Dashboard Camera Market Size, Share, Trends, Industry Analysis Report: By Technology (Basic, Advanced, and Smart), Product, Video Quality, Application, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 212

- Format: PDF

- Report ID: PM2067

- Base Year: 2023

- Historical Data: 2019-2022

Dashboard Camera Market Overview

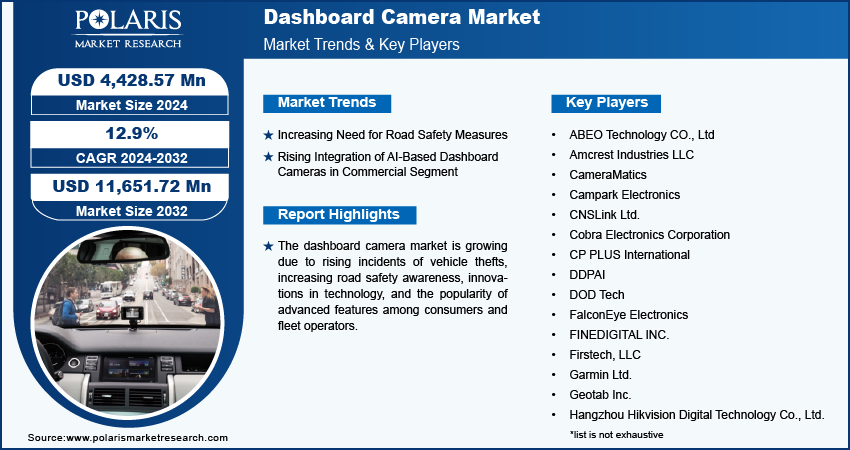

The global dashboard camera market size was valued at USD 4,007.03 million in 2023. The market is projected to grow from USD 4,428.57 million in 2024 to USD 11,651.72 million by 2032, exhibiting a CAGR of 12.9% during 2024–2032.

A dashboard camera is an electronic device mounted on a car’s dashboard, providing front and rear or 360-degree views around the vehicle. It records road activities continuously, activating automatically when the engine starts. The demand for dashboard cameras is growing due to an increasing desire for comprehensive vehicle monitoring and safety. This trend is driven by enhanced awareness of driving safety, insurance benefits, and accident documentation. In September 2023, Firstech LLC introduced the DroneMobile XC Dash Cam, integrating with remote start and security systems to offer real-time footage through smartphones. These innovations reflect the expanding market driven by technological advancements and increased safety concerns.

To Understand More About this Research: Request a Free Sample Report

Dashboard cameras are increasingly integrated with telematics systems, offering a detailed view of driver behavior and vehicle performance. Advanced models leverage Artificial Intelligence (AI) to analyze video footage, detect risky and positive driving actions, and deliver real-time feedback to drivers. Dashboard cameras enhance safety and streamline insurance claims, fueling their growing demand in the automotive sector. They also help prevent and identify accidents by continuously monitoring road activities and driver conduct, providing crucial real-time feedback. Additionally, dashboard cameras serve as objective evidence in accident or dispute scenarios, safeguarding the interests of insurers and claimants. Growing government efforts to enforce regulations aimed at improving road safety further drive the expansion of the dashboard camera market.

The growing trends of cloud storage, GPS tracking, and advanced driver assistance capabilities in dashcams are expected to promote the dashboard camera market growth in the coming years. Further, with improvements in communication technology in autonomous vehicles to connect with IoT devices, dashcams are playing an integral role in enhancing road safety.

Dashboard Camera Market Drivers and Trends

Increasing Need for Road Safety Measures

The increasing need for road safety measures is significantly driving the demand for the dashboard camera market. Road traffic accidents remain one of the leading causes of death globally, emphasizing the urgent necessity for effective safety solutions. According to the World Health Organization (WHO) report on road safety in 2023, road traffic accidents are among the leading causes of death globally, with the number of fatalities slightly decreasing to 1.19 million annually due to heightened awareness. This trend indicates that while progress has been made, further efforts are needed to improve road safety.

The installation of dashboard cameras provides drivers with a reliable way to document their driving experiences, creating a deterrent against reckless behavior. These devices capture real-time footage that is valuable in accidents, offering clear evidence for insurance claims and legal disputes. Moreover, dashcams enhance driver awareness by encouraging safer driving practices. Governments and organizations increasingly recognize the importance of such technology, implementing measures that encourage the use of dashcams to enhance overall road safety.

The push for enhanced safety measures continues to drive demand for dashboard cameras. The trend reflects a reduction in road accidents and fatalities, underscoring the crucial role technology plays in promoting safer driving environments. Integrating dashcams into road safety initiatives fosters a culture of accountability and vigilance among drivers, ultimately leading to a decline in accidents and improved public safety.

Rising Integration of AI-Based Dashboard Cameras in Commercial Segment

The demand for dashboard cameras in the commercial segment is rising due to their adoption by fleet operators to reduce the chances of accidents, monitor driver behavior, and optimize insurance claims. The cameras capture video of speeding, harsh braking, and hazardous driving. Commercial drivers benefit from real-time feedback and AI-driven in-cab coaching. Technologies such as edge computing alert drivers and fleet managers during critical incidents, enhancing safety and operational efficiency. According to the NSTSCE, over 87% of commercial vehicle crashes in the US result from driver error. AI-based dashboard cameras are crucial in reducing fatal accidents, increasing their demand in the automotive industry.

Dashboard Camera Market Segment Insights

Dashboard Camera Market Breakdown By Technology Insights

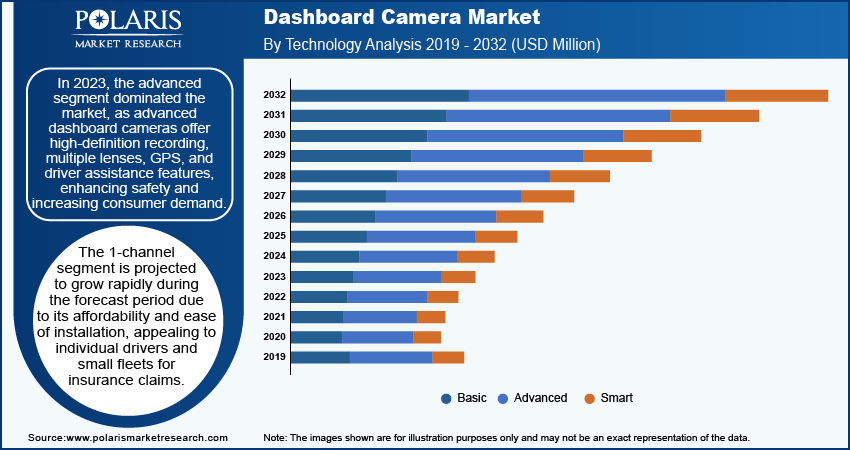

The global dashboard camera market segmentation, based on technology, includes basic, advanced, and smart. In 2023, the advanced segment dominated the market, accounting for 47.7% of market revenue (1,910.2 million). Advanced dashboard cameras offer high-definition recording up to 1080p and feature multiple lenses for comprehensive front, rear, and interior views. They include built-in GPS for location and speed data, Wi-Fi or Bluetooth for wireless data transfer, and driver assistance features, including lane departure warnings and collision alerts. Models such as the DrivePro 550 cater to drivers seeking high-quality video and advanced functionalities for enhanced safety and vehicle protection. These advanced capabilities make them expensive than basic models, driving demand in the dashboard camera market.

Dashboard Camera Market Breakdown By Product Insights

The global dashboard camera market segmentation, based on product, includes 1-channel, 2-channel, and rear view. The 1-channel segment is expected to record a CAGR of 13.0% during the forecast period. 1-channel dashboard cameras, or front-facing cameras, are basic models used in personal vehicles mounted on the windshield to capture the front view. They are popular for their affordability, ease of installation, and utility in insurance claims. Limited field of view makes them less popular in the commercial sector, and individual drivers and small fleets increasingly favor these basic features.

Dashboard Camera Breakdown By Regional Insights

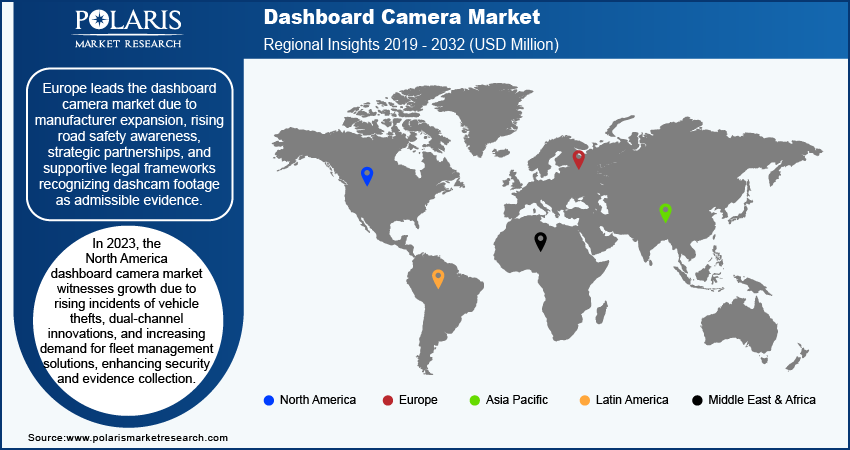

By region, the study provides the market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Europe led the global dashboard camera market in 2023 due to diverse expansion strategies by manufacturers, increasing awareness related to road safety, and supportive regulatory frameworks. Companies such as Radius Telematics, Nextbase, and CameraMatics are forming strategic partnerships, integrating advanced dashcams into vehicles, and expanding distribution networks, enhancing product visibility and accessibility. Rising awareness of road safety and the benefits of dashcams in incident documentation and insurance claims are driving their adoption among consumers. Additionally, varying legal frameworks across European countries, recognizing dashcam footage as admissible evidence and promoting its use boost the dashboard camera market growth in Europe.

North America accounts for the second-largest share of the global dashboard camera market in 2023. The rise in incidents of vehicle thefts and accidental fatalities in the region has significantly boosted dashboard camera adoption for enhanced security and evidence. For instance, Toronto Police reported a surge in auto thefts from 6,518 in 2021 to 9,439 in 2022. Fleet management is also increasing in North America, with innovations such as Fleet Complete's FC Vision, that integrates AI-based safety features. The market is further driven by the growing preference and launch of dual-channel cameras, such as Garmin’s Dash Cam Tandem, offering comprehensive front and rear footage. For instance, in January 2020, Garmin introduced the Dash Cam Tandem, a dual-lens camera with 1440p HDR and NightGlo technology, capturing road and interior footage day and night. These factors mentioned above propel the North America dashboard camera market growth.

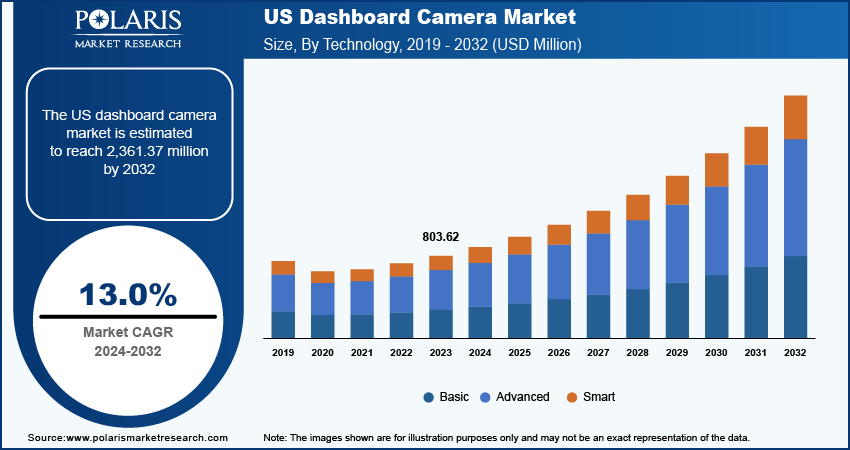

The US dashboard camera market held the largest market share and is expected to be the fastest-growing country in North America. Dashboard cameras are increasingly used to collect visual evidence of accidents and incidents, aiding drivers and insurance companies in resolving disputes quickly and fairly. Insurers encourage dashcam use to reduce fraud and potentially lower premiums for honest drivers. For instance, in August 2021, Nexar partnered with Black Car Fund to install AI dash cams in cars, enhancing accident reporting and workers' compensation claim processing. This incentive, along with the improved accuracy in claim processing, propels the demand for dashcams. Insurance discounts for dashcam users further boost their adoption, contributing to the expanding US dashboard camera market.

Dashboard Camera Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the dashboard camera market growth in the coming years. Market participants are also undertaking a variety of strategic activities, including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations, to expand their global footprint. To expand and survive in a more competitive and rising market climate, the dashboard camera industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global dashboard camera industry to benefit clients and propel business growth. Major players in the dashboard camera market are ABEO Technology CO., Ltd; Amcrest Industries LLC; CameraMatics; Campark Electronics; CNSLink Ltd.; Cobra Electronics Corporation; CP PLUS International; DDPAI; DOD Tech; FalconEye Electronics; FINEDIGITAL INC.; Firstech, LLC; Garmin Ltd.; Geotab Inc.; Hangzhou Hikvision Digital Technology Co., Ltd.; Hero Electronix; Hewlett Packard Enterprise Development LP; INNOVV; IROAD MOBILITY Co., Ltd.; JVCKENWOOD Corporation; KENT Cam Technologies; Linxup; MiTAC Holdings Corp.; Motive Technologies, Inc.; Nexar; Nextbase; Panasonic Holding Corporation; Pittasoft Co. Ltd.; Powerology; Qrontech Co., Ltd.; Radius Telematics; Rosco, Inc.; Samsara Inc.; Shenzhen Jimi IoT Co., Ltd.; Shenzhen Zhixingsheng Electronics Co., Ltd.; STONKAM CO., LTD.; THINKWARE; Truckx.com; Verizon; and VIOFO LTD.

Cobra Electronics, a part of Cedar Electronics, manufactures connected automotive and consumer electronics, including smart dash cams, radar detectors, CB radios, portable jump starters, and power inverters, with various companion apps. In November 2021, Cobra Electronics introduced the latest models in its Cobra SC Series: the SC 400 and SC 400D Smart Dash Cameras. The company claims that the new dash cams are designed to enhance driver awareness with their Ultra HD 4K video resolution, integrated Alexa, and the ability to record three camera views (front, rear, and cabin) simultaneously.

Radius, a multinational business services company, operates in 18 countries, offering products and services across telematics, insurance, telecoms, vehicle leasing, and EV solutions, including integrated fleet tracking and management software. In January 2024, the company announced a new telematics distribution center located in Celbridge, near Dublin. The facility enables expedited dispatch of vehicle trackers and dashcams to local Irish customers as well as to EU users.

List of Key Companies in Dashboard Camera Market

- ABEO Technology CO., Ltd

- Amcrest Industries LLC

- CameraMatics

- Campark Electronics

- CNSLink Ltd.

- Cobra Electronics Corporation

- CP PLUS International

- DDPAI

- DOD Tech

- FalconEye Electronics

- FINEDIGITAL INC.

- Firstech, LLC

- Garmin Ltd.

- Geotab Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hero Electronix

- Hewlett Packard Enterprise Development LP

- INNOVV

- IROAD MOBILITY Co., Ltd.

- JVCKENWOOD Corporation

- KENT Cam Technologies

- Linxup

- MiTAC Holdings Corp.

- Motive Technologies, Inc.

- Nexar

- Nextbase

- Panasonic Holding Corporation

- Pittasoft Co. Ltd.

- Powerology

- Qrontech Co., Ltd.

- Radius Telematics

- Rosco, Inc.

- Samsara Inc.

- Shenzhen Jimi IoT Co., Ltd.

- Shenzhen Zhixingsheng Electronics Co., Ltd.

- STONKAM CO., LTD.

- THINKWARE

- Truckx.com

- Verizon

- VIOFO LTD.

Dashboard Camera Industry Developments

April 2024: Thinkware introduced the ARC, a compact dual-channel dash cam with 2K resolution, WDR, Super Night Vision, parking surveillance, and GPS-enabled safety alerts.

March 2024: DDPAI introduced two new dashcams in the Malaysian market, one tailored for cars and the other for two-wheeled vehicles. The first offering is the N5 Dual, which features a dashcam integrated with AI-controlled millimetre wave radar. The Ranger is a hybrid dashcam and action camera engineered for motorcycle and bicycle riders.

October 2023: Geotab partnered with Lytx to offer the Surfsight dash cam in Suriname, South America, through the Geotab Marketplace Order Now program.

Dashboard Camera Market Segmentation

By Technology Outlook

- Basic

- Advanced

- Smart

By Product Outlook

- 1-Channel

- 2-Channel

- Rear View

By Video Quality Outlook

- Standard Definition & High Definition (SD & HD)

- Full HD & 4K

By Application Outlook

- Commercial Vehicle

- Personal Vehicle

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Malaysia

- Indonesia

- South Korea

- Thailand

- Vietnam

- Taiwan

- Philippines

- Singapore

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dashboard Camera Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 4,007.03 million |

|

Market Size Value in 2024 |

USD 4,428.57 million |

|

Revenue Forecast by 2032 |

USD 11,651.72 million |

|

CAGR |

12.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global dashboard camera market size was valued at USD 4,007.03 million in 2023 and is projected to reach USD 11,651.72 million by 2032

The global market is projected to register a CAGR of 12.9% during the forecast period.

Europe accounted for the largest share of the global market in 2023.

A few key players in the market are ABEO Technology CO., Ltd; Amcrest Industries LLC; CameraMatics; Campark Electronics; CNSLink Ltd.; Cobra Electronics Corporation; CP PLUS International; DDPAI; DOD Tech; FalconEye Electronics; FINEDIGITAL INC.; Firstech, LLC; Garmin Ltd.; Geotab Inc.; Hangzhou Hikvision Digital Technology Co., Ltd.; Hero Electronix; Hewlett Packard Enterprise Development LP; INNOVV; IROAD MOBILITY Co., Ltd.; JVCKENWOOD Corporation; KENT Cam Technologies; Linxup; MiTAC Holdings Corp.; Motive Technologies, Inc.; Nexar; Nextbase; Panasonic Holding Corporation; Pittasoft Co. Ltd.; Powerology; Qrontech Co., Ltd.; Radius Telematics; Rosco, Inc.; Samsara Inc.; Shenzhen Jimi IoT Co., Ltd.; Shenzhen Zhixingsheng Electronics Co., Ltd.; STONKAM CO., LTD.; THINKWARE; Truckx.com; Verizon; VIOFO LTD.

The advanced segment dominated the market in 2023.

The 1-channel accounted for the largest market share in 2023.