Data Center Accelerator Market Share, Size, Trends, Industry Analysis Report

By Processor (GPU, CPU, FPGA, ASIC); By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 117

- Format: PDF

- Report ID: PM2940

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

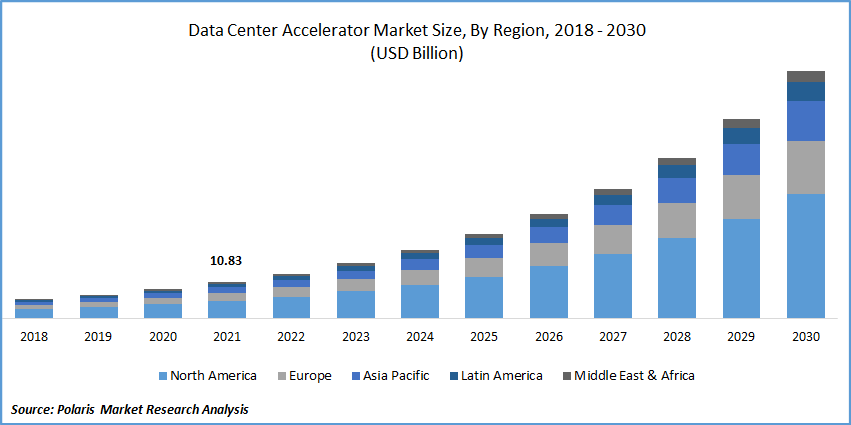

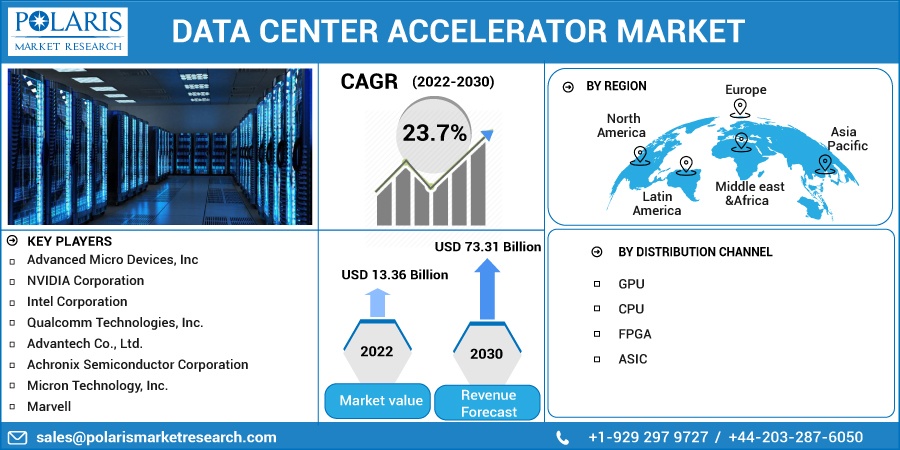

The global data center accelerator market was valued at USD 10.83 billion in 2021 and is expected to grow at a CAGR of 23.7% during the forecast period. The data center accelerator market is expanding due to increased deployment and cloud-based services. Furthermore, the growing adoption of technologies such as artificial intelligence (AI), big data analytics, and internet of things (IoT) is fueling the market’s growth.

Know more about this report: Request for sample pages

Data center acceleration supports various HPC workloads, including genomics, astrophysics, cyber security, machine learning, big data analysis, modular dynamics, oil and gas, and weather and climate.

There are some difficulties associated with programming and deploying multiple FPGAs. The first difficulty in programming a cluster of FPGAs is determining how to abstract and use the communication links between the FPGAs and how to connect the kernels on multiple FPGAs. A second challenge in building FPGA clusters is deciding how to distribute, coordinate, and manage a multi-FPGA application once it is built. In industrial applications, IoT is expected to generate large amounts of data. Quicksilver Capital estimates that a smart factory will generate 5 petabytes of data per week, while an offshore oil rig will generate 1 to 2 terabytes per day.

New business models that use artificial intelligence, platforms, and algorithms to transform massive amounts of data into insights and value. The World Economic Forum predicts that digitally enabled platform business models will create 70% of new economic value over the next decade.

Increased corporate awareness of the benefits cloud services can provide, increased board pressure to provide more secure and robust IT environments and the establishment of local data centers all contributed to the market growth. Business demand relying on digital infrastructure has increased, resulting in a significance for data center network services across various industries. As more businesses and educational institutions move online, data centers ensure program availability and data security. Healthcare, aerospace, manufacturing, finance, and urban planning are the top industries that use HPC.

University of Texas researchers at Austin are using HPC to advance the science of cancer treatment. In a groundbreaking project in 2017, Researchers examined petabytes of data to look for links between cancer patients' genomes and tumor characteristics. This enabled the university to use HPC for additional cancer research, now expanded to include the diagnosis and treatment of prostate, blood, liver, and skin cancer cases.

The COVID-19 pandemic positively impacted the market because it shifted the focus to digital transformation. Widespread lockdowns have led many universities and institutions to switch to operating and delivering online courses quickly. The education sector is highly receptive to cloud technologies for carrying out and managing tuition, admission exams, and assessments.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing need to improve application performance is expected to drive demand for data center accelerators. Other factors driving market demand include increased data storage requirements, increased use of mobile data, and increased internet usage in businesses. Globally, SMEs and large enterprises are shifting their businesses to a cloud-based module, which is expected to strain data centers and increase demand for accelerators in the coming years. One of the industry's challenges is achieving economies of scale to cover the cost of accelerator deployment and development. They use less power because they can share resources with the main processor and reduce overall costs by improving power efficiency.

Because of the coronavirus disease (COVID-19), a shift toward remote working culture has positively influenced using artificial intelligence (AI) to ease business operations. This necessitates the use of data center accelerators to manage AI workloads. This contributes to the market's growth. In addition, many businesses are providing machine learning (ML) as a cloud service for applications such as voice recognition, voice search, fraud detection, image recognition, recommendation engines, sentiment analysis, and motion detection. This is expected to broaden the applications of data center accelerators worldwide.

Report Segmentation

The market is primarily segmented based on processor and region.

|

By Processor |

By Region |

|

|

Know more about this report: Request for sample pages

The GPU Segment Accounted for the Maximum Revenue in 2021

The increasing use of GPU in supercomputing, AI training and inference, drug research, medical imaging, and financial modeling can be attributed to the segment's growth. Furthermore, GPUs are helpful in machine learning and AI in hyper-scale networks and enterprise data centers to perform various calculations.

Cloud service providers such as Microsoft, Amazon, Alibaba, Baidu, and Tencent have adopted FPGAs as a reconfigurable heterogeneous processing asset. Furthermore, advancements in architecture, programming paradigms, and security are expected to result in a broader range of FPGA-based cloud deployment applications around the globe.

North America Accounted for the Largest Revenue in 2021

Significant contributors to regional market growth include prominent market players such as Advanced Micro Devices, Inc., Intel, NVIDIA Corporation, Qualcomm Technologies, Inc., and others, as well as developed technology and data center infrastructure.

During the forecast period, Asia-Pacific is expected to grow the fastest. The region's market growth can be attributed to the increasing adoption of cloud-based services such as IoT and big data analytics. Furthermore, appropriate government policies and the need for data center infrastructure upgrades in Asia Pacific are driving the region's data center accelerator market growth in the given forecast period.

Competitive Insight

Key players in the market are Advanced Micro Devices, Inc, Advantech Co., Ltd., Intel Corporation, NVIDIA Corporation, Qualcomm Technologies, Inc., Achronix Semiconductor Corporation, Marvell, KIOXIA Holdings Corporation, Micron Technology, Inc., Western Digital Technologies.

Recent Developments

- DeepCube announced the release of a software-based inference accelerator on May 12, 2020, significantly improving deep learning performance on any existing hardware. DeepCube's patented architecture can be installed on top of any existing hardware (CPU, GPU, ASIC) in data centers and edge devices, allowing for up to a tenfold increase in performance and memory reduction.

- Intel Corporation released the 3rd Generation Intel Xeon Scalable processor in April 2021. This processor has a balanced architecture with AI, advanced security features, and crypto acceleration.

- Infobip launched its ID1 data center in Indonesia on June 23, 2022, to support local and APAC firms' digital innovation capabilities. This initiative will take place in West Java, by Indonesia's Digital Roadmap 2021-2024, which aims to build an inclusive, safe, and dependable digital and communication infrastructure with high-quality services.

Data Center Accelerator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 13.36 billion |

|

Revenue forecast in 2030 |

USD 73.31 billion |

|

CAGR |

23.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Processor, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Advanced Micro Devices, Inc, NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Inc., Advantech Co., Ltd., Achronix Semiconductor Corporation, Micron Technology, Inc., Marvell, KIOXIA Holdings Corporation, Western Digital Technologies |