Crop Protection Chemicals Market Size, Share, Trends, Industry Analysis Report: By Type (Herbicides, Insecticides, Fungicides & Bactericides, Other), Origin, Form, Mode of Application, Crop Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 116

- Format: PDF

- Report ID: PM5075

- Base Year: 2023

- Historical Data: 2019-2022

Crop Protection Chemicals Market Overview

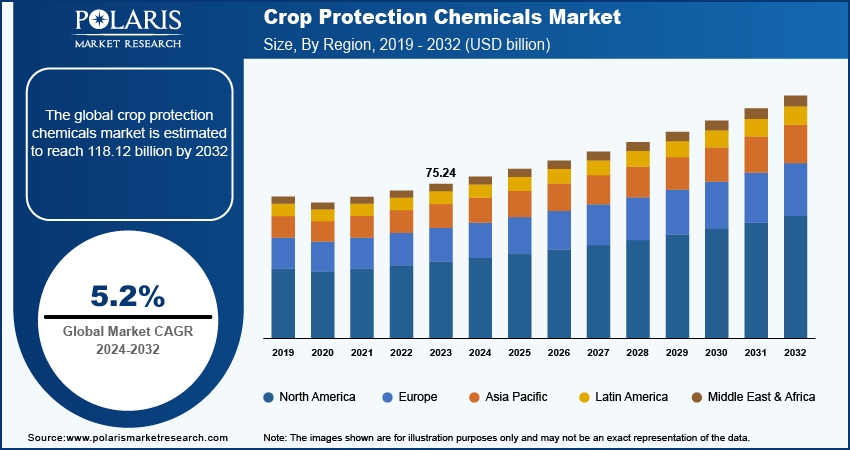

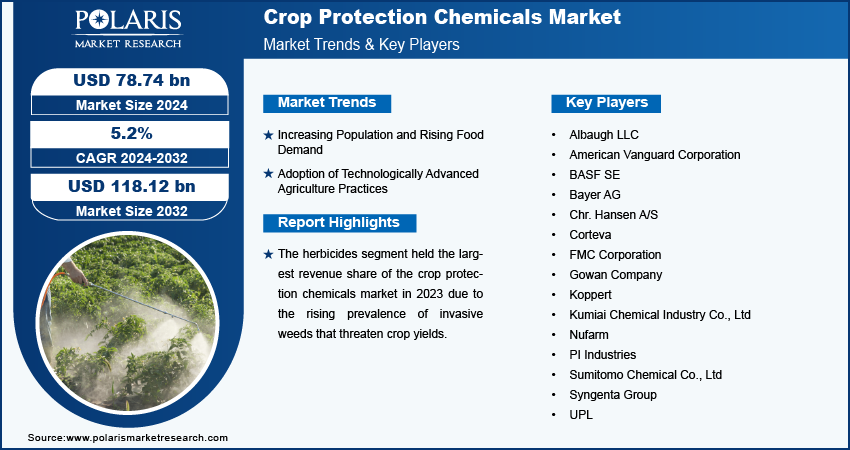

Global crop protection chemicals market size was valued at USD 75.24 billion in 2023. The market is projected to grow from USD 78.74 billion in 2024 to USD 118.12 billion by 2032, exhibiting a CAGR of 5.2% during the forecast period.

The crop protection chemicals market is experiencing robust growth as climate change drives shifts in weather patterns, resulting in more persistent threats from pests and diseases. According to the Centre for Agriculture and Bioscience International (CABI), approximately 40% of global crop yields are lost each year due to pests, weeds, and pathogens, with the damaging Fall armyworm (FAW) among the most significant threats. These challenges are intensified by climate change and pose substantial risks to vital crops such as maize, banana, wheat, and coffee, affecting household incomes, global food security, and national economies. This pressing situation underscores the critical need for effective crop protection solutions to mitigate these risks and safeguard agricultural productivity.

There is an increased demand for crop protection chemicals market as farmers seek reliable methods to combat pests and diseases, ensuring stable yields and protecting agricultural production. This growth in the market is driven by the necessity for advanced formulations and technologies capable of efficiently managing evolving pest pressures while promoting sustainable agricultural practices. Therefore, the ongoing requirement to shield crops from diverse threats continues to stimulate innovation and investment in the global crop protection chemicals market.

To Understand More About this Research: Request a Free Sample Report

The expansion of agriculture into uncultivated areas, including marginal lands, is driving an increased demand for crop protection chemicals. As farming extends into these new environments, often characterized by challenging conditions such as poor soil quality or harsh climates, the risk of pest infestations and disease outbreaks rises. This rising risk of pests and diseases propels the demand for crop protection chemicals market.

Crop Protection Chemicals Market Drivers and Trends

Increasing Population and Rising Food Demand

Market CAGR for crop protection chemicals is being driven by the rising world’s population with projections from the Department of Economic and Social Affairs (UN) indicating an increase of 8.6 billion by 2030, 9.8 billion by 2050, and 11.2 billion by 2100. This continuous growth in population has boosted the demand for increased food production. As more people require nutrition, the pressure on farmers to maximize crop yields becomes more prominent. Crop protection chemicals offer solutions to mitigate the detrimental effects of pests, diseases, and weeds that threaten crop health and productivity. By effectively managing these challenges, farmers can safeguard their yields and contribute to overall food security on a global scale.

There is also a rising need for nutrient-rich and environmentally friendly food options due to increasing health consciousness, socio-economic shifts, rising incomes, and swift urbanization.

Adoption of Technologically Advanced Agriculture Practices

Advancements in agricultural practices, particularly the adoption of genetically modified organisms (GMOs) and precision farming techniques, have revolutionized modern agriculture. GMOs are engineered to resist pests, diseases, and herbicides, thereby enhancing crop resilience and yield potential. This genetic modification often necessitates the use of specific herbicides or pesticides that are designed to work in tandem with these crops, ensuring effective protection against targeted threats while minimizing collateral damage to non-target organisms. The demand for crop protection chemicals rises as farmers seek to optimize the performance of GMO crops and maintain their productivity under varying environmental conditions.

Another key advancement is precision farming, which involves the use of technology such as GPS, sensors, and data analytics to precisely manage crop inputs like water, fertilizers, and pesticides. This targeted approach enables farmers to apply crop protection chemicals only where and when they are needed, reducing wastage and environmental impact. However, the adoption of precision farming often requires advanced chemical formulations that can be applied in precise quantities and timings, driving further demand for specialized crop protection products and these solutions driving the crop protection chemicals market revenue.

Crop Protection Chemicals Market Segment Insights

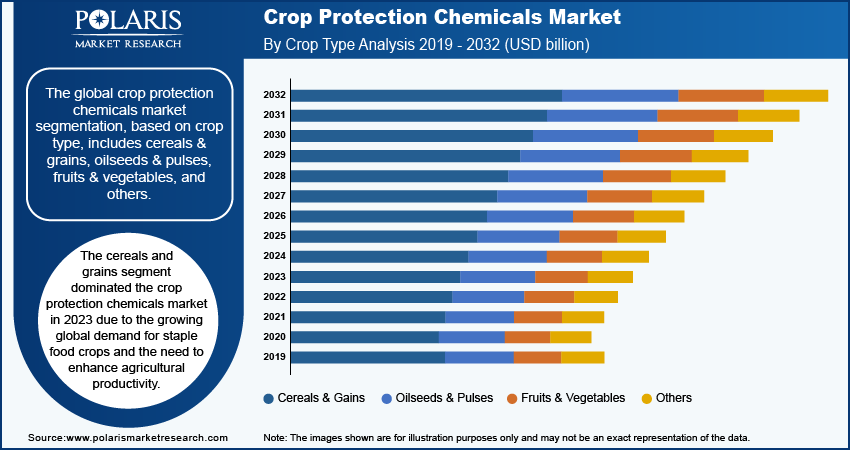

Crop Protection Chemicals Breakdown by Crop Type Insights

The global crop protection chemicals market segmentation, based on crop type, includes cereals & grains, oilseeds & pulses, fruits & vegetables, and others. The cereals and grains segment dominated the crop protection chemicals market in 2023. Cereals and grains are essential for both human and livestock consumption. Staple crops such as wheat, rice, corn, and barley drive considerable demand for effective crop protection solutions. These crops are highly susceptible to pests, diseases, and weeds, requiring extensive use of herbicides, insecticides, and fungicides. In May 2023, according to estimates by the Ministry of Agriculture & Farmers Welfare for the 2022-23 period, wheat production was projected to reach 112.7 million tons (MT), reflecting a 5-million-ton increase from the previous year. Similarly, rice production is anticipated to rise to 135.5 million tons (MT), showing an increase of 6 million tons compared to the previous year. These estimates highlight significant growth in both wheat and rice production, contributing to the demand for crop protection chemicals for cultivation.

Their widespread cultivation and economic importance intensify the necessity for crop protection chemicals, as any yield reduction directly affects food supply chains and market stability.

Crop Protection Chemicals Type Insights

The global crop protection chemicals market segmentation, based on type, includes herbicides, insecticides, fungicides & bactericides, and others. The herbicides segment held the largest revenue share of the market in 2023. Herbicides play a critical role in controlling weeds, which compete with crops for essential resources such as nutrients, water, and sunlight, significantly affecting crop productivity. For instance, Glyphosate is widely recognized for its efficacy in managing a wide range of weeds and commands a substantial market share, with annual sales reaching billions of dollars globally. Its extensive use is particularly notable in countries such as the US, Brazil, and Argentina, where large-scale industrial farming prevails.

Another example is atrazine, widely used in corn cultivation to effectively control weeds and boost crop yields, particularly in the US, the globally utilized in corn production. Atrazine's adaptability to diverse climatic and soil conditions has contributed to its widespread adoption, reinforcing the dominance of herbicides in the market. Additionally, the introduction of herbicide-resistant crops as Roundup Ready soybeans has further boosted herbicide utilization. These genetically modified crops can withstand specific herbicides, enabling farmers to manage weed growth more efficiently without harming their crops.

Crop Protection Chemicals Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is anticipated to hold the largest revenue share in the forecast period of 2024 - 2032. This growth is driven by the region's extensive agricultural sector and the growing urgency to improve crop yields for a rapidly expanding population. With Asia Pacific hosting more than 60% of the global population, countries such as China and India are at the forefront of agricultural production. Agriculture plays a crucial role in these economies, necessitating reliable crop protection solutions to safeguard food security and maintain economic resilience.

The region faces significant challenges from pests and diseases due to its diverse climatic conditions, further boosting the demand for effective crop protection chemicals.

The crop protection chemicals market in Latin America held the significant revenue share of the market, due to the region's extensive and diverse agricultural landscape. Countries including Brazil and Argentina are major global producers of key crops such as soybeans, sugarcane, corn, and coffee, driving substantial demand for these chemicals. The humid and subtropical climates in much of Latin America create ideal conditions for diseases and pests, necessitating effective crop protection measures to ensure high yields and quality. For instance, threats like soybean rust and the fall armyworm require robust chemical management. The region's integration into global agricultural markets through favorable trade policies further boosts demand, as rigorous pest and disease management is crucial to meet international quality standards for export crops.

Crop Protection Chemicals Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the crop protection chemicals market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the crop protection chemicals industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global crop protection chemicals industry to benefit clients and increase the market sector. In recent years, the crop protection chemicals industry has offered some technological advancements. Major players in the crop protection chemicals market include Albaugh LLC; American Vanguard Corporation; BASF SE; Bayer AG; Chr. Hansen A/S; Corteva; FMC Corporation; Gowan Company; Koppert; Kumiai Chemical Industry Co., Ltd; Nufarm; PI Industries; Sumitomo Chemical Co., Ltd; and Syngenta Group, UPL.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. In October 2023, BASF is constructing a new fermentation plant in Ludwigshafen to produce biological and biotechnology-based crop protection products, aiming for commissioning in the second half of 2025.

Bayer AG is a multinational conglomerate with core competencies in Life Sciences, encompassing healthcare and agriculture. The company has evolved into a global powerhouse with a diverse portfolio of products and solutions to improve lives and address some of the world's most pressing challenges. It is advancing medical science and enhancing patient well-being in the healthcare sector. In April 2024, Bayer plans to introduce its first bioinsecticide for arable crops in 2028 through an exclusive agreement with AlphaBio Control, aiming to enhance pest management while supporting sustainability goals.

List of Key Companies in Crop Protection Chemicals Market

- Albaugh LLC

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Chr. Hansen A/S

- Corteva

- FMC Corporation

- Gowan Company

- Koppert

- Kumiai Chemical Industry Co., Ltd

- Nufarm

- PI Industries

- Sumitomo Chemical Co., Ltd

- Syngenta Group

- UPL

Crop Protection Chemicals Industry Developments

- May 2024: Stara launched Latin America's first crop protection sprayer featuring ONE SMART SPRAY's precision weed management system, integrating Bosch's technology and Xarvio Digital Farming Solutions for efficient herbicide application.

- January 2024: Syngenta and Enko accelerated agricultural innovation with novel chemistry for fungal disease control in crops, leveraging AI and DNA-encoded libraries to expedite R&D discovery.

- January 2024: BASF plans to launch six new crop protection active ingredients in Brazil, aiming to introduce 24 new products and bolster its solutions for Brazilian agriculture.

Crop Protection Chemicals Market Segmentation

By Type Outlook

- Herbicides

- Insecticides

- Fungicides & Bactericides

- Other

By Origin Outlook

- Synthetic

- Biopesticides

By Form Outlook

- Liquid

- Solid

By Application Outlook

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Other

By Crop Type Outlook

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Crop Protection Chemicals Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 75.24 billion |

|

Market Size Value in 2024 |

USD 78.74 billion |

|

Revenue Forecast in 2032 |

USD 118.12 billion |

|

CAGR |

5.2% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global crop protection chemicals market size was valued at USD 75.24 billion in 2023 and is projected to grow to USD 118.12 billion in 2032.

The global market is projected to grow at a CAGR of 5.2% during the forecast period, 2024-2032.

Asia Pacific had the largest share of the global market.

The key players in the market are Albaugh LLC; American Vanguard Corporation; BASF SE; Bayer AG; Chr. Hansen A/S; Corteva; FMC Corporation; Gowan Company; Koppert; Kumiai Chemical Industry Co., Ltd; Nufarm; PI Industries; Sumitomo Chemical Co., Ltd; Syngenta Group; and UPL.

The cereals & grains category dominated the market in 2023.

The herbicides had the largest share in the global market.