Dental Equipment Market Size, Share, Trends, Industry Analysis Report: By End Use (Hospitals & Clinics and Research & Academic Institutes), Product, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 117

- Format: PDF

- Report ID: PM5061

- Base Year: 2023

- Historical Data: 2019-2022

Dental Equipment Market Overview

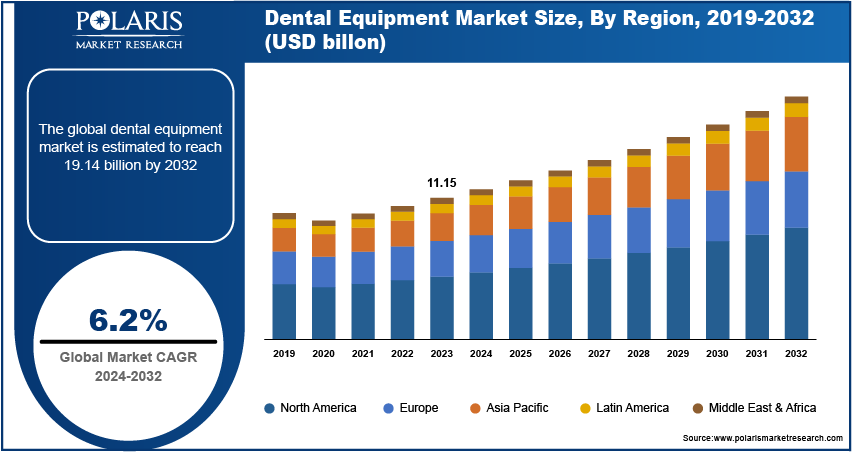

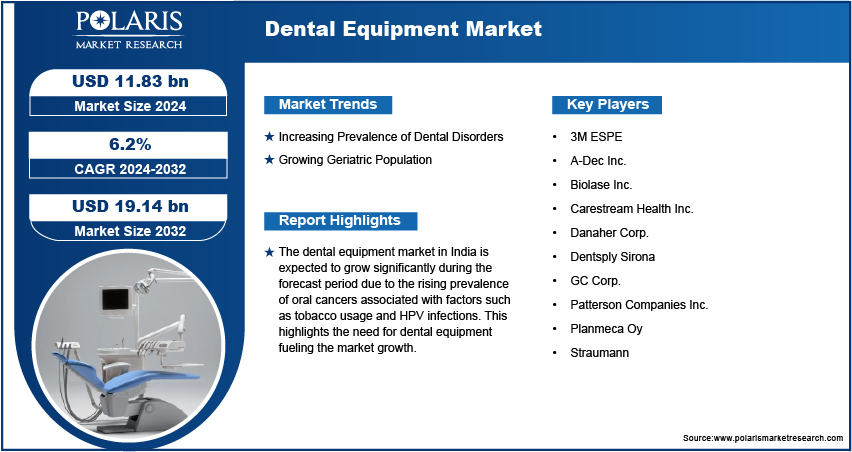

Global dental equipment Market Size was valued at USD 11.15 billion in 2023. The dental equipment industry is projected to grow from USD 11.83 billion in 2024 to USD 19.14 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.2% during the forecast period (2024 - 2032).

Dental equipment encompasses a wide range of tools and devices used by dental professionals for various procedures and treatments. The demand for dental equipment is rising due to increasing awareness of dental aesthetics and the availability of advanced cosmetic dental procedures. Furthermore, the global increase in the number of dental clinics and private practices is contributing to the growing demand for dental equipment market.

To Understand More About this Research: Request a Free Sample Report

Government initiatives and reimbursement policies for dental procedures also drive market growth. Technological innovations such as digital dentistry, CAD/CAM systems, 3D imaging, and laser dentistry significantly improve the efficiency and precision of dental procedures, thereby expanding the dental equipment market.

Dental Equipment Market Drivers and Trends

Increasing Prevalence of Dental Disorders

The increasing prevalence of dental disorders is propelling the dental equipment market. Factors such as poor dietary habits, inadequate oral hygiene, and lifestyle changes have contributed to the widespread occurrence of dental caries and periodontal diseases. For instance, according to WHO, in 2022, the Global Oral Health Status Report revealed that oral diseases affect nearly 3.5 billion people globally, with 3 out of 4 affected individuals residing in middle-income countries. Additionally, about 2 billion individuals worldwide have caries of permanent teeth, and 514 billion children suffer from caries of primary teeth. The prevalence of these oral diseases is on the rise due to global urbanization and changes in living conditions, which has bolstered the demand for dental equipment, further driving the market growth.

Growing Geriatric Population

The increasing elderly population, with a higher susceptibility to dental issues, significantly spurs the demand for dental treatments and equipment. For instance, according to the World Health Organization (WHO), the global geriatric population aged 60 and above is projected to reach 1.4 billion by 2030, a significant rise from 1 billion in 2020, leading to an increased need for dental equipment and driving market growth. The aging population is more vulnerable to dental problems like tooth decay, gum disease, tooth loss, and oral cancers. Factors such as reduced saliva production, receding gums, and the cumulative impact of dental wear and tear contribute to a decline in oral health among the elderly. Consequently, the rising dental issues are anticipated to drive the dental equipment market during the forecast period.

Dental Equipment Market Segment Insights

Dental Equipment Market Breakdown by Product Insights

The global dental equipment market segmentation, based on product, includes dental radiology equipment, dental systems & parts, laboratory machines, hygiene maintenance devices, and other equipment. In 2023, the dental systems & parts segment accounted for the largest market share. The rising prevalence of dental disorders and the increasing focus on oral health have resulted in a heightened demand for diagnostic equipment. Advanced imaging systems and diagnostic tools are critical for early detection and precise treatment of dental conditions, contributing to the segment’s dominance. Moreover, continuous innovations and product launches in dental systems and components, including digital radiography, CAD/CAM systems, and cone beam computed tomography (CBCT), have notably improved diagnostic precision, treatment planning, and procedural efficiency. For instance, ZimVie Inc. launched its latest digital dentistry software, including the RealGUIDE CAD and FULL SUITE modules. The CAD module offers advanced software for therapeutic design and manufacturing, allowing detailed implant and tooth restoration. The rising advancements make dental systems vital for modern dental practices, contributing to the growth of the dental equipment market.

Dental Equipment End-Use Insights

The global dental equipment market segmentation, based on end use, includes hospitals & clinics and research & academic institutes. The hospitals and clinics category are expected to be the fastest-growing market segment. The expansion of dental clinics and hospitals worldwide, especially in emerging economies, is driving the demand for advanced dental equipment. For instance, in October 2022, new dental clinics launched in Rockaway schools aim to improve the oral health of underserved students. The implementation of this program aimed at setting up dental clinics has resulted in a surge in the need for dental equipment in hospitals and the dental clinic sector. The increased number of healthcare facilities has heightened the requirement for advanced dental systems and tools to cater to patients effectively. Moreover, regular check-ups and maintenance are essential for preventive care, while specialized treatments such as orthodontics, endodontics, and oral surgery require advanced equipment and tools.

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Dental Equipment Regional Insights

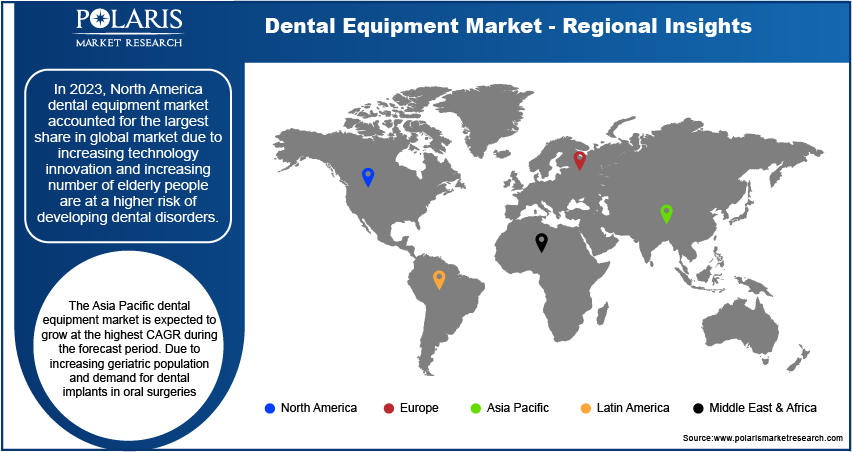

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dental equipment market accounted for the largest market share in 2023. The population in North America exhibits a strong adherence to dental care, supported by a vital insurance framework that covers a wide array of dental procedures. This financial support enables individuals to pursue advanced dental treatments, driving substantial demand for sophisticated dental equipment. Government initiatives and policies further catalyze market expansion by allocating funding towards healthcare and dental care programs. These efforts significantly enhance accessibility to dental care solutions and equipment across the region.

North America is also at the forefront of dental technology innovation, with a strong focus on research and development. This has led to rapid advancements in digital dentistry, CAD/CAM systems, 3D printing, and laser dentistry technologies, contributing to the growth of the dental equipment market in the region.

The U.S. dental equipment market is expected to grow significantly in the forecast period. Increasing awareness about the importance of oral health and preventive dental care in the U.S. has led to more frequent dental check-ups and a higher demand for preventive and diagnostic dental equipment. For instance, according to the American Dental Association, in 2021, 43.3% of the U.S. population had a dental visit in the past 12 months, including 50.0% of children aged 0-18 and seniors aged 65 and older. This greater awareness has significantly contributed to the growth of the U.S. dental equipment market.

The Asia Pacific dental equipment market is expected to grow at the highest CAGR during the forecast period. The increasing geriatric population is expected to drive the demand for dental implants and oral surgeries, thereby boosting the market for dental equipment in the Asia Pacific region. For instance, the Elderly in India 2021 report indicates that the number of people over the age of 60 in India was around 137.9 billion in 2021 and is projected to reach 193.8 billion by 2031. The increasing number of elderly people are at a higher risk of developing dental disorders, which is a major driver for the growth of the dental equipment market.

The dental equipment market in India is expected to grow significantly during the forecast period due to the rising prevalence of oral cancers associated with factors such as tobacco usage and HPV infections. This highlights the need for dental equipment fueling the market growth.

Dental Equipment Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the dental equipment market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the dental equipment industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global dental equipment industry to benefit clients and increase the market sector. In recent years, the dental equipment industry has offered some technological advancements. Major players in the dental equipment market include 3M ESP; A-Dec Inc.; Biolase Inc.; Carestream Health Inc.; Danaher Corp.; Dentsply Sirona; GC Corp.; Patterson Companies Inc.; Planmeca Oy; and Straumann.

A-dec is headquartered in Oregon, United States. The company is engaged in manufacturing reliable dental operatory equipment. Their product portfolio includes dental chairs, delivery systems, dental lights, dental stools, dental cabinets, mechanical room equipment, infection control products, handpieces & motors, and software. In June 2023, A-dec, a dental equipment company, launched its first digitally interconnected delivery systems: A-dec 500 Pro and A-dec 300 Pro platforms.

Planmeca Oy is headquartered in Helsinki, Finland. It operates in the healthcare technology sector and has a global presence in over 120 countries. The company offers a wide range of products, including CAD/CAM solutions, 2D and 3D imaging devices, digital dental units, and advanced software solutions catering to the needs of the healthcare industry. In March 2023, Planmeca launched its advanced features to the Planmeca Romexis software platform. These new features include an AI-based segmentation tool for CBCT images, a Planmeca Romexis Ortho Simulator software module for generating orthodontic simulations, and enhancements to existing software modules like Planmeca Romexis CMF Surgery.

List of Key Companies in Dental Equipment Market

- 3M ESPE

- A-Dec Inc.

- Biolase Inc.

- Carestream Health Inc.

- Danaher Corp.

- Dentsply Sirona

- GC Corp.

- Patterson Companies Inc.

- Planmeca Oy

- Straumann

Dental Equipment Industry Developments

- July 2024: SICAT GmbH & Co. KG partnered with Vatech America, a leading developer and manufacturer of dental equipment. This partnership allows dental professionals utilizing Vatech CBCT tools to seamlessly utilize 3D diagnostics and planning through the newly integrated SICAT Suite software modules.

- February 2024: Torch Dental, the company with dental supply and equipment discovery, ordering, and spend management, announced a strategic partnership with the Chicago Dental Society, an organization committed to the promotion of oral health and the advancement of the dental profession in the state.

- January 2023: W&H launched Lexa Plus Class B sterilizer; a pre-vacuum sterilizer designed for the North American dental equipment market. This new product offers increased capacity, energy-efficient rapid cycles, automated water filling, as well as connectivity and traceability options.

Dental Equipment Market Segmentation

Dental Equipment Product Outlook

- Dental Radiology Equipment

- Intra-Oral

- Digital X-ray Units

- Digital Sensors

- Extra-Oral

- Digital Units

- Analog Units

- Dental Lasers

- Diode Lasers

- Quantum Well Lasers

- Distributed Feedback Lasers

- Vertical Cavity Surface Emitting Lasers

- Heterostructure Lasers

- Quantum Cascade Lasers

- Separate Confinement Heterostructure Lasers

- Vertical External Cavity Surface Emitting Lasers

- Carbon Dioxide Lasers

- Yttrium Aluminium Garnet Lasers

- Laboratory Machines

- Ceramic Furnaces

- Hydraulic Press

- Electronic Waxer

- Suction Unit

- Micro Motor

- Systems & Parts

- CAD/CAM

- Cast Machine

- Cone Beam CT Systems

- Electrosurgical Equipment

- Furnace and Ovens

- Others

- Hygiene Maintenance Devices

- Sterilizers

- Air Purification & Filters

- Hypodermic Needle Incinerator

- Other Equipment

- Chairs

- Hand Piece

- Light Cure

- Scaling Unit

Dental Equipment End Use Outlook

- Hospitals and Clinics

- Research and Academic Institutes

Dental Equipment Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dental Equipment Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 11.15 billion |

|

Market Size Value in 2024 |

USD 11.83 billion |

|

Revenue Forecast in 2032 |

USD 19.14 billion |

|

CAGR |

6.2% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global dental equipment market size was valued at USD 11.15 billion in 2023.

The global market is projected to register a CAGR of 6.2% during the forecast period, 2024-2032

North America had the largest share of the global market

The key players in the market are 3M ES; A-Dec Inc.; Biolase Inc.; Carestream Health Inc.; Danaher Corp.; Dentsply Sirona; GC Corp.; Patterson Companies Inc. Planmeca Oy; Straumann.

The dental systems & parts category dominated the market in 2023.

The hospitals and clinics had the fastest share in the global market.