Dental Implants and Prosthetics Market Share, Size, Trends, Industry Analysis Report, By Type (Dental Prosthetics, Dental Implants); By Material; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4281

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

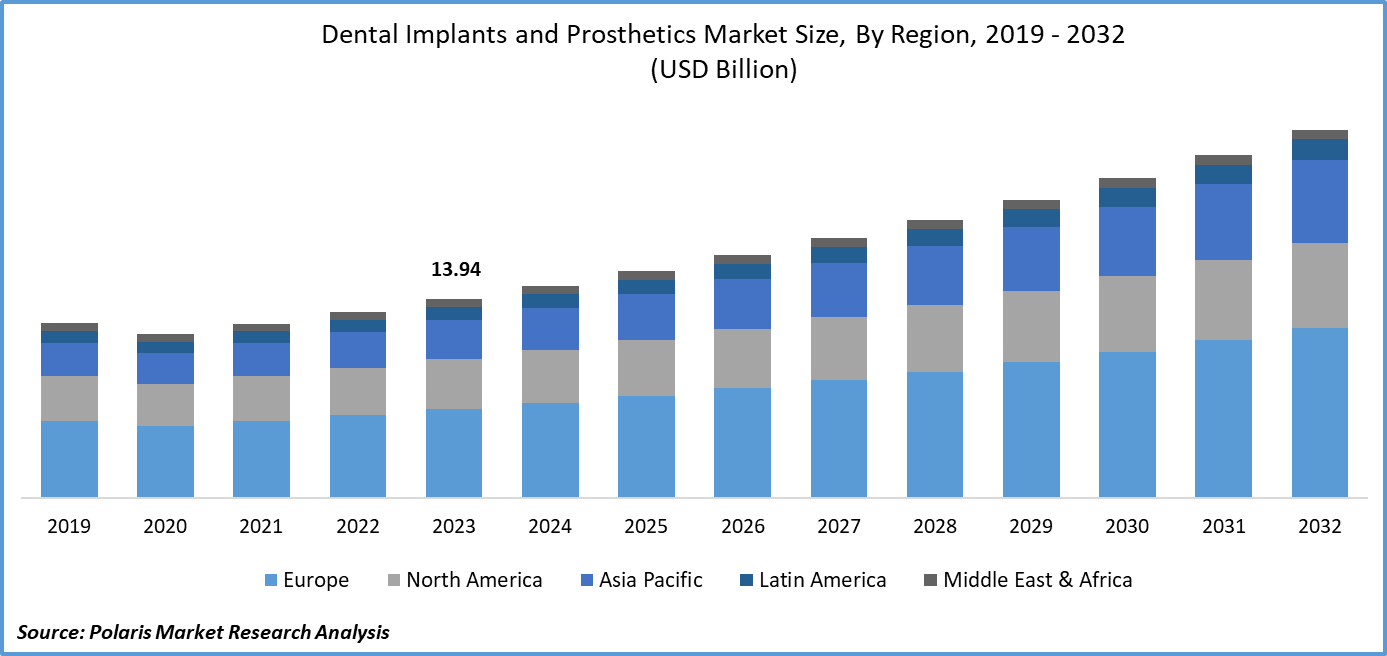

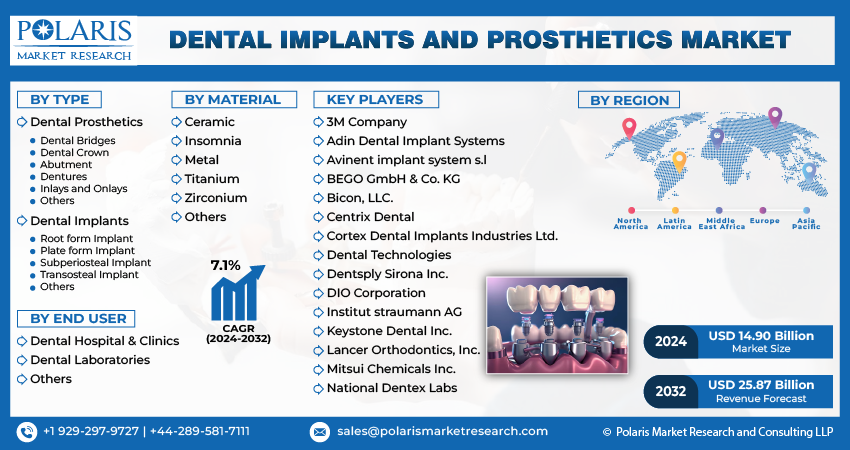

Dental Implants and Prosthetics Market size was valued at USD 13.94 billion in 2023. The market is anticipated to grow from USD 14.90 billion in 2024 to USD 25.87 billion by 2032, exhibiting a CAGR of 7.1% during the forecast period

Dental implants are compact titanium posts that are positioned in jawbone to oblige as a substitution for the root of the tooth. Subsequent to be positioned in the jawbone, these titanium posts are deliberated to amalgamate with the adjoining bone so as to behave as an attachment for a dental prosthetic. The dental implants and prosthetics market size is expanding as they are normally suggested for people who have lost one or more teeth and require a prolonged solution to restore their missing teeth. Dental implants are an approved option for those who are seeking tooth substitution alternative as they provide several advantages such as dentures or bridges.

Dental implants are a prolonged solution. They can prevail course of life with appropriate care. They appear and fancy like organic teeth. Dental implants are robust and steady. They will not slither or advance around like dentures. They maintain the jawbone. When a tooth goes missing, the jawbone commences to worsen. Dental implants assist to maintain the jawbone and prohibit from contacting over time. It is a surgical process that should be executed by a tutored and skilled dentist or oral surgeon.

Industry Trends

Dental implants and dental prosthetics are solutions for people who have lost teeth due to injury, disease, or other factors. A dental implant is a small titanium post that is surgically placed into the jawbone to replace a missing tooth root. The implant serves as an anchor for a naturally looking crown or bridge that is custom-made to match surrounding teeth. Dental prosthetics, on the other hand, refer to artificial replacement teeth, such as dentures, bridges, and crowns, that are designed to restore the natural appearance and function of the mouth. Prosthetics can be removable or fixed in place with dental implants or other attachments.

The global market for dental implants and dental prosthetics is expected to experience significant growth in the coming years, driven by increasing demand for cosmetic dentistry, advancements in technology, and an aging population. One of the key drivers of the dental implant and prosthetic market is the increasing demand for cosmetic dentistry. With rising awareness about oral health and aesthetics, people are seeking solutions to improve their smiles and overall appearance. Dental implants and prosthetics offer a way to replace missing teeth and restore confidence in one's smile, leading to increased demand for these products. In addition, technological advancements have made dental implant procedures less invasive and more efficient, further boosting the dental implants and dental prosthetics market growth.

For instance, the development of computer-aided design (CAD) and computer-aided manufacturing (CAM) technology has enabled dentists to create customized implants that fit perfectly into the patient's mouth, reducing recovery time and improving results.

To Understand More About this Research: Request a Free Sample Report

Similarly, as people age, they are more likely to lose teeth due to decay, periodontal disease, or other factors. This creates a need for replacement teeth, which drives the demand for dental implants and prosthetics.

However, the growth of the dental implant and prosthetic market is hindered by the high cost of dental implant procedures, which are prohibitively expensive for many patients. Further, the risk of complications associated with dental implant surgery, such as nerve damage, bleeding, and infection, can deter some patients from opting for this treatment option.

Key Takeaways

- Europe dominated the market and contributed more than 37% of the share in 2023

- By type, the dental prosthetics segment accounted for the dominating market share in 2023

- By material category, the titanium segment held the largest revenue share in 2023

- By end user, the dental laboratories segment is expected to grow with a significant CAGR over the forecast period

What are the Market Drivers Driving the Demand for Dental Implants and Prosthetics Market?

The advancements in dental technology drive dental implants and prosthetics market growth

The rapid progress in dental technology has been a significant driver of growth for the dental implants and prosthetics market. Advancements in digital imaging, computer-aided design (CAD) software, and 3D printing have enabled dentists to create highly accurate models of patients' teeth and jaws, allowing for more precise and personalized implant placement. In addition, improvements in materials science have led to the development of stronger, longer-lasting, and biocompatible materials that are used in dental implants, crowns, bridges, and dentures. These technological advancements have increased patient satisfaction and confidence in dental procedures, leading to an increase in demand for dental implants and prosthetics.

Advances in dental technology have also expanded the range of treatment options available to patients. For example, the development of mini-implants has provided a solution for patients who were previously unable to undergo traditional implant surgery due to insufficient bone volume. Similarly, the development of All-on-4 and All-on-6 implant systems has allowed for full arch reconstruction using fewer implants, making it possible to restore a natural-looking smile in a shorter amount of time. Thus, the advancements in dental technology are considered a significant market driver.

Which Factor is Restraining the Demand for Dental Implants and Prosthetics?

The Risk of Complications Poses a Significant Threat to the Growth of the Dental Implants and Prosthetics Market

The risk of complications associated with dental implant procedures, such as failure of the implant, infection, nerve damage, and prolonged recovery time, can deter patients from undergoing these treatments. These risks can lead to increased costs, extended treatment periods, and decreased patient satisfaction, which can negatively impact the growth of the dental implants and prosthetics market. Moreover, the fear of complications can discourage potential patients from considering dental implants or prosthetics as an option for replacing missing teeth, leading to a decrease in demand and hindering the market's growth.

Report Segmentation

The market is primarily segmented based on type, material, end-user, and region.

|

By Type |

By Material |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the market is segmented on the basis of dental prosthetics and dental implants. The dental prosthetics type held the largest market share in the global dental implants and prosthetics market in 2023, owing to factors such as increasing incidence of dental caries, periodontal diseases, and other oral health issues leading to tooth loss. Prosthetic dentistry has evolved significantly over the years, with advancements in technology and materials used for fabricating dental prosthetics. Modern dentures, for instance, are more comfortable and natural-looking than traditional ones, thanks to improvements in their design and the use of durable materials like acrylic resin and porcelain.

Also, the growing demand for dental prosthetics is attributed to the rising prevalence of dental problems, oral health, and advances in dental technology. For instance, according to the World Health Organization (WHO), tooth decay affects 60–90% of schoolchildren and the majority of adults worldwide. Moreover, the senior population, who are more susceptible to oral health issues, is expanding rapidly, further driving the need for dental prosthetics.

By Material Insights

Based on material analysis, the market has been segmented on the basis of ceramic, insomnia, metal, titanium, zirconium, and others. The titanium segment held the largest dental implants and dental prosthetics market share in 2023 since titanium has found extensive use in both Endosseous and Subperiosteal implants in dentistry. Endosseous implants, which come in the form of rods, posts, and blades made from pure titanium or titanium alloys, have been shown to be successful as biocompatible implant materials. Continuous improvements in both device design and clinical implantation techniques have led to highly accepted and predictable procedures. Since titanium alloys were introduced for this purpose in 1981, there has been a significant increase in the use of dental implants to replace missing teeth in patients.

Implants rely on the use of a metal support that makes direct contact with the bone. Due to titanium's excellent mechanical properties, low density, and superior bone-contact biocompatibility, it is used in alloys to fabricate dental implants.

By End User Insights

Based on end-user analysis, the market has been segmented on the basis of dental hospitals & clinics, dental laboratories, and others. The dental hospital and clinics segment dominated the global market in 2023 because dental hospitals and clinics are equipped with advanced technology and facilities that enable them to provide high-quality dental care services. They possess a team of experienced dentists, oral surgeons, and other specialists who perform complex procedures such as dental implant surgery and prosthetic restoration. These professionals have extensive training and expertise in their respective fields, which ensures that patients receive the best possible treatment outcomes. Additionally, dental hospitals and clinics follow strict sterilization protocols and maintain a clean environment, reducing the risk of postoperative complications. Owing to these factors, the dental hospital & clinics segment dominated the global market for dental implants and prosthetics.

Regional Insights

Europe

The European region is expected to dominate the global dental implants and prosthetics market in 2023 due to the region's well-developed healthcare industry, which provides easy access to advanced dental care services, including dental implant procedures. The presence of a large number of dental and oral surgeons in countries such as Germany, Italy, France, and the UK has contributed to the growth of the market in this region. The European region has been witnessing a surge in dental problems owing to the growing number of aged individuals in the population. According to Eurostat data, in 2022, more than 21% of the EU population was aged 65 and older. This age group is more susceptible to tooth decay, leading to the region's dominance in the global dental implants and dental prosthetics market.

Asia Pacific

The Asia Pacific region is expected to experience significant growth in the global dental implants and prosthetics market during the forecast period, driven by the advancements in technology and the development of innovative products that have made dental implantation procedures more accessible and affordable, further driving demand for these services. Furthermore, the increasing prevalence of oral diseases in the region has contributed significantly to the high growth of the dental implants and dental prosthetics market. For instance, according to a report from the World Health Organization, a significant proportion of the population in the Western Pacific region, approximately 42% (approximately 800 million people), suffer from a range of oral diseases. Such diseases include untreated dental caries, gum disease, and tooth loss.

Competitive Landscape

The manufacturers in the dental implants and prosthetics market are engaged in various activities to promote their products, expand their customer base, and maintain their competitive edge. They invest heavily in research and development to design and develop innovative and high-quality dental implant systems and prosthetic devices that meet the evolving needs of dentists, orthodontists, and patients.

Some of the major players operating in the global market include:

- 3M Company

- Adin Dental Implant Systems

- Avinent implant system s.l

- BEGO GmbH & Co. KG

- Bicon, LLC.

- Centrix Dental

- Cortex Dental Implants Industries Ltd.

- Dental Technologies

- Dentsply Sirona Inc.

- DIO Corporation

- Institut straumann AG

- Keystone Dental Inc.

- Lancer Orthodontics, Inc.

- Mitsui Chemicals Inc.

- National Dentex Labs

- TBR Implants Group

- Thommen Medical AG

- T-Plus

- Ultradent Products, Inc.

- ZimVie Inc.

Recent Developments

- In June 2024, BioLargo, Inc. announced that its subsidiary Clyra Medical Technologies has chosen Keystone Industries to support the manufacturing of its medical products. Keystone Industries, a global producer of dental, medical, and cosmetic products, has distribution partners in more than 70 countries. Clyra and Keystone have and continue to make significant investments in infrastructure to support the development of innovative products.

- In February 2024, global life sciences leader ZimVie Inc. announced the launch of TSX Implant in Japan. TSX Implants are designed for immediate extraction and standard loading protocols. Also, these implants allow for placement predictability and facilitate primary stability in soft and dense bone. With the launch of TSX Implants, the company can compete directly with top industry participants in the digital implants space.

- In November 2023, Keystone Dental introduced the Genesis Active implant system, which is a surgical solution specifically designed for implant placement and restoration. This new system features a singular connection and three different emergence profiles, along with multiple therapeutic platforms, to enable the creation of aesthetically pleasing restorations that closely follow the natural tooth contour.

- In September 2023, Neoss Group, a renowned company that provides innovative dental implant solutions, partnered with Osstell AB, a player in the field of implant stability measurement and osseointegration progress monitoring. Together, they have launched NeoTell, a device to measure the stability of dental implants.

- In November 2022, ZimVie, one of the leading global life sciences companies in the dental market, introduced the TSX implant in the United States. This implant is specifically designed to cater to extraction and loading protocols while also ensuring accurate primary stability and placement predictability in both dense and soft bone.

Report Coverage

The Dental Implants and Prosthetics market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, material, end user, and their futuristic growth opportunities.

Dental Implants and Prosthetics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.90 billion |

|

Revenue Forecast in 2032 |

USD 25.87 billion |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Material, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global dental implants and prosthetics market size is expected to reach USD 25.87 Billion by 2032

Key players in the market are 3M Company, Adin Dental Implant Systems, Avinent implant system, BEGO GmbH & Co. KG, Bicon, LLC

Europe contribute notably towards the global dental implants and dental prosthetics market

Dental Implants and Prosthetics Market exhibiting a CAGR of 7.1% during the forecast period

The dental implants and dental prosthetics market report covering key segments are type, material, end-user, and region.