Dental Bone Graft Substitutes Market Size, Share, Trends, Industry Analysis Report: By Type (Synthetic Bone Graft, Xenograft, Allograft, Autograft, Alloplast, Deminerlized Allograft, and Others), Application, Mechanism, Product, By End-User, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 117

- Format: PDF

- Report ID: PM5071

- Base Year: 2023

- Historical Data: 2019-2022

Dental Bone Graft Substitutes Market Overview

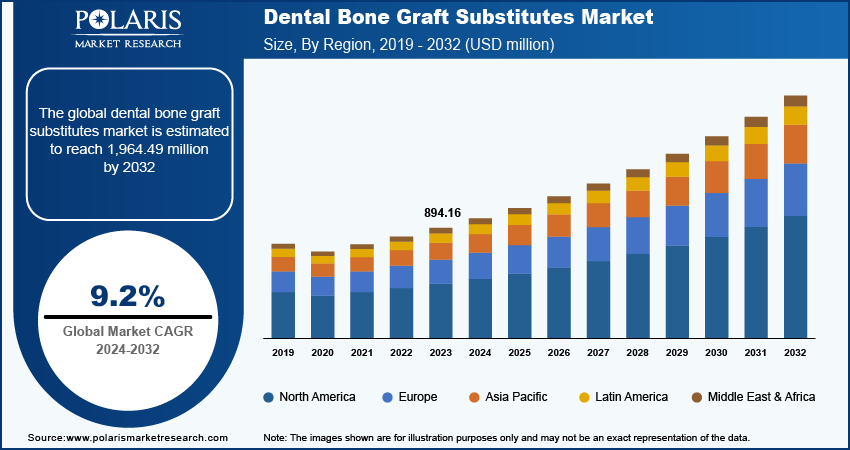

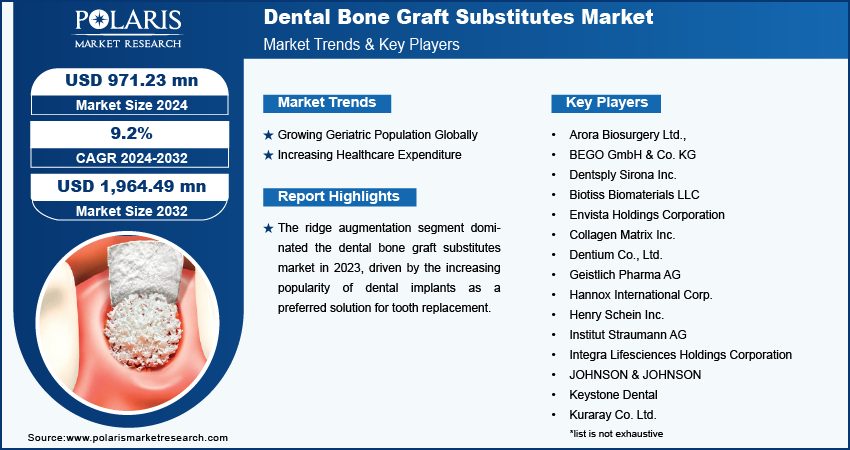

Global dental bone graft substitutes market size was valued at USD 894.16 million in 2023. The market is projected to grow from USD 971.23 million in 2024 to USD 1,964.49 million by 2032, exhibiting a CAGR of 9.2% during the forecast period.

The dental bone graft substitutes market refers to the healthcare industry, which is involved in the production, distribution, and use of materials that serve as substitutes for natural bone grafts in dental procedures. These substitutes are utilized primarily in dental surgeries to promote bone regeneration and support structures such as dental implants.

The increasing prevalence of dental disorders such as periodontal diseases, dental caries, and tooth loss is driving demand for dental bone graft substitutes. Factors such as aging population, unhealthy lifestyles, and poor oral hygiene habits contribute significantly to these conditions. For instance, according to the WHO's Global Oral Health Status Report of 2022, about 3.5 billion people worldwide experience oral diseases, with three-quarters of affected people residing in middle-income countries. Moreover, approximately 2 billion individuals suffer from cavities in their permanent teeth, and 514 million children are affected by cavities in their primary teeth globally.

Bone graft substitutes are increasingly essential in supporting dental implant placements as more individuals seek effective solutions to restore dental health and function, raising the demand for dental bone graft substitutes market.

To Understand More About this Research: Request a Free Sample Report

In recent years, growing awareness among patients about dental implants and bone grafting procedures has significantly boosted acceptance rates for dental bone graft substitute solutions. Patients are now more informed about available treatment options and the benefits of the procedures offered in restoring oral health and functionality, contributing to the growth of the dental bone graft substitutes market worldwide.

Dental Bone Graft Substitutes Market Drivers and Trends

Growing Geriatric Population Globally

The global geriatric population is rapidly increasing, significantly impacting the demand for dental procedures, particularly bone grafting. According to the World Health Organization (WHO), the number of individuals aged 60 and above is projected to rise to 1.4 billion by 2030 and double to 2.1 billion by 2050. Furthermore, the population aged 80 years and older is expected to triple, reaching 426 million during this timeframe. This demographic shift underscores the growing need for dental care tailored to the unique needs of older adults, highlighting the importance of advancements in procedures such as bone grafting to support oral health in an aging population.

Aged people often face dental issues such as tooth loss and bone resorption, which can compromise oral health and overall well-being. These conditions necessitate effective solutions to restore dental function and aesthetics. Dental implants, supported by bone grafting procedures, are crucial in addressing these challenges by providing a stable foundation for replacement teeth.

Increasing Healthcare Expenditure

The growth in healthcare expenditure, particularly in emerging markets, is significantly driving the adoption of advanced dental procedures and technologies, including bone graft substitutes. As disposable incomes rise in these regions, more patients are choosing dental treatments that incorporate these innovative products. This trend reflects a broader shift toward prioritizing oral healthcare and investing in sophisticated treatment options to effectively address dental conditions.

For instance, a study published in the National Library of Medicine in May 2021 reported that approximately 2.2 million bone graft procedures are performed annually worldwide, with associated costs reaching $664 million in 2021. The study projects an annual growth rate of about 13% in the number of surgical procedures, indicating a robust demand for these treatments.

As patients' financial capabilities increase, access to previously unaffordable procedures is improving, further fueling the demand for the dental bone graft substitutes market. This trend is contributing to the expanding use of these products in dental surgeries globally, highlighting the evolving landscape of oral healthcare.

Dental Bone Graft Substitutes Market Segment Insights

Dental Bone Graft Substitutes Type Insights

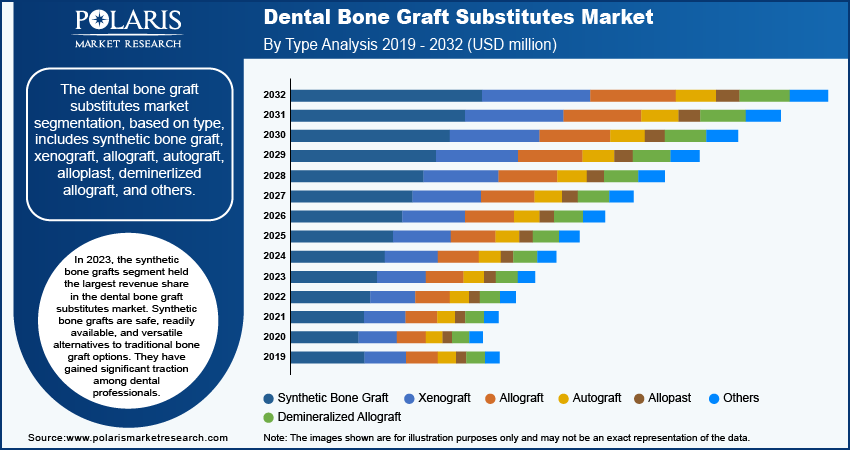

The dental bone graft substitutes market segmentation, based on type, includes synthetic bone graft, xenograft, allograft, autograft, alloplast, deminerlized allograft, and others. In 2023, the synthetic bone grafts segment held the largest revenue share in the dental bone graft substitutes market. Synthetic bone grafts are safe, readily available, and versatile alternatives to traditional bone graft options. They have gained significant traction among dental professionals.

As technology continues to advance and production costs decrease, synthetic bone grafts are expected to play a major role in procedures such as jawbone reconstruction and implant placement. This is projected to drive the growth of the synthetic bone grafts segment due to growing preference for innovative solutions that improve surgical outcomes and patient recovery in dental surgeries worldwide. For instance, in January 2023, Osstem Implant intended to develop synthetic bone graft materials, including LCA-R and LCA-N, with the goal of pioneering advancements in bone grafting by 2026.

Dental Bone Graft Substitutes Application Insights

The global dental bone graft substitutes market segmentation, based on application, includes socket preservation, ridge augmentation, periodontal defect regeneration, implant bone regeneration, and sinus lift. The ridge augmentation segment dominated the dental bone graft substitutes market in 2023, driven by the increasing popularity of dental implants as a preferred solution for tooth replacement. Ridge augmentation is a vital procedure in dental implantology that addresses bone deficiencies in the alveolar ridge, enabling the successful placement of dental implants. Ridge augmentation significantly improves implant success rates and aesthetic outcomes by restoring bone volume and enhancing the biological performance of graft materials.

Also, minimally invasive surgical techniques and advancements in biomaterials are enhancing the effectiveness of ridge augmentation procedures, improving patient outcomes, and contributing to quicker recovery processes.

Dental Bone Graft Substitutes Regional Insights

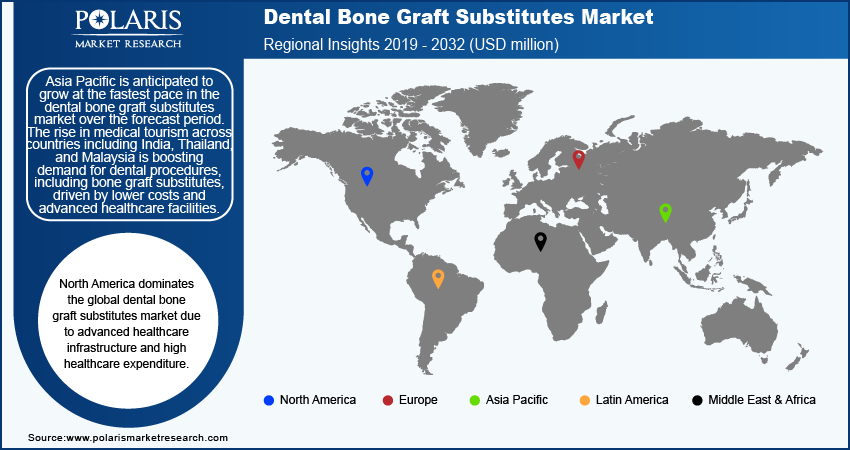

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the global dental bone graft substitutes market due to advanced healthcare infrastructure and high healthcare expenditure. Countries such as the US and Canada possess well-established dental care facilities equipped with advanced technologies, facilitating the widespread adoption of bone graft substitutes. Furthermore, the high demand for dental implants, driven by a growing population requiring the procedures and the success rates of implant surgeries, encourages their use. The region has seen advancements in dental procedures, including the adoption of bone grafts and regeneration methods, enhancing the effectiveness of treatments and leading to a rising demand for bone graft substitutes.

North America’s aging population and increasing prevalence of dental disorders also drive the demand for bone graft substitutes. Also, strategic industry initiatives, such as product launches and mergers, by major players have further boosted the market growth in North America. For instance, in June 2022, ZimVie Inc. Introduced the T3 PRO Tapered Implant and Encode Emergence Healing Abutment, advancing dental implant technology in the United States.

Asia Pacific is anticipated to grow at the fastest pace in the dental bone graft substitutes market over the forecast period. The rise in medical tourism across countries including India, Thailand, and Malaysia is boosting demand for dental procedures, including bone graft substitutes, driven by lower costs and advanced healthcare facilities. Also, government initiatives aimed at enhancing healthcare infrastructure and promoting dental health are further propelling market growth. These initiatives include subsidies for dental treatments and investments in healthcare facilities, fostering increased accessibility to dental care and treatment options.

The region's aging population is contributing to higher incidences of dental issues such as tooth loss and bone deterioration, necessitating procedures such as dental implants that often require bone graft substitutes. As awareness of dental health grows among the population, there is a rising demand for treatments to maintain oral health and aesthetics, bolstering the dental bone graft substitutes market in Asia Pacific.

Dental Bone Graft Substitutes Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the dental bone graft substitutes market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the dental bone graft substitutes industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global dental bone graft substitutes market to benefit clients and increase the market sector. In recent years, the dental bone graft substitutes market has offered some technological advancements. Major players in the dental bone graft substitutes market include Arora Biosurgery Ltd.; BEGO GmbH & Co. KG; Biotiss Biomaterials LLC; Collagen Matrix Inc.; Dentium Co., Ltd.; Dentsply Sirona Inc.; Envista Holdings Corporation; Geistlich Pharma AG; Hannox International Corp.; Henry Schein Inc.; Institut Straumann AG; Integra Lifesciences Holdings Corporation; JOHNSON & JOHNSON; Keystone Dental; Kuraray Co. Ltd.; Lifenet Health; Medtronic; Plc,; Meyer Haake GmbH; Novabone LLC.; Osteogenics Biomedical; RTI Surgical Holdings Inc.; Stryker Corporation; Tissue Regenix Group; Young Innovations; and Zimvie Inc.

Dentsply Sirona Inc. is an American manufacturer of dental equipment and consumables and a provider of professional dental products and technologies. The company offers a wide range of products, including dental prosthetics, equipment, and consumables, serving over 600,000 dental professionals globally. It is headquartered in Charlotte, North Carolina and operates in over 120 countries and has manufacturing facilities in 21 countries. In July 2024, Dentsply Sirona enhanced its Symbios Allograft line to offer advanced regenerative solutions for dental surgeries and implants, emphasizing sterility and versatility.

ZimVie is a global player in the life sciences sector, specializing in dental and spine markets. The company develops, manufactures, and distributes a diverse array of products and solutions tailored for treating various spine pathologies and facilitating dental tooth replacement and restoration procedures. In April 2023, ZimVie Inc. introduced RegenerOss CC Allograft Particulate and RegenerOss Bone Graft Plug, expanding their dental biomaterials portfolio in North America.

List of Key Companies in Dental Bone Graft Substitutes Market

- Arora Biosurgery Ltd.,

- BEGO GmbH & Co. KG

- Dentsply Sirona Inc.

- Biotiss Biomaterials LLC

- Envista Holdings Corporation

- Collagen Matrix Inc.

- Dentium Co., Ltd.

- Geistlich Pharma AG

- Hannox International Corp.

- Henry Schein Inc.

- Institut Straumann AG

- Integra Lifesciences Holdings Corporation

- JOHNSON & JOHNSON

- Keystone Dental

- Kuraray Co. Ltd.

- Lifenet Health

- Medtronic, Plc

- Meyer Haake GmbH

- Novabone LLC.

- Osteogenics Biomedical

- RTI Surgical Holdings Inc.

- Stryker Corporation

- Tissue Regenix Group

- Young Innovations

- Zimvie Inc.

Dental Bone Graft Substitutes Industry Developments

- February 2024: ZimVie Inc. launched its TSX Implant in Japan, enhancing its dental implant offerings with features designed for immediate extraction and standard loading protocols, aiming to compete in the premium dental implant market.

- November 2023: Keystone Dental launched the GENESIS ACTIVE Implant System, a comprehensive dental implant solution featuring innovative technologies designed to enhance implant placement efficiency and aesthetic outcomes.

- March 2022: Envista Holdings Corporation re-brands its dental imaging business to DEXIS, encompassing a range of digital imaging solutions and devices like CBCT, handheld X-rays, intraoral scanners, and surgical systems, alongside brands i-CAT, Instrumentarium, SOREDEX, and NOMAD.

Dental Bone Graft Substitutes Market Segmentation

By Type Outlook

- Synthetic Bone Graft

- Xenograft

- Allograft

- Autograft

- Alloplast

- Deminerlized Allograft

- Others

By Application Outlook

- Socket Preservation

- Ridge Augmentation

- Periodontal Defect Regeneration

- Implant Bone Regeneration

- Sinus Lift

By Mechanism Outlook

- Osteoconduction

- Osteoinduction

- Osteopromotion

- Osteogenesis

By Product Outlook

- Bio OSS

- Osteograf

- Grafton

- Others

By End-User Outlook

- Hospitals

- Dental Clinics

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dental Bone Graft Substitutes Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 894.16 million |

|

Market Size Value in 2024 |

USD 971.23 million |

|

Revenue Forecast in 2032 |

USD 1,964.49 million |

|

CAGR |

9.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global dental bone graft substitutes market size was valued at USD 894.16 million in 2023 and is anticipated to reach at USD 1,964.49 million in 2032

The global market is projected to register a CAGR of 9.2% during the forecast period, 2024-2032.

North America had the largest share of the global market in 2023.

The key players in the market are Arora Biosurgery Ltd.; BEGO GmbH & Co. KG; Biotiss Biomaterials LLC; Collagen Matrix Inc.; Dentium Co., Ltd.; Dentsply Sirona Inc.; Envista Holdings Corporation; Geistlich Pharma AG; Hannox International Corp.; Henry Schein Inc.; Institut Straumann AG; Integra Lifesciences Holdings Corporation; JOHNSON & JOHNSON; Keystone Dental; Kuraray Co. Ltd.; Lifenet Health; Medtronic; Plc; Meyer Haake GmbH; Novabone LLC.; Osteogenics Biomedical; RTI Surgical Holdings Inc.; Stryker Corporation; Tissue Regenix Group; Young Innovations; and Zimvie Inc.

The synthetic bone graft category dominated the market in 2023

The ridge augmentation had the largest share in the global market.