Corporate Lending Platform Market Share, Size, Trends, Industry Analysis Report, By Offering (Solutions, Services); By Lending Type; By Deployment Model; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM4828

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

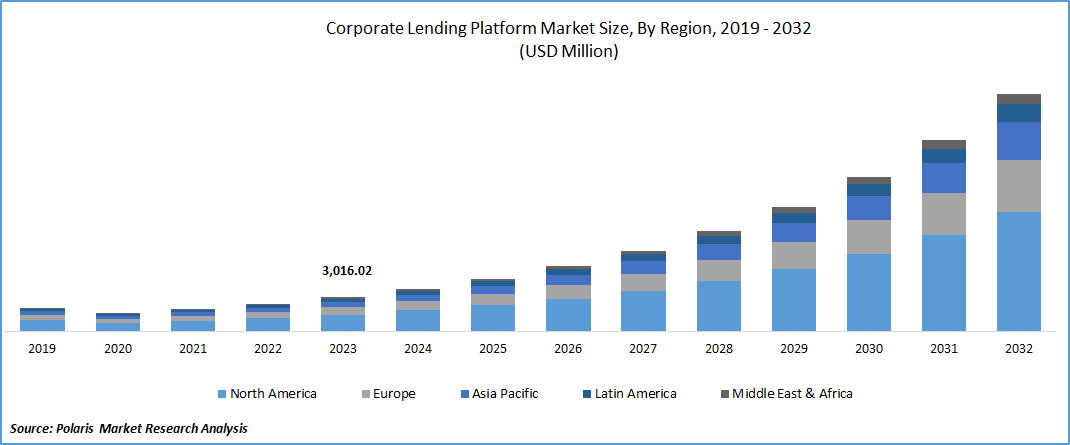

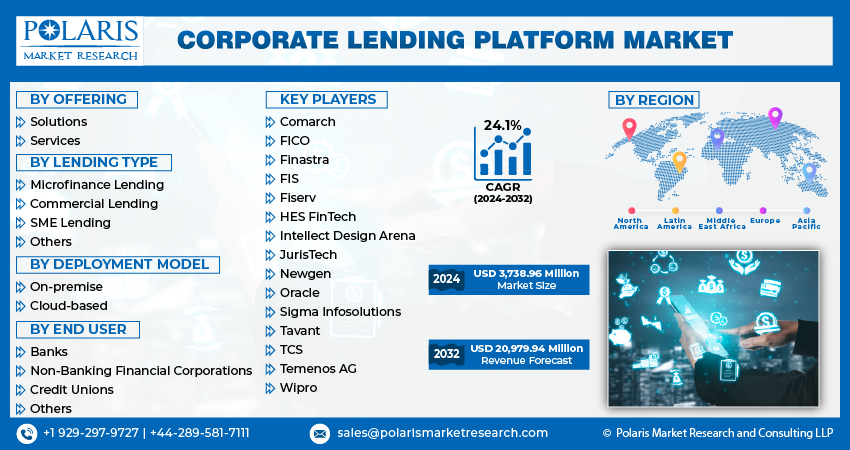

Corporate Lending Platform Market size was valued at USD 3,016.02 million in 2023. The market is anticipated to grow from USD 3,738.96 million in 2024 to USD 20,979.94 million by 2032, exhibiting the CAGR of 24.1% during the forecast period.

Market Introduction

The corporate lending platform market size experiences substantial growth driven by the ongoing digital transformation in financial services. As financial institutions adapt to modernize their operations, there's a rising demand for advanced lending platforms offering streamlined processes and improved accessibility. These platforms leverage digital tools and automation to simplify loan origination, underwriting, and servicing, expediting loan approvals and enhancing borrower experience. Additionally, they facilitate seamless communication between borrowers and lenders, fostering efficient collaboration. With cloud-based solutions and data analytics, corporate lending platforms provide valuable insights into borrower behavior, enabling informed decisions.

To Understand More About this Research:Request a Free Sample Report

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

For instance, in September 2022, M2P Fintech, a provider of API infrastructure for banks and NBFCs, unveiled the introduction of a Core Lending Suite (CLS). This suite empowers lenders to rapidly customize, develop, test in the market, and promptly deploy lending products.

The corporate lending platform market trends is also witnessing substantial growth driven by the increasing emphasis on risk management and compliance in corporate lending. With regulatory requirements becoming more stringent, businesses seek comprehensive platforms to effectively manage risks and ensure compliance. These platforms offer features such as real-time monitoring, predictive analytics, and automated compliance checks to assess and mitigate lending risks. Additionally, they provide centralized repositories for loan documentation, streamlining audit processes and regulatory reporting.

Industry Growth Drivers

Increasing Demand for Streamlined Loan Origination and Processing is Projected to Spur the Product Demand

The corporate lending platform market share is expanding due to the rising demand for streamlined loan origination and processing. Businesses are increasingly seeking efficient solutions to access financing and manage financial operations. These platforms utilize advanced technologies like AI and machine learning to automate tasks, assess creditworthiness, and expedite loan approvals. Furthermore, they offer centralized platforms for transparent communication and collaboration between borrowers and lenders. With corporate lending becoming more complex and the need for agile financial decision-making, businesses are turning to these platforms to enhance efficiency, reduce costs, and accelerate loan processing.

Shift Towards Online and Mobile Banking is Expected to Drive Corporate Lending Platform Market Growth

The transition towards online and mobile banking is driving significant growth in the market. With more businesses opting for digital banking solutions, there's a rising demand for streamlined lending processes. Corporate lending platforms offer online portals and mobile apps for loan applications, financing access, and account management. Leveraging technology, these platforms automate tasks like application processing and credit assessments, reducing time and resources for loan approval. Financial institutions invest in advanced lending platforms to remain competitive, further boosting market growth.

Industry Challenges

Data Security and Privacy Concerns are Likely to Impede the Market Growth

Data security and privacy concerns pose obstacles to the expansion of the market. These platforms handle sensitive financial information, making them vulnerable to data breaches and cyberattacks. Heightened regulatory requirements, such as GDPR and CCPA, mandate stringent data protection measures, adding to businesses' reluctance to share confidential data online. Failure to comply with these regulations can lead to severe penalties and reputational damage. To overcome these barriers, corporate lending platforms must implement robust cybersecurity protocols, encryption mechanisms, and strict adherence to regulatory frameworks.

Report Segmentation

The corporate lending platform market analysis is primarily segmented based on offering, lending type, deployment model, end user, and region.

|

By Offering |

By Lending Type |

By Deployment Model |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Offering Analysis

Solutions Segment Held Significant Market Revenue Share in 2023

The solutions segment held significant revenue share in 2023. These solutions offer tailored lending options, catering to diverse business needs and attracting a broad clientele. They are scalable, accommodating businesses of all sizes, thus capturing a wide market segment. Integration capabilities with existing financial systems enhance operational efficiency. Automation streamlines lending processes, reducing manual intervention and improving efficiency. Robust risk management tools help lenders assess and mitigate lending risks effectively. Advanced analytics and reporting features provide data-driven insights for informed decision-making.

By Lending Type Analysis

Commercial Lending Segment Held Significant Market Revenue Share in 2023

The commercial lending segment held significant revenue share in 2023. Commercial lending transactions typically involve high volumes, contributing to revenue growth. The complexity of these transactions, including diverse loan structures and risk management requirements, drives demand for tailored solutions offered by corporate lending platforms. Commercial lenders serve a diverse client base, from small businesses to large corporations, further increasing the market share. Additionally, corporate lending platforms streamline compliance processes, ensuring adherence to regulatory standards. Seamless integration with other financial services enhances efficiency and productivity, contributing to revenue growth in the market.

By Deployment Model Analysis

Cloud-Based Segment Held Significant Market Revenue Share in 2023

The cloud-based segment held significant revenue share in 2023. These platforms offer scalability and flexibility, enabling lenders to adjust resources according to demand and support growth. They are cost-effective, eliminating the need for expensive hardware and maintenance. Additionally, cloud-based solutions provide accessible anytime, anywhere access to lending tools and data, enhancing productivity. They also offer rapid deployment and updates, ensuring adaptability to market changes and regulatory requirements. Moreover, seamless integration with other financial systems and robust data security measures further drive growth.

By End User Analysis

Banks Segment Held Significant Market Revenue Share in 2023

The banks segment held significant revenue share in 2023. Banks possess established reputations and extensive customer bases, facilitating cross-selling of lending services through their platforms. Their trustworthiness and credibility instill confidence in borrowers, ensuring widespread adoption of their lending platforms. Furthermore, banks adhere to stringent regulatory compliance standards, reassuring borrowers about data security and privacy. Offering a diverse range of financial products beyond lending, banks provide comprehensive solutions to businesses. Additionally, their access to substantial capital resources enables them to offer competitive loan terms and amounts through their lending platforms.

Regional Insights

North America Region Dominated the Global Market in 2023

In 2023, North America region dominated the global market. Its highly developed economy and large corporate sector create substantial demand for lending services. The region's advanced technological landscape fosters innovation and high adoption rates of corporate lending platforms. Well-established regulatory frameworks ensure stability and transparency in lending practices. Additionally, North America's robust financial infrastructure facilitates efficient lending operations and attracts investment. Furthermore, abundant capital resources and a large customer base contribute to the region's market dominance.

Asia-Pacific is expected to experience significant growth during the forecast period. Rapid economic development fosters increased demand for corporate financing solutions, particularly in supporting SMEs. Moreover, the region's embrace of digitalization and technology facilitates the adoption of corporate lending platforms. A thriving fintech ecosystem, coupled with government initiatives promoting financial inclusion and SME support, further propels market expansion. Additionally, heightened investor interest in the fintech sector drives increased investment in corporate lending platforms, contributing to the region's growth.

Key Market Players & Competitive Insights

The corporate lending platform market players includes various players, with the expected arrival of new contenders intensifying competition. Key players consistently upgrade their technologies to sustain a competitive edge, emphasizing effectiveness, dependability, and security. They prioritize strategic maneuvers, like forming alliances, enhancing product offerings, and engaging in joint ventures, to surpass competitors. Their aim is to secure a notable corporate lending platform market share.

Some of the major players operating in the global corporate lending platform market include:

- Comarch

- FICO

- Finastra

- FIS

- Fiserv

- HES FinTech

- Intellect Design Arena

- JurisTech

- Newgen

- Oracle

- Sigma Infosolutions

- Tavant

- TCS

- Temenos AG

- Wipro

Recent Developments

- In January 2023, Temenos introduced an upgraded iteration of its AI-powered Corporate Lending solution, aiming to empower banks in consolidating worldwide commercial loan portfolios and streamlining servicing, all integrated within the Temenos banking platform.

- In December 2023, Lentra unveiled its Intelligent Lending Cloud Platform and announced the release of three new artificial intelligence (AI) offerings tailored for the financial industry. These AI solutions, Lentra Convo, Lentra Insights, and Lentra Wingman, are designed to optimize lending operations and provide enhanced lending solutions to lenders.

- In June 2023, Comerica Bank introduced the Comerica Small Business Convenient Capital, marking its inaugural fully digital lending platform designed to offer seamless access to capital and unique value-added perks for small business clients of Comerica.

Report Coverage

The corporate lending platform market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offerings, lending types, deployment models, end users, and their futuristic growth opportunities.

Corporate Lending Platform Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3,738.96 million |

|

Revenue forecast in 2032 |

USD 20,979.94 million |

|

CAGR |

24.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Corporate Lending Platform Market are FICO, Finastra, FIS, Fiserv, Oracle, Tavant

Corporate Lending Platform Market exhibiting the CAGR of 24.1% during the forecast period.

Corporate Lending Platform Market report covering key segments are offering, lending type, deployment model, end user, and region.

The key driving factors in Corporate Lending Platform Market are Increasing demand for streamlined loan origination and processing is projected to spur the product demand

Corporate Lending Platform Market Size Worth $ 20,979.94 Million By 2032