Decorative Laminates Market Share, Size, Trends, Industry Analysis Report, By Product (High Pressure Laminates, Low Pressure Laminates); By Raw Material; By Application; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 117

- Format: PDF

- Report ID: PM4960

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

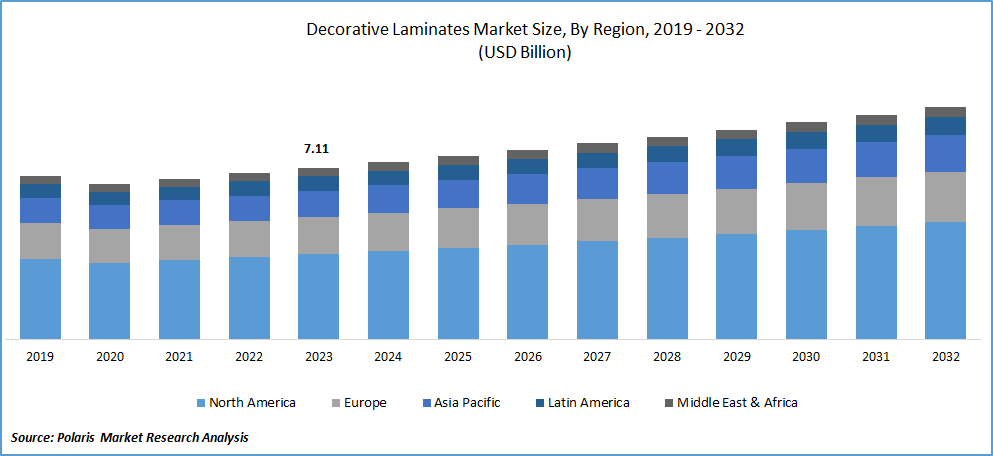

Decorative Laminates Market size was valued at USD 7.11 billion in 2023. The market is anticipated to grow from USD 7.35 billion in 2024 to USD 9.64 billion by 2032, exhibiting the CAGR of 3.4% during the forecast period.

Decorative Laminates Market Overview

Decorative laminates are expected to witness significant demand, driven by growing consumer’s net income, which is enabling them to consume house decorating products. The increasing accessibility of these products to people in diverse regions through online sales channels is projected to foster their adoption in the global marketplace. Additionally, the rising studies exploring new designs and material incorporation in laminate design are expected to showcase significant demand for decorative laminates over the forecast period.

To Understand More About this Research:Request a Free Sample Report

For instance, in February 2023, Merino Laminate announced the launch of a new range of decorative laminates that are compatible for application on multiple surfaces, including furniture, wardrobes, wall panels, and lobbies.

Moreover, the growing companies' efforts to promote awareness about their products and brand coverage are anticipated to create new potential opportunities for the decorative laminates market, as it can drive their demand from consumers. For instance, in April 2024, Dorby announced the launch of a new experience center in Delhi to showcase laminates, plywood, and other decorative items for customers.

Growth Drivers

Growing Production of New Decorative Laminates

The rising consumer's interest in purchasing products and raw materials to enhance their housing look is one of the major factors influencing the growth of decorative laminates, due to their potential to transform the outlook of houses and offices into a beautiful environment. The potential to alter individual mindsets and provide peace through the incorporation of customized decorative laminates and comfortable dwellings is driving demand from employers to get relief from work pressure.

This trend is motivating key players in the decorative laminates market to extend product innovations and production capacity in the marketplace. For instance, in March 2023, Greenply Industries, an interior design company engaged in producing decorative laminates, plywood, blackboard, and decorative veneers, announced the launch of Greenply MDF (medium-density fiber boards) at its manufacturing facility in Vadodara, India.

Rising Availability of Effective Raw Materials

The significant uptick in demand for decorative laminates is significantly necessitating the need for highly performing, rigid, and reliable raw materials in the market. This is enabling raw material suppliers to boost their production and research innovations to meet the diverse needs of the decorative laminate market. For instance, in January 2023, Decorative Panel Lamination introduced a range of FineFlex Metallic Designs from the FineDecor and Schattdecor brands.

Additionally, the ongoing product launches around the world are driving innovation in advanced decorative laminates, which are gaining attention from the global population. For instance, in March 2023, Monarchlam unveiled its decorative laminate product line with twenty-eight new designs and six new textures.

Restraining Factors

Unstable Raw Material Prices are Likely to Impede Market Growth

The global supply chain disruptions of raw materials utilized in the production process of decorative laminates, such as adhesives, plastic-resin, and paper, are leading to lower production of decorative laminates, causing an increase in the cost of decorative laminates to end users. Furthermore, the rising concerns about longevity and the growing production of advanced decorative laminates are expected to restrict their demand for some time in the marketplace.

Report Segmentation

The Decorative Laminates Market is primarily segmented based on product, raw material, application, end user, and region.

|

By Product |

By Raw Material |

By Application |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

High Pressure Laminates Segment is Expected to Witness the Highest Growth During the Forecast Period

The high-pressure laminates segment is projected to grow at a CAGR during the projected period, mainly driven by its longevity, potential to withstand harsh weather conditions, and rigidity. The antimicrobial and anti-fingerprint characteristics of decorative laminates are driving their adoption in premium house construction activities. Additionally, they are registering a significant rise in the utility of kitchen tops, flooring, and wall treatment in hospitals and other commercial settings.

Moreover, rising research activities in developing high pressure decorative laminates are projected to propel market expansion. For instance, in August 2023, Wilsonart announced the introduced 2 new laminate designs: the LUJO Collection & Wilsonart High Pressure Laminate (HPL).

By Raw Material Analysis

Plastic Resin Segment Accounted for the Largest Market Share in 2023

The plastic resin segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is mainly driven by its appealing properties, such as durability, chemical resistance, and weather resistance. The affordability of plastic resin-based decorative laminates is expected to bolster market expansion during the forecast period.

By Application Analysis

Furniture Segment Held the Significant Market Revenue Share in 2023

The furniture segment held a significant market share in revenue in 2023, which was highly accelerated due to the continuous rise in house remodeling activities and rising demand for interior design among households, retailers, and others. The growing innovation of effective plywood with its unique characteristics is anticipated to propel decorative laminate market growth over the forecast period.

By End user Analysis

Residential Segment is Projected to Witness Sustainable Growth

The residential segment is likely to register significant growth over the study time frame. This is due to its growing working population, leading to increased household income and driving house renovation and remodeling activities in the marketplace. The aesthetics and ease of application and maintenance of decorative laminates are further boosting their utility among households.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North America region held the dominant share in 2023. This is mainly attributable to the growing business expansion activities of the market players to increase their brand coverage and expand their production capacity with rising consumer demand. For instance, in March 2023, North American Speciality Laminations announced the acquisition of Diversified Manufacturing of California to expand its footprint in the decorative laminate market.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing consumer expenditure in interior design. The rising availability of affordable decorative laminates is providing new demand potential for the market. The rising product upgrades and developments in the region are optimally driving decorative laminate market growth. For instance, in June 2023, Asian Laminates announced the launch of its 1mm decorative laminates at its partners meeting in Kanha, India.

Key Market Players & Competitive Insights

Strategic Collaborations to Drive the Competition

The decorative laminate market is partly fragmented. This is expected to register moderate to high competition with the growing investments in the development of new decorative laminates and growing expansion activities, such as collaborations, partnerships, and acquisitions. For instance, in November 2023, TOPPAN Holdings Inc. entered into a collaboration agreement with Joyful Co., Ltd. to boost innovations in the decorative surfacing material market.

Some of the major players operating in the global market include:

- Abet Laminati SpA (Italy)

- Airolam Decorative Laminates (India)

- Archidply (India)

- Bell Laminates (India)

- Broadview Holding (Netherlands)

- FunderMax (Austria)

- Greenlam Industries Limited (India)

- Merino Laminates Ltd (India)

- OMNOVA North America Inc (US)

- STYLAM INDUSTRIES LIMITED (India)

- Wilsonart LLC (US)

Decorative Laminates Market Recent Developments in the Industry

- In January 2023, Genesis Products announced the acquisition of Funder America to increase its production capacity, driven by growing market demand for laminated panels and components in North America.

Decorative Laminates Market Report Coverage

The decorative laminates market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, raw material, application, end user, and their futuristic growth opportunities.

Decorative Laminates Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.35 billion |

|

Revenue forecast in 2032 |

USD 9.64 billion |

|

CAGR |

3.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Decorative Laminates Market Size Worth $ 9.64 Billion By 2032

The top market players in Decorative Laminates Market are Abet Laminati, Airolam Decorative Laminates, Archidply, Bell Laminates, Broadview Holding

North America is the region contribute notably towards the Decorative Laminates Market

Decorative Laminates Market exhibiting the CAGR of 3.4% during the forecast period.

Decorative Laminates Market report covering key segments are product, raw material, application, end user, and region.