Dental Insurance Market Share, Size, Trends, Industry Analysis Report, By Coverage (Dental Preferred Provider Organizations, Dental Health Maintenance Organizations), By Type (Major, Basic), By Demographic, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM4236

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

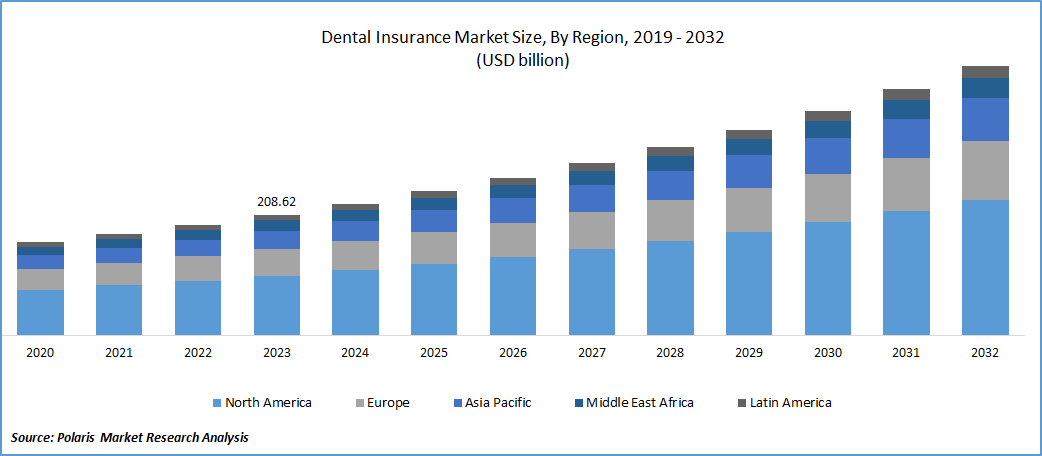

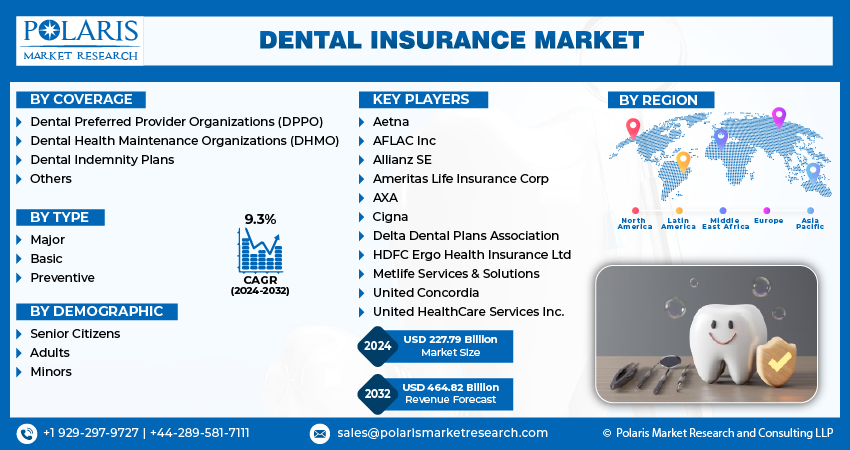

The global dental insurance market was valued at USD 208.62 billion in 2023 and is expected to grow at a CAGR of 9.3% during the forecast period.

The market is primarily stimulated by growing awareness about dental care and the rise in dental health issues. Anticipated increases in treatment costs are also expected to drive market growth in the coming years. The COVID-19 pandemic had a significant impact on the market dynamics. In the initial stages of the pandemic, numerous dental clinics postponed non-urgent procedures or limited their services to urgent care only.

Consequently, there has been a decline in the utilization of dental services as individuals avoid regular check-ups and treatments due to concerns about disease transmission. Additionally, due to quarantine measures, restrictions, and fears about contracting the virus, many people have delayed routine dental examinations and preventive care.

To Understand More About this Research: Request a Free Sample Report

For instance, according to the CareQuest Institute for Oral Health in September 2023, around 68.5 million adults in the U.S. did not have dental insurance. The results from the third annual State of Oral Health Equity in America (SOHEA) survey indicate that this number might rise significantly by the end of 2023 due to more household members losing coverage and the Medicaid redetermination process.

A substantial portion of adults in the population lacks dental insurance, leading to an increased demand for dental coverage plans.

Growth Drivers

Increased Dental Care Awareness

Growing awareness of the importance of oral health and preventive dental care has been a key driver. As people become more conscious of the link between oral health and overall well-being, the demand for dental insurance rises. The overall increase in healthcare costs, including dental services, has driven individuals and employers to seek insurance coverage to manage and mitigate expenses related to dental care.

The market is poised for growth due to technological advancements. The move towards Software as a Service (SaaS) and cloud-based solutions, replacing traditional legacy systems, has the potential to transform the health and dental insurance sector. This transition eliminates the need for maintaining on-site servers, leading to cost savings and better access to information. Additionally, it encourages collaboration, scalability, easy integrations, straightforward upgrades, and improved user experience. These benefits collectively ensure an enhanced experience for both consumers and healthcare professionals.

Report Segmentation

The market is primarily segmented based on coverage, type, demographic, and region.

|

By Coverage |

By Type |

By Demographic |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Coverage Analysis

DPPO Segment Held the Largest Share

DPPO segment dominated the market. DPPOs typically establish a network of dentists who agree to offer services to plan members at discounted rates. This arrangement can significantly lower consumers' out-of-pocket costs in comparison to co-pays or medical bills for services. Many individuals opt for plans that offer savings on dental care expenses. DPPO plans often provide a billing schedule detailing the costs of specific procedures. This transparency is appealing to consumers as it allows them to better anticipate and plan for their dental expenditures.

Dental health maintenance segment will grow at significant pace. DHMO plans typically come with lower monthly premiums when compared to alternative dental insurance choices such as dental indemnity plans. This affordability makes them an appealing option for individuals and families seeking dental coverage while managing their expenses effectively.

By Type Analysis

Preventive Segment Accounted for the Largest Market Share in 2022

Preventive segment accounted for the largest market share. Preventive dental plans primarily focus on routine checkups, cleanings, and early intervention for dental issues. This strategy motivates policyholders to prioritize their oral health by scheduling regular dental appointments. Moreover, premiums for preventive dental insurance plans are typically more affordable compared to comprehensive or primary dental insurance plans. This cost-effectiveness makes them a popular choice among many individuals and families, enhancing their attractiveness in the market.

Basic plan segment will exhibit robust growth rate. Basic plans are generally the most economical choices accessible to consumers, providing fundamental services or products at a lower price point. This affordability ensures their accessibility to a wider customer base, including individuals with constrained budgets. Furthermore, basic plans serve as introductory options for customers who are new to a specific product or service category.

By Demography Analysis

Senior Citizens Segment Accounted for the Largest Market Share in 2022

Senior citizens segment accounted for the largest market share. Several countries, including the U.S., are witnessing a rise in their aging population due to increased life expectancy. This demographic shift significantly influences the dental insurance industry, highlighting the importance of senior citizens. Additionally, as people age, they are more susceptible to dental health issues like gum disease, tooth decay, and tooth loss. Consequently, there is a heightened demand for dental insurance to cover expenses related to preventive care, restorative procedures, and various dental treatments.

Adult segment will exhibit robust growth rate. Numerous countries are grappling with aging populations, with a significant portion of adults entering their 50s and beyond. With age, individuals often necessitate more extensive dental care, encompassing preventive, restorative, and potentially major dental procedures. This heightened need for dental services among the aging adult population fuels the expansion of the dental insurance sector.

Regional Insights

North America Region Accounted for the Largest Share of Global Market in 2022

North America region emerged as largest region. The region boasts a large and comparatively prosperous population, with the United States standing out due to its substantial middle-class demographic able to afford dental insurance premiums. This demographic scenario provides a substantial customer base for dental insurance providers. Additionally, in the U.S., numerous employers include dental insurance as a component of their employee benefits packages. This approach encourages a significant portion of the population to opt for dental insurance coverage.

Asia Pacific will grow at the substantial pace. This growth can be attributed to the increasing awareness of dental health in the region. People in the region are proactive about their oral health, having regular dental check-ups & preventive care measures. As awareness spreads about the necessity of these practices for overall well-being, there is a growing demand for dental insurance to cover the costs associated with these essential dental services.

The shift towards proactive oral healthcare indicates a change in mindset among the population, leading to a rising need for financial protection against dental expenses. Dental insurance offers individuals the assurance that they can afford necessary dental treatments, encouraging more people to prioritize their oral health. This trend is driving the demand for dental insurance policies, making the Asia Pacific region a promising market for dental insurance providers.

Key Market Players & Competitive Insights

Major players in the dental insurance market are implementing diverse strategic initiatives to maintain their market presence. These initiatives include collaboration with other companies, forming partnerships with key stakeholders, and introducing new insurance plans to cater to different customer needs.

Some of the major players operating in the global market include:

- Aetna

- AFLAC Inc

- Allianz SE

- Ameritas Life Insurance Corp

- AXA

- Cigna

- Delta Dental Plans Association

- HDFC Ergo Health Insurance Ltd

- Metlife Services & Solutions

- United Concordia

- United HealthCare Services Inc.

Recent Developments

- In May 2022, PNB MetLife introduced a dental health insurance plan in India, covering fixed-benefit outpatient costs and providing financial assistance for a range of dental health-related expenses.

- In December 2022, Bupa & YuLife have joined forces, allowing group clients the option to incorporate dental insurance for its employees. Bupa's coverage included as a choice within the YuLife's life insurance policies, serving both new & existing clients.

- In August 2023, Ameritas has introduced a life-time deductible option for its group dental plans. This change guarantees that once members fulfill their deductible requirement, they will not have to worry about meeting it again if they stay with same firm.

Dental Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 227.79 billion |

|

Revenue forecast in 2032 |

USD 464.82 billion |

|

CAGR |

9.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2020 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Coverage, By Type, By Demographic, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2024 Dental Insurance Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Dental Insurance Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Temperature Sensors Market Size, Share 2024 Research Report

Field Programmable Gate Array (FPGA) Market Size, Share 2024 Research Report

Drylab Photo Printing Market Size, Share 2024 Research Report

Infectious Disease Diagnostics Market Size, Share 2024 Research Report

Dental Implants and Prosthetics Market Size, Share 2024 Research Report

FAQ's

Coverage, type, demographic, and region are the key segments in the Dental Insurance Market

The global dental insurance market size is expected to reach USD 464.82 billion by 2032

The global dental insurance market is expected to grow at a CAGR of 9.3% during the forecast period

North America regions is leading the global market

Increasing dental health issues are the key driving factors in Dental Insurance Market