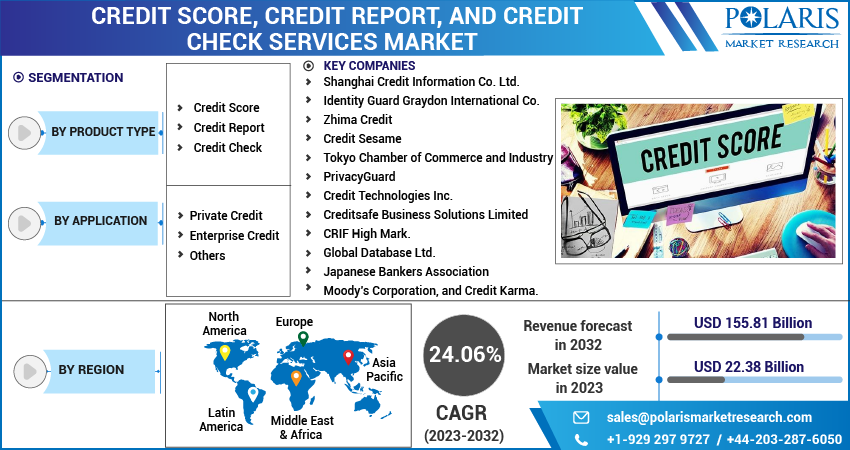

Credit Score, Credit Report, and Credit Check Services Market Share, Size, Trends, Industry Analysis Report, By Product Type (Credit Score, Credit Report, and Credit Check); By Application; By Region; Segment Forecast, 2023- 2032

- Published Date:Jun-2023

- Pages: 115

- Format: PDF

- Report ID: PM3422

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

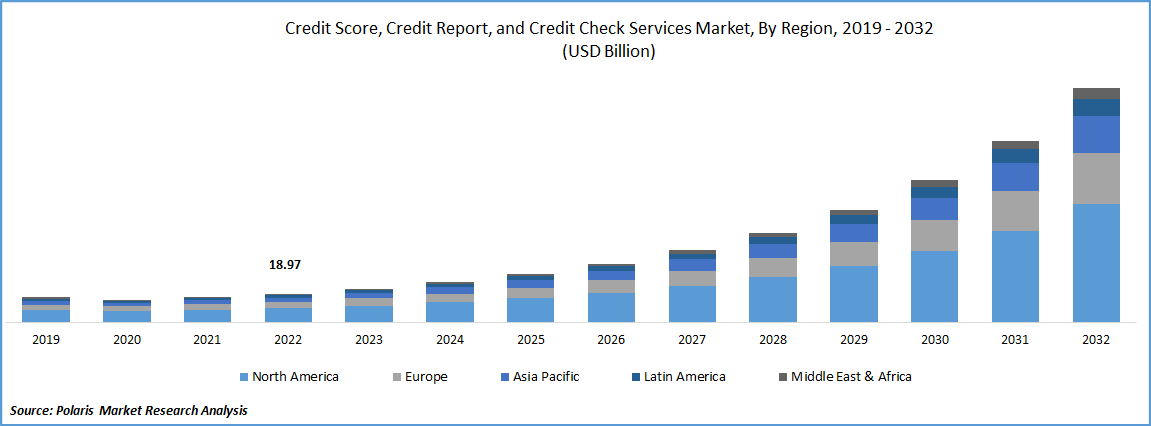

The global credit score, credit report, and credit check services market was valued at USD 18.97 billion in 2022 and is expected to grow at a CAGR of 24.06% during the forecast period. The growing demand for credit reports and other related services from both consumers and lenders in the recent past years, as it helps lenders to easily evaluate the target customer whether to provide the lending facility or not and helping consumers to get know about what credit offer, they have on their hand, that is positively influencing the global market demand and growth. Additionally, with the rapid emergence of credit or lending services globally, which allow to reach these services almost every corner of the globe where the internet is accessible coupled with the rising penetration for smartphones among global population, has also been propelling the market growth.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces credit score, credit report, and credit check services market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

To Understand More About this Research: Request a Free Sample Report

For instance, in November 2022, FICO, a leading California-based analytics software firm, announced the launch of FICO Score in India in partnership with Lenddo, that will help Indian lenders in assessing the risk with greater precision. The service will further provide them the flexibility so that they could extend credit to more people.

Moreover, AI and machine learning algorithms are gaining traction and being widely used to analyze vast amounts of data and generate more accurate credit scores. These algorithms can identify patterns in consumer behavior that traditional credit scoring models may miss, while enabling lenders to make more informed lending decisions.

The outbreak of the COVID-19 pandemic has had a mixed impact on the growth of the credit score, credit report, and credit check services market. On one hand, the pandemic has also led to an increased demand for credit services, as consumers seek to manage their finances and access credit during challenging time, which fueled the demand for these services. However, it caused a global economic downturn, which has led to job losses, reduced income, and financial hardship, resulted in late payments, delinquencies, and defaults, that negatively impacted the market.

For Specific Research Requirements, Request for a Sample Report

Industry Dynamics

Growth Drivers

Large number of major fintech companies across the globe are replacing the traditional credit scoring industry with innovative solutions that use alternative data sources to assess creditworthiness including analyzing social media activity, online shopping behavior, and even smartphone usage patterns to build a more comprehensive picture of a consumer's creditworthiness and potential for getting credit, which is fueling the global credit score, credit report, and credit check services market growth at rapid pace. Furthermore, there is a growing recognition regarding the importance of financial education and credit literacy. As a result, many companies globally are now offering resources and tools to help consumers better understand credit and improve their credit scores, that is further anticipated to drive the demand for these service/solutions worldwide.

Report Segmentation

The market is primarily segmented based on product type, application, and region.

|

By Product Type |

By Application |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

Credit score segment accounted for the largest market share in 2022

The credit score segment garnered major global share in 2022. The demand and growth of the segment market can be largely attributed to significant advancements in the technology which have made it easier for customers to check their credit scores conveniently along with this, governments and regulatory bodies in various countries have introduced several regulations that require lenders to carry out credit checks on borrowers, which fuels the need for credits score checking facilities.

Various leading lenders such as banks and credit card companies, rely heavily on credit scores to evaluate the creditworthiness of potential borrowers because they require accurate and up-to-date information to make informed lending decisions. As a result, the demand for credit score services from lenders has also contributed to the growth of the segment market.

The credit report segment is expected to exhibit significant growth rate over the coming years, which is mainly driven by continuous rise in consumer spending and the easy availability of credit across the globe. Moreover, growing use of credit reports by lenders to evaluate the eligibility of borrowers before granting loans, which has made credit reports a vital part of the lending process and experiencing drastic growth in the recent years.

Private credit segment is expected to witness highest growth during forecast period

The private credit segment is projected to grow at a highest CAGR during the course of study period, mainly due to numerous factors including easy availability of credit to customers for fulfilling their needs and requirements, regulatory changes, surge in the competition, and constant technological advancements. Additionally, due to easy access to credit facilities that are being offered by numerous companies with very few steps or processes, customers are spending more and more and are also opting for expensive or luxury things which they can’t afford normally, thereby fueling the growth of the segment market.

The enterprise credit segment led the industry market with significant revenue share in 2022, that is highly attributable rise in the number of businesses seeking to reduce their risk exposure and mitigate the likelihood of bad debt, which is likely to fuel the prevalence for credit risk assessment services. As, these services help businesses assess their potential customers and partners, while enabling them to make more informed decisions about lending, financing, and other credit-related activities.

North America region dominated the global market during 2022

The North America region dominated the global market with substantial share in 2022, and is projected to maintain its dominance throughout the forecast period. The rising consumer awareness regarding the importance of maintaining good credit score and regularly monitoring their credit reports coupled with this, continuous expansion in the North American economy, which results in a greater number of people are seeking for credit products like loans and credit cards, which are the major factors boosting the market growth.

The Asia Pacific region is anticipated to be the fastest growing region with a healthy CAGR during the projected period, owing to continuous increase in the credit demand mainly in emerging economies like China, India, and Malaysia along with the surge in the number of lenders and financial institutions in the APAC region. Apart from this, the shift towards the digitalization in the financial services sector, which has made it easier for consumers to access credit score, credit report, and credit check services online without any kind of troubles, is also likely to foster the regional market growth.

For instance, according to our findings, the demand for personal loans reported an increase of over 109% year-on-year as compared to the growth rate of around 91% in the same period of 2021m and the inquiry volumes for the credit cards increased by approx. 102% compared to growth rate of 33% in the corresponding quarter of previous year.

Competitive Insight

Some of the major players operating in the global market include Shanghai Credit Information, Identity Guard Graydon, Zhima Credit, Credit Sesame, PrivacyGuard, Credit Technologies Inc., Creditsafe Business Solutions, CRIF High Mark., Global Database, Japanese Bankers Association, Moody’s Corporation, and Credit Karma.

Recent Developments

- In November 2022, Experian, introduced its new service to check the credit score on WhatsApp. They can easily check their Experian credit report, can easily detect fraud, re-build their credit score, & track irregularities, while enabling them to gain control of their credit profile. It allows Indian customers go check their credit scores in real-time and help them to make informed credit decisions.

- In April 2021, Fullerton India, a leading non-banking financial institution with branched across all over India, unveiled its free credit score service online for their customers. It is a quite easy and simple process allowing customers to check their credit score for free with Company credit score tracker by just providing a few personal and financial details.

Credit Score, Credit Report, and Credit Check Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 22.38 billion |

|

Revenue forecast in 2032 |

USD 155.81 billion |

|

CAGR |

24.06% from 2023– 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Shanghai Credit Information Co. Ltd., Identity Guard Graydon International Co., Zhima Credit, Credit Sesame, Tokyo Chamber of Commerce and Industry, PrivacyGuard, Credit Technologies Inc., Creditsafe Business Solutions Limited, CRIF High Mark., Global Database Ltd., Japanese Bankers Association, Moody’s Corporation, and Credit Karma. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the credit score, credit report, and credit check services market report with a phone call or email, as and when needed.

FAQ's

key companies in credit score, credit report, and credit check services market are Shanghai Credit Information, Identity Guard Graydon, Zhima Credit, Credit Sesame, PrivacyGuard.

The global credit score, credit report, and credit check services market is expected to grow at a CAGR of 24.06% during the forecast period.

The credit score, credit report, and credit check services market report covering key segments are product type, application, and region.

key driving factors in credit score, credit report, and credit check services market are rising recognition regarding the importance of financial education.

The global credit score, credit report, and credit check services market size is expected to reach USD 155.81 billion by 2032.