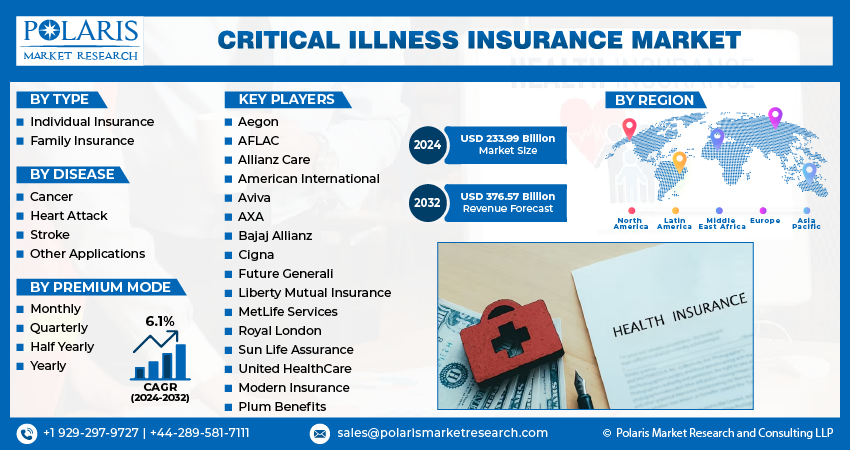

Critical Illness Insurance Market Size, By Type (Individual Insurance, Family Insurance); By Application; By Premium Mode; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3338

- Base Year: 2023

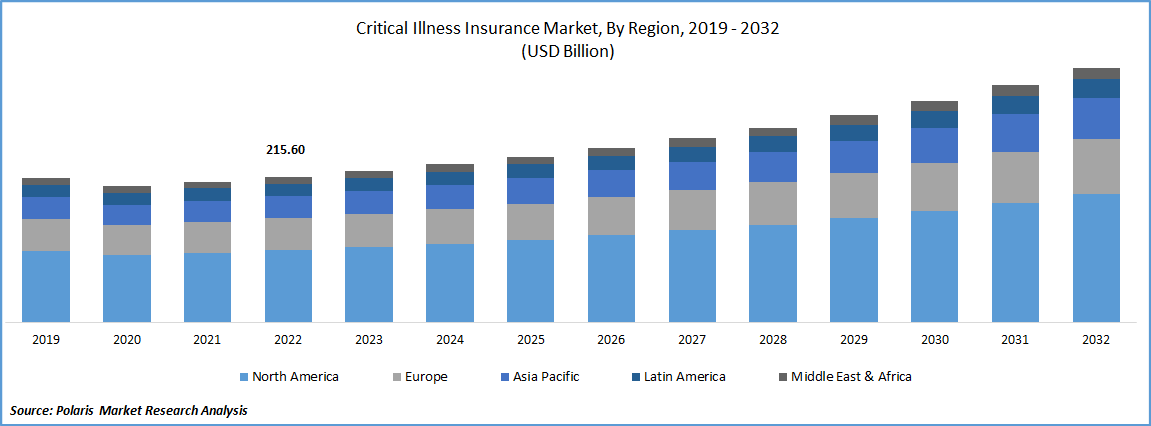

- Historical Data: 2019-2022

Report Outlook

The critical illness insurance market was valued at USD 224.19 billion in 2023 and is expected to grow at a CAGR of 6.1% during the forecast period. The global market is growing as more individuals seek comprehensive coverage for potential medical and financial challenges as it offers financial protection to policyholders diagnosed with severe medical conditions listed in the policy. This coverage helps in reduction of the financial burden associated with medical expenses, lost income, and other costs that arise from a critical illness. It's crucial to note that these insurances are differ from life insurance, as it provides support during the policyholder's lifetime, rather than to their family after their passing and becoming the factor of market growth.

To Understand More About this Research: Request a Free Sample Report

Moreover, the global market provides financial assistance for the costly treatment and recovery of severe disorders. Various products are available that are linked to pre-determined lists of diseases selected by separate companies. Critical illness plans can supplement existing health insurance policies, and they offer numerous advantages such as simplified paperwork, easy claims settlement, tax benefits, coverage for all hospitalization costs, and the ability to purchase extra riders. Due to these benefits, the global market is expanding rapidly. For instance, In November 2022, PolicyMe and Canadian Premier Life Insurance Company are partnering to release Canada's most comprehensive critical illness insurance plan, covering 44 conditions, exceeding the standard Canadian insurer, and complementing policyme's core term life insurance service.

The research report offers a quantitative and qualitative analysis of the critical illness insurance market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The covid-19 pandemic has had a intense impact on people's lives, causing financial and health challenges and triggering an economic recession. As a result, the market has also suffered with a sharp decline in sales revenue due to disrupted supply chains and financial difficulties. However, leading companies are making their insurance plans more attractive by offering coverage for sars-cov-2 diagnoses. Furthermore, the pandemic has led to a surge in demand for term plans, which is driving market growth at rapid pace.

Industry Dynamics

Growth Drivers

The surge in unhealthy lifestyle habits has resulted in a rise in severe illnesses such as cancer and heart attacks, which are not often covered by standard health insurance policies. As a result, consumers are turning to critical illness insurance to cover their medical bills, hospitalization fees, and related expenses. Besides, the increasing prevalence of diseases such as brain tumors and cardiovascular diseases is also driving the demand for critical illness policies and driving the global critical illness insurance market rapidly.

Furthermore, the market is also poised for growth due to the hassle-free cashless medical treatment experience it provides to policyholders, as well as the sense of security it offers by eliminating concerns about paying costly medical bills. The reimbursement process is also seamless and insured individuals may even be eligible for cashless treatment at top-rated hospitals, ensuring they receive optimal care. The resulting smooth remuneration process and peace of mind provided by critical illness insurance coverage are anticipated to create substantial growth opportunities for the market in the coming years.

Report Segmentation

The market is primarily segmented based on by type, application, premium mode, end-user, and region.

|

By Type |

By Disease |

By Premium Mode |

By Region |

|

|

|

|

For Specific Research Requirements: Request for Customized Report

The Individual Insurance Segment Dominated the Market in 2022

The individual insurance segment dominated the market owing to the significant facilities offered contains flexibility to select their insurance provider, customize their coverage, and switch plans during open enrollment, additionally, individuals can purchase this insurance as a standalone policy or as a rider to their existing life insurance policy, providing financial security and peace of mind in case of a serious illness. As it is essential to carefully review policy terms and coverage options before buying a critical illness policy and seek advice from a financial advisor or insurance professional to ensure that it aligns with the individual's needs and budget.

Moreover, the family insurance segment has accounted for rapid growth due to its cost-effectiveness compared to individual health insurance. With family insurance plans, customers can provide coverage for multiple family members at a lower cost with better conditions, making it a more affordable option. These policies often include wellness benefits and health screening programs, which can prevent serious illnesses and help manage health more effectively. The increasing demand for policies that cover the primary policyholder, their partner, and dependent children under a single policy is driving the growth of the global market.

The Cancer Segment Generated the Largest Revenue in 2022

The cancer segment generated the largest revenue over the anticipated period. This can be attributed to the fact that cancer is a widespread disease with a high incidence rate globally and is among the leading cause of death and disability. The treatment of cancer is often accompanied by a significant financial burden, which has resulted in the high demand for insurance policies that provide coverage for cancer-related conditions. This trend is expected to continue as the incidence of cancer continues to rise worldwide.

Moreover, the heart attack segment is expected to experience significant growth due to the cumulative impact on various factors. These include an aging population, which has been linked to an increased incidence of heart attacks, an unhealthy lifestyle that includes poor dietary habits, lack of physical activity, and tobacco and alcohol consumption. Other risk factors, such as diabetes and hypertension, are also becoming increasingly prevalent worldwide and contribute to the growth of this segment. Advancements in medical technology and treatment options, such as novel drugs, medical devices, and innovative surgical procedures, may help prevent, manage, or treat heart attacks, thereby further contributing to the growth of this market at rapid pace.

The Monthly Premium Segment is Projected to Account for a Substantial Revenue Share During Forecast Period

The monthly premium segment is projected to account for a substantial revenue share owing to various factors including increasing demand for comprehensive insurance coverage for critical illnesses requiring higher premiums, making the monthly premium option attractive and the monthly payment option offers greater flexibility to customers. Furthermore, technological advancements like AI-enabled underwriting and personalized risk assessments make it easier for insurers to offer more tailored coverage options, resulting in higher levels of satisfaction and loyalty, driving the growth of global market rapidly.

Furthermore, the yearly premium segment is accounted for the fastest growth due to several factors, such as the preference of customers for annual premium payments, which often include discounts. The yearly premium segment also offers more predictability to both customers and insurers, allowing insurers to forecast revenue and plan business operations more accurately. In addition, insurers benefit from cost savings resulting from the reduction in administrative expenses associated with processing monthly payments. Furthermore, customers who opt for yearly premiums tend to remain with the insurer for longer periods, which increases long-term profitability, contributing to segment growth.

North America Dominated the Global Market in 2022

North America dominate the global market due to the increasing prevalence of chronic diseases, rising healthcare costs, and an increasing awareness of the importance of health insurance. In addition to cancer, heart disease and stroke are also prevalent in the region, resulting in significant medical expenses that this insurance can help cover. The market is also growing due to advancements in medical technology, which have led to higher survival rates for critical illnesses.

Furthermore, the Asia Pacific region is anticipated to experience remarkable growth in the global market due to various factors. One of the primary factors is the growing elderly population, and with the large populations in some countries. Furthermore, the commercial health insurance market has expanded rapidly in the region since the implementation of a new phase of medical care system reforms in 2009, which included the establishment of a well-funded social medical insurance program.

Competitive Insight

Major players operating in the global critical illness insurance market Aegon, AFLAC, Allianz Care, American International, Aviva, AXA, Bajaj Allianz, Cigna, Future Generali, Liberty Mutual Insurance, MetLife Services, Royal London, Sun Life Assurance, United HealthCare, Modern Insurance, and Plum Benefits.

Recent Developments

- In May 2022, Aflac has launched a revamped version of its Aflac Group Critical Illness Insurance to provide better support for employees' changing needs in the aftermath of the COVID-19 pandemic. The updated product offers more standard and optional benefits for employers.

- For instance, in November 2020, The Revised Industry Standard Definitions of Critical Illness were launched through a collaboration between the China Medical Doctor Association and the Insurance Association of China. These definitions were formulated after conducting a thorough analysis of 400 million policies and claims and 2,900 clinical illness products across the industry.

- In January 2020, Mumbai's HDFC Ergo, a general insurance company, has acquired a 50.08% stake in India's Apollo Munich Health Insurance for a sum of $183 million (equivalent to 1,494 crore rupees). By combining the strengths of both companies, the acquisition aims to offer enhanced value to their customers. Apollo Munich Health Insurance is an insurance company based in India.

Critical Illness Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 233.99 billion |

|

Revenue forecast in 2032 |

USD 376.57 billion |

|

CAGR |

6.1% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By Premium Mode, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Aegon, AFLAC INCORPORATED, Allianz Care, American International Group, Inc., Aviva, AXA, Bajaj Allianz General Insurance Co. Ltd., Cigna, Future Generali India Insurance Company Ltd., Legal & General Group plc, Liberty Mutual Insurance, MetLife Services and Solutions, LLC., Royal London, Sun Life Assurance Company of Canada, United HealthCare Services, Inc., Modern Insurance Agency, Inc., Plum Benefits Private Limited. |

Want to check out the critical illness insurance market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

FAQ's

key companies in critical illness insurance market are Aegon, AFLAC, Allianz Care, American International, Aviva, AXA, Bajaj Allianz, Cigna, Future Generali, Liberty Mutual Insurance, MetLife Services, Royal London.

The critical illness insurance market expected to grow at a CAGR of 5.93% during the forecast period.

The critical illness insurance market report covering key segments are type, disease, premium mode and region.

key driving factors in critical illness insurance market are increase in the range of critical illnesses covered in critical illness insurance policies

The global critical illness insurance market size is expected to reach USD 376.57 billion by 2032.