Desiccant Dehumidifier Market Size, Share, Trends, Industry Analysis Report: By Product Type (Fixed/Mounted and Portable), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5174

- Base Year: 2024

- Historical Data: 2020-2023

Desiccant Dehumidifier Market Overview

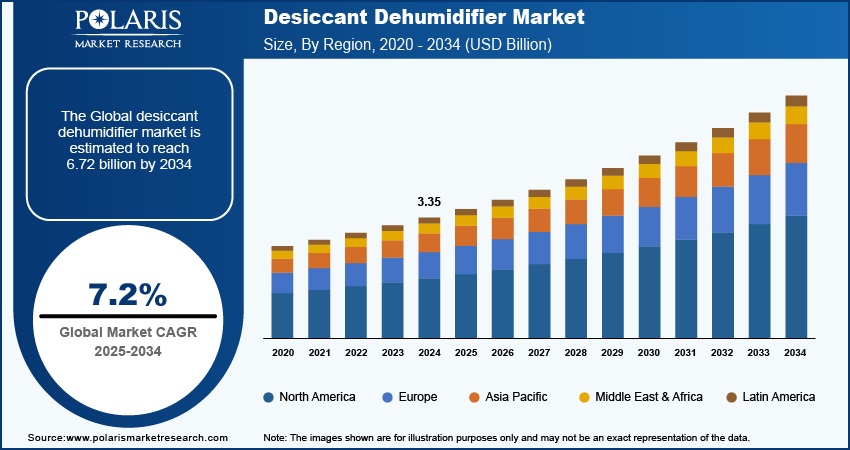

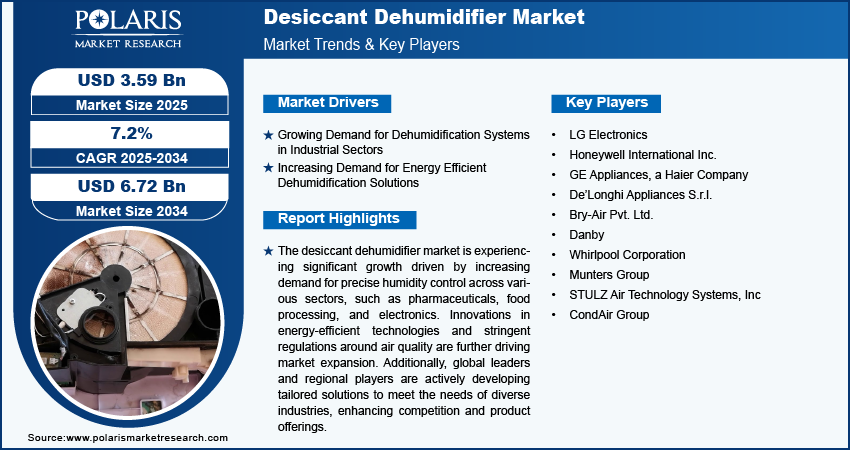

The desiccant dehumidifier market size was valued at USD 3.35 billion in 2024. The market is projected to grow from USD 3.59 billion in 2025 to USD 6.72 billion by 2034, exhibiting a CAGR of 7.2% during 2025–2034.

Desiccant dehumidifier is a device that removes moisture from the air using a desiccant material such as sponge and silica gel, which absorbs and retains water vapor. These devices are effective in low-temperature environments and applications requiring precise humidity control.

The desiccant dehumidifier market is experiencing steady growth due to rising demand for efficient humidity control across various industries such as pharmaceuticals, food processing, electronics, and lithium-ion battery manufacturing. The dehumidifiers are favored for their ability to operate effectively in low temperatures and deliver precise moisture control, making them ideal for sensitive industrial applications. Moreover, increased focus on energy efficiency and sustainability has boosted their adoption as desiccant dehumidifiers offer significant energy-saving potential, especially in HVAC systems. Moreover, the increasing demand for better indoor air quality and regulations such as good manufacturing practices (GMP) and hygiene regulations (EU Regulation 852/2004) for processes that are sensitive to moisture propel the desiccant dehumidifier market growth.

To Understand More About this Research: Request a Free Sample Report

Desiccant Dehumidifier Market Drivers

Growing Demand for Dehumidification Systems in Industrial Sectors

Various industrial and commercial sectors increasingly require precise humidity control in many applications such as drying, storage, and microbial growth prevention. Industries such as pharmaceuticals, food processing, electronics, and HVAC require stringent moisture management to ensure product quality and compliance with safety regulations. Desiccant dehumidifiers are particularly effective in low-temperature environments, making them ideal for sensitive processes. Pfizer, a pharmaceutical company, uses desiccant dehumidifiers in its manufacturing facilities to control humidity. By implementing advanced technology, Pfizer ensures strict humidity control during vaccine production, preventing moisture-related issues that could compromise product quality. Furthermore, the rising awareness of energy efficiency and sustainability is prompting businesses to invest in advanced dehumidification solutions that reduce energy consumption while enhancing operational efficiency. Thus, the rising demand for dehumidification systems in industrial and commercial sectors significantly drives the desiccant dehumidifier market growth.

Increasing Demand for Energy Efficient Dehumidification Solutions

Desiccant dehumidifiers are known for their ability to operate effectively in low temperatures that require less energy compared to traditional refrigerant-based systems. As industries are becoming more conscious of energy consumption and sustainability, they are shifting to advanced desiccant technologies that offer improved performance with lower energy usage. For instance, in June 2023, Cotes launched the CR240 lightweight dehumidifier, originally made for transporting and storing wind turbine parts such as towers and nacelles. This new dehumidifier has many changes as compared to the old one and it is now being used in other industries, such as food processing, pharmaceutical manufacturing, and marine shipping. Although it was first designed for wind turbines, its effective air-drying features make it useful in industrial settings. This change helps boost efficiency and meet regulations, as well as support sustainability goals. Thus, surging demand for energy-efficient dehumidification solutions boosts the growth of the desiccant dehumidifier market.

Desiccant Dehumidifier Market Segment Insights

Desiccant Dehumidifier Market Breakdown by Product Type Outlook

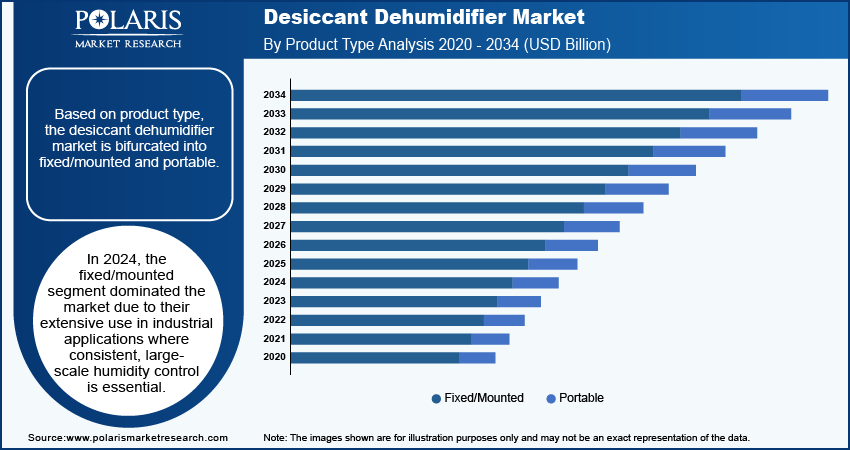

The global desiccant dehumidifier market segmentation, based on product type, includes fixed/mounted and portable. In 2024, the fixed/mounted segment dominated the market due to their extensive usage in industrial applications where consistent, large-scale humidity control is essential. Industries such as pharmaceuticals, food processing, and data centers require reliable, continuous dehumidification to maintain product quality, safety, and equipment performance. Fixed units are robust and can handle higher volumes of air, which are mainly required for extreme industrial conditions. Additionally, the rising adoption of fixed dehumidifiers aligns with increasing regulatory standards for humidity control in critical sectors, reinforcing their preference for portable units in the global market.

Desiccant Dehumidifier Market Breakdown by End User Outlook

The global desiccant dehumidifier market segmentation, based on end user, includes commercial and industrial. The commercial sector is projected to register a higher CAGR in the market during the forecast period due to increasing demand for energy-efficient humidity controllers in settings such as data centers, offices, healthcare facilities, and retail environments. As businesses prioritize air quality and comfort for employees and customers, desiccant dehumidifiers offer reliable, efficient moisture control without significantly increasing energy costs. Additionally, heightened awareness around indoor air quality, coupled with stricter regulatory standards in sectors such as healthcare and data management, would drive the rapid adoption of advanced dehumidification solutions across the commercial sector.

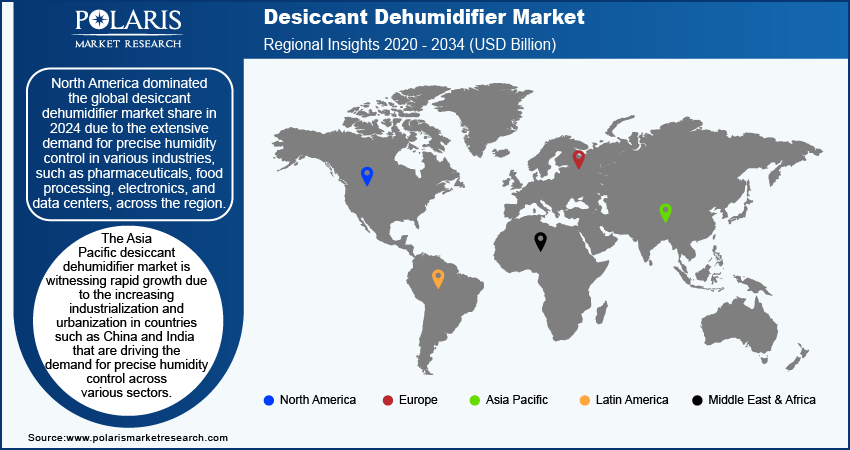

Desiccant Dehumidifier Market Breakdown by Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global desiccant dehumidifier market share in 2024 due to the extensive demand for precise humidity control in various industries such as pharmaceuticals, food processing, electronics, and data centers across the region. Stringent regulations on air quality and moisture control in these sectors drive the adoption of advanced dehumidification systems to ensure product quality and regulatory compliance. Additionally, North America's strong focus on energy efficiency and sustainability has led businesses to invest in desiccant technology, which operates efficiently in low temperatures and reduces energy consumption. The presence of established players and continuous technological advancements further strengthen North America's leadership in the global desiccant dehumidifiers market. In May 2021, Condair announced that it had enhanced its humidity control solutions by introducing the DA Series Desiccant Dehumidifier. This addition provides advanced moisture management capabilities, catering to applications requiring precise humidity levels. The company stated that the DA series is designed to deliver strong performance in low-temperature environments, making it suitable for industrial and commercial settings where optimal humidity control is critical.

The Asia Pacific desiccant dehumidifier market is witnessing rapid growth due to the increasing industrialization and urbanization in countries such as China and India. There is an increased demand for precise humidity control measures across various industrial sectors, including pharmaceuticals, food processing, and electronics. Additionally, the rising awareness of energy efficiency and sustainability is prompting industries to adopt advanced dehumidification technologies. Regulatory measures to enhance air quality are further driving market growth in the region, as companies are adopting solutions such as dehumidification technologies to ensure product quality and compliance.

Desiccant Dehumidifier Market – Key Players and Competitive Insights

The competitive landscape of the desiccant dehumidifier market is characterized by a mix of global leaders and regional players competing for market share through innovation and strategic collaborations. Major companies such as Bry-Air, Munters, and others leverage their strong R&D capabilities and extensive distribution networks to provide advanced dehumidification solutions across various sectors, including pharmaceuticals, food processing, electronics, and data centers. These leaders focus on product innovation to enhance performance, efficiency, and scalability, addressing the specific needs of industries with stringent humidity control requirements. Meanwhile, smaller regional firms are emerging with niche dehumidifiers tailored to local markets, offering unique solutions and customized applications. Key competitive strategies in this market are mergers and acquisitions, partnerships with technology firms, and expanding product portfolios to strengthen market presence in critical geographic regions. A few key market players are LG Electronics; Honeywell International Inc.; GE Appliances, a Haier Company; De’Longhi Appliances S.r.l.; Bry-Air Pvt. Ltd.; Danby; Whirlpool Corporation; Munters Group; STULZ Air Technology Systems, Inc.; and CondAir Group.

LG Electronics Inc. is a South Korean multinational corporation headquartered in Yeouido-dong, Seoul. The company is known for its innovation in various sectors such as home entertainment, mobile technology, and smart appliances. It operates through four main business units—home entertainment, mobility, home appliances & air solutions, and business solutions. The company employs approximately 83,000 people across 128 operations worldwide and continues to focus on sustainability and technological advancements, such as energy-efficient dehumidifiers designed to reduce environmental impact.

Munters specializes in climate control solutions and innovative technologies that optimize humidity, temperature, and air quality for various industrial and agricultural applications. The company’s key areas of business operations include battery production, pharmaceuticals, data center cooling, and food processing. The company's approach integrates advanced digital solutions and AI capabilities to enhance operational efficiency and support its customers in meeting their goals with a reduced ecological footprint.

Key Companies in Desiccant Dehumidifier Market

- LG Electronics

- Honeywell International Inc.

- GE Appliances, a Haier Company

- De’Longhi Appliances S.r.l.

- Bry-Air Pvt. Ltd.

- Danby

- Whirlpool Corporation

- Munters Group

- STULZ Air Technology Systems, Inc

- CondAir Group

Desiccant Dehumidifier Industry Developments

In April 2024, Quest launched the Quest 335’s MERV-13 air filter, which is 20% more effective than MERV-11 and 65% more effective than MERV-8 at removing particulate matter. This advanced filtration captures dust, pollen, mold spores, bacteria, and virus carriers, ensuring cleaner air for better health. Additionally, MERV-13 helps keep dehumidifiers clean, extending their lifespan and maintaining condensate purity.

In November 2022, Munters acquired Hygromedia LLC and Rotor Source Inc. to strengthen its core business in desiccant dehumidification technology. These acquisitions align with its strategy to expand market reach and improve its product offerings. Hygromedia provides desiccant dehumidification components globally, while Rotor Source offers dehumidification and energy recovery products to OEMs, serving key industries such as HVAC, lithium-ion batteries, pharmaceuticals, and food processing.

Desiccant Dehumidifier Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Fixed/Mounted

- Portable

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Energy

- EV Battery Manufacturing

- Power Plants and Wind Turbines

- Chemical

- Construction

- Electronics

- Food & Pharmaceuticals

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Desiccant Dehumidifier Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.35 billion |

|

Market Size Value in 2025 |

USD 3.59 billion |

|

Revenue Forecast by 2034 |

USD 6.72 billion |

|

CAGR |

7.2% from 2024 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global desiccant dehumidifier market size was valued at USD 3.35 billion in 2024 and is projected to grow to USD 6.72 billion by 2034.

The global market is projected to register a CAGR of 7.2% during the forecast period.

North America dominated the market in 2024.

A few key players in the market are LG Electronics; Honeywell International Inc.; GE Appliances, a Haier Company; De’Longhi Appliances S.r.l.; Bry-Air Pvt. Ltd.; Danby; Whirlpool Corporation; Munters Group; STULZ Air Technology Systems, Inc.; and CondAir Group.

In 2024, the fixed/mounted segment dominated the market.

The commercial sector is projected to record a higher CAGR in the market during the forecast period.