Crane Rental Market Size, Share, Trends, Industry Analysis Report: By Type (Mobile Cranes and Fixed Cranes), Weight Lifting Capacity, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5162

- Base Year: 2024

- Historical Data: 2020-2023

Crane Rental Market Overview

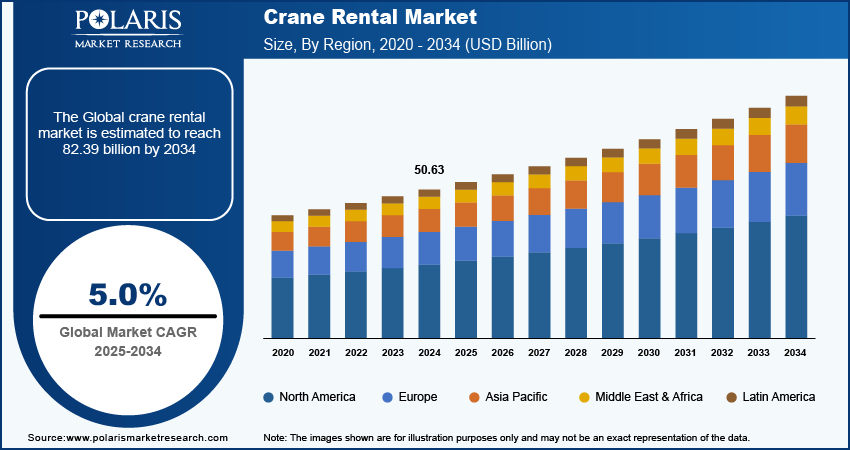

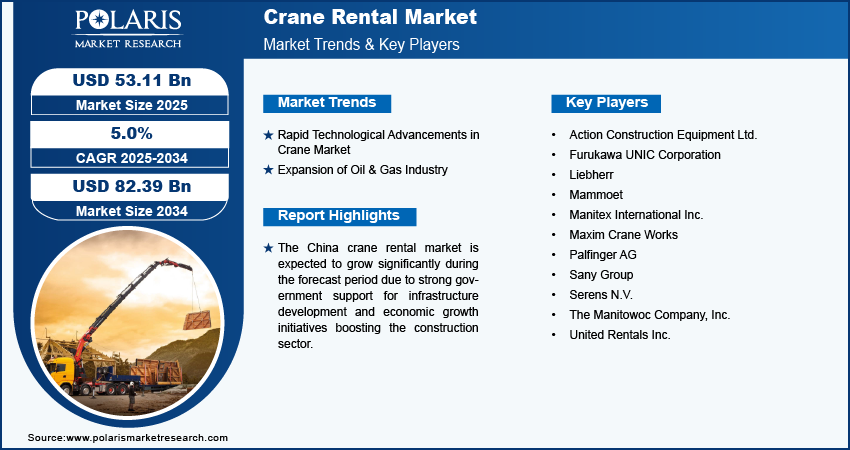

The global crane rental market size was valued at USD 50.63 billion in 2024. The market is projected to grow from USD 53.11 billion in 2025 to USD 82.39 billion by 2034, exhibiting a CAGR of 5.0% during 2025–2034.

The crane rental market involves the leasing of cranes for various construction and industrial activities. Renting cranes is more cost-effective for companies than purchasing, especially for short-term projects or projects requiring specialized cranes, which reduces maintenance costs. Furthermore, renting cranes provides construction companies with the flexibility to scale their equipment needs according to project requirements, offering a practical solution for varying project sizes and durations. These benefits of rental cranes are driving the market growth.

To Understand More About this Research: Request a Free Sample Report

The growing transportation sector is driving the demand for infrastructure projects such as highways, bridges, and railways, boosting the rental crane market growth. Furthermore, the rising iron & metal industry requires heavy lifting and material handling, which is significantly driving the market growth.

Crane Rental Market Trends

Rapid Technological Advancements in Crane Market

Technological advancements in the crane market such as electric cranes are transforming the industry by introducing more efficient and sustainable lifting solutions. Moreover, companies are launching electric cranes featuring advanced battery technology and IoT integration, driving efficiency and sustainability in the crane rental market. In February 2023, ACE launched India's first fully electric mobile crane, the country's largest indigenous mobile crane with a 180-tonne lifting capacity, and the first self-propelled aerial work platforms in India. Electric cranes produce lower emissions and less noise pollution than traditional diesel-powered cranes, which is driving significant innovation in the market. Thus, the surge in the adoption of advanced cranes for construction activities across various regions enhances the demand for crane rentals, leading to robust market expansion. Furthermore, the shift toward automation and the incorporation of IoT (Internet of Things) in electric cranes are enhancing their operational capabilities, including remote monitoring and predictive maintenance. Such technological advancements drive the market growth.

Expansion of Oil & Gas Industry

The oil & gas industry is reporting the rising production of oil and gas. For instance, in December 2021, U.S. oil production reached 11.7 million barrels per day, with natural gas gross withdrawals at 120.0 billion cubic feet per day, by December 2022, oil output increased to 12.1 million b/d, and natural gas production rose to 121.1 Bcf/d. The increasing demand for energy is significantly boosting activities such as exploration, drilling, and production in onshore and offshore environments. These activities require heavy lifting and precise material handling, making cranes an essential part of the operations. Rental cranes provide a flexible and cost-efficient solution for oil and gas companies. Consequently, the growth and expansion of the oil & gas sector significantly contribute to the robust development of the rental crane market.

Crane Rental Market Segment Insights

Crane Rental Market – Type Insights

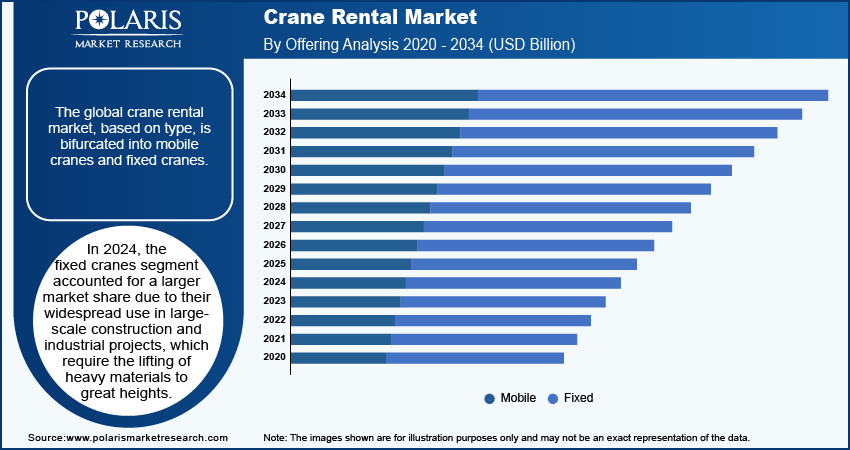

The global crane rental market segmentation, based on type, includes mobile cranes and fixed cranes. In 2024, the fixed cranes segment accounted for a larger market share due to their widespread applications in large-scale construction and industrial projects, which require the lifting of heavy materials to great heights. Furthermore, the increasing activity in the steel industry is significantly boosting the demand for fixed cranes. For instance, in December 2023, according to the US Census Bureau, between October and November 2023, the US imported steel worth USD 4.9 billion, which weighed 3.8 million metric tons. Steel manufacturing and processing plants often require the lifting and movement of heavy steel materials. Thus, the rising adoption of fixed cranes in the steel industry is driving the crane rental market growth for the segment.

Crane Rental Market – End-Use Industry Insights

The global crane rental market segmentation, based on end-use industry, includes buildings & constructions, infrastructure, oil & gas, mining & excavation, transportation, marine & offshore, and others. The buildings & constructions segment is expected to be the fastest-growing market segment due to rapid urbanization, increased investments in residential and commercial real estate, and the development of large-scale infrastructure projects worldwide. According to the US Department of Commerce, in June 2024, construction spending totaled USD 2,148.4 billion. This represents a 6.2% increase from the June 2023 data. For the first half of 2024, spending amounted to USD 1,034.8 billion, an 8.6% increase from the same period in 2023. Thus, with the expanding cities and an increasing number of new developments, the buildings & constructions segment continues to drive significant growth in the crane rental market.

Regional Insights

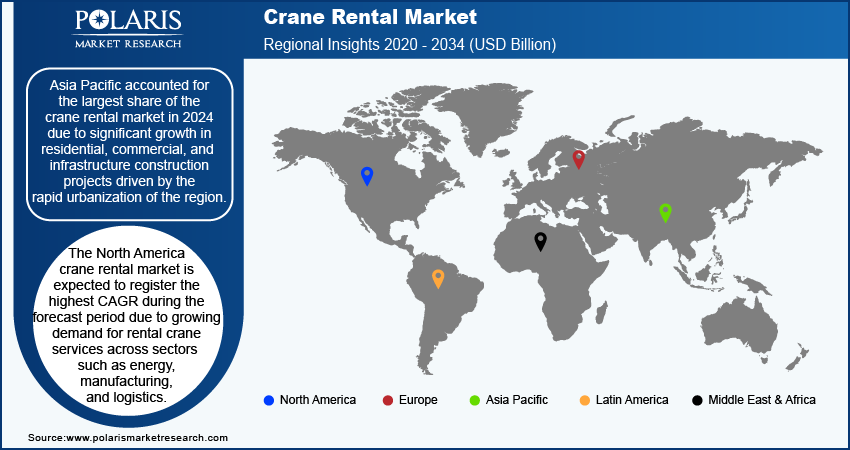

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest share of the crane rental market in 2024, driven by significant growth in residential, commercial, and infrastructure construction projects due to the rapid urbanization of the region. As a result, there has been a substantial demand for cranes to support the ongoing construction and development activities. In February 2024, according to Invest India, the Indian government aims to develop a 0.2million-km national roadway network by 2025, increase airports to 220, and operationalize 23 waterways by 2030. The report shows a significant increase in infrastructure-related development costs, from around USD 444 million in Fiscal Year 2023 to USD 600 million in Fiscal Year 2024. This rapid urbanization and increased government investments have led to more infrastructure development, driving the crane rental market in the region.

The China crane rental market is expected to grow significantly during the forecast period due to strong government support for infrastructure development and economic growth initiatives boosting the construction sector, which propels the demand for crane rentals across the country.

The North America crane rental market is expected to register the highest CAGR during the forecast period due to sectors such as energy, manufacturing, and logistics, significantly contributing to the growing demand for rental crane services. Cranes in the energy sector are indispensable for constructing and maintaining heavy and complicated equipment in oil and gas operations, as well as for installing large components in renewable energy projects such as wind turbines and solar panels. Similarly, the manufacturing sector relies on cranes for the assembly, installation, and maintenance of large machinery and equipment, supporting production processes and facility expansions. Furthermore, the logistics sector utilizes cranes extensively for loading and unloading goods in warehouses, distribution centers, and ports. Thus, this increasing application of cranes drives their demand in a dynamic and rapidly evolving market in North America.

The US crane rental market is expected to grow significantly during the forecast period due to the ongoing economic recovery and growth of various sectors, including construction, manufacturing, and energy, leading to more construction and renovation activities.

Crane Rental Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the crane rental market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the market players must offer cost-effective products.

In recent years, the crane rental industry has offered some technological advancements. Major players in the crane rental market are Action Construction Equipment Ltd.; Furukawa UNIC Corporation, Liebherr; Mammoet; Manitex International Inc.; Maxim Crane Works; Palfinger AG; Sany Group; Serens N.V.; The Manitowoc Company, Inc.; and United Rentals Inc.

Sany Group is involved in the research, development, manufacturing, and sales of construction machinery across multiple continents. The company operates in six segments—excavation machinery, hoisting machinery, concrete machinery, pile-working machinery, and financial service and pavement machinery.

In March 2022, three SANY all-terrain cranes, including SAC2500S, SAC1600S, and SAC3000S, were supplied to Hareket, a hoisting machinery rental service company in Turkey with a robust global presence.

United Rentals, Inc. is an equipment rental company operating in two segments including general rentals and specialty. The general rentals segment offers a wide range of equipment, including skid-steer loaders, backhoes, forklifts, material handling equipment, earthmoving equipment, aerial work platforms (boom and scissor lifts), as well as general tools and light equipment such as pressure washers, water pumps, and power tools. These offerings cater to a diverse clientele, including construction and industrial companies, utilities, manufacturers, municipalities, homeowners, and government entities. In March 2024, United Rentals, Inc. added battery energy systems for tower cranes. Developed with Termaco, this system offers clean, sustainable power, reducing fuel consumption and equipment-related downtime for contractors.

Key Companies in Crane Rental Market Include

- Action Construction Equipment Ltd.

- Furukawa UNIC Corporation

- Liebherr

- Mammoet

- Manitex International Inc.

- Maxim Crane Works

- Palfinger AG

- Sany Group

- Serens N.V.

- The Manitowoc Company, Inc.

- United Rentals Inc.

Crane Rental Industry Developments

In October 2022, MYCRANE launched an online platform to enhance crane rental efficiency for the construction industry in North America with a new office in Houston, Texas.

In October 2023, MYCRANE has launched operations in Saudi Arabia, enhancing its crane rental services following successful funding. This expansion aligns with Saudi Arabia's growth plans, emphasizing efficient technology in the construction sector.

Crane Rental Market Segmentation

By Type Outlook

- Mobile Cranes

- Fixed Cranes

By Weight Lifting Capacity Outlook

- Low

- Low to Medium

- Heavy

- Extreme Heavy

By End Use Industry Outlook

- Buildings & Constructions

- Infrastructure

- Oil & Gas

- Mining & Excavation

- Transportation

- Marine & Offshore

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Crane Rental Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 50.63 billion |

|

Market Size Value In 2025 |

USD 53.11 billion |

|

Revenue Forecast by 2034 |

USD 82.39 billion |

|

CAGR |

5.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global crane rental market size was valued at USD 50.63 billion in 2024.

The global market is projected to register a CAGR of 5.0% during 2025–2034.

Asia Pacific held the largest share of the global market in 2024 due to rising government investments in infrastructure development

A few key players in the market are Action Construction Equipment Ltd.; Furukawa UNIC Corporation, Liebherr; Mammoet; Manitex International Inc.; Maxim Crane Works; Palfinger AG; Sany Group; Serens N.V.; The Manitowoc Company, Inc.; and United Rentals Inc

The fixed crane segment dominated the market in 2024 due to increasing activity in the steel industry.

The buildings & constructions segment held the largest share of the global market in 2024 due to rapid urbanization.