Dairy Testing Market Size, Share, Trends, Industry Analysis Report

: By Product (Milk & Milk Powder, Cheese, Butter & Spreads, Infant Food, Ice Cream & Desserts, Yogurt, and Others), Technology, Test Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM2318

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

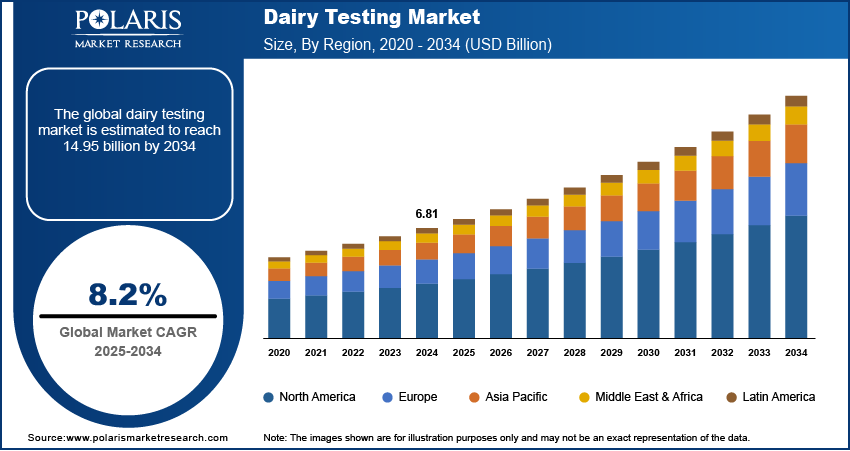

The global dairy testing market size was valued at USD 6.81 billion in 2024, exhibiting a CAGR of 8.2 % during 2025–2034. The market is driven by the surging use of dairy products, outbreaks of foodborne diseases, urbanization, and technological advancements, all indicating an improvement in the quality control and safety of the industry.

Key Insights

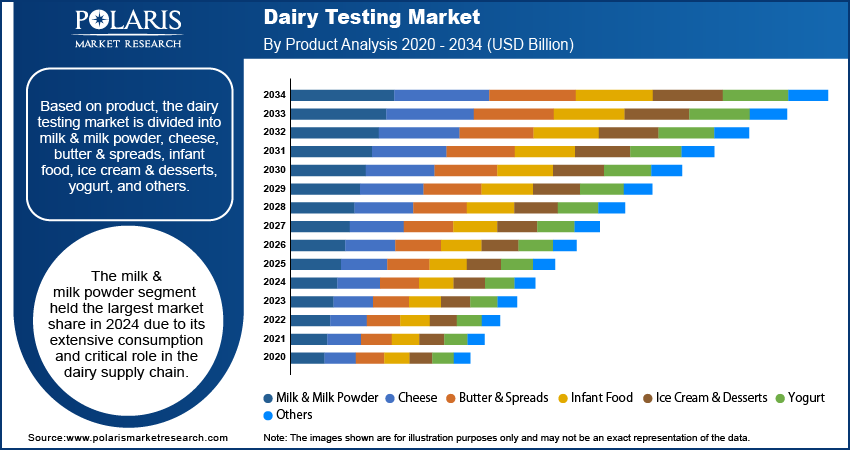

- In 2024, the milk and milk powder segment accounted for the largest revenue market share in the dairy testing industry, driven by high demand and its central role in the dairy value chain.

- The quick technology category is poised to expand at a rapid pace in the upcoming years, driven by its high accuracy, efficiency, and prompt results.

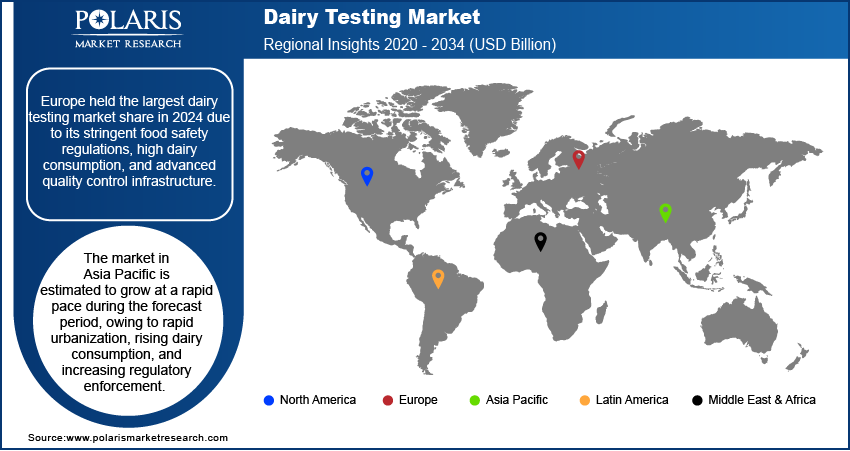

- Europe accounted for the largest revenue market share of dairy testing in 2024, driven by strict food safety requirements, high dairy food consumption rates, and advanced quality control facilities.

- Asia Pacific is projected to grow at a high rate within the forecast period, driven by urbanization, increasing consumption of dairy products, and enhanced enforcement of regulations.

Industry Dynamics

- Rising worldwide demand for milk intensifies the need for rigorous testing to ensure safety and compliance with regulations.

- Specialty dairy product ranges, such as lactose-free and organic versions, require specialized testing to ensure accurate claims and nutritional values.

- The increasing interest in preventive safety initiatives prompts investment in early detection technology for contaminated milk products.

- High cost and expertise requirements of investments can discourage the adoption of new dairy testing technologies in developing countries.

Market Statistics

2024 Market Size: USD 6.81 billion

2034 Projected Market Size: USD 14.95 billion

CAGR (2025-2034): 8.2%

Europe: Largest Market Share

AI Impact on Dairy Testing Market

- Faster and more precise detection of contaminants and pathogens in dairy products is achieved through AI, improving both safety and quality.

- Predictive analytics for quality control is enhanced by machine learning algorithms, lessening the likelihood of product recalls and waste.

- Automation powered by AI enhances testing procedures, improving efficiency and reducing the operational costs for dairy farmers.

- The integration of AI with digital supply chains enhances traceability and transparency from the farm to the consumer.

- Advanced AI diagnostics enable real-time monitoring, facilitating proactive interventions in potential safety challenges during milk production.

To Understand More About this Research: Request a Free Sample Report

Dairy testing involves evaluating milk and dairy products to ensure their quality, safety, and suitability for consumption. This process plays a critical role in the dairy industry, as it determines whether raw materials and finished products meet regulatory standards and consumer expectations. Dairy testing assesses various parameters such as purity, chemical composition, microbial content, and physical characteristics. Testing also identifies potential adulteration with substances such as water or preservatives.

The rising consumption of dairy products across the globe is propelling the dairy testing market growth. The US Department of Agriculture published a report stating that in 2022, per capita consumption of all dairy products in the US reached 653 pounds. Increased consumption of dairy products, such as milk, cheese, and yogurt, drives producers to ensure that their products meet strict safety and quality standards. This increases the demand for dairy testing services and testing equipment. Additionally, the growing variety of dairy products, including lactose-free, organic, and fortified options, further amplifies the need for specialized testing. Each product category has unique composition and labeling requirements, necessitating precise dairy testing to verify nutritional content and ensure accurate labeling.

The dairy testing market demand is driven by increasing outbreaks of foodborne diseases. For instance, as per the report published by the Centers for Disease Control and Prevention, a total of 2,677 (40.5%) foodborne illness outbreaks were reported during 2014–2022. These outbreaks raise public awareness about the risks associated with dairy consumption, prompting stricter scrutiny of dairy production processes, leading to high demand for dairy testing services. Regulatory bodies also respond to foodborne disease outbreaks by tightening safety standards and introducing new testing requirements or increasing the frequency of inspections to prevent future outbreaks. Thus, as foodborne disease outbreaks become more frequent, dairy producers adopt advanced testing solutions, leading to dairy testing market expansion.

Market Dynamics

Growing Urbanization Across the Globe

Urbanization leads to a higher demand for convenience, ready-to-eat, and frozen foods, which often contain dairy ingredients. This necessitates stringent quality control measures to ensure the safety and hygiene of these products, which dairy testing services provide. Urbanization also leads to longer and more complex supply chains, which created the need for dairy testing. Dairy products often travel greater distances from rural farms to urban markets, increasing the risk of contamination, spoilage, or adulteration during transportation and storage. To mitigate these risks, producers and distributors implement testing at multiple stages of the supply chain, from raw milk collection to final product delivery. This expanded testing ensures that products remain safe and high-quality by the time they reach urban consumers, driving up overall demand for dairy testing services. Additionally, urban areas typically have stricter regulatory environments and more frequent inspections, further boosting the need for dairy testing. As per the data published by the United Nations, 55% of the world's population lives in urban areas and is expected to increase to 68% by 2050. Therefore, increasing urbanization across the world propels the dairy testing market development.

Growing Advancement in Technology

Innovations such as rapid pathogen detection, DNA-based testing, and automated quality control systems enabled dairy producers to identify contaminants with greater precision. This drives dairy companies to adopt them to enhance product safety and quality. New testing technologies also reduce the time required for results, allowing dairy producers to respond quickly to potential safety concerns and helping them prevent unsafe products from reaching the market, minimizing health risks and financial losses. Furthermore, the development and integration of automation and digital tools into dairy testing processes increase their demand by streamlining operations and improving efficiency. Hence, rising technological advancements in dairy testing are expected to create the dairy testing market opportunities during the forecast period.

Segmental Insights

Market Evaluation by Product

Based on product, the dairy testing market is divided into milk & milk powder, cheese, butter & spreads, infant food, ice cream & desserts, yogurt, and others. The milk & milk powder segment held the largest dairy testing market share in 2024 due to its extensive consumption and critical role in the dairy supply chain. Milk serves as a staple food product in households worldwide, while milk powder extends shelf life and enhances product stability, making it a preferred choice for manufacturers. Stringent safety regulations and the rising demand for high-quality dairy products have driven the need for comprehensive testing across the milk & milk powder segment. Increasing health awareness among consumers has further amplified the demand for contaminant-free milk, leading to significant investments in advanced testing technologies. Moreover, expanding dairy production, particularly in emerging economies, has contributed to the segment’s dominance, as regulatory bodies enforce strict quality standards to ensure consumer safety.

Outlook by Technology

In terms of technology, the dairy testing market is segregated into traditional technology and rapid technology. The rapid technology segment is expected to grow at a robust pace in the coming years owing to its efficiency, accuracy, and ability to deliver quick results. The growing demand for high-throughput testing solutions has driven the widespread adoption of rapid technology among dairy producers and regulatory agencies. Traditional methods often require extensive time for microbial culture and chemical analysis, creating delays in quality control processes. In contrast, advanced technologies such as polymerase chain reaction (PCR), chromatography, and spectroscopy enable faster detection of contaminants, ensuring compliance with stringent safety regulations. Rising concerns over foodborne illnesses and adulteration have further fueled the need for immediate and precise testing solutions. Additionally, the expansion of large-scale dairy production and international trade has created the demand for rapid testing methods as manufacturers seek to maintain product integrity while meeting global regulatory standards.

Regional Analysis

By region, the report provides dairy testing market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe held the largest dairy testing market revenue share in 2024 due to its stringent food safety regulations, high dairy consumption, and advanced quality control infrastructure. Regulatory bodies such as the European Food Safety Authority (EFSA) enforce strict dairy testing protocols, driving the widespread adoption of advanced analytical methods. Consumers in Europe prioritize clean-label and organic dairy products, prompting manufacturers to implement rigorous testing measures to meet these expectations. Additionally, the growing export of dairy products from Europe to global markets has further amplified the need for reliable testing solutions to comply with international standards.

Germany dominated the Europe dairy testing market share due to its robust dairy sector, technological advancements, and strong regulatory framework. The country has one of the highest dairy production capacities in the region, with a significant focus on quality control and food safety, leading to a high demand for dairy testing. Major dairy producers and testing service providers in Germany are investing heavily in advanced analytical techniques, ensuring compliance with evolving safety regulations. The rising demand for premium and functional dairy products in the country has further fueled the adoption of advanced testing technologies.

The Asia Pacific dairy testing market is estimated to grow at a rapid pace during the forecast period, owing to rapid urbanization, rising dairy consumption, and increasing regulatory enforcement. Countries such as China, India, and Japan are witnessing significant growth in dairy production, creating a strong demand for reliable dairy testing solutions. Governments across the region are imposing stringent food safety standards to address concerns related to contamination, adulteration, and microbial hazards, which are estimated to fuel the Asia Pacific dairy testing market expansion during the forecast period. The expanding middle-class population and growing consumer awareness of food safety have further accelerated the adoption of advanced dairy testing solutions. Additionally, technological advancements and investments in modern dairy infrastructure are strengthening the region’s position in the global market.

Key Players & Competitive Analysis Report

The competitive landscape of the dairy testing market is shaped by leading players making significant investments in research and development to enhance their product offerings and gain a competitive edge. Companies are actively pursuing strategic initiatives such as product innovation, international collaborations, increased capital investments, and mergers and acquisitions to expand their global footprint. By developing advanced solutions, forging strategic partnerships, and strengthening manufacturing capabilities, these market participants are driving industry growth and positioning themselves for long-term success.

The dairy testing market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are AES Laboratories Pvt. Ltd.; ALS; AsureQuality; Bureau Veritas; Charm Sciences; Dairyland Laboratories, Inc.; EnviroLogix; Eurofins Scientific; Intertek Group plc; Krishgen Biosystems; Mérieux NutriSciences Corporation; Premier Analytics Servies; and SGS Société Générale de Surveillance SA.

Bureau Veritas, a global company in testing, inspection, and certification, plays a critical role in ensuring food safety and quality through its comprehensive food laboratory testing services. Bureau Veritas provides tailored solutions to meet regulatory compliance and safeguard consumer health. Its services include microbiological testing to detect harmful pathogens, contaminant analysis for pesticides and heavy metals, and physical-chemical testing to determine nutritional content and product characteristics. These capabilities are crucial for reducing risks such as recalls and complaints while enhancing brand protection and consumer trust.

Intertek Group plc, a British multinational company headquartered in London, is a global company in quality assurance, testing, inspection, and certification services. Established in 1888, Intertek operates across more than 100 countries, with over 1,000 laboratories and 44,000 employees. Its services span diverse industries, including aerospace, chemicals, food, healthcare, energy, and construction. Intertek's Total Quality Assurance (TQA) solutions ensure the safety, quality, and compliance of products and processes throughout supply chains.

List Of Key Companies

- AES Laboratories Pvt. Ltd.

- ALS

- AsureQuality

- Bureau Veritas

- Charm Sciences

- Dairyland Laboratories, Inc.

- EnviroLogix

- Eurofins Scientific

- Intertek Group plc

- Krishgen Biosystems

- Mérieux NutriSciences Corporation

- Premier Analytics Servies

- SGS Société Générale de Surveillance SA

Dairy Testing Industry Developments

December 2024: The US Department of Agriculture announced the launch of national testing of milk from dairy farms to track the spread of bird flu or H5N1 in domestic poultry.

March 2024: Everest Instruments, a pioneer in innovative dairy and food testing solutions, announced the launch of an India-made FTIR-based milk analyzer, Gas Chromatography machine, and Somatic Cell Analyzer.

Dairy Testing Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Milk & Milk Powder

- Cheese

- Butter & Spreads

- Infant Food

- Ice Cream & Desserts

- Yogurt

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Traditional Technology

- Agar Culturing

- Rapid Technology

- Convenience-Based

- Polymerase Chain Reaction (PCR)

- Immunoassay

- Chromatography & Spectrometry

By Test Type Outlook (Revenue, USD Billion, 2020–2034)

- Safety Testing

- Pathogens

- E. Coli

- Salmonella

- Campylobacter

- Listeria

- Others

- Adulterants

- Pesticides

- Genetically Modified Organisms (GMOs)

- Mycotoxins

- Others

- Pathogens

- Quality Testing

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Dairy Producers

- Dairy Processors

- Food & Beverage Manufacturers

- Regulatory Authorities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dairy Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 6.81 Billion |

|

Market Forecast in 2025 |

USD 7.36 Billion |

|

Revenue Forecast by 2034 |

USD 14.95 Billion |

|

CAGR |

8.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global dairy testing market size was valued at USD 6.81 billion in 2024 and is projected to grow to USD 14.95 billion by 2034.

The global market is projected to register a CAGR of 8.2% during the forecast period.

Europe held the largest share of the global market in 2024.

A few of the key players in the market are AES Laboratories Pvt. Ltd.; ALS; AsureQuality; Bureau Veritas; Charm Sciences; Dairyland Laboratories, Inc.; EnviroLogix; Eurofins Scientific; Intertek Group plc; Krishgen Biosystems; Mérieux NutriSciences Corporation; Premier Analytics Servies; and SGS Société Générale de Surveillance SA.

The milk & milk powder segment dominated the market share in 2024 due to its extensive consumption and critical role in the dairy supply chain.

The rapid technology segment is expected to grow at the fastest pace in the coming years owing to its efficiency, accuracy, and ability to deliver quick results.