Data Center Containment Market Size, Share, Trends, Industry Analysis Report – By Containment Type [Aisle Containment (Hot Aisle Containment and Cold Aisle Containment), Rack Based Chimney Containment, Curtain Containment, and In Row Cooling Containment], Arrangement, Data Center Type, and Region; Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 117

- Format: PDF

- Report ID: PM5163

- Base Year: 2024

- Historical Data: 2020-2023

Data Center Containment Market Outlook

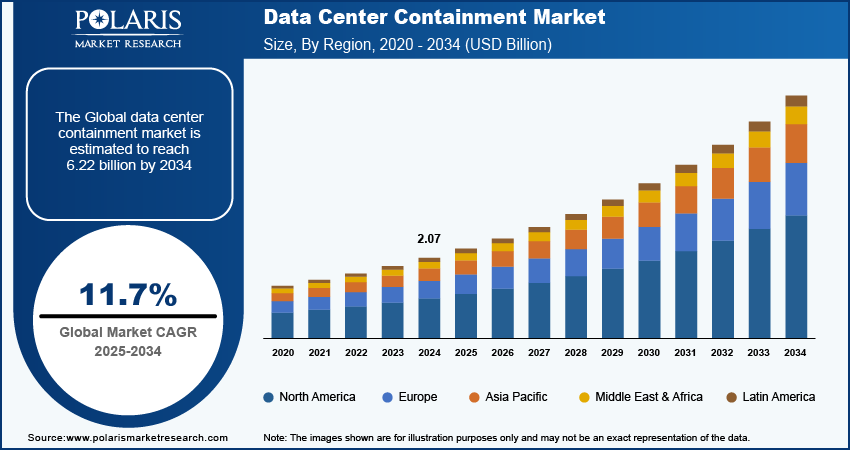

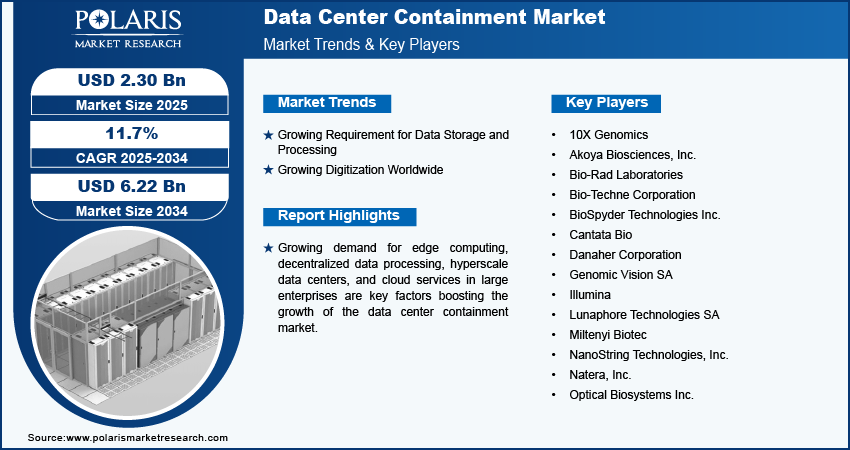

The data center containment market size was valued at USD 2.07 billion in 2024. The market is anticipated to grow from USD 2.30 billion in 2025 to USD 6.22 billion by 2034, exhibiting a CAGR of 11.7% during 2025–2034.

Data Center Containment Market Overview

Growing demand for edge computing, decentralized data processing, hyperscale data centers, and cloud services in large enterprises are key factors boosting the growth of the data center containment market. Organizations are continuously upgrading their IT infrastructure to stay competitive. Therefore, high investments are being made in data centers and modern containment solutions, which is propelling the market growth. In April 2024, Nucor Corporation acquired Southwest Data Products for USD 115 billion to launch a dedicated unit to supply data center customers.

To Understand More About this Research: Request a Free Sample Report

Emerging economies are rapidly digitizing, which, in turn, is expected to create numerous opportunities for the data center containment market during 2024–2032. Emerging economies are undergoing rapid digitization, with increased internet penetration and mobile device usage. This growth leads to higher demand for data centers, which in turn drives the need for effective containment solutions. Furthermore, governments and private sectors in these regions are investing heavily in IT infrastructure to support economic growth. This investment often includes the development of data centers that require efficient containment systems to manage energy and space effectively.

The ongoing expansion initiatives in data center infrastructure, increasing focus on reliability and uptime, and corporate investments in IT infrastructure are among the factors responsible for the increased adoption of containment solutions. For instance, In March 2024, the University of Pisa in Italy selected Vertiv to expand its data center infrastructure. The growing integration of artificial intelligence (AI) and IoT devices across multiple sectors requires excellent operational flexibility with higher computing performance, thereby increasing demand for data center containment.

Data Center Containment Growth Drivers

Growing Requirement for Data Storage and Processing

The significant growth in data generation from various sources, such as enterprise applications, IoT devices, and social media platforms, creates the need for efficient data storage capabilities, which drives demand for data centers and containment solutions to provide quick deployment and optimized cost reduction, making it feasible for businesses to operate. In November 2022, Equinix invested USD 115 billion in its new data center to fulfill its storage and computational requirements.

Growing Digitization Worldwide

The growing digitization worldwide is projected to propel the global data center containment market. Digitization requires significant computing power, leading to a rising number of data centers and higher energy consumption. Data center containment systems enhance cooling effectiveness and reduce energy waste, which is essential for managing operational costs and meeting sustainability goals in data centers.

Restraining Factors

High implementation costs, operational disruptions, scalability concerns, and complexity in integration with existing infrastructure hinder the growth of the data center containment market.

Report Segmentation

The data center containment market is primarily segmented on the basis of containment type, arrangement, data center type, and region.

|

By Containment Type |

By Arrangement |

By Data Center Type |

By Region |

|

|

|

|

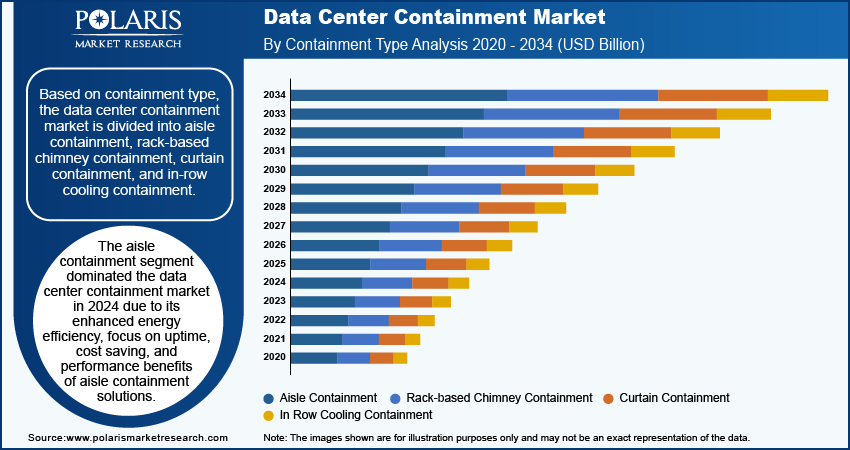

By Containment Type Analysis

Aisle Containment Segment Held Largest Share in 2024

The aisle containment segment dominated the data center containment market in 2024 due to the enhanced energy efficiency, focus on uptime, cost saving, and performance benefits of aisle containment solutions. The solution reduces the huge amount of energy required to cool the system by separating cold and hot airflows to stabilize temperature. These use cases make it a preferred choice in containment solutions and attract investment from private players.

By Arrangement Analysis

Modular Containment Segment to Witness Significant Growth During 2025–2034

The modular containment segment is expected to register the highest growth rate in the data center containment market during the forecast period. This is due to the rising demand for scalability, use of standardized components, cost-effectiveness, and enhanced airflow management in data centers. The prefabricated materials used in modular settings are often affordable and accessible with existing structures, which reduces the time required for deployment, thereby driving segment growth.

By Data Center Type Analysis

Colocation Data Center Segment Accounted for Significant Revenue Share in 2024

The colocation data center segment held the largest revenue share in the data center containment market in 2024 due to the growing need for effective data storage facilities and massive workloads. Outsourced management facilities, expert support and services, and enhanced security at colocation data centers provide businesses with safe access, control, and surveillance facilities, which boost the adoption of these systems. For instance, in January 2024, the Reserve Bank of Australia (RBA) relocated all workloads to a colocation facility to avoid resiliency risk to the company.

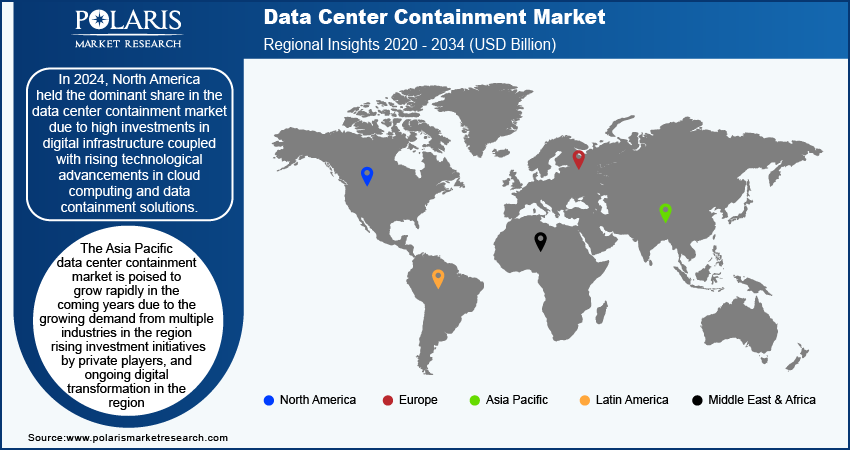

Regional Insights

North America Held the Largest Share of Global Market in 2024

North America held the dominant share in the data center containment market in 2024. Increasing investments in digital infrastructure coupled with rising technological advancements in cloud computing and data containment solutions fueled the market growth in North America.

The Asia Pacific data center containment market is poised to grow rapidly in the coming years due to the growing demand from multiple industries in the region, rising investment initiatives by private players, and ongoing digital transformation in the region. Governments across the region are formulating favorable policies to attract data center investments in large-scale infrastructure projects, which propels demand for data center containment. For instance, in January 2023, at the World Economic Forum, the Maharashtra government signed a memorandum of understanding (MoU) with two companies worth USD 3.9 Bn to build two data centers in the city of Pune, in western India.

Key Market Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the data center containment market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the data center containment market must offer innovative solutions.

The data center containment market is fragmented, with the presence of numerous global and regional market players. Major players in the data center containment market are Vertiv Group Corp; Rittal GmbH & Co. KG; Eaton; nVent; Legrand; Google; Sealco; Tate; Polargy, Inc.; Chatsworth Products (CPI); Upsite technologies; and Conatech.

Major Players Operating in The Global Data Center Containment Market

- Vertiv Group Corp

- Rittal GmbH & Co. KG

- Eaton

- nVent

- Legrand

- Sealco

- Tate

- Polargy, Inc.

- Chatsworth Products (CPI)

- Upsite technologies

- Conatech

Recent Developments in Industry

- In May 2024, Google announced an investment of USD 2 billion in Malaysia to develop its data center and Google Cloud in the country.

- In May 2024, Microsoft announced an investment of USD 3.3 billion to build an AI data center in Wisconsin.

- In February 2024, Teqnion acquired Nubis Solutions Limited to increase data and processing capacity.

Report Coverage

The data center containment market report emphasizes key regions across the globe to provide a better understanding of the product to the users. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions. The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, containment type, arrangement, data center type, and futuristic growth opportunities.

Data Center Containment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 2.30 billion |

|

Revenue Forecast in 2034 |

USD 6.22 billion |

|

CAGR |

11.7% from 2024 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2034 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Data Center Containment Industry Trends Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global data center containment market size was valued at USD 2.07 billion in 2024 and is projected to grow to USD 6.22 billion by 2034.

The global market is projected to grow at a CAGR of 11.7% during the forecast period.

North America had the largest share of the global market in 2024.

The key players in the market are Vertiv Group Corp; Rittal GmbH & Co. KG; Eaton; nVent; Legrand; Google; Sealco; Tate; Polargy, Inc.; Chatsworth Products (CPI); Upsite technologies; and Conatech.

The modular segment is projected for significant growth in the global market.

The aisle containment segment dominated the data center containment market in 2024.