Data Center Power Market Size, Share, Trends, Industry Analysis Report: By Component, Data Center Size (Small and Medium Sized and Large Sized), End Users, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 – 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5188

- Base Year: 2024

- Historical Data: 2020-2023

Data Center Power Market Overview

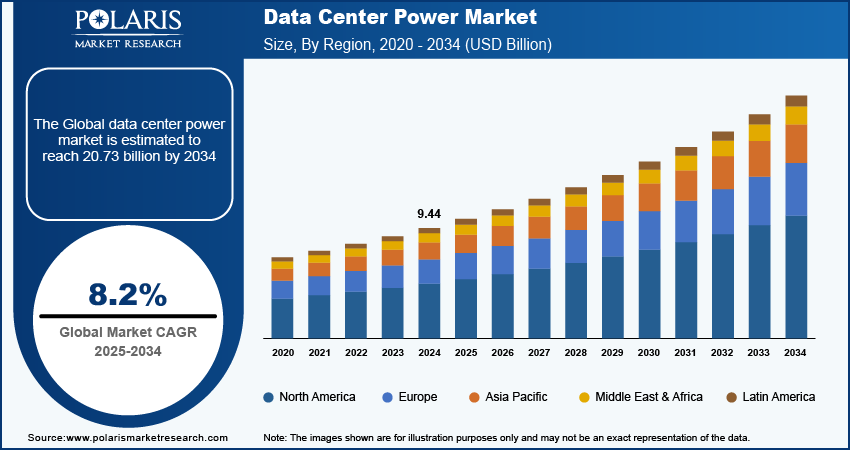

Global data center power market size was valued at USD 9.44 billion in 2024. The market is projected to grow from USD 10.21 billion in 2025 to USD 20.73 billion by 2034, exhibiting a CAGR of 8.2% during the forecast period.

The data center power market encompasses the systems and solutions used to manage and distribute electrical power within data centers. The increasing data center operators are constantly looking for ways to lower operational expenses. For instance, according to the US Department of Energy, data centers consume a significant amount of energy, using 10 to 50 times the energy per unit of floor space compared to a typical commercial office building. They contribute about 2% of the total electricity consumption in the US. Thus, advanced power management solutions are necessary that improve energy efficiency and decrease power usage, which plays a crucial role in achieving substantial cost savings and, thereby, driving the growth of the data center power market. Furthermore, the expanding array of cloud-based services, concerns regarding application security for businesses, and the growing frequency of cyber-attacks are further stimulating demand in the global data center powers market.

Data center operators are progressively incorporating renewable energy sources such as solar and wind into their facilities to minimize their environmental impact. This transition to sustainable energy is spurring the utilization of power solutions capable of effectively handling and incorporating these renewable sources, thereby fueling market expansion.

The rapid economic expansion and increasing digitalization in emerging markets are resulting in the development of new data centers. This surge is creating a greater need for advanced power management solutions in emerging regions. Furthermore, stringent regulations and standards applicable to energy efficiency, emissions, and environmental impact are compelling data center operators to implement advanced power management solutions. These factors are significantly contributing to the expansion of the data center power market.

Data Center Power Market Drivers

Rapid Expansion of Digital Economy

The rapid expansion of the digital economy and the increasing trend of digitalization have led to the proliferation of new data centers. This surge in data center establishment has consequently fueled the need for power management solutions. For instance, according to the American Bankers Association, 90% of individuals aged 18-44 have utilized a mobile device to oversee their bank accounts in the last month. In contrast, this percentage stands at 62% for individuals over the age of 65. Furthermore, the survey discovered that 60% of adults in the United States have used a mobile application for payment transactions or money transfers within the past year. As a result, due to this expansion there is a growing requirement for resilient and adaptable power management systems, thus contributing to the expansion of the data center power market.

Rapid Increase in Data Traffic

The rapid increase in data traffic, fueled by digital transformation, remote work, streaming services, and e-commerce, is necessitating the expansion and enhancement of data center infrastructure. For instance, the US Department of Commerce reported that US retail e-commerce sales hit USD 289.2 billion in the first quarter of 2024, representing a 2.1 percent rise from the fourth quarter of 2023. As a result of the escalating e-commerce sales, businesses are expanding their data centers to meet the demand for services. This expansion demands robust and scalable power management systems, thus driving the growth of the data center power market.

Data Center Power Market Segment Insights

Data Center Power Market Breakdown by Vertical Insights

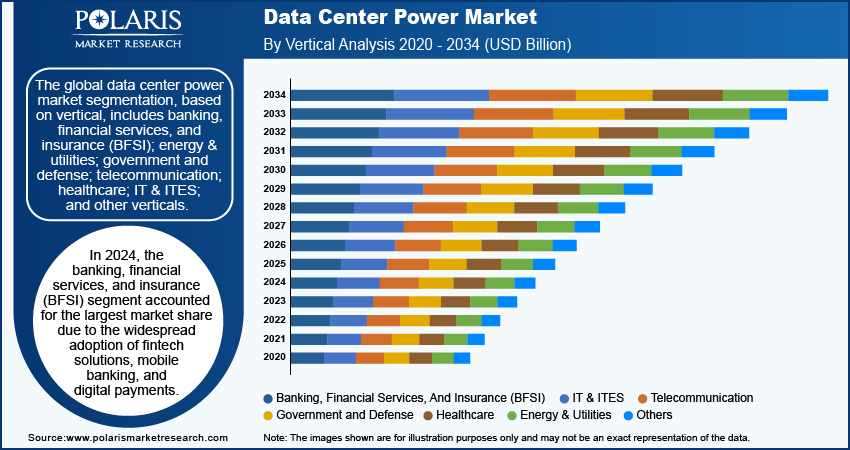

The global data center power market segmentation, based on vertical, includes banking, financial services, and insurance (BFSI); energy & utilities; government and defense; telecommunication; healthcare; IT & ITES; and other verticals. In 2024, the banking, financial services, and insurance (BFSI) segment accounted for the largest market share. The ongoing digital transformation in the BFSI sector has resulted in the widespread adoption of fintech solutions, mobile wallets, and digital payments, leading to a significant increase in data center capacities. For instance, UPI recorded over 1.49 million transactions in June 2021 and reached approximately 83.75 million transactions in 2023 in India. This surge in online transactions has created a substantial demand for data centers, necessitating advanced power solutions to meet the growing computational requirements, thereby driving the market segment.

Data Center Power Market Breakdown by Data Center Size Insights

The global data center power market segmentation, based on data center size, includes small and medium-sized, and large sized. The large-sized data center category is expected to be the fastest-growing market segment. The widespread adoption of cloud computing services across businesses of varying scales has led to a significant need for data centers. This is driven by the escalating volume of data from diverse sources, including social media, IoT devices, streaming services, and enterprise applications, which necessitates large-scale data centers with the capacity to handle extensive data storage and processing.

Major players in the cloud services domain, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are consistently expanding their data center capabilities to meet the escalating demand for cloud services. For instance, in June 2024, Amazon Web Services planned to invest USD 10 billion aimed at establishing data center complexes in Mississippi and creating 1,000 jobs. This expansion has generated a heightened need for data center power solutions. Furthermore, the increasing number of hyperscale data centers are large facilities that are capable of efficiently handling significant data processing and storage requirements. These data centers usually house tens of thousands of servers and require strong power management solutions to guarantee reliability and efficiency. Thus large-sized data centers are expected to be the fastest-growing segment in the data center power market.

Regional Insights

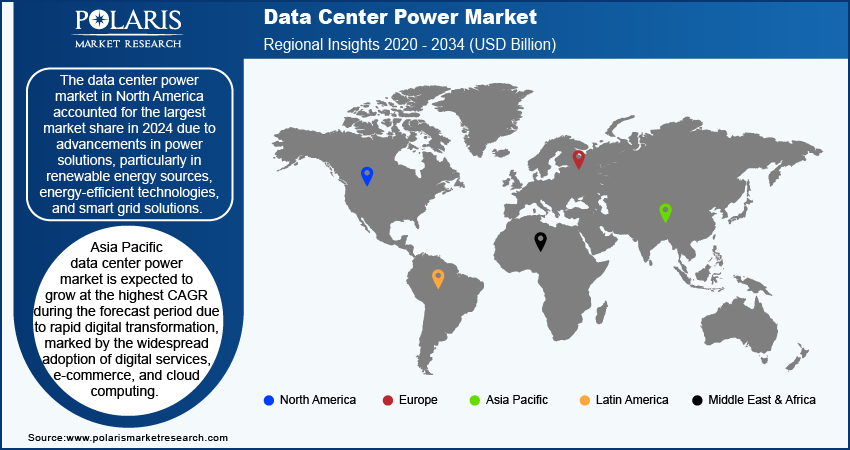

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The data center power market in North America accounted for the largest market share in 2024. North America has emerged as a center for innovative advancements in power solutions, particularly in renewable energy sources, energy-efficient technologies, and smart grid solutions. These innovations are seamlessly integrated into data center power systems to enhance performance and promote sustainability. The region is home to many leading data center operators and power management solution providers. Major companies such as Amazon, Google, Microsoft, and Facebook have established substantial data center operations in North America, driving significant demand for advanced power solutions. For instance, in March 2024, Meta plans to open a new data center in Rosemount in 2026, entirely powered by renewable energy, which is expected to stimulate local infrastructure development and create job opportunities. This development indicates a substantial increase in data generation and processing requirements due to the ongoing digital transformation across diverse industries in North America. As a result, there is a growing demand for high-capacity data center facilities equipped with advanced power management capabilities, significantly contributing to the data center power market.

The US accounted for the largest market share in the region in 2024 due to the ongoing proliferation of hyperscale data centers. The substantial power requirements of these facilities have been a major factor in driving market growth. Hyperscale data centers are designed to accommodate extensive data processing and storage demands at a large scale.

Asia Pacific data center power market is expected to grow at the highest CAGR during the forecast period. The region is experiencing a rapid digital transformation, marked by the widespread adoption of digital services, e-commerce, and cloud computing. This surge is driving the need for resilient data center infrastructure. Major cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud are expanding their footprint in the region, resulting in heightened demand for data center power solutions.

Japan data center power market is expected to grow significantly during the forecast period due to the increasing adoption of edge computing and IoT devices resulting in the decentralization of data processing and storage. This trend is leading to the establishment of edge data centers and micro data centers in closer proximity to end-users and IoT endpoints. These facilities demand power solutions that are compact and efficient to suit their space-constrained environments, contributing to the growing demand in the data center power market.

Data Center Power Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the data center power market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the data center power industry must offer cost-effective items.

In recent years, the data center power industry has offered some technological advancements. Major players in the data center power market include ABB; Black Box; Eaton; Equinix Inc.; GDS Holdings; Generac Power Systems, Inc.; General Electric Company; Huawei Technologies Co., Ltd.; Legrand; Rittal GmbH & Co. KG; Schneider Electric; and Vertiv Group Corp.

ABB operates as a technology company worldwide. The company operates through four segments: electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgear under the distribution solution sub-segment. The Motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. In October 2023, The ABB TruFit power distribution unit delivers a fast and space-efficient solution for data centers. It is designed to complete the tight project timelines of data centers, delivering a highly customizable, all-in-one power distribution resolution. The TruFit PDU offers superior configurability, reliability, and safety features for applications ranging from 50 to 800 kVA.

Eaton is a power management company that operates across multiple segments, such as electrical systems and services, electrical products, vehicles, aerospace, and eMobility. The company's portfolio is broadly categorized into two main sections, including industrial and electrical. The industrial sector encompasses a diverse range of end markets, such as commercial vehicles, general aviation, and trucks. On the other hand, the electrical sector portfolio caters to utilities, data centers, and the residential end market, among others. In November 2023, Eaton launched Rack PDU G4, designed for data centers and border facilities, offering a versatile solution for managing power demands across different equipment and facility types. This PDU enables data center operators to streamline power management by deploying a single unit across multiple locations, leading to cost and time savings.

Key Companies in the Data Center Power Market

- ABB

- Black Box

- Eaton

- Equinix Inc.

- GDS Holdings

- Generac Power Systems, Inc.

- General Electric Company

- Huawei Technologies Co., Ltd.

- Legrand

- Rittal GmbH & Co. KG

- Schneider Electric

- Vertiv Group Corp.

Data Center Power Industry Developments

March 2024: ABB launched nickel-zinc batteries, which provide increased-density UPS solutions for critical power applications and data centers. The batteries supplied by ZincFive deliver a resilient, safe, and sustainable energy storage alternative to traditional batteries.

June 2024: Generac Power Systems acquired PowerPlay Battery Energy Storage Systems. This acquisition allows Generac further to expand its offerings in the energy storage sector, specifically concentrating on turnkey Battery Energy Storage Systems solutions designed for industrial and commercial projects with a capacity of up to 7 megawatt-hours.

September 2023: Schneider Electric collaborated with Compass Datacenters with a USD 3 billion multi-year agreement focused on data center technology. The increasing demand for data, particularly from the growing AI sector, calls for a new class of standardized, efficiently manufactured, and cost-effective data centers.

Data Center Power Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Power Distribution

- Power Monitoring

- Power Backup

- Cabling Infrastructure

- Services

- Design and Consulting

- Support and Maintenance

- Integration and Deployment

By Data Center Size Outlook (Revenue, USD Billion, 2020–2034)

- Small and Medium Sized

- Large Sized

By End Users Outlook (Revenue, USD Billion, 2020–2034)

- Cloud Providers

- Enterprises

- Others

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Banking, Financial Services, And Insurance (BFSI)

- Energy & Utilities

- Government and Defense

- Telecommunication

- Healthcare

- IT & ITES

- Other Verticals

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Data Center Power Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.44 Billion |

|

Market Size Value in 2025 |

USD 10.21 Billion |

|

Revenue Forecast in 2034 |

USD 20.73 Billion |

|

CAGR |

8.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global data center power market size was valued at USD 9.44 billion in 2024 and is expected to reach USD 20.73 billion by 2034.

The global market is projected to grow at a CAGR of 8.2% during the forecast period 2025-2034.

North America had the largest share of the global market in 2024

The key players in the market are ABB; Black Box; Eaton; Equinix Inc.; GDS Holdings; Generac Power Systems, Inc.; General Electric Company; Huawei Technologies Co., Ltd.; Legrand; Rittal GmbH & Co. KG; Schneider Electric; and Vertiv Group Corp.

The banking, financial services, and insurance (BFSI) category dominated the market in 2024.

The large-sized had the fastest share in the global market.