Dental Service Organization Market Size, Share, Trends, Industry Analysis Report: By Services (Human Resources, Marketing & Branding, Accounting, Medical Supplies Procurement, and Others), End Use, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM4141

- Base Year: 2023

- Historical Data: 2019-2022

Dental Service Organization Market Overview

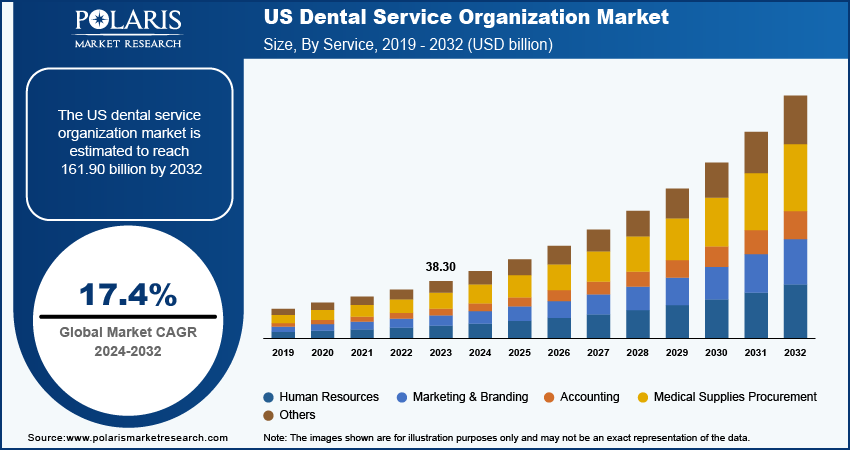

The global dental service organization market size was valued at USD 137.77 billion in 2023. The market is projected to grow from USD 161.58 billion in 2024 to USD 583.68 billion by 2032, exhibiting a CAGR of 17.4% during 2024–2032.

The demand for dental service organizations (DSOs) is significantly increasing as the dental care market expands, driven by growing investments in dental sector and heightened awareness of oral health. With 2.3 billion people affected by cavities and severe gum disease and 34 million school hours lost annually in the US due to dental emergencies, there is an urgent need for proactive dental care. As consumers prioritize preventive and cosmetic dental procedures, DSOs are well-equipped to meet this demand by providing a wide range of services across multiple locations, ensuring accessibility and consistency in care, ultimately propelling the dental service organizations market growth.

To Understand More About this Research: Request a Free Sample Report

A dental service organization (DSO) is a business model where dental practices are supported by a centralized organization that handles nonclinical tasks such as administration, marketing, billing, and supply chain management. The organization allows dentists to focus primarily on patient care while the DSO provides the necessary infrastructure and business expertise to streamline operations and enhance efficiency. The DSO model is gaining popularity due to its ability to optimize resources, reduce operational costs, and provide consistent care across multiple locations.

Higher expenditure on oral health treatments and procedures contributes to the dental service organization market growth. According to the World Economic Forum report, oral diseases adversely impact over 1 billion people and cost USD 710 billion annually in treatment and productivity losses, urging greater investments in oral health. Individuals prioritize their dental health. They seek out advanced treatments and technologies, which often come at a higher cost. DSOs, with their centralized management, are better equipped to invest in equipment and offer advanced services. The ability of DSOs to provide high-quality services at competitive prices makes them an attractive option for patients prioritizing quality care and investors, which drives the dental service organization market expansion.

Initiatives by government and private organizations to raise awareness of dental health are playing a crucial role in increasing demand for DSOs. For instance, in October 2022, the American Diabetes Association partnered with Pacific Dental Services to increase awareness of periodontal disease among Americans. Further, Germany celebrates Dental Health Day on September 25 each year to promote oral health awareness among the public. Public health campaigns and educational programs emphasize the importance of regular dental check-ups and preventive care, leading to a health-conscious population. Therefore, increased awareness of dental health, higher expenditure on dental care, and the operational efficiency of DSOs fuel the market growth.

Dental Service Organization Market Drivers and Trends

Improved Efficiency in Nonclinical Business Management by DSOs

DSOs can enhance efficiency in nonclinical business management. The organizations allow dentists and other clinical experts to focus on patient care by taking over administrative tasks, marketing, and business management. This streamlined approach improves practice efficiency and boosts patient care quality. In December 2023, Heartland Dental partnered with VideaHealth to enhance efficiency in nonclinical business management, leveraging AI-driven dental solutions to improve operations across its 1,700+ supported practices nationwide.

DSOs offer dentists various benefits, including access to advanced technology, competitive salaries, and flexible practice locations. These advantages are particularly appealing to dentists at different stages of their careers, leading to a growing number of dentists partnering with DSOs. For instance, in 2019, over 10% of dentists were part of a DSO-supported practice, reflecting a growing trend.

DSOs' ability to effectively manage nonclinical operations while supporting growth and service expansion makes them an attractive option for dental practices. Thus, the need for improved efficiency and a better work-life balance for dentists propels the dental service organization market expansion.

Increase in Prevalence of Dental Conditions

The growing prevalence of dental conditions worldwide, affecting 3.5 billion people, is driving demand for dental service organizations (DSOs). Conditions such as dental caries, impacting 2 billion adults and 514 billion children, pose a significant public health challenge, particularly in middle-income countries where 75% of those affected live. Factors such as poor fluoride exposure, high-sugar diets, and limited access to care contribute to this trend. DSOs offer a scalable solution by consolidating dental practices, improving resource access, standardizing care, and reducing costs. Their role in expanding access to care is crucial in regions with limited dental infrastructure. As a result, the rising demand for affordable, accessible dental services across the world drives the dental service organization market growth.

Dental Service Organization Market Segment Insights

Dental Service Organization Market Breakdown by Service Insights

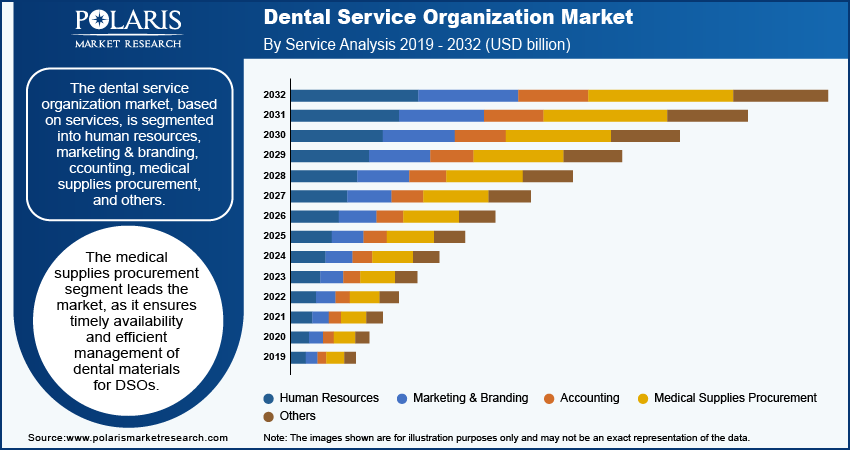

The dental service organization market segmentation, based on services, includes human resources, marketing & branding, accounting, medical supplies procurement, and others. In 2023, the medical supplies procurement segment dominated the market, accounting for 27.27% of market revenue (37.57 billion). The segment focuses on ensuring the timely availability of dental materials and equipment. Efficient procurement practices involve managing inventory, negotiating with suppliers, and controlling costs. Benco Dental, a leading distributor in the US, offers a wide range of dental supplies and implements effective procurement and supply chain management strategies. Their approach ensures that DSOs can maintain high standards of care while managing operational costs effectively.

Strategic procurement of medical supplies is essential for optimizing supply chains and maintaining operational efficiency. The adoption of advanced technologies in procurement is transforming how DSOs manage their supplies. Automated inventory systems and data analytics tools are increasingly used to enhance procurement efficiency. Dentalcorp, a major Canadian DSO, leverages these technologies to optimize its supply chain and ensure the timely availability of dental materials. This focus on technological integration helps DSOs reduce operational costs and maintain high standards of patient care.

Dental Service Organization Market Breakdown by End Use Insights

The dental service organization market segmentation, based on end use, includes dental surgeons, endodontists, general dentists, and others. The general dentists are expected to register a CAGR of 17.7% during the forecast period. General dentists play a crucial role in the global dental service organization market by providing essential routine and preventive care. Companies such as Smile Brands Inc. in the US and Dentistree in India exemplify the significance of general dentistry in their business models, offering services such as cleanings, check-ups, and basic restorative treatments. The global demand for general dental services is growing due to increased awareness of dental health and the importance of preventive care. In emerging markets, the expansion of DSOs such as Dentistree addresses the rising demand for affordable, accessible care. This trend reflects the growing importance of preventive and basic dental services, driving the global dental service organizations market growth.

Dental Service Organization Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America held the largest share of the global dental service organization market in 2023, driven by factors such as an expanding patient base, rising dental care spending, and rising awareness related to the efficient services provided by DSOs. Advanced technology integration, such as Heartland Dental's use of VideaAI, and the creation of DSO University highlight the sector's focus on innovation and training. Consolidation trends, including the merger of 123Dentist, Lapointe Group, and Altima Dental, and partnerships such as Pacific Dental Services' collaboration with MemorialCare, further enhance market reach and service integration, positioning DSOs for continued growth amidst rising demand.

Europe accounts for the second-largest share of the global dental service organization (DSO) market, fueled by rising oral health awareness and increasing prevalence of dental issues such as cavities and periodontal diseases. DSOs invest heavily in advanced dental technologies and use large loan facilities to acquire smaller practices, fueling market consolidation. For instance, Colosseum Dental Group's USD 1.08 billion loan facilities have significantly contributed to the European DSO market’s growth. By consolidating smaller practices, DSOs achieve economies of scale, reducing operational costs and improving service efficiency. This financial backing and strategic expansion are key factors driving DSO market growth.

The Asia Pacific dental service organization market is expected to register the highest CAGR from 2024 to 2032. The regional market is growing rapidly, driven by increased oral health awareness, rising disposable incomes, and expanding dental insurance coverage. The demand for quality dental care, fueled by urbanization and a rising middle-class population, is leading DSOs to expand their networks. Companies such as Pacific Smiles Group and SmileDirectClub are increasing their presence in key markets such as China, India, and Australia. Technological advancements, including electronic health records (EHR), are further transforming the dental landscape, contributing to the dental service organization market growth in the region.

Dental Service Organization Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the dental service organization market growth in the coming years. Market participants are also undertaking a variety of strategic initiatives, including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations, to expand their global footprint. To expand and survive in a more competitive and rising market climate, the dental service organization market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global dental service organization market to benefit clients and increase the market sector. A few major players in the dental service organization market are 42North Dental PLLC; Aspen Dental Management, Inc.; Colosseum Dental Group; DentalCare Alliance; GSD Dental Clinics; Heartland Dental; MB2 Dental; DÜRR DENTAL SE; Beacon Dental Partners; and InterDent.

42North Dental is a DSO that supports affiliated practices by handling business operations, allowing dentists to focus on patient care. It provides resources across general, cosmetic, and specialized dentistry while maintaining clinical autonomy for its partner practices. In January 2024, Henry Schein One partnered with 42 North Dental PLLC to implement a full suite of cloud-based tools, including Dentrix Ascend, Jarvis Analytics, TechCentral, and the AI-enabled X-ray analysis tool, Detect AI, powered by VideaHealth. 42 North Dental is integrating this platform across its more than 100 practices to enhance scalability for clinicians and patients.

Aspen Dental, a DSO, supports over 1,000 practices across 45 states, handling administrative tasks while dentists focus on patient care. Its services span dentures; dental implants; clear aligners; and general dental care, including checkups, veneers, and oral surgery. In October 2024, Aspen Dental Management, Inc., a network of over 900 dental practices, partnered with SprintRay Inc., operating in digital dentistry and 3D printing. This multi-year agreement will bring SprintRay’s advanced 3D printing technology to Aspen Dental practices in 45 states.

List of Key Companies in Dental Service Organization Market

- 42North Dental PLLC

- Aspen Dental Management, Inc.

- Beacon Dental Partners

- Colosseum Dental Group

- DentalCare Alliance

- Dürr Dental SE

- GSD Dental Clinics

- Heartland Dental

- InterDent

- MB2 Dental

Dental Service Organization Industry Developments

July 2024: Dental Care Alliance (DCA) partnered with Patient Prism, an advanced AI conversational intelligence platform, to enhance patient service across its network of over 400 dental practices nationwide. The collaboration is expected to allow DCA to advance dentistry and improve patient care through innovative solutions.

February 2023: 42North Dental launched Birdeye, a reputation and customer experience platform that supports 110+ supported practices. The software is designed to improve the collection and analysis of patient feedback, enabling better decision-making and a more patient-centered approach.

June 2021: Colosseum Dental Group acquired a majority stake in Mirò Dental Medical Center (Mirò). This acquisition extends CDG's presence in Italy from the northeast to the northwest.

Dental Service Organization Market Segmentation

By Service Outlook

- Human Resources

- Marketing & Branding

- Accounting

- Medical Supplies Procurement

- Others

By End-Use Outlook

- Dental Surgeons

- Endodontists

- General Dentists

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dental Service Organization Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 137.77 billion |

|

Market Size Value in 2024 |

USD 161.58 billion |

|

Revenue Forecast by 2032 |

USD 583.68 billion |

|

CAGR |

17.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global dental service organization market size was valued at USD 137.77 billion in 2023 and is projected to grow to USD 583.68 billion by 2032

The global market is expected to register a CAGR of 17.4% during the forecast period.

North America accounted for the largest share of the global market in 2023

A few key players in the market are 42North Dental PLLC; Aspen Dental Management, Inc.; Colosseum Dental Group; DentalCare Alliance; GSD Dental Clinics; Heartland Dental; MB2 Dental; DÜRR DENTAL SE; Beacon Dental Partners; and InterDent.

The medical supplies procurement segment dominated the market in 2023.

The general dentists segment accounted for the largest share of the global market in 2023.