoeye Photonics AG

- Jenoptic

- Nalux Co., Inc

- Nil Technology

- Nissei Technology Corp

- Sintec Optronics Ltd

- Zeiss Group

Diffractive Optical Element Industry Developments

In January 2024, Focuslight Technologies Inc., a provider of high-power diode lasers, laser optics, and photonics systems solutions, acquired SUSS MicroOptics SA, a Switzerland-based manufacturer of precision micro-optics. This strategic acquisition strengthens Focuslight’s position in the photonics industry, allowing it to expand its capabilities in photon generation, photon control, and advanced photonics application solutions. It is expected to enhance Focuslight’s growth trajectory, particularly in offering integrated solutions for industries that rely on precision photonics technology.

In June 2023, At the LASER World of PHOTONICS trade fair in Munich, Jenoptik introduced a high-power F-Theta lens with an expanded scan field, demonstrating their advancements in laser optics. Alongside this, they showcased an array of high-performance optical components and systems tailored to meet emerging trends in industries such as biophotonics, laser production, optoelectronics, data transmission, and imaging.

Diffractive Optical Element Market Segmentation

By Type Outlook (Revenue, USD Million, 2019–2032)

- Diffractive Beam Splitters

- Diffractive Pattern Generators

- Diffractive Beam Shapers/Diffractive Diffusers

- Flat Top

- Line Top

- Spot Array

- Others

By Component Outlook (Revenue, USD Million, 2019–2032)

- Binary/Multilevel DOE

- Diffractive Lenses

- Diffusing Materials

- Gratings

By Application Outlook (Revenue, USD Million, 2019–2032)

- AR/VR

- Optical Prototyping

- Aberration Correction

- Lightweight Optics

- Illumination Systems

- Spectroscopy

- Imaging & Sensing

- Laser Material Processing

- Lidar

- Biomedical Devices

- Holography

- Metrology & Industrial Inspection

- Others

By Industry Outlook (Revenue, USD Million, 2019–2032)

- Telecommunication

- Industrial

- Healthcare

- Electronics and Semiconductors

- Energy

- Others

By Regional Outlook (Revenue, USD Million, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Diffractive Optical Element Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 199.80 million |

|

Market Size Value in 2024 |

USD 219.03 million |

|

Revenue Forecast by 2032 |

USD 463.93 million |

|

CAGR |

9.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global diffractive optical element market size was valued at USD 199.80 million in 2023 and is projected to grow to USD 463.93 million by 2032.

The global market is projected to register a CAGR of 9.8% during the forecast period.

In 2023, North America dominated the market due to the strong presence of advanced technology industries, leading research institutions, and substantial investments in optical and photonic technologies across the region.

A few key players in the market are Zeiss Group; AGC Inc; Coherent Corp; Jenoptic; HOLO/OR Ltd; Broadcom; Nalux Co., Inc; Holoeye Photonics AG; Nissei Technology Corp; Sintec Optronics Ltd; and Nil Technology.

In 2023, the diffractive pattern generators (DPGs) segment dominated the market due to their versatility and use in applications such as beam shaping, optical testing, and imaging systems.

In 2023, the industrial segment dominated the market due to the wide range of applications across industries such as telecommunications, electronics, semiconductors, and energy.