Dairy Alternatives Market Share, Size, Trends, Industry Analysis Report, By Source (Soy, Almond, Coconut, Rice, Oats, Others); By Product; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM1967

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

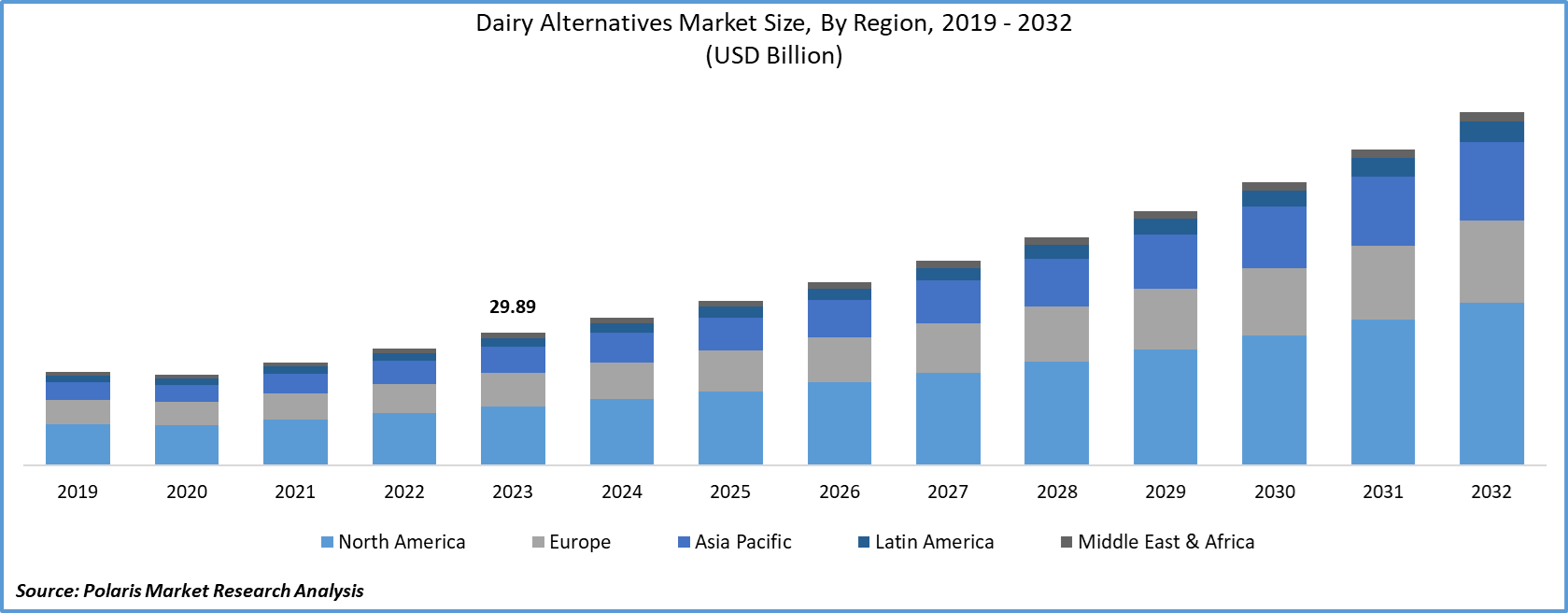

The global dairy alternatives market size was valued at USD 29.89 billion in 2023. The market is anticipated to grow from USD 33.30 billion in 2024 to USD 79.55 billion by 2032, exhibiting the CAGR of 11.5% during the forecast period.

The global market is gaining traction and facing high demand due to switching customer eating habits and diet trends. The rising milk allergies among the population, increasing cases of lactose intolerance, changing consumer standard of living, and increasing health awareness among the public are anticipated to fuel the demand of the alternatives market even further over the forecast timeframe.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

According to WHO, food allergies affect 520 million people across the globe and are responsible for more than 150 deaths and around 2000 hospitalizations in 2018 in the U.S. alone. Globally, lactose intolerance is increasing, and two-third of people face some type of lactose intolerance after their infant age. This is shifting consumers towards non-dairy products, which will significantly fuel the growth of the alternatives market in the coming years.

These products contain a low number of calories compared to animal-based dairy products and hence help reduce obesity, which is responsible for developing many chronic diseases, including diabetes. Soy milk is rich in phytoestrogen and isoflavones, which have numerous health benefits.

Phytoestrogen is like estrogen, and therefore consuming soy milk will help to increase estrogen levels in women. Iso-flavones are associated with a reduced risk of cancer and heart-related diseases. These huge health benefits will lead to the increased consumption of dairy alternatives.

Industry Dynamics

Growth Drivers

The global dairy alternatives market is mainly driven by factors rising cases of people suffering from milk intolerance along with the increasing rise in the people following vegan diets and avoiding animal-based products. The health benefits associated with dairy alternatives are anticipated to accelerate the growth of the alternatives market during the forecast period.

The number of people following a vegan diet has increased across the globe, and majorities are avoiding animal-based products. This has increased the demand for dairy alternatives based on soy, coconut, almond, hazelnut, and other such products. The adoption of plant-based diets is expected to lower worldwide mortality rates by 6% by 2050. Plant-based dairy alternatives offer similar vitamin and protein profiles to animal-based products. These factors will significantly increase the adoption of the products in the world.

The increasing popularity has resulted in the increased product launch, acquisitions, and funding related to the market. For instance, Nestle launched its plant-based Nesquik drink for the European market in 2020. This drink is produced from peas, oats, and cocoa, and this drink contains low calories compared with milk-based beverages offered by the same company.

In July 2020, Perfect Day announced that it received USD 300 million in Series C funding to produce dairy proteins casein and whey through fermentation using microflora inserted with essential milk genes. The genetically modified microflora has the ability to convert plant sugar into whey and casein that has applications in food, like cheese and butter.

Report Segments

The market is primarily segmented on the basis of source, product, distribution channel, and region.

|

By Source |

By Product |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The milk-based dairy alternatives product segment dominated the market and generated the highest revenue in 2020. The growing elderly population has led to an increased preference for milk-based dairy alternatives in the European region. Rising demand for low-calorie foods, combined with the increasing popularity of plant-based nutritious products in Europe, is further expected to drive alternatives industry growth over the projected period.

The milk product category includes many new and creative beverage choices with dairy alternatives as to the main ingredient. Beverage producers are launching new products in order to increase industry capitalization. The growing demand among customers for various beverage selections has resulted in a variety of flavored drinks that constitute dairy alternatives. Lactose-intolerant customers looking for a range of milk-based dairy alternatives beverages will enjoy the flavored drinks.

The rising demand for cheese-based dairy alternatives, such as sour creams, almond, and soy-based cream cheese, and standard cheese, is expected to drive the industry demand over the forecast era. Consumers having lactose intolerant or allergic to milk products are moving to almond and soy-based cheeses, which is driving the market demand.

Insight by Distribution Channel

The supermarket and hypermarket segment dominated the industry and generated the highest revenue in 2020. These are massive retail stores that typically deliver a variety of retail product categories under a single roof. In order to be convenient to consumers, supermarkets are normally situated near a residential area. However, due to a lack of space near residential areas, most supermarkets, and hypermarket chains are expanding outside the city.

The penetration of supermarkets and hypermarkets is higher in developed countries such as North America and Europe than in emerging economies. In addition, the availability of a wide range of dairy alternatives in one location and ease of purchase aided supermarket and hypermarket development as distribution channels in the estimated year.

The convenience stores normally provide lower discounts than other distribution channels due to their low-volume sourcing from suppliers and manufacturers. The availability of limited dairy alternatives will restrain the growth of this segment during the projected period. Still, as these stores mostly concentrate on daily foods, their limited shelf space prevents them from stocking a diverse range of dairy alternatives.

Geographic Overview

The Asia Pacific is expected to be the most significant region for the global industry over the study period, owing to a surge in urbanization and increasing consumer awareness of the health benefits of plant-based products in emerging economies such as China, South Korea, and India. The sales of Soy milk have doubled in China in 2020 when compared to a decade ago.

Increasing population and surging disposable incomes in the region are expected to boost demand for the product. The increasing population of lactose intolerance and growing health concerns about unsafe additives in dairy products are expected to drive the demand for dairy alternatives such as rice milk, almond milk, soy milk, and other products.

North America is expected to significantly contribute to the growth of the industry during the forecast period, owing to the increasing use of products such as yogurt and ice cream in these countries on a bigger scale.

Since the U.S. has a huge obese population, people are increasingly adopting yogurt, flavored milk, and other products based on non-animal sources. About two-thirds of flavored milk items are sold in North American schools. Growing demand for flavored almond and soy milk is anticipated to drive growth for alternatives in this region.

Competitive Insight

Major players across the globe are investing in R&D to develop new dairy alternatives that have similar flavor and composition compared to animal-based dairy products to cater to the increasing number of vegan people across the globe. The companies are also involved in new product launches, funding, and acquisitions to expand their global industry reach.

Some of the major players operating in the dairy alternatives market include SunOpta Inc., Oatly, Danone, The Hain Celestial Group, Inc., DAIYA FOODS INC., Living Harvest Foods Inc., Melt Organic, Vitasoy International Holdings Limited, Freedom Foods Group, Earth’s Own Food Company, The Whitewave Foods Company, ADM, Ripple Foods, Nutriops, Blue Diamond Growers, Eden Foods, Inc., Organic Valley Family of Farms and CP Kelco.

Dairy Alternatives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 33.30 billion |

|

Revenue forecast in 2032 |

USD 79.55 billion |

|

CAGR |

11.5% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Source, By Product, By Distribution Channel, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America, Middle East & Africa |

|

Key Companies |

The Hain Celestial, Blue Diamond Growers, SunOpta, Sanitarium Health and Wellbeing Company, Danone, Freedom Foods Group, Earth’s Own Food Company, Triballat Noyal, Valsoia S.p.A, Panos Brands, Melt Organic, Oatly, Living Harvest Foods, Ripple Foods, Kite Hill, Califia Farms, Hudson River Foods Inc., Daiya Foods Inc., Pureharvest, Yoconut Dairy Free, Yumbutter. |