Data Center Interconnect Market Share, Size, Trends, Industry Analysis Report, By End-Use (Communication Service Providers, Internet Content Providers/ Carrier-Neutral Providers, Government, Enterprises, Others); By Type; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 116

- Format: PDF

- Report ID: PM2379

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

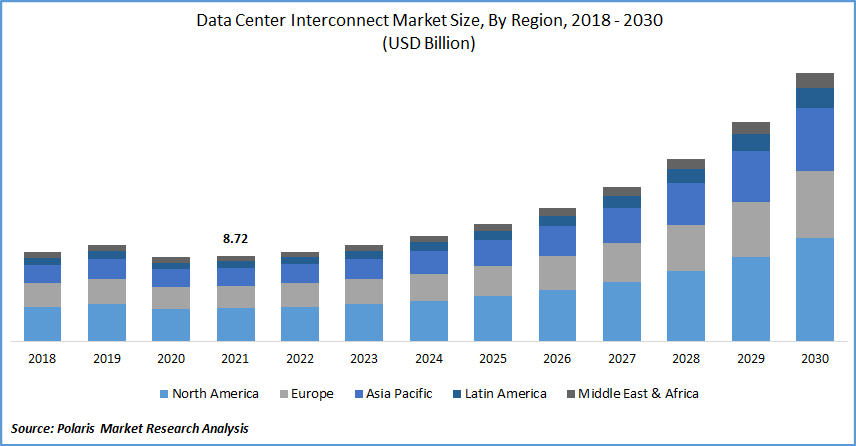

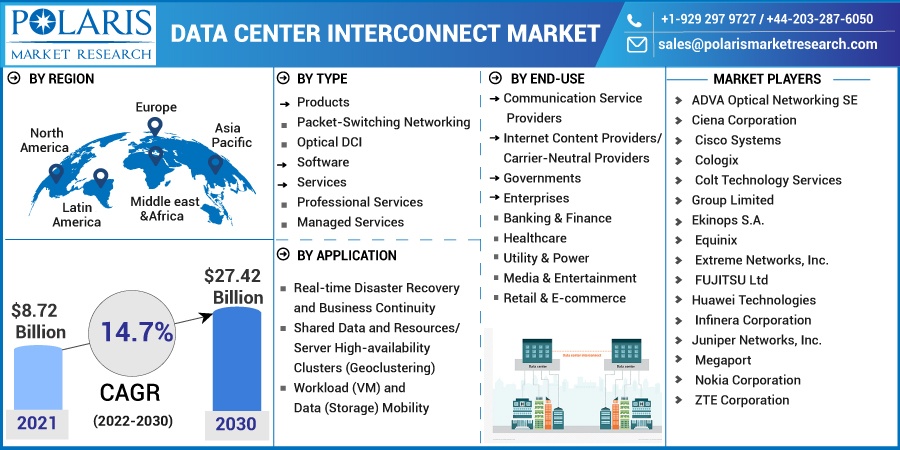

The global data center interconnect market was valued at USD 8.72 billion in 2021 and is expected to grow at a CAGR of 14.7% during the forecast period. The exceptional increase in internet traffic, combined with a dynamic relocation to cloud-based services, is pressuring content providers and internet service providers to improve network connectivity, driving industry growth over the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Interconnection of data centers provides access to multiple internet service providers, which is critical if a customer is in a different location. Businesses can use this to establish a strong domestic and international presence, expanding their consumer base and business operations. Moreover, financial services digitization, particularly in emerging markets, is one of the primary market growth drivers.

Data Center Interconnect (DCI) must also share data with financial transactions and third-party providers already part of a bank's digital services environment. The primary motivator is the exponential growth in video and OTT traffic. OTT content is compressed locally in data centers to reduce overall bandwidth costs and delivered via DCI. Furthermore, the introduction of cloud services to reduce individual capital expenditure frequently drives industry growth.

As 5G technology becomes more prevalent in the data center interconnect market, it will bring massive, faster, and denser data streams, necessitating more data center capacity. It is expected to enable 5G, which necessitates a seamless network that connects all interactions and devices, making information transfer, storage, and transmission simple. As a result, organizations anticipate a significant opportunity in the data center interconnect market with the deployment of 5G. However, the high initial investment required to set up data centers impedes industry growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The significant increase in data generation and use across various industries has increased the demand for data servers and centers. According to CloudScene data from 110 countries with available information, there were nearly 8,000 data centers globally as of January 2021. The U.S. (33% of the total), the United Kingdom (5.7%), Germany (5.5%), China (5.2%), Canada (3.3%), and the Netherlands house the majority of data centers (3.4%).

Approximately 77% are in OECD member countries, and approximately 64% are in NATO countries. There are over 2,600 data centers in the U.S., spread across the country. Also, as per Huawei, the yearly global data produced could reach 180 ZB by 2025. The percentage of unstructured data may rise, eventually reaching more than 95%. As a result, the global growth of data centers is accelerating.

In addition, data-center providers are enhancing their co-location and cloud services. Due to data center growth and distribution, improved fiber utilization, and low-cost pluggable modules, industries including OTT, ISP, financial sector, and public sector will develop their utilization cases for DCI networks. Product innovation is a key differentiator among market participants. Since the beginning of 2020, vendors such as Ciena, Infinera, Huawei, and Nokia have been pushing the boundaries of modern optics.

For instance, in September 2021, Nokia Corporation and Infradata collaborated to create an optical data center inter-connect alternative for NorthC Data-centers, the Netherlands' world's largest data center provider. NorthC would be capable of improving its customers' data-center inter-connectivity and quality inter-connected transmission services between the data-centers to match their bandwidth, connectivity, and performance needs due to Nokia's integrated IP/optical solution. Thus, the increasing data centers boost industry growth during the forecast period.

Report Segmentation

The market is primarily segmented based on type, application, end-use, and region.

|

By Type |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by End-Use

Enterprise's segment is expected to garner the largest segmental revenue in the global market. Increased employee flexibility, the availability of bring-your-own-device and bring-your-own-application options, and the proliferation of big data all influence the potential needs and requirements for enterprise data center interconnect market solutions. These include optical WDM solutions with high performance, low latency, and security.

Geographic Overview

Europe had the largest revenue share. The increasing number of data centers increased investment in cloud technologies, and the growth of end-user markets are key factors driving data center investment in Europe. The region's stringent laws, such as GDPR and personal data protection, among others, are boosting the establishment of local data centers. This is primarily due to the rapid adoption of cloud technologies. The increase in data traffic is projected to contribute to the market's growth.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. The region's DCI market has enormous growth potential attributed to the prevalence of various developing countries in the region, seeing increased adoption of DCI networks due to increased investments and recent innovations in DCI offerings. The region's requirement for DCI networks is being driven by an increase in the number of new data centers and innovations in DCI solutions.

Competitive Insight

Some of the major players operating in the global market include ADVA Optical Networking SE, Ciena Corporation, Cisco Systems, Cologix, Colt Technology Services Group Limited, Ekinops S.A., Equinix, Extreme Networks, Inc., FUJITSU Ltd, Huawei Technologies, Infinera Corporation, Juniper Networks, Inc., Megaport, Nokia Corporation, and ZTE Corporation.

Data Center Interconnect Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 8.72 Billion |

|

Revenue forecast in 2030 |

USD 27.42 Billion |

|

CAGR |

14.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ADVA Optical Networking SE, Ciena Corporation, Cisco Systems, Cologix, Colt Technology Services Group Limited, Ekinops S.A., Equinix, Extreme Networks, Inc., FUJITSU Ltd, Huawei Technologies, Infinera Corporation, Juniper Networks, Inc., Megaport, Nokia Corporation, and ZTE Corporation |