Cosmetic Surgery Market Size, Share, Trends, Industry Analysis Report: By Procedure (Invasive and Non-invasive), Equipment, Gender, Age Group, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1383

- Base Year: 2024

- Historical Data: 2020-2023

Cosmetic Surgery Market Overview

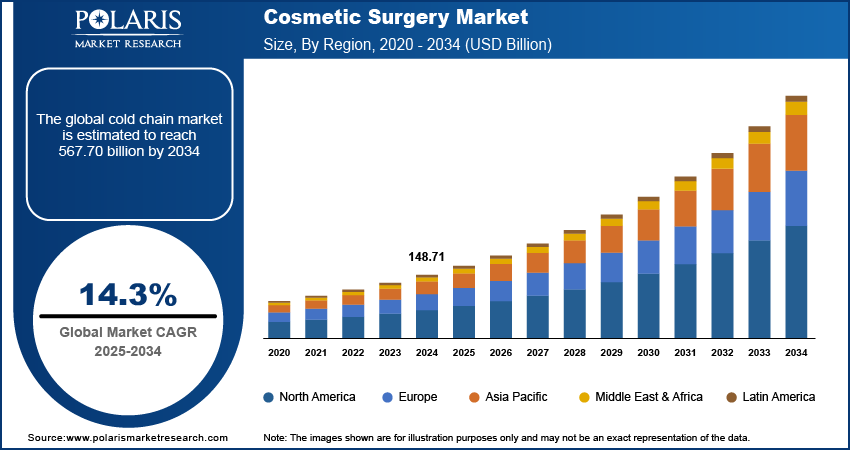

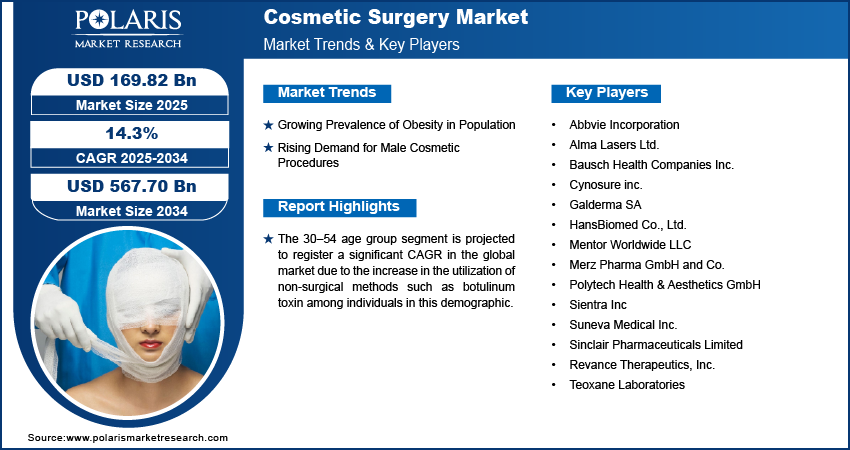

The global cosmetic surgery market size was valued at USD 148.71 billion in 2024. The market is projected to grow from USD 169.82 billion in 2025 to USD 567.70 billion by 2034, exhibiting a CAGR of 14.3% during the forecast period.

Cosmetic surgery, also known as aesthetic surgery, involves procedures altering a person's physical appearance. These procedures include body contouring, wrinkle reduction, hair restoration, varicose vein treatment, and breast augmentation. Both men and women have a range of cosmetic surgery options available to enhance and improve their overall confidence and comfort with their physical appearance. New innovative products and technological advances have driven cosmetic surgery market growth. For instance, in June 2022, Cynosure launched Picosure Pro, an advanced laser device designed for aesthetic procedures. The device administers energy in rapid pulses, utilizing pressure rather than heat for safe and efficient treatments. The Picosure Pro is specifically utilized to treat melasma pigment. Therefore, with these advancements in product technology, the growth of the cosmetic surgery market is being propelled.

To Understand More About this Research: Request a Free Sample Report

The cosmetic surgery market is driven by the growing adoption of plastic surgery, liposuction, tummy tuck (abdominoplasty), and others. For instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS), there was a 5.5% rise in surgical procedures, with a total of 15.8 million surgical and 19.1 million non-surgical procedures performed by plastic surgeons worldwide in 2023. The most common surgical procedure in 2023 was liposuction, with more than 2.2 million, followed by breast augmentation, eyelid surgery, rhinoplasty, and abdominoplasty. In non-surgical procedures, the botulinum toxin was most common, followed by hair removal, hyaluronic acid, non-surgical fat reduction, and non-surgical skin tightening. Therefore, these growing adoptions in surgical and non-surgical methods are driving the market growth.

Cosmetic Surgery Market Drivers and Trends

Growing Prevalence of Obesity in Population

The increasing prevalence of obesity in the population, which leads to an rise in the number of liposuction surgery cases, is driving the market growth. According to Trust for America's Health, the adult obesity rate in 2023 was 14.9% whereas, the number of liposuction cases also increased. For instance, The International Society of Aesthetic Plastic Surgery (ISAPS) reported that 2.2 million liposuction surgeries took place in 2023. Liposuction also became a common surgical procedure replacing breast augmentation, there were 1.8 million liposuction procedures carried out, demonstrating a substantial 29% increase in its popularity. Therefore, the prevalence of obesity in the population is driving market growth.

Rising Demand for Male Cosmetic Procedures

The prevalence and uptake of cosmetic procedures among men are steadily rising, primarily driven by age-related anxieties. Men are increasingly embracing these interventions to preserve a youthful appearance. The growing interest in non-surgical treatments like dermal fillers and botulinum toxin among men is driving market expansion. For instance, in 2023, The International Society of Aesthetic Plastic Surgery (ISAPS) reported a 6% increase in men’s cosmetic surgery, whereas body procedure surgery increased by 18% and face and neck procedure by 15%. Some popular procedures for men include hyaluronic acid fillers, non-hyaluronic acid fillers, laser hair removal, and laser skin resurfacing. Consequently, the rise in men's cosmetics is driving the market growth.

Cosmetic Surgery Market Segment Insights

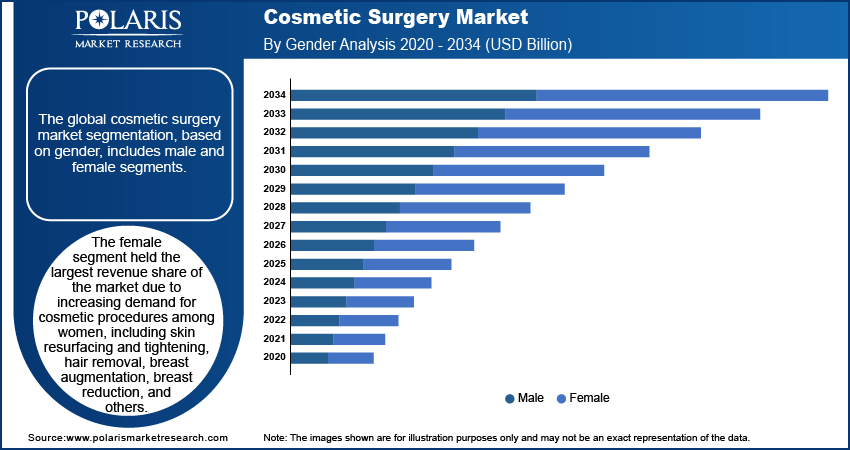

Cosmetic Surgery Market Analysis by Gender Insights

The global cosmetic surgery market segmentation, based on gender, includes male and female segments. The female segment held the largest revenue share of the market due to increasing demand for cosmetic procedures among women, including skin resurfacing and tightening, hair removal, breast augmentation, breast reduction, and others. Breast augmentation was the most frequently performed procedure by plastic surgeons worldwide. For instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS), in 2022, the aesthetic procedure performed on women accounted for 85.7%. The survey also reported that breast augmentation was the most common surgery performed in 2022, with a 29% increase.

Cosmetic Surgery Market Analysis by Age Group Insights

The global cosmetic surgery market segmentation, based on age group, includes 13–29, 30–54, and above 55. The 30–54 age group segment is projected to register a significant CAGR in the global market due to the increase in the utilization of non-surgical methods such as botulinum toxin among individuals in this demographic. Additionally, the increased consciousness of anti-aging and body contouring therapies among women in this age category is expected to drive market growth. For instance, according to the American Society of Plastic Surgeons (ASAPS), the age group of 35–50 held 43% of all cosmetic surgery procedures in 2022. The most common procedures were breast surgery, tummy tuck, liposuction, laser resurfacing botox, and xeomin.

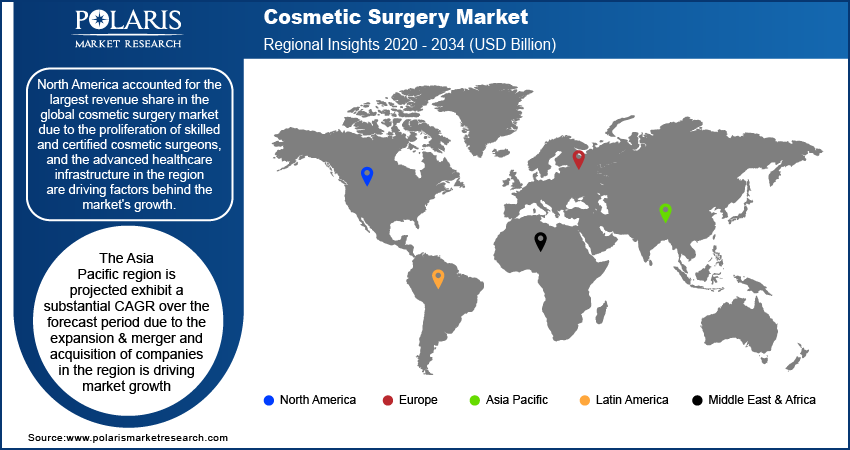

Cosmetic Surgery Regional Insights

By region, the study provides the cosmetic surgery market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest revenue share in the global cosmetic surgery market due to the proliferation of skilled and certified cosmetic surgeons, and the advanced healthcare infrastructure in the region are driving factors behind the market's growth. According to the American Society of Plastic Surgeons (ASAPS), more than 6.1 million cosmetic surgeries were performed in the region in 2023. Liposuction was the most performed surgery in the region in 2023, with a 7% increase, followed by breast augmentation with a 2% increase. Thus, the rise in the number of surgeries is driving market growth, thereby contributing to the dominance of North America in the global market.

The Asia Pacific region is projected exhibit a substantial CAGR over the forecast period due to the expansion & merger and acquisition of companies in the region is driving market growth. For instance, in February 2024, Cynosure and Hahn & Company, which recently acquired Lutronic, announced a definitive merger agreement for the strategic combination of Cynosure and Lutronic. This merger is intended to enable Cynosure and Lutronic to offer advanced solutions to customers and transform the medical aesthetics industry. The combined entity will possess a strong global presence and enhanced research and development capabilities. Thus, such mergers and acquisitions are fuelling the cosmetic surgery market in the Asia Pacific region.

The cosmetic surgery market in Japan is also expected to hold significant growth during the forecast period. The rising adoption of cosmetic surgery in Japan is driven by celebrity emulation, career advancement, and the influence of social media. For instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS), in 2022, more than 2.46 million cosmetic surgeries were performed in Japan. Thus, the growing normalization and acceptance of cosmetic enhancements in Japanese society is anticipated to propel the cosmetic surgery market growth.

Cosmetic Surgery Key Market Players & Competitive Insights

The cosmetic surgery market is a dynamic and rapidly evolving environment with several players striving to innovate and differentiate from each other. Major global companies are dominating the market by leveraging extensive research and development capabilities, advanced manufacturing technologies, and broad distribution networks to maintain a competitive edge. The players are engaged in strategic activities such as mergers and acquisitions, partnerships, and collaborations to enhance their product portfolios and expand their market presence.

Startups are also contributing to the market by introducing unique cosmetic surgery technologies and catering to niche applications. This competitive scenario is further intensified by ongoing advancements in biotechnology, increased focus on non-invasive techniques, and growing demand for the cosmetic surgery market. Major players in the cosmetic surgery market include Abbvie Incorporation; Alma Lasers Ltd.; Bausch Health Companies Inc.; Cynosure inc.; Galderma SA; HansBiomed Co., Ltd.; Mentor Worldwide LLC; Merz Pharma GmbH and Co.; Polytech Health & Aesthetics GmbH; Sientra Inc; Suneva Medical, Inc.; Sinclair Pharmaceuticals Limited; Revance Therapeutics, Inc.; and Teoxane Laboratories.

Merz Aesthetics, a subsidiary of Merz Group, operates as a global medical aesthetics company, offering a range of clinically proven injectables, devices, and skincare treatments designed to meet the specific needs of patients. The company is headquartered in Raleigh, N.C., USA, with commercial operations in 90 countries worldwide. In February 2022, a Radiesse Lidocaine injectable implant was launched for deep injection to address soft tissue augmentation and improve moderate to severe loss of jawline contour in adults over the age of 21. It is FDA-approved for enhancing jawline contour through injectable treatment. It is an approved non-surgical treatment option designed to enhance the appearance of the jawline instantly.

AirSculpt Technologies, headquartered in Florida, was founded in 2012. The company specializes in body contouring through the use of our exclusive AirSculpt method, which effectively eliminates unwanted fat through a minimally invasive procedure, yielding significant results. In August 2022, AirSculpt Technologies introduced its latest technology for cellulite removal, AirSculpt Smooth. This FDA-cleared, minimally invasive one-time procedure is performed in conjunction with a standard AirSculpt procedure and guarantees the complete elimination of stubborn cellulite dimples. It does not involve the use of needles, scalpels, or stitches, and the patient remains awake throughout the process, allowing them to resume their normal activities within 24-48 hours. AirSculpt Technologies has conducted over 30,000 cases in the US.

List of Key Companies in Cosmetic Surgery Market

- Abbvie Incorporation

- Alma Lasers Ltd.

- Bausch Health Companies Inc.

- Cynosure inc.

- Galderma SA

- HansBiomed Co., Ltd.

- Mentor Worldwide LLC

- Merz Pharma GmbH and Co.

- Polytech Health & Aesthetics GmbH

- Sientra Inc

- Suneva Medical Inc.

- Sinclair Pharmaceuticals Limited

- Revance Therapeutics, Inc.

- Teoxane Laboratories

Cosmetic Surgery Industry Developments

August 2024: AirSculpt Technologies, Inc. announced the opening of its new center in Columbus. The center features two operating rooms, enabling simultaneous procedures. Additionally, the clinic now offers the innovative AirSculpt skin tightening procedure as part of its comprehensive service offerings.

September 2023: Cutera has just announced the release of Secret DUO, a new skin resurfacing and revitalization platform. It incorporates dual non-ablative fractional technologies, offering the flexibility to use each modality separately or in combination. This allows for precise targeting of a variety of aesthetic indications.

March 2022: Sientra has received regulatory approval to commercialize its breast implants in Canada. The company will distribute the implants in the Canadian market through Kai Aesthetic, a local partner specializing in the distribution of medical aesthetics products and technology.

Cosmetic Surgery Market Segmentation

By Procedure Outlook

- Invasive

- Breast Augmentation

- Liposuction

- Eyelid Surgery

- Tummy Tuck

- Others

- Non-invasive

- Botox Injections

- Soft Tissue Fillers

- Chemical Peel

- Laser Hair Removal

- Microdermabrasion

- Others

By Equipment Outlook

- Laser Equipment

- Electrotherapy Equipment

- Radiofrequency Equipment

- Others

By Gender Outlook

- Male

- Female

By Age Group Outlook

- 13–29

- 30–54

- 55 and above

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cosmetic Surgery Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 148.71 billion |

|

Market Size Value in 2025 |

USD 169.82 billion |

|

Revenue Forecast in 2034 |

USD 567.70 billion |

|

CAGR |

14.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cosmetic surgery market size was valued at USD 148.71 billion in 2024 and is projected to grow to USD 567.70 billion by 2034.

The global market is projected to register a CAGR of 14.3% during the forecast period, 2025-2034.

North America had the largest share of the global market

The key players in the market are Abbvie Incorportaipn; Alma Lasers Ltd.; Bausch Health Companies Inc.; Cynosure inc.; Galderma SA; HansBiomed Co., Ltd.; Mentor Worldwide LLC; Merz Pharma GmbH and Co.; Polytech Health & Aesthetics GmbH; Sientra Inc; Suneva Medical, Inc.; Sinclair Pharmaceuticals Limited; and Teoxane Laboratories.

The female segment is anticipated to experience substantial growth with a significant CAGR in the global market due to increasing demand for cosmetic procedures among women, including skin resurfacing and tightening, hair removal, breast augmentation, breast reduction, and others

The age group 30–54 segment accounted for a significant revenue share of the market in 2024 due to the increase in the utilization of non-surgical methods like botulinum toxin.