Data Diode Market Size, Share, Trends, Industry Analysis Report: By Component, Type, Form Factor, Organization Size (SMEs and Large Enterprises), Application, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5397

- Base Year: 2024

- Historical Data: 2020-2023

Data Diode Market Overview

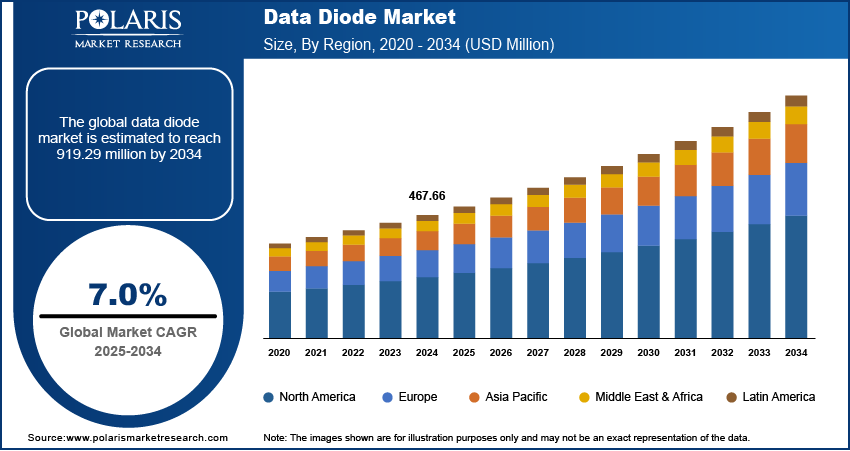

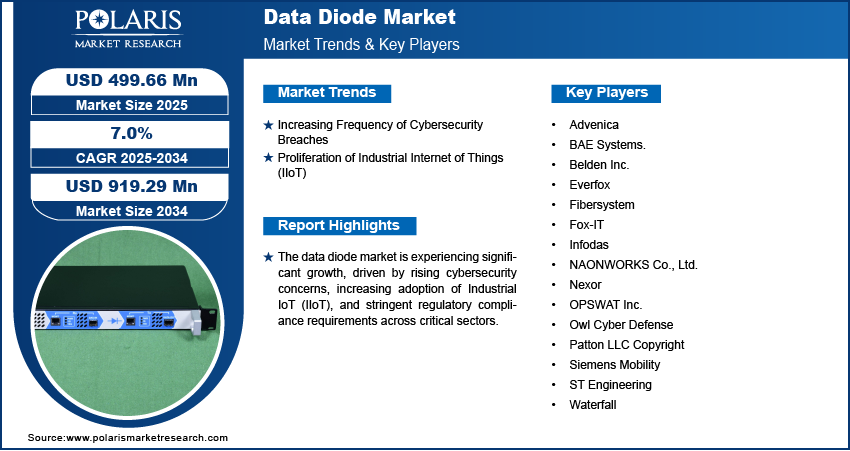

The global data diode market was valued at USD 467.66 million in 2024. It is expected to grow from USD 499.66 million in 2025 to USD 919.29 million by 2034, at a CAGR of 7.0% from 2025 to 2034.

A data diode is a cybersecurity device that implements one-way data transfer between networks, ensuring secure and controlled information flow while preventing cyber threats. The growing wave of digital transformation and Industry 4.0 is propelling the data diode market as organizations across infrastructure, defense, and manufacturing sectors increasingly adopt interconnected systems. For instance, in March 2023, BMW implemented NVIDIA's Omniverse platform for digital twin factory planning. They utilized AI and IoT sensors to enhance quality control and optimize processes. Additionally, collaborative robots (cobots) were deployed to work alongside humans on the assembly lines, resulting in a reduction of production planning time by up to 30%. The integration of Industrial IoT (IIoT), cloud computing, and real-time analytics has heightened the need for robust network security solutions to prevent cyber intrusions. This demand for secure data transmission solutions continues to rise as enterprises embrace Industry 4.0, strengthening the data diode market growth.

To Understand More About this Research: Request a Free Sample Report

Strict government regulations and initiatives aimed at strengthening cybersecurity frameworks further drive the data diode market expansion. A report published in July 2024 by India’s Ministry of IT & Electronics highlighted that 23,158 cybersecurity incidents were recorded in 2023. In response, the government launched several initiatives, such as the Digital Personal Data Protection Act of 2023, which aims to protect individual's rights to safeguard their data and incorporates established principles of data protection. Regulatory bodies worldwide are mandating strict cybersecurity policies to protect national security, critical infrastructure, and classified information from cyber threats. Compliance requirements, such as defense cybersecurity directives and industrial security standards, necessitate the implementation of data diodes to safeguard sensitive networks from unauthorized access and data breaches. Governments are also launching initiatives to enhance cyber resilience across sectors, reinforcing the need for high-assurance security solutions such as data diodes. This regulatory landscape, coupled with increasing cyber risks, continues to shape data diode market dynamics, pushing organizations toward advanced unidirectional security technologies.

Data Diode Market Dynamics

Increasing Frequency of Cybersecurity Breaches

The growing reliance on digital ecosystems has expanded the attack surface, making traditional cybersecurity measures insufficient to prevent data breaches, ransomware attacks, and nation-state cyber intrusions. Data diodes address this challenge by enforcing strict one-way data flow, ensuring that sensitive systems remain isolated from external threats while allowing controlled data transmission. This high-assurance security model is crucial for sectors handling classified information, such as defense, energy, and financial services, where even a minor breach can have severe consequences. For instance, in October 2024, NATO launched a new initiative to enhance secure data sharing at speed and scale, improving situational awareness and data-driven decision-making. This initiative is focused on the unidirectional transfer of operational data while ensuring air-gapped security. Thus, the need for robust, hardware-based network security solutions such as data diodes continues to grow as cyber threats become more advanced, fueling the data diode market development.

Proliferation of Industrial Internet of Things (IIoT)

IIoT enables real-time monitoring, predictive maintenance, and automation in sectors such as manufacturing, energy, and transportation, but it also exposes operational technology (OT) systems to cyber risks. A January 2025 report by the NCSC highlighted that international cybersecurity agencies, including GCHQ's NCSC, have released guidance to help organizations secure their OT systems. The guide outlines 12 security considerations for purchasing OT products that follow secure-by-design principles, addressing growing cyber threats where attackers exploit common weaknesses in critical infrastructure. Traditional IT security solutions often fail to provide adequate protection for industrial networks, which require strict isolation to prevent unauthorized access and potential sabotage. Data diodes offer a secure mechanism for transmitting critical operational data while ensuring external threats cannot infiltrate industrial control systems. As industries advance digital transformation and smart manufacturing efforts, the demand for secure and reliable data exchange solutions continues to grow, fueling the expansion of the data diode market.

Data Diode Market Segment Insights

Data Diode Market Assessment by Component Outlook

The global data diode market segmentation, based on component, includes hardware and services. The hardware segment dominated the market in 2024 due to its critical role in ensuring unidirectional data flow with high security and reliability. Unlike software-based security solutions, hardware-based data diodes provide a physically enforced one-way communication channel, making them essential for protecting sensitive networks across critical infrastructure, defense, and industrial sectors. Organizations prefer hardware diodes for their tamper-proof architecture, low maintenance, and ability to comply with strict cybersecurity regulations. Additionally, advancements in hardware design, such as compact and high-performance data diode solutions, have strengthened their market adoption.

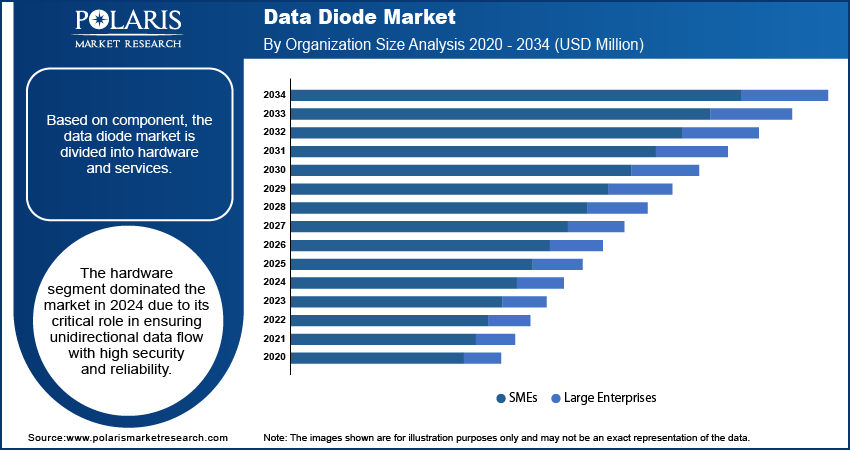

Data Diode Market Evaluation by Organization Size Outlook

The global data diode market evaluation, based on organization size, includes SMEs and large enterprises. The SMEs segment is expected to witness the fastest growth during the forecast period, driven by the increasing cybersecurity risks faced by small and medium-sized enterprises. SMEs are adopting cloud computing, IoT, and connected systems, exposing them to cyber threats that were previously more relevant to large enterprises as digital transformation accelerates. In response, these enterprises are turning to cost-effective and scalable data diode solutions to protect critical business operations without compromising security with limited cybersecurity resources. Additionally, growing regulatory pressures and compliance requirements are pushing SMEs to adopt high-assurance security measures. The demand for affordable and efficient data diode solutions is expected to surge as cybersecurity awareness rises among smaller organizations, thereby contributing to the segment’s growth.

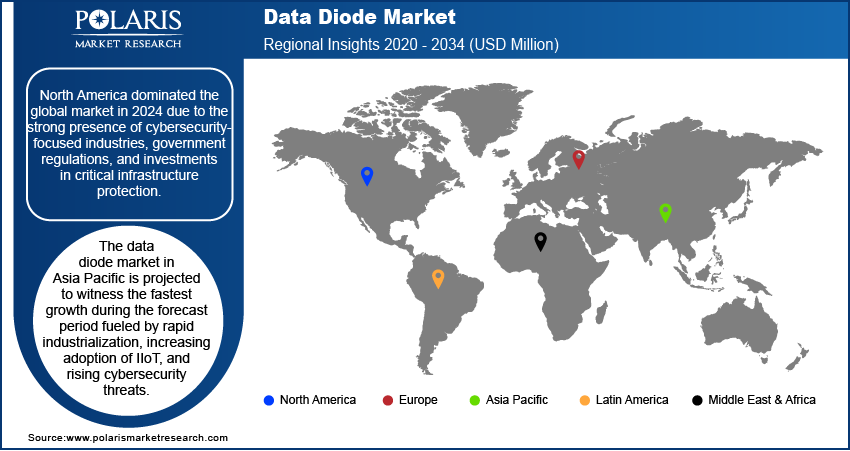

Data Diode Market Regional Analysis

By region, the report provides the data diode market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the data diode market revenue in 2024 due to the strong presence of cybersecurity-focused industries, government regulations, and investments in critical infrastructure protection. The region has a robust presence in industries such as defense, energy, finance, and healthcare, all of which require robust cybersecurity measures to prevent cyber threats and data breaches. Additionally, stringent regulatory frameworks and cybersecurity mandates from government agencies have driven the widespread adoption of advanced security solutions like data diodes across classified and industrial networks. A report in January 2025 stated that President Biden signed an executive order to improve US cybersecurity in response to increasing threats. Key measures include establishing minimum cybersecurity standards for federal contractors and encouraging collaboration between the public and private sectors. The region's leadership in technological advancements, along with growing concerns over nation-state cyber threats, has further strengthened the demand for high-assurance network security solutions, contributing to the regional market dominance.

The Asia Pacific data diode market is projected to witness the fastest growth during the forecast period, fueled by rapid industrialization, increasing adoption of IIoT, and rising cybersecurity threats. The region’s expanding manufacturing, energy, and transportation sectors are integrating digital technologies, creating a strong demand for secure data transmission solutions. Governments across the Asia Pacific are also implementing cybersecurity policies to protect critical infrastructure, driving investments in high-assurance security solutions such as data diodes. For instance, in January 2025, Singapore implemented amendments to its Cyber Security Act, extending its coverage to both physical and virtual critical information infrastructure (CII) systems, including those hosted on cloud platforms. This legislation mandates critical infrastructure operators to improve their cybersecurity measures and introduces new regulatory frameworks for managing cybersecurity incidents. Additionally, the growing presence of SMEs and startups embracing digital transformation is contributing to the regional market expansion. The demand for data diodes in Asia Pacific is expected to surge as industries and governments prioritize cybersecurity resilience, making it the fastest-growing regional market.

Data Diode Market – Key Players and Competitive Insights

The competitive landscape features a combination of global leaders and regional players aiming to capture market share through innovation, strategic partnerships, and geographic expansion. Major global companies such as FoxGuard Solutions, Owl Cyber Defense, and Waterfall Security Solutions leverage their extensive research and development capabilities along with robust distribution networks to provide advanced data diode solutions that ensure secure data transfer in critical infrastructures. Market trends indicate a rising demand for data diodes driven by increasing cybersecurity threats and the need for secure information exchange across various sectors, including government, finance, and healthcare. The projected data diode market growth is substantial, fueled by escalating concerns over data breaches and regulatory compliance requirements.

Regional players are capitalizing on localized needs by offering tailored solutions that meet specific industry requirements, particularly in emerging markets where digital transformation is accelerating. Competitive strategies within the market include mergers and acquisitions, collaborations with cybersecurity firms, and the introduction of innovative products designed to enhance data security. These developments underscore the importance of technological advancement, market adaptability, and regional investments in propelling the market expansion. The demand for high-quality data diode solutions is expected to rise as organizations increasingly recognize the value of robust cybersecurity measures, reflecting a broader trend towards enhanced protection against cyber threats. A few key major players are Advenica; BAE Systems; Belden Inc.; Everfox; Fibersystem; Fox-IT; Infodas; NAONWORKS Co., Ltd.; Nexor; OPSWAT Inc.; Owl Cyber Defense; Patton LLC; Siemens Mobility; ST Engineering; and Waterfall.

Advenica AB is a Swedish cybersecurity company founded in 1993, specializing in high-assurance security solutions for critical data in motion, including products that meet the highest EU and national security standards. Based in Malmö, Advenica develops a range of products, such as data diodes, which are crucial for ensuring secure one-way data transfer and preventing unauthorized access and cyber threats. The company serves various sectors, including defense, government agencies, and critical infrastructure, offering solutions such as VPN encryptors and network segmentation tools. Advenica's commitment to cybersecurity is reflected in its extensive experience and focus on protecting sensitive information for clients worldwide, ensuring secure communication and information exchange across diverse domains.

Siemens Mobility GmbH, a division of Siemens AG, is headquartered in Munich and has focused on intelligent transport solutions for over 175 years. The company operates four core business units: Mobility Management, Railway Electrification, Rolling Stock, and Customer Services. Siemens Mobility is recognized for its innovative contributions to rail technology and intelligent traffic systems, including the world's first driverless tram unveiled in 2018. A significant aspect of Siemens Mobility's operations is the integration of advanced cybersecurity measures, such as data diodes. These devices ensure secure data transfer by allowing information to flow in only one direction, effectively protecting critical infrastructure from cyber threats. This capability is vital for maintaining the integrity and reliability of transportation systems, especially as digitalization increases the vulnerability of operational technologies. Overall, Siemens Mobility continues to lead in developing sustainable and efficient transport solutions worldwide.

List of Key Companies in Data Diode Market

- Advenica

- BAE Systems.

- Belden Inc.

- Everfox

- Fibersystem

- Fox-IT

- Infodas

- NAONWORKS Co., Ltd.

- Nexor

- OPSWAT Inc.

- Owl Cyber Defense

- Patton LLC

- Siemens Mobility

- ST Engineering

- Waterfall

Data Diode Industry Developments

January 2024: Patton launched its Data Diode Controller Software, a cybersecurity solution for secure file transfer, data extraction, and log export over air-gapped uni-directional Data Diode segments.

April 2024: Owl Cyber Defense released Owl Talon 3, enhancing secure one-way data transfer with a new interface, improved security, and flexible deployment options.

Data Diode Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Hardware

- Services

By Type Outlook (Revenue, USD Million, 2020–2034)

- Ruggedized

- Non-Ruggedized

By Form Factor Outlook (Revenue, USD Million, 2020–2034)

- Din Rail

- Rack-Mounted

- Small/Portable

- Other Form Factors

By Organization Size Outlook (Revenue, USD Million, 2020–2034)

- SMEs

- Large Enterprises

By Application Outlook (Revenue, USD Million, 2020–2034)

- Secure Communication

- Network Segmentation

- Data Leakage Prevention

- Cloud Security

- Others

By Vertical Outlook (Revenue, USD Million, 2020–2034)

- Government & Public Utilities

- Energy and Power

- Manufacturing

- BFSI

- Healthcare

- Telecommunications

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Data Diode Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 467.66 million |

|

Market Size Value in 2025 |

USD 499.66 million |

|

Revenue Forecast in 2034 |

USD 919.29 million |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global data diode market size was valued at USD 467.66 million in 2024 and is projected to grow to USD 919.29 million by 2034.

• The global market is projected to register a CAGR of 7.0 % during the forecast period.

• North America dominated the global market in 2024.

• Some of the key players in the market are Advenica; BAE Systems; Belden Inc.; Everfox; Fibersystem; Fox-IT; Infodas; NAONWORKS Co., Ltd.; Nexor; OPSWAT Inc.; Owl Cyber Defense; Patton LLC; Siemens Mobility; ST Engineering; and Waterfall.

• The hardware segment dominated the market in 2024.