Dairy Herd Management Market Share, Size, Trends, Industry Analysis Report, By Type; By End-use (Small-scale, Large-scale, Cooperative Farms); By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM3986

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

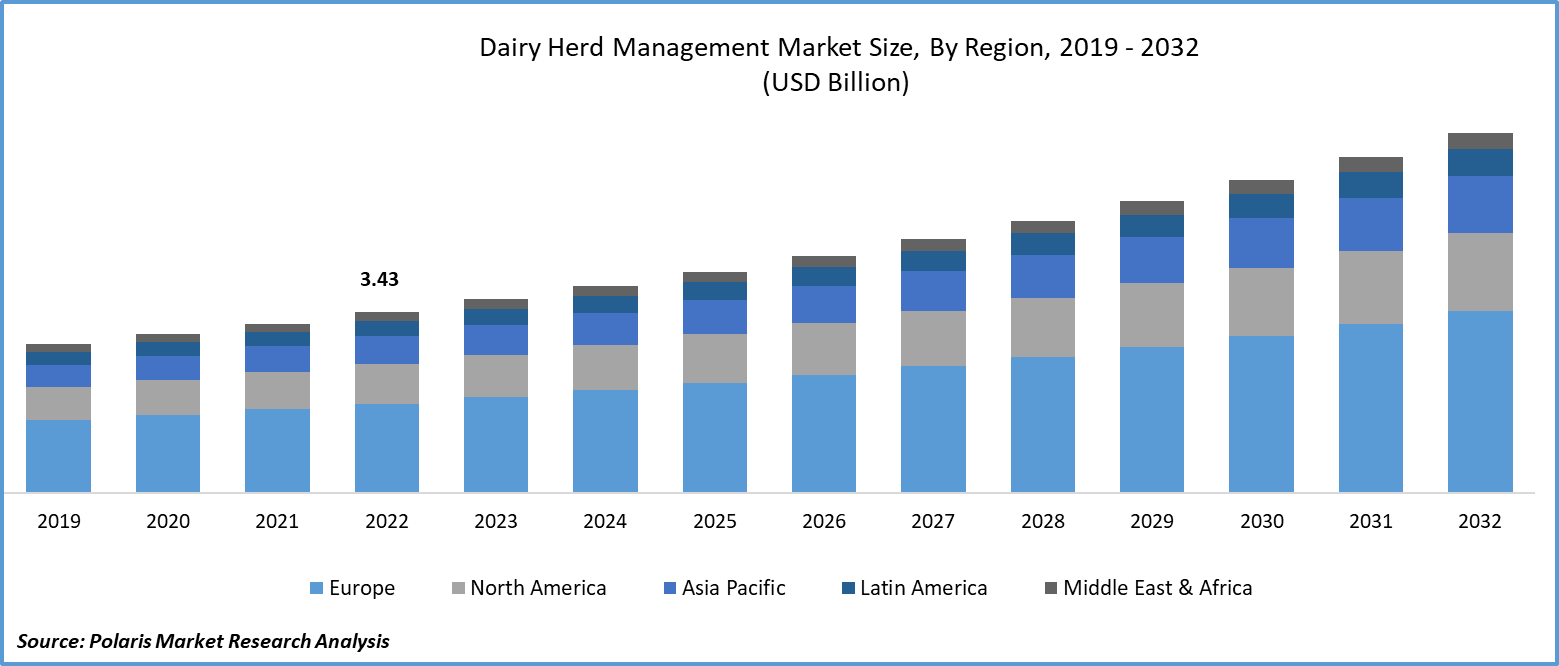

The global dairy herd management market was valued at USD 3.43 billion in 2022 and is expected to grow at a CAGR of 7.1% during the forecast period.

The demand for milk and its derivatives, such as cream, butter, and cheese, is expected to increase, leading to the growth of the market. Long-term cost advantages associated with livestock management solutions are also likely to benefit the market. These solutions help maintain the health of livestock by monitoring feeding patterns, environmental conditions, disease occurrences, and animal behavior.

To Understand More About this Research: Request a Free Sample Report

The expansion of the dairy industry is expected to be supported by improvements in cold storage facilities, the establishment of cooperative infrastructure, increased setup of collection depots and distribution centers, technological advancements in supply chain management, and overall improvements in public infrastructure and transportation of goods.

Herd management requires significant labor, which incurs significant labor expenses, thereby contributing to the operational costs of livestock owners. However, recent advancements, such as milking robots, feeding management systems, and waste management solutions, have entered the market, enabling cattle management with minimal human involvement. These technologies have automated routine tasks such as milking and feeding, reducing the need for extensive human intervention in herd management.

In the long run, dairy farms must achieve productivity growth to ensure their survival. Especially when milk prices are low, farmers must carefully manage production costs to maximize profits from fixed factors such as electricity. The adoption of automated technologies is an increasingly prevalent trend in the dairy sector and is pivotal to the market's outlook. Common automatic systems in this industry include identification, milking, estrus detection, feeding, birth detection, and various other farm operations. Implementing these systems has substantially decreased labor requirements and boosted the productivity of dairy farms.

Additionally, the market is poised for growth due to innovation and the widespread availability of dairy equipment. Increased adoption and efficient production of items such as sensors and integrated circuits are likely to drive down the prices of dairy herd management solutions. Additionally, positive influences are expected from government initiatives, funding opportunities, venture capital investments, and advancements in related technologies. However, the high expenses associated with dairy herd management might impede its adoption, particularly among small and medium-sized farms in developing nations such as Brazil and India.

For Specific Research Requirements: Request for Customized Report

The COVID-19 pandemic had a positive effect on the market. In response to the outbreak, dairy farmers focused on integrating advanced technologies and solutions to efficiently manage their herds. Coping with supply chain difficulties and labor shortages, farmers increasingly adopted dairy herd management systems to automate and enhance tasks related to animal health, milk production, and overall herd management.

Industry Dynamics

Growth Drivers

- Technological advancements in livestock monitoring

Livestock monitoring technology has played a significant role in the growth of the dairy herd management market. By incorporating advanced sensors, RFID tags, and data analytics, farmers can now easily monitor the health, behavior, and production of individual cows or the entire herd in real time with greater accuracy. This technology helps in the early detection of diseases, optimized feeding and breeding practices, and better overall herd management, leading to improved productivity, reduced operational costs, and higher dairy yields.

Additionally, the implementation of data-driven processes in dairy farming offers farmers measurable data, enabling constant monitoring and adjustment of farm operations and livestock behavior. This enhances farm efficiency and profitability. The rising popularity of herd management signifies a larger shift toward automation and advanced livestock management in the dairy industry. Dairy companies are capitalizing on this trend, enhancing herd management for diverse cattle and livestock applications. Automated milking parlors, smartphone apps for data analysis, micro-sensor technology, and robotics are expected to become standard features on dairy farms in the coming years.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Milk management systems segment accounted for the largest share in the market

The milk management systems segment holds the largest share in the dairy industry. This is because milking cows is a labor-intensive task, and the use of milk management systems has significantly reduced the required labor hours. As a result, further progress can be achieved through automation and by replacing aspects of operators' tasks, making the job less physically demanding and more efficient. For larger dairies, adding more milking units can lead to efficiency improvements.

Herd management software serves as a unified system, replacing manual labor in tasks such as fixed milking schedules, waste management, and monitoring. This allows farmers to redirect their work efforts elsewhere, resulting in a decrease in labor and an increase in operational efficiency. This not only improves farmers' quality of life but also increases profit margins and personal time, ultimately elevating their living standards.

Breeding management is expected to grow at a rapid pace. This segment holds a crucial position within the dairy herd management industry. It is specially designed to streamline the reproductive processes of dairy herds, enabling farmers to effectively oversee breeding cycles, track fertility, and improve genetic selection for enhanced milk production and overall herd performance.

By End Use Analysis

- Large scale dairy farms segment accounted for the largest share in 2022

The large-scale dairy farms segment holds the largest share in the dairy industry. This is because these farms have the financial capacity to invest in dairy herd management software, which leads to increased profits. In contrast, small-scale farms often face financial losses as their production value fails to cover all costs, including the time and capital invested by their owners.

Large farms have lower expenses than small farms, and this advantage persists across various herd sizes until economies of scale are maintained. The adoption of dairy herd management systems has led to a decrease in the price per ton of milk as herd sizes expand. For instance, increasing the herd size from less than 50 to 500 is expected to cut operational costs in half. This cost reduction can be extended to consumers, enabling small farms to compete with larger counterparts in terms of pricing.

Cooperative farms that use dairy herd management solutions are likely to grow at a rapid pace as they achieve economies of scale, reducing production expenses for individual farms. This cost reduction can then be passed on to consumers, enabling them to compete with larger farms in terms of pricing.

Regional Insights

- Europe garnered the largest share in 2022

The global market has been dominated by Europe, owing to the growing awareness among dairy farm owners in the region regarding the benefits of automation. This awareness has led to a significant increase in the adoption of milk and nutrition management systems within the European dairy industry. These systems, which are an essential part of dairy herd management solutions, allow for precise monitoring and control of crucial factors such as milking processes and animal nutrition. By implementing these advanced systems, dairy farm owners in the region have been able to significantly enhance the efficiency of their farms.

In contrast, the Asia Pacific region is expected to experience rapid growth, driven by government initiatives that include subsidies for automation technologies. There is a rising awareness among farmers about the efficiency and productivity gains associated with adopting advanced dairy farm automation solutions. The support from governments in the form of subsidies serves as a crucial incentive for farmers to adopt automation solutions. These subsidies make it financially feasible for farmers to invest in advanced technologies such as dairy herd management systems, milking robots, and automated feeding systems. By reducing the financial burden, governments facilitate the widespread adoption of automation tools, leading to improved efficiency and productivity in dairy farming operations.

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- Alta Genetics Inc.

- DeLaval

- GEA Group Aktiengesellschaft

- Lely

- Afimilk Ltd.

- BouMatic

- Herdlync

- Dun & Bradstreet, Inc.

- SUM-IT

- VAS

Recent Developments

- September 2022: VAS, introduced MyDC on PULSE. This platform is designed to enhance daily operations by simplifying tasks for farm members. With its user-friendly interface and intuitive guided workflows, users can effortlessly establish antibiotic protocols, ovsynch schedules, and oversee the overall health of their herds.

- April 2023: DeLaval, partnered with its affiliates UNIFORM-Agri, a provider of herd management software, and Dairy Data Warehouse, a dairy data company, to form a strategic alliance with iDDEN. This collaboration aims to provide customers with a secure and efficient system, simplifying the process of data exchange.

- March 2023: The European Union of Romania has offered financial support to farmers in the form of co-financing grants for the implementation of milking and feeding robots. This support, combined with subsidies and regulatory guidelines, encourages the adoption of precision agriculture technologies and sustainable farming practices. These initiatives contribute to the growth of the dairy herd management sector.

- April 2024: DeLaval publicly announced a tactical partnership with SERAP, a leading company in the manufacturing of tanks for cooling. Under the partnership, SERAP will go on to fully take over manufacturing, development, and quality assurance of the milk tanks of DeLaval on a global scale.

- April 2024: BouMatic went into partnership with Brolis Sensor Technology. The partnership will incorporate the Brolis in-line milk analyzer in the BouMatic milking system along with the Gemini UP milking robot to improve the quality of the milk.

Dairy Herd Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.67 billion |

|

Revenue forecast in 2032 |

USD 6.83 billion |

|

CAGR |

7.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Delve into the intricacies of Dairy Herd Management Market in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Lenalidomide Market Size, Share 2024 Research Report

Nitrile Butadiene Rubber Market Size, Share 2024 Research Report

Europe Textile Chemicals Market Size, Share 2024 Research Report

Oral Transmucosal Drugs Market Size, Share 2024 Research Report