CVD Lab-Grown Diamonds Market Size, Share, Trends, Industry Analysis Report

: By Type (Rough and Polished), Color, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM3247

- Base Year: 2024

- Historical Data: 2020-2023

CVD Lab-Grown Diamonds Market Overview

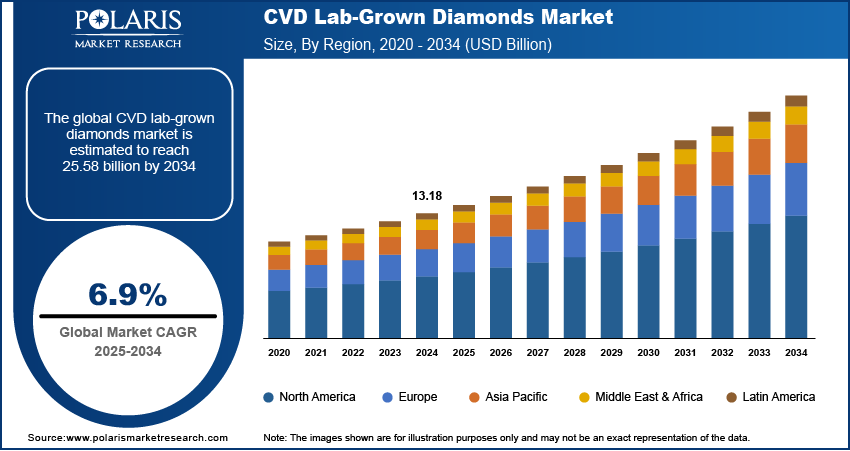

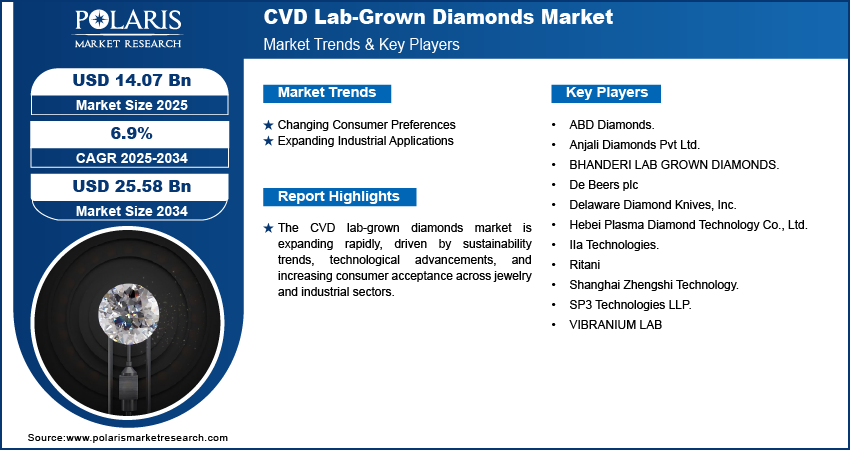

The global CVD lab-grown diamonds market size was valued at USD 13.18 billion in 2024. It is expected to grow from USD 14.07 billion in 2025 to USD 25.58 billion by 2034, at a CAGR of 6.9% during 2025–2034.

Chemical vapor deposition (CVD) lab-grown diamonds are synthetic diamonds produced using a controlled process that replicates the natural diamond formation environment. The CVD lab-grown diamonds market demand is rising as consumers and industries recognize their benefits, particularly in terms of sustainability and technological advancements. The growing interest in sustainability is driving the demand for CVD diamonds as they offer an eco-friendly alternative to mined diamonds, reducing environmental degradation and ethical concerns associated with traditional diamond mining. In April 2024, Brilliant Earth collaborated with Dr. Jane Goodall and the Jane Goodall Institute to advance ethical practices in fine jewelry. The partnership includes a USD 100,000 donation and a recycled gold jewelry collection to support conservation initiatives, highlighting the industry’s shift toward sustainability and responsible sourcing. CVD diamonds are gaining traction in both the jewelry and industrial sectors, driven by rising consumer awareness and preference for environmentally conscious products.

To Understand More About this Research: Request a Free Sample Report

Technological advancements such as improved size and quality control, and enhanced color and clarity customization accelerate the CVD lab-grown diamonds market opportunities by improving the quality, efficiency, and scalability of CVD diamond production. Innovations in deposition techniques, reactor designs, and material purification have allowed the production of high-purity diamonds with superior optical and physical properties. These improvements have expanded their application beyond jewelry into sectors such as electronics, semiconductors, and medical devices. Therefore, as technology continues to evolve, CVD lab-grown diamonds are becoming more cost-effective and widely accepted, positioning them as a strong competitor to natural diamonds in various high-performance applications.

CVD Lab-Grown Diamonds Market Dynamics

Changing Consumer Preferences

Consumers, particularly younger generations, are shifting away from traditionally mined diamonds due to concerns about environmental impact and labor practices as modern buyers increasingly prioritize ethical sourcing, affordability, and customization. In May 2024, Pandora a lab-grown diamond company reported a 13% rise in 2024 organic sales, though its lab-grown diamond line underperformed. CVD lab-grown diamonds offer a sustainable and cost-effective alternative without compromising on quality, clarity, or brilliance. Additionally, advancements in manufacturing allow for greater customization, serving to evolving fashion trends and personalized jewelry designs. Thus, as brand perception and consumer trust in lab-grown diamonds strengthen, their acceptance in both luxury and mainstream markets continues to grow, further propelling CVD lab-grown diamonds market development.

Expanding Industrial Applications

CVD lab-grown diamonds are increasingly utilized in high-tech industries such as electronics, semiconductors, and medical devices as they are driven by their exceptional hardness, thermal conductivity, and optical properties. In June 2024, Element Six collaborated with Japan’s Orbray to develop the world’s highest quality wafer-scale single crystal diamond. This innovation aims to address power and efficiency challenges in AI, telecommunications, and 6G wireless components, further contributing to the CVD lab-grown diamonds market application in various industries. Their superior wear resistance makes them ideal for precision cutting tools, while their electrical insulating properties support advancements in quantum computing and high-power electronics. CVD lab-grown diamonds provide a reliable and scalable solution, reinforcing their demand across multiple sectors as industries seek advanced materials for performance-driven applications.

CVD Lab-Grown Diamonds Market Segmental Insights

CVD Lab-Grown Diamonds Market Assessment by Color Outlook

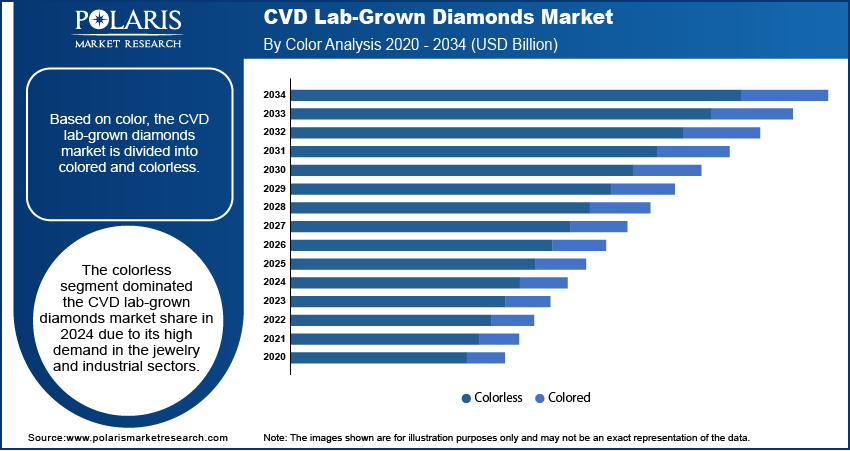

The global CVD lab-grown diamonds market segmentation, based on color, includes colored and colorless. The colorless segment dominated the CVD lab-grown diamonds market share in 2024 due to its high demand in the jewelry and industrial sectors. Consumers seeking an alternative to natural diamonds prefer colorless CVD diamonds for their optical purity, brilliance, and near-identical appearance to mined diamonds. Jewelers and luxury brands increasingly incorporate these diamonds into high-end collections, reinforcing their revenue forecast. Additionally, advancements in CVD technology have improved the production efficiency of high-quality, colorless diamonds, making them more accessible. The growing consumer trust and acceptance of lab-grown diamonds as a sustainable and cost-effective choice further drive the industry insights.

CVD Lab-Grown Diamonds Market Evaluation by Type Outlook

The global CVD lab-grown diamonds market segmentation, based on type, includes rough and polished. The rough segment is expected to witness the fastest growth during the forecast period, driven by its increasing use in industrial applications and the jewelry manufacturing process. Rough CVD diamonds serve as a critical raw material for precision-cut gemstones and specialized industrial tools. Their superior hardness, thermal conductivity, and wear resistance make them essential for applications in electronics, cutting tools, and medical instruments. Additionally, the rising adoption of rough lab-grown diamonds by manufacturers looking to reduce production costs while maintaining high-quality standards fuels the CVD lab-grown diamonds market development. The scalability of CVD production further supports the expansion of rough diamonds in multiple industries.

CVD Lab-Grown Diamonds Market Regional Analysis

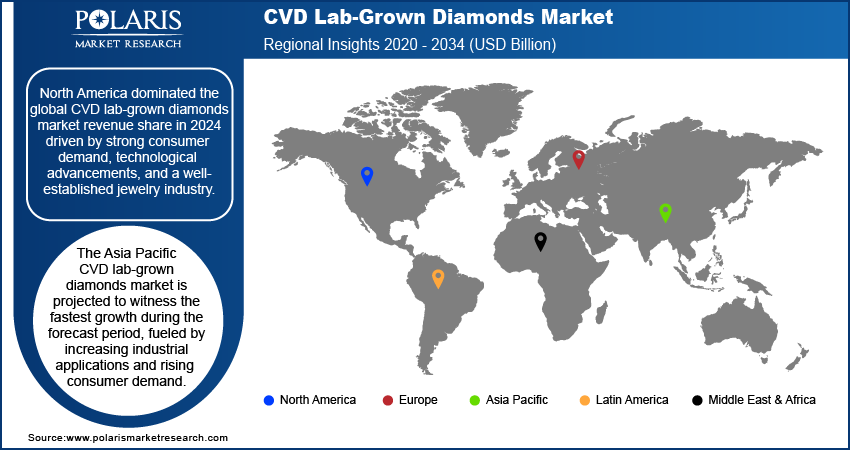

By region, the report provides the CVD lab-grown diamonds market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the CVD lab-grown diamonds market revenue share in 2024, driven by strong consumer demand, technological advancements, and a well-established jewelry industry. The region has a high awareness of sustainable and ethically sourced products, leading to increased adoption of lab-grown diamonds. In 2024, US domestic production of industrial diamond bort, grit, and powder reached 160 million carats, valued at USD 53 million, a 5% increase from 2023. Synthetic diamonds dominated consumption (99%), used in construction, chip production, drilling, and stone cutting, highlighting the region’s focus on advanced diamond applications. Major jewelry brands and retailers in the US and Canada have actively promoted CVD diamonds, strengthening their market presence. Additionally, North America is home to several leading manufacturers and research institutions focused on advancing CVD diamond technology, further supporting the market’s growth potential. The strong purchasing power of consumers and their preference for high-quality, eco-friendly alternatives contribute to the region’s market leadership.

The CVD lab-grown diamonds market in Asia Pacific is projected to witness the fastest growth during the forecast period, fueled by increasing industrial applications and rising consumer demand. The region is experiencing rapid economic development, leading to a growing middle-class population with higher disposable income and evolving luxury preferences. Countries such as China, India, and Japan are key markets for both jewelry and industrial applications, driving region-wise market size for CVD diamonds. Additionally, the expansion of manufacturing facilities and technological advancements in diamond synthesis contribute to market growth. Thus, as awareness and acceptance of lab-grown diamonds continue to rise, Asia Pacific is expected to emerge as a major hub for CVD diamond production and consumption.

CVD Lab-Grown Diamonds Market – Key Players & Competitive Analysis Report

The competitive landscape of the CVD lab-grown diamonds market features global leaders and regional players competing for market share through innovation, strategic alliances, and geographic expansion. Global players such as De Beers (Lightbox), SP3 Technologies LLP., and Bhanderi Lab Grown Diamonds leverage advanced R&D capabilities and extensive distribution networks to deliver high-quality, sustainable lab-grown diamonds. CVD lab-grown diamonds market trends indicate rising demand for eco-friendly and ethically sourced diamonds, driven by increasing consumer awareness and environmental concerns. According to CVD lab-grown diamonds market statistics, the industry outlook is projected to grow, fueled by the growing preference for sustainable luxury and the affordability of lab-grown diamonds compared to mined diamonds. Regional companies are addressing localized demands by offering cost-effective and customized solutions, particularly in emerging markets, which are expected to witness the fastest CAGR due to rising disposable incomes and shifting consumer preferences. Competitive strategies include mergers and acquisitions, partnerships with jewelry brands, and the introduction of innovative diamond-growing technologies to meet the growing demand for high-quality, sustainable gemstones. These developments highlight the importance of technological innovation, market adaptability, and regional investments in driving the expansion of the CVD lab-grown diamonds industry. A few key major players are ABD Diamonds; Anjali Diamonds Pvt Ltd; BHANDERI LAB GROWN DIAMONDS; De Beers plc; Delaware Diamond Knives, Inc.; Hebei Plasma Diamond Technology Co., Ltd.; IIa Technologies; Ritani; Shanghai Zhengshi Technology; SP3 Technologies LLP; and VIBRANIUM LAB.

ABD Diamonds is a lab-grown diamond company based in India, specializing in the manufacturing and supply of CVD and HPHT diamonds. Established in 2017, the company has carved a place for itself as a synthetic diamond manufacturer, offering a wide range of products such as diamond jewelry, loose diamonds, and industrial diamonds. ABD Diamonds highlights the brilliance of the 4Cs: Clarity, Cut, Color, and Carat assuring that every diamond is crafted with maximum passion to showcase these attributes. CVD lab-grown diamonds, a specialty of ABD Diamonds, are created using the Chemical Vapor Deposition method. This involves placing diamond seed crystals in a chamber with heated carbon-containing gas, allowing carbon to deposit layer by layer over several weeks. CVD diamonds are chemically and physically identical to natural diamonds, making them indistinguishable without specialized tools. They feature excellent thermal conductivity, hardness, and wear resistance, making them ideal for both jewelry and industrial applications. ABD Diamonds prides itself on its innovative infrastructure and commitment to sustainability, producing diamonds with no carbon footprint.

Shanghai Zhengshi Technology Co., Ltd. is based in Shanghai, China, known for its contributions to the field of CVD lab-grown diamonds. Founded in 2016, the company has established itself as a leader in the high-tech industry, particularly in the jewelry and watches market segment, with a focus on CVD lab-grown diamonds. Shanghai Zhengshi Technology holds a notable record in producing large, high-quality CVD diamonds. For instance, it previously held the record for producing a 12.75-carat F/VVS2 diamond before achieving a new milestone with a 16.41-carat G/VVS2 princess-cut gemstone, which was recognized by the Gemological Institute of America (GIA). This achievement highlights the company's advanced capabilities in CVD growth technology and its role in pushing the boundaries of lab-grown diamond production. Shanghai Zhengshi Technology continues to innovate and expand its presence in the global market with a total of 13 patents. The company's commitment to technological advancements and quality has positioned it as a key player in the rapidly evolving CVD lab-grown diamond industry.

List of Key Companies in CVD Lab-Grown Diamonds Market

- ABD Diamonds.

- Anjali Diamonds Pvt Ltd.

- BHANDERI LAB GROWN DIAMONDS.

- De Beers plc

- Delaware Diamond Knives, Inc.

- Hebei Plasma Diamond Technology Co., Ltd.

- IIa Technologies.

- Ritani

- Shanghai Zhengshi Technology.

- SP3 Technologies LLP.

- VIBRANIUM LAB

CVD Lab-Grown Diamonds Industry Development

December 2024: Limelight Diamonds opened its first retail store in Chennai and announced its plans to launch seven more stores by year-end to meet the rising demand for lab-grown diamond jewelry, aligning with its vision of blending tradition with modern luxury.

CVD Lab-Grown Diamonds Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Rough

- Polished

By Color Outlook (Revenue, USD Billion, 2020–2034)

- Colored

- Colorless

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Machine and Cutting tools

- Heat Sinks & Exchangers

- Optical, Laser and X-ray

- Electronics

- Healthcare Instruments

- Gemstone

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

CVD Lab-Grown Diamonds Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.18 billion |

|

Market Size Value in 2025 |

USD 14.07 billion |

|

Revenue Forecast by 2034 |

USD 25.58 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global CVD lab-grown diamonds market size was valued at USD 13.18 billion in 2024 and is projected to grow to USD 25.58 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are ABD Diamonds; Anjali Diamonds Pvt Ltd; BHANDERI LAB GROWN DIAMONDS; De Beers plc; Delaware Diamond Knives, Inc.; Hebei Plasma Diamond Technology Co., Ltd.; IIa Technologies; Ritani; Shanghai Zhengshi Technology; SP3 Technologies LLP; and VIBRANIUM LAB.

The colorless segment dominated the market share in 2024.

The rough segment is expected to witness the fastest market growth during the forecast period.