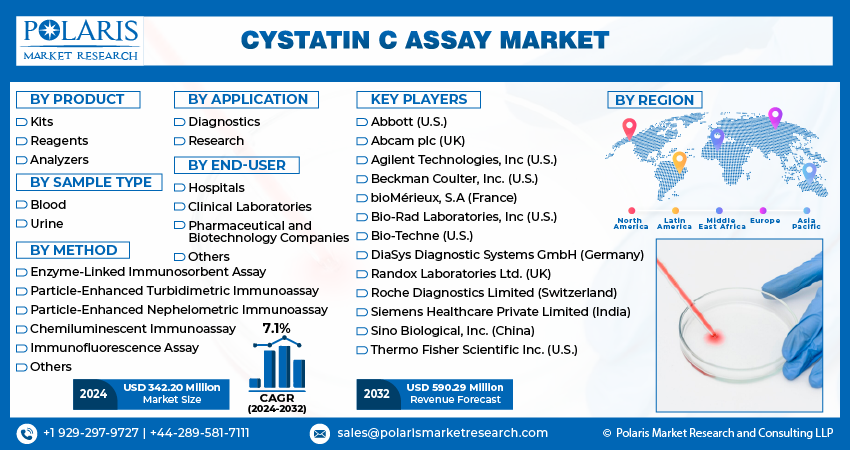

Cystatin C Assay Market Share, Size, Trends, Industry Analysis Report, By Product (Kits, Reagents, and Analyzers); By Sample Type; By Method; By Application, By End-user, By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4650

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

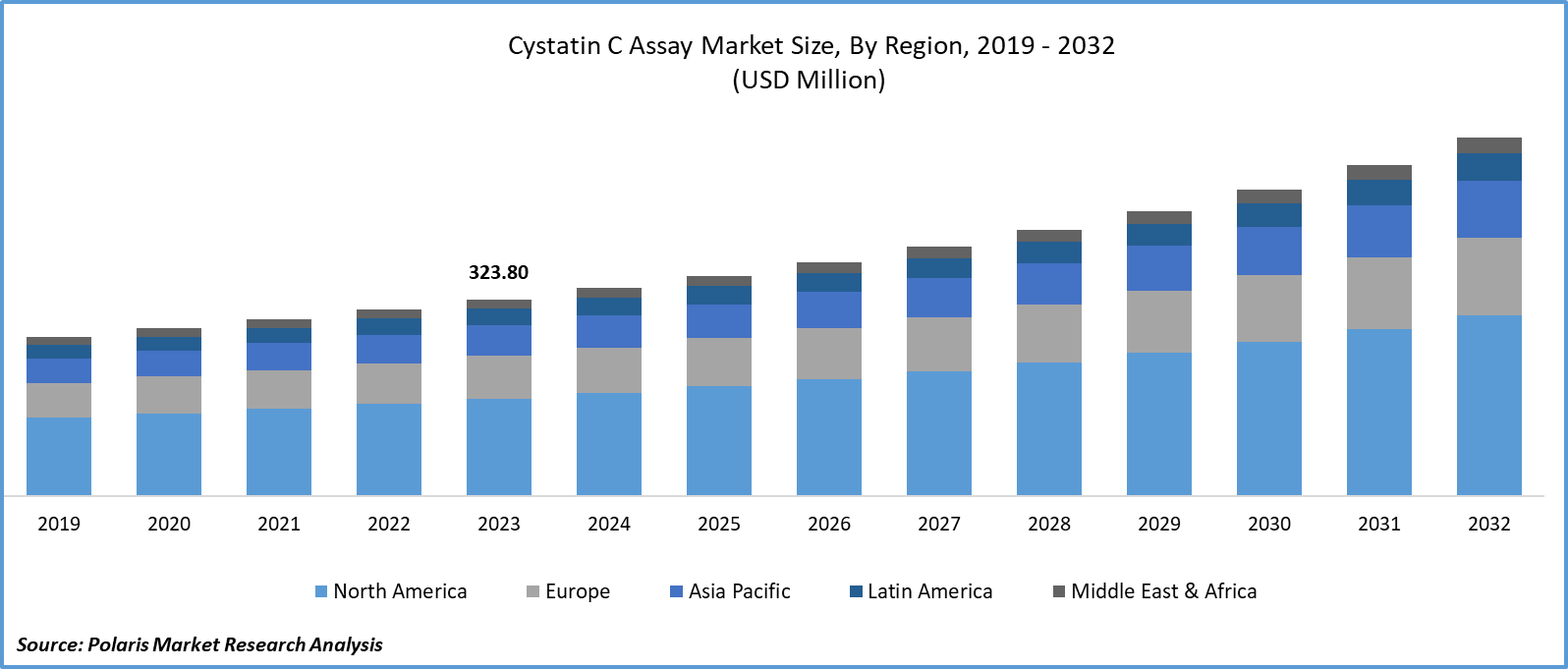

Cystatin C assay market size was valued at USD 323.80 million in 2023. The market is anticipated to grow from USD 342.20 million in 2024 to USD 590.29 million by 2032, exhibiting the CAGR of 7.1% during the forecast period.

Market Overview

The growing burden of chronic kidney disease (CKD) is one of the major factors driving the growth of cystatin C assay market. Factors such as changes in lifestyle and rising geriatric population are the primary reasons attributed to the growing prevalence of CKD. Moreover, several benefits associated with the use of cystatin C test over creatinine test is fueling the adoption of cystatin C assay. Furthermore, the rising number of patients suffering from diabetes, hypertension, heart diseases, glomerulonephritis, and obesity is expected to increase the patient pool of chronic kidney diseases thereby, fueling the cystatin C assay market expansion.

- According to the IDF Diabetes Atlas (2021) by the International Diabetes Federation (IDF), it is projected that approximately 783 million people will be living with diabetes by 2045, with an increase of 46.0% compared to 2021.

To Understand More About this Research: Request a Free Sample Report

The strong focus of government towards the spending on kidney diseases coupled with high prevalence of various kidney disorders in the developed countries are expected to contribute to the cystatin C assay market growth in the projected years. Moreover, the early screening of kidney function tests in sick babies and ageing population is expected to increase the demand for cystatin C tests. Furthermore, increasing accessibility and convenience to cystatin C assays owing to the emergence of various diagnostic technologies such as point-of-care testing will also prove beneficial for the market growth.

However, several healthcare facilities with limited resources may find it financially difficult to develop, produce, and implement cystatin C tests due to the related costs, as well as the need for equipment and training. Moreover, the high cost associated with cystatin C tests compared to creatinine will limit the market growth in the coming years. Furthermore, lack of skilled professionals to conduct tests and interpret accurate results is expected to hamper the adoption of cystatin C assays in the coming years.

Growth Factors

Increasing prevalence of chronic kidney diseases is expected to boost the cystatin C assay market growth

Cystatin C is a new marker for the diagnosis of kidney-related problems. Chronic kidney disease (CKD) is one of the most common kidney diseases. A large patient pool suffering from the chronic kidney disease will contribute to the growth of Cystatin C assay market in the upcoming years. For instance, according to the recently published statistics by the Centers for Disease Control & Prevention (CDC), in 2023, approximately 35.5 million people in the U.S. are estimated to have CKD. The health problems such as loss of appetite, weakened immune system, anemia, low calcium levels, and high phosphorus levels arise due to the low kidney function, which makes the early screening of kidney disease more important. The growing need for early detection of kidney diseases will increase the test volume thereby, fueling the growth of cystatin C assay market.

Several advantages associated with the use of cystatin C test over creatinine test will drive the market growth

The tests such as cystatin C and creatinine are used to screen and monitor kidney dysfunction. Creatinine test has been used as a traditional screening method to investigate kidney problems. However, the use of cystatin C test offers several vital benefits which is expected to increase the preference for these tests, thereby spurring the demand for cystatin C assay. For instance, factors such as race, diet, and muscle mass have no significant effect on cystatin C levels. Moreover, creatinine measurements could not be accurate in people with liver cirrhosis, extreme obesity, amputated limbs, and decreased muscle mass (elderly and children). Unlike creatinine, cystatin C is not affected by diet or body mass, making it a more accurate indicator of kidney function. Such benefits of cystatin C over creatinine are expected to increase the demand cystatin C assay during the forecast period.

Restraining Factors

Cystatin C assay's high costs are predicted to impede the market expansion

The expenses involved in the research & development and validation of cystatin C assay can challenge the industry players, thereby limiting the overall market growth. Moreover, financial challenges related to the development, manufacturing, and implementation coupled with the necessary training & equipment for cystatin C assay are some of the biggest challenges for market players. Furthermore, the high cost of cystatin C reagents over creatinine reagents is expected to restrain the market growth during the forecast period. For instance, as per the research study published by the National Center for Biotechnology Information (NCBI) in August 2022, in the US, creatinine tests cost about USD 0.50 per test, while cystatin C reagents range from USD 5.0 to USD 10.0 per test. Such high costs are likely to decline the test volume thereby, hampering the cystatin C assay market growth.

Report Segmentation

The market is primarily segmented based on product, sample type, method, application, end-user, and region.

|

By Product |

By Sample Type |

By Method |

By Application |

By End-user |

By Region |

|

|

|

|

|

|

By Product Insights

Kits segment is expected to witness significant growth during the forecast period

The kits segment is anticipated to expand at the highest CAGR during the forecast period. The primary factors driving the growth of this segment are convenience and ease of use of kits. Moreover, the purpose to offer a complete solution for carrying out the cystatin C assay and the high preference of healthcare facilities and laboratories to adopt ready-to-use solution are expected to contribute to the growth of kits segment in the projected years. Furthermore, the research & development activities by manufacturers to introduce new and high-quality testing kits will also fuel the segmental growth.

By Sample Type Insights

Blood segment held the largest market share in 2023

Based on sample type, the blood segment dominated the market in 2023. High accuracy and widespread adoption of blood tests are the primary factors contributing to the dominance of blood segment. Accurate assessment of renal function by cystatin C tests requires the use of blood as a sample. It enables the sensitive identification of changes in GFR and also ensures the clinical significance of the data through quantitative and standardized measures. Thus, high preference for blood sample by the clinical laboratories is expected to contribute to the segmental growth in the upcoming years.

By Method Insights

Enzyme-linked immunosorbent assay (ELISA) segment generated the largest cystatin C assay market revenue

The enzyme-linked immunosorbent assay (ELISA) segment accounted for the significant market share. The widespread adoption of this method for quantifying the concentration of cystatin C in different samples is responsible for the significant share of the segment. In the developing countries, the prevalence of chronic kidney disease is increasing significantly owing to the growing burden of hypertension and diabetes mellitus. Factors such as simplicity in process and easy availability of ELISA tests are attracting the researchers as well as clinicians from the developing countries. Thus, aforementioned factors contribute to the segmental share.

By End-user Insights

The hospitals segment emerged as the largest revenue-generating end-user

In 2023, the hospitals segment held the significant share of the cystatin c assay market. The large patient population and easy access are responsible for the largest share of the segment. Moreover, the strict quality control and assurance guidelines followed by hospitals for performing cystatin c tests are expected to increase the demand for cystatin C assay in this end-user setting. Furthermore, greater reliability and guaranteed precision associated with the cystatin C tests conducted in hospitals drives the segmental growth.

Regional Insights

North America emerged as the largest market in 2023

North America dominated the market in 2023. The dominance of this region is majorly attributed to the factors such as high prevalence of chronic kidney disease among geriatric population, and presence of large patient pool suffering from diabetes and other chronic disorders. For instance, according to the Centers for Disease Control & Prevention (CDC), people with age 65 years and above are more likely to have CKD in the U.S. Moreover, sophisticated healthcare system, extensive availability of state-of-the-art diagnostic tools, and high awareness about early screening of diseases are the factors that will help the region to maintain its dominant position in the market.

Asia Pacific region is expected to register the highest CAGR during the forecast period

Asia Pacific region is projected to witness significant growth during the forecast timeframe. Rising number of patient suffering from kidney diseases coupled with increasing awareness related to the early detection of these diseases are expected to propel the demand for cystatin C assay in the projected years. Ageing populations, rising occurrence rates of hypertension, and diabetes are also contributing to the chronic kidney disease epidemic thereby, increasing the demand for cystatin C assay.

Key Market Players & Competitive Insights

Few companies dominated the cystatin C assay market in 2023

The market is consolidated in nature owing to the dominance of several major players. Companies such as Roche Diagnostics Limited, Siemens Healthineers AG, Abbott, and Beckman Coulter, Inc. are the key players operating in the market. These companies along with other small and medium-sized companies are continuously focused on the strategic developments such as new product launches, acquisitions, and collaborations in order to improve their market shares.

Some of the major players operating in the global market include:

- Abbott (U.S.)

- Abcam plc (UK)

- Agilent Technologies, Inc (U.S.)

- Beckman Coulter, Inc. (U.S.)

- bioMérieux, S.A (France)

- Bio-Rad Laboratories, Inc (U.S.)

- Bio-Techne (U.S.)

- DiaSys Diagnostic Systems GmbH (Germany)

- Randox Laboratories Ltd. (UK)

- Roche Diagnostics Limited (Switzerland)

- Siemens Healthcare Private Limited (India)

- Sino Biological, Inc. (China)

- Thermo Fisher Scientific Inc. (U.S.)

Recent Developments in the Industry

- In August 2022, Bloom Diagnostics announced the launch of its new kidney test. This test is used for the quantitative assessment of cystatin C in whole blood.

Report Coverage

The cystatin C assay market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, sample type, method, application, end-user, and their futuristic growth opportunities.

Cystatin C Assay Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 342.20 million |

|

Revenue forecast in 2032 |

USD 590.29 million |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Cystatin C Assay Market report covering key segments are product, sample type, method, application, end-user, and region.

Cystatin C Assay Market Size Worth $590.29 Million By 2032

Cystatin C assay market exhibiting the CAGR of 7.1% during the forecast period.

North America is leading the global market

key driving factors in Cystatin C Assay Market are Increasing prevalence of chronic kidney diseases