Dicyclopentadiene Polyesters Resin Market Size, Share, Trends, Industry Analysis Report: By Resin Type (Unsaturated Polyesters, Epoxy-Based Polyesters, and Vinyl Ester Polyesters), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 119

- Format: PDF

- Report ID: PM5236

- Base Year: 2024

- Historical Data: 2020-2023

Dicyclopentadiene Polyesters Resin Market Overview

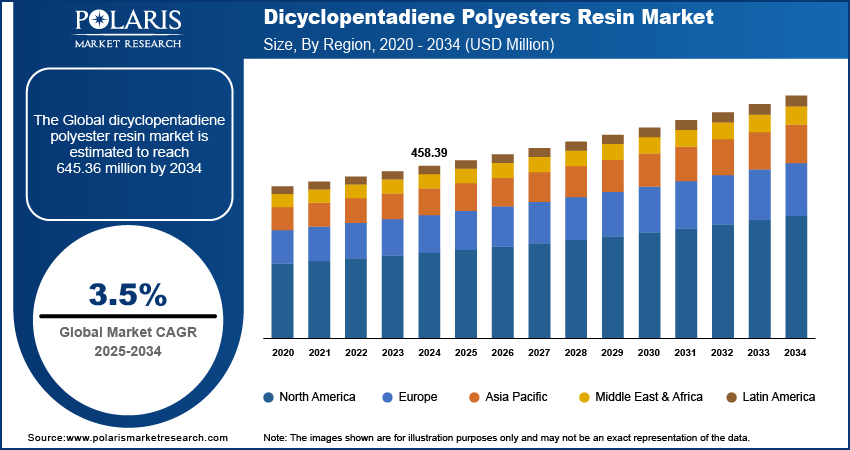

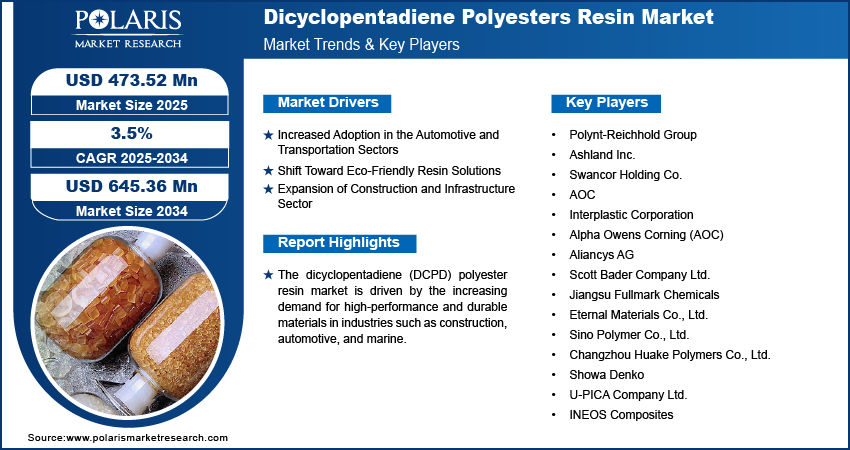

The dicyclopentadiene polyesters resin market size was valued at USD 458.39 million in 2024. The market is projected to grow from USD 473.52 million in 2025 to USD 645.36 million by 2034, exhibiting a CAGR of 3.5% from 2025 to 2034.

Dicyclopentadiene polyester resin is a type of unsaturated polyester resin that incorporates dicyclopentadiene (DCPD) as a key component. DCPD, a dimer of cyclopentadiene, is known for its unique chemical properties and is primarily used in the production of resins due to its reactivity and ability to enhance material characteristics.

The dicyclopentadiene (DCPD) polyester resin market is driven by the increasing demand for high-performance and durable materials in industries such as construction, automotive, and marine. DCPD polyester resins offer enhanced resistance to corrosion, chemicals, and heat, making them suitable for a variety of applications. Additionally, advancements in resin technology and rising infrastructure projects, particularly in emerging economies, are expected to drive market growth.

To Understand More About this Research: Request a Free Sample Report

Dicyclopentadiene Polyesters Resin Market Drivers and Trends Analysis

Increased Adoption in the Automotive and Transportation Sectors

One of the major trends anticipated in the dicyclopentadiene (DCPD) polyester resin market is its growing use in the automotive and transportation industries. The material's lightweight and high-strength properties help manufacturers meet fuel efficiency and emissions standards. DCPD polyester resins also provide enhanced durability and resistance to corrosion, making them ideal for automotive body panels, truck parts, and other components. According to a study by the European Automobile Manufacturers’ Association (ACEA), the use of lightweight materials like DCPD resins may reduce vehicle weight by up to 10%, contributing to a 6-8% improvement in fuel economy.

Shift Toward Eco-Friendly Resin Solutions

The increasing emphasis on sustainability is driving demand for eco-friendly and bio-based polyester resins, including those derived from DCPD. Consumers and manufacturers are seeking greener alternatives due to regulatory pressures and environmental concerns. Several companies are developing bio-based DCPD resins that reduce carbon emissions during production and offer lower environmental impact. A 2022 report from the European Plastics Converters (EuPC) highlights that over 60% of companies surveyed are prioritizing the development of sustainable materials, reflecting a growing trend toward greener resin solutions across various industries.

Expansion of Construction and Infrastructure Sector

The construction and infrastructure sector is another key driver of the DCPD polyester resin market, particularly in regions with rapid urbanization and growing infrastructure investments. DCPD polyester resins are favored for their excellent thermal stability, chemical resistance, and structural performance in construction applications such as pipes, tanks, and building materials. As per data from the World Bank, global infrastructure investment is expected to increase by 3-5% annually over the next decade, further propelling demand for advanced materials like DCPD resins in large-scale projects.

Dicyclopentadiene Polyesters Resin Market Segment Analysis

Dicyclopentadiene Polyesters Resin Market Assessment by Resin Type

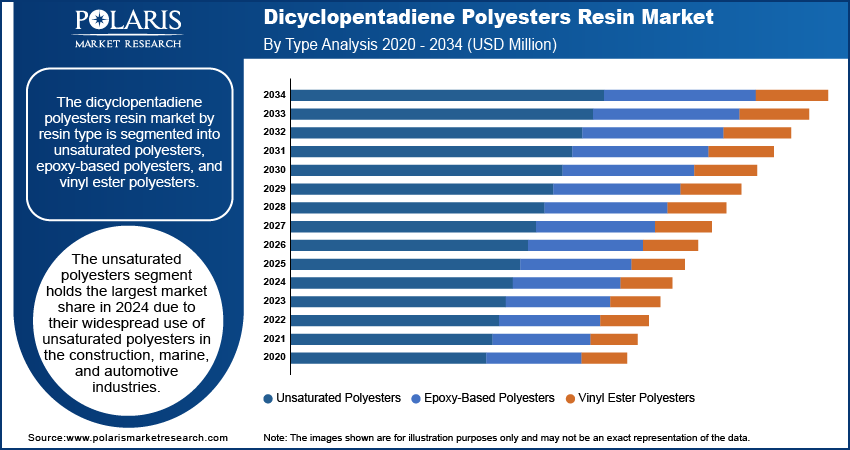

The dicyclopentadiene polyesters resin market by resin type is segmented into unsaturated polyesters, epoxy-based polyesters, and vinyl ester polyesters. Among these, the unsaturated polyesters segment holds the largest market share due to their widespread use of unsaturated polyesters in the construction, marine, and automotive industries. Their versatility, cost-effectiveness, and superior mechanical properties make them the preferred choice for a range of applications, including building materials, tanks, and automotive components. Unsaturated polyesters also offer excellent chemical resistance and thermal stability, further driving their adoption in industrial applications.

Epoxy-based polyesters, on the other hand, are witnessing the highest growth rate within the market. These resins are particularly valued for their strong adhesive properties, toughness, and resistance to extreme environmental conditions, making them ideal for specialized applications such as coatings, adhesives, and electrical components. The rising demand for high-performance materials in sectors like electronics and aerospace is significantly contributing to the growth of epoxy-based polyesters. Vinyl ester polyesters, while not the largest segment, continue to gain traction in niche markets due to their superior corrosion resistance and durability in harsh environments.

Dicyclopentadiene Polyesters Resin Market Evaluation by End Use

The market by end-use is segmented into automotive & transportation, marine, construction, aerospace, industrial, and others. The construction segment holds the largest market share, driven by the extensive use of DCPD polyester resins in building materials, pipes, and storage tanks. The material's excellent chemical resistance, mechanical strength, and durability make it highly suitable for infrastructure projects, particularly in regions experiencing rapid urbanization and industrialization. With continued investments in construction and infrastructure development globally, the demand for DCPD polyester resins in this segment is expected to remain robust.

The automotive & transportation segment is registering the highest growth, fueled by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions. DCPD polyester resins are increasingly being used in automotive components such as body panels and exterior parts due to their high strength-to-weight ratio and corrosion resistance. Additionally, the growing focus on electric vehicles (EVs) is driving the need for materials that offer both performance and sustainability, further boosting the adoption of DCPD resins in this sector. The marine and aerospace segments also continue to witness steady demand, particularly for high-performance applications requiring corrosion resistance and durability.

Dicyclopentadiene Polyesters Resin Market Breakdown by Regional Insights

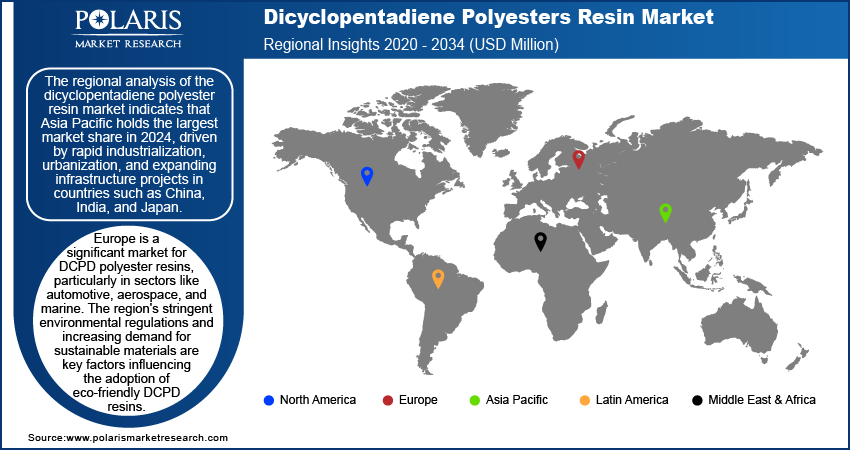

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The regional analysis of the dicyclopentadiene (DCPD) polyester resin market indicates that Asia Pacific holds the largest market share in 2024, driven by rapid industrialization, urbanization, and expanding infrastructure projects in countries such as China, India, and Japan. The booming automotive and construction industries, coupled with increasing demand for lightweight and durable materials, have significantly contributed to the dominance of Asia Pacific. Additionally, the availability of raw materials and cost-effective manufacturing processes further support the market growth in this region.

Europe is a significant market for DCPD polyester resins, particularly in sectors like automotive, aerospace, and marine. The region's stringent environmental regulations and increasing demand for sustainable materials are key factors influencing the adoption of eco-friendly DCPD resins. Countries such as Germany, France, and the UK are leading in the use of lightweight materials in automotive and industrial applications. Additionally, Europe's well-established automotive manufacturing sector and the push toward electric vehicle production are contributing to the steady growth of the DCPD polyester resin market in the region.

Dicyclopentadiene Polyesters Resin Market – Key Players and Competitive Analysis Report

Major players in the dicyclopentadiene (DCPD) polyester resin market include Polynt-Reichhold Group; Ashland Inc.; Swancor Holding Co.; AOC; Interplastic Corporation; Aliancys AG; Scott Bader Company Ltd.; Jiangsu Fullmark Chemicals; Eternal Materials Co., Ltd.; Sino Polymer Co., Ltd.; Changzhou Huake Polymers Co., Ltd.; Showa Denko; U-PICA Company Ltd.; and INEOS Composites. These companies are actively involved in the production and development of DCPD polyester resins, catering to various end-use industries such as automotive, marine, and construction.

Polynt-Reichhold Group and AOC Resins are particularly strong in providing solutions for industrial and construction applications, benefiting from their extensive global presence and product portfolios. Swancor Holding Co. and Interplastic Corporation are focusing on expanding their range of sustainable and eco-friendly polyester resins, responding to the growing demand for environmentally conscious products, especially in the European and North American markets. Companies such as Scott Bader and Sino Polymer are also investing in research and development to improve resin performance, particularly in high-performance sectors like aerospace and automotive.

The competitive landscape of the DCPD polyester resin market is characterized by a mix of global and regional players, each focusing on specific industries and applications. Some players, such as Alpha Owens Corning and Eternal Materials Co., Ltd., are concentrating on enhancing their product offerings in automotive and marine applications, while others, like INEOS Composites and Jiangsu Fullmark Chemicals, are leveraging their expertise in chemical-resistant resins for industrial purposes. Overall, the competition is driven by innovations in resin technology, sustainability efforts, and the ability to meet diverse industry requirements across various regions.

Polynt-Reichhold Group is a key player in the dicyclopentadiene (DCPD) polyester resin market, known for its extensive range of resins used across industries such as construction, automotive, and marine. The company benefits from a strong global presence and a diverse product portfolio.

Swancor Holding Co. is another significant player, particularly in the area of sustainable resin development. The company is focused on expanding its eco-friendly product line, targeting markets that are shifting towards greener solutions.

List of Key Companies in Dicyclopentadiene Polyesters Resin Market

- Polynt-Reichhold Group

- Ashland Inc.

- Swancor Holding Co.

- AOC

- Interplastic Corporation

- Aliancys AG

- Scott Bader Company Ltd.

- Jiangsu Fullmark Chemicals

- Eternal Materials Co., Ltd.

- Sino Polymer Co., Ltd.

- Changzhou Huake Polymers Co., Ltd.

- Showa Denko

- U-PICA Company Ltd.

- INEOS Composites

Dicyclopentadiene Polyesters Resin Market Developments

- In August 2023, Polynt-Reichhold announced its continued investment in expanding its production capacity for polyester resins in Europe to meet growing demand from the construction and industrial sectors. Accroding to Polynt-Reichhold, this expansion aims at enhancing their ability to serve clients more sustainably and efficiently.

- In April 2023, Swancor unveiled a new range of bio-based DCPD polyester resins aimed at reducing carbon emissions in the production process, aligning with global environmental standards. This move highlights the company’s focus on innovation and sustainability within the resin market.

Dicyclopentadiene Polyesters Resin Market Segmentation

By Resin Type Outlook (Revenue – USD Million, 2020–2034)

- Unsaturated Polyesters

- Epoxy-Based Polyesters

- Vinyl Ester Polyesters

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Automotive & Transportation

- Marine

- Construction

- Aerospace

- Industrial

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dicyclopentadiene Polyesters Resin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 458.39 million |

|

Market Size Value in 2025 |

USD 473.52 million |

|

Revenue Forecast in 2034 |

USD 645.36 million |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020-2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The dicyclopentadiene polyesters resin market size was valued at USD 458.39 million in 2024 and is projected to grow to USD 645.36 million by 2034.

The market is projected to register a CAGR of 3.5% from 2025 to 2034.

Asia Pacific had the largest share of the market.

Key players in the dicyclopentadiene (DCPD) polyester resin market include Polynt-Reichhold Group; Ashland Inc.; Swancor Holding Co.; AOC Resins; Interplastic Corporation; Alpha Owens Corning (AOC); Aliancys AG; Scott Bader Company Ltd.; Jiangsu Fullmark Chemicals; Eternal Materials Co., Ltd.; Sino Polymer Co., Ltd.; Changzhou Huake Polymers Co., Ltd.; Showa Denko; U-PICA Company Ltd.; and INEOS Composites

The unsaturated polyesters segment accounts for the largest share of the market.

The construction segment holds the largest share of the global market.