Coronary Stent Market Size, Share, Trends, Industry Analysis Report: By Type (Bare-Metal Stents (BMS), Drug-Eluting Stents (DES), and Bioabsorbable Stents), Mode of Delivery, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 114

- Format: PDF

- Report ID: PM1701

- Base Year: 2024

- Historical Data: 2020-2023

Coronary Stent Market Overview

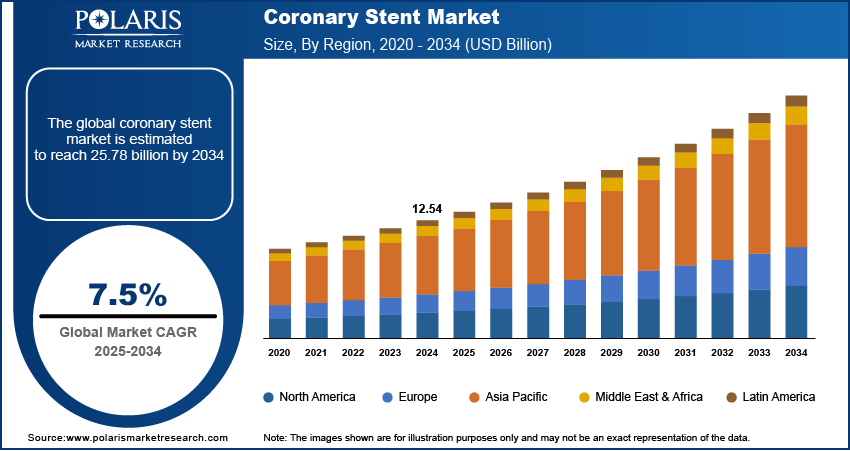

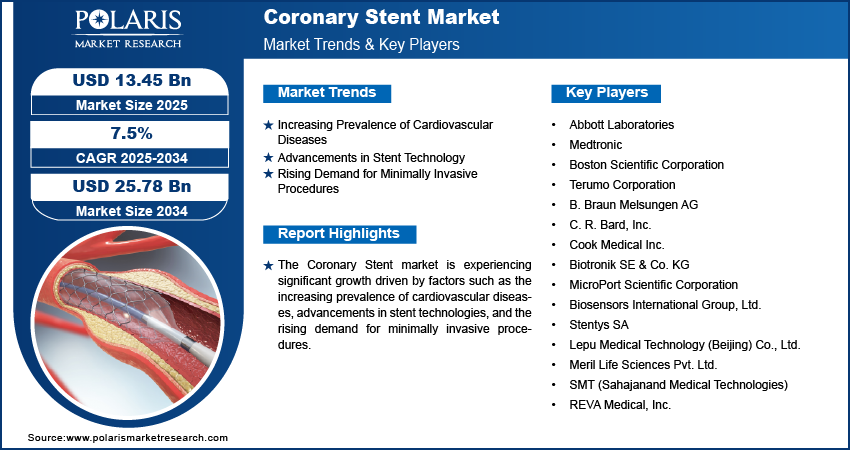

The coronary stent market size was valued at USD 12.54 billion in 2024. The market is projected to grow from USD 13.45 billion in 2025 to USD 25.78 billion by 2034, exhibiting a CAGR of 7.5% during 2025–2034.

The coronary stent market involves the production and distribution of small, expandable tubes used to treat narrowed or blocked coronary arteries in patients with cardiovascular diseases. This market is driven by the increasing prevalence of coronary artery disease, advancements in stent technology, and the rising demand for minimally invasive procedures. Key trends include the development of bioresorbable stents, the growing adoption of drug-eluting stents, and the focus on improving long-term patient outcomes. Additionally, the expanding geriatric population and increasing awareness of cardiovascular health contribute to coronary stent market growth.

To Understand More About this Research: Request a Free Sample Report

Coronary Stent Market Dynamics

Increasing Prevalence of Cardiovascular Diseases

The growing incidence of cardiovascular diseases, particularly coronary artery disease, is a significant driver of the coronary stent market. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for approximately 17.9 million deaths annually. This high prevalence necessitates the use of coronary stents for effective treatment, contributing to the demand for advanced stent technologies. The increasing burden of cardiovascular conditions in aging populations further underscores the need for stent implantation procedures.

Advancements in Stent Technology

Technological advancements in stent design and materials are crucial drivers of coronary stent market growth. The development of drug-eluting stents (DES), which release medication to prevent restenosis, has significantly improved patient outcomes. Bioresorbable stents, designed to dissolve after fulfilling their purpose, are gaining traction due to their potential to reduce long-term complications. Research and development efforts continue to enhance stent performance, with a focus on improving flexibility, reducing thrombosis risk, and enabling better vascular healing, thereby boosting market adoption.

Rising Demand for Minimally Invasive Procedures

The shift towards minimally invasive surgical procedures is a major driver in the market. Patients and healthcare providers increasingly prefer minimally invasive techniques due to shorter recovery times, reduced hospital stays, and lower overall healthcare costs. Coronary stenting, as a less invasive alternative to coronary artery bypass grafting (CABG), aligns with this trend. The adoption of advanced imaging technologies and catheter-based interventions further supports the growth of stent-based treatments, responding to the rising demand for efficient and patient-friendly cardiac care solutions.

Coronary Stent Market Segment Insights

Coronary Stent Market Assessment by Type

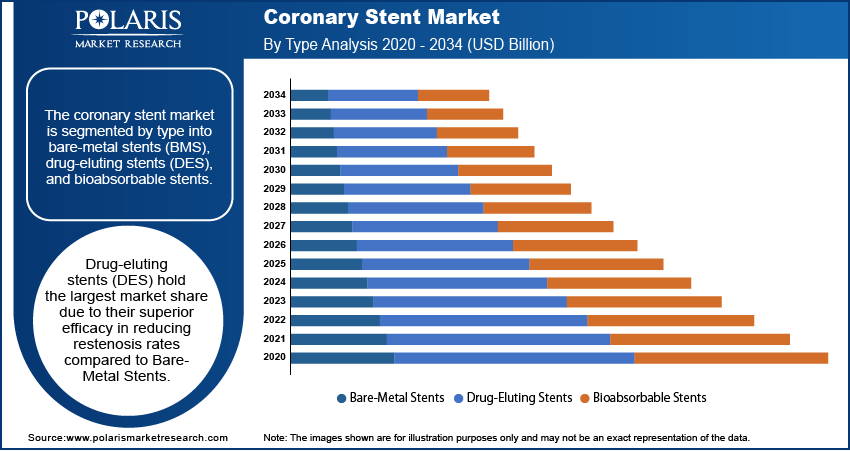

The coronary stent market is segmented by type into bare-metal stents (BMS), drug-eluting stents (DES), and bioabsorbable stents. Drug-eluting stents (DES) hold the largest market share due to their superior efficacy in reducing restenosis rates compared to bare-metal stents. The gradual release of anti-proliferative drugs from DES helps prevent the re-narrowing of arteries, making them the preferred choice for many interventional cardiologists. The adoption of DES is further supported by clinical evidence demonstrating their long-term benefits, leading to widespread use in both elective and emergency percutaneous coronary interventions.

Bioabsorbable stents, although currently a smaller segment, are also registering the highest growth due to their innovative design and potential to reduce long-term complications associated with permanent stents. These stents dissolve after providing necessary support to the artery, thereby minimizing risks such as late-stent thrombosis. The increasing focus on developing next-generation bioabsorbable stents with improved safety profiles is driving their rapid adoption. Additionally, ongoing clinical trials and regulatory approvals are expected to further accelerate the growth of this segment in the coming years.

Coronary Stent Market Assessment by Mode of Delivery

The coronary stent market segmentation, based on the mode of delivery, includes balloon-expandable stents and self-expanding stents. Balloon-expandable stents hold the largest coronary stent market share due to their widespread use in the treatment of coronary artery disease. These stents are delivered via a catheter and expanded at the site of the blockage using a balloon. Their precise deployment and ability to achieve optimal stent placement make them the preferred choice in many percutaneous coronary interventions, particularly in controlled environments such as elective procedures.

Self-expanding stents are registering the fastest growth, driven by their unique properties that allow for gradual expansion and adaptability to the arterial walls. This feature makes them particularly suitable for complex cases, such as tortuous or calcified arteries, where flexibility and self-adjustment are critical. The increasing use of self-expanding stents in treating peripheral artery disease and their growing adoption in high-risk patients contribute to their rapid market growth. Advances in stent materials and designs are further enhancing their performance, supporting their expanding application in various clinical scenarios.

Coronary Stent Market Evaluation by End User

The coronary stent market by end user includes hospitals, cardiac centers, and ambulatory surgical centers. Hospitals, cardiac centers hold the largest market share due to the high volume of cardiovascular procedures performed in these settings. Hospitals are equipped with advanced diagnostic and therapeutic facilities, allowing them to handle complex cases and emergencies efficiently. The availability of skilled healthcare professionals and comprehensive post-operative care in hospitals further contributes to their dominance in the market.

Cardiac centers are also registering the fastest growth in the coronary stent market. These specialized centers focus exclusively on cardiovascular care, offering a range of advanced treatments and interventions, including coronary stenting. The rise in the number of dedicated cardiac centers, driven by the growing burden of heart diseases and the demand for specialized care, is propelling their growth. Additionally, the focus on providing patient-centric services and the adoption of the latest stent technologies are enhancing the role of cardiac centers in the overall market.

Coronary Stent Market Regional Insights

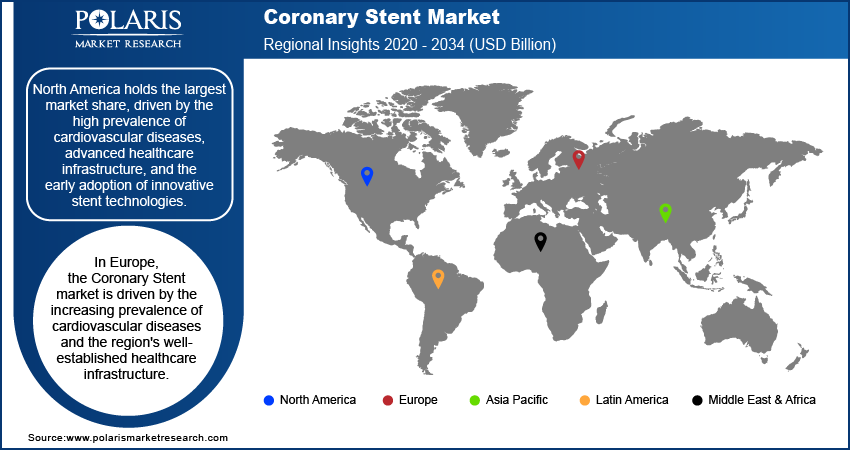

By region, the study provides coronary stent market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and the early adoption of innovative stent technologies. The US, in particular, contributes significantly due to the increasing number of percutaneous coronary intervention (PCI) procedures and strong investment in healthcare research and development. Additionally, favorable reimbursement policies and the presence of key market players further support the dominance of North America. Other regions, such as Europe and Asia Pacific, are also experiencing growth due to rising healthcare awareness and improving medical infrastructure, but North America remains the leading region due to its robust healthcare ecosystem and technological advancements.

The coronary stent market in Europe is driven by the increasing prevalence of cardiovascular diseases and the region's well-established healthcare infrastructure. Countries such as Germany, France, and the UK are key contributors due to their advanced medical facilities and high adoption of minimally invasive procedures. The presence of prominent market players and ongoing clinical research further boost the market. Additionally, favorable government initiatives and healthcare policies aimed at improving cardiac care are supporting the coronary stent market growth in this region.

Asia Pacific region is witnessing significant growth in the coronary stent market, attributed to the rising incidence of heart diseases and the expanding healthcare sector. Countries such as China, India, and Japan are major contributors, driven by large patient populations, increasing healthcare expenditure, and the growing awareness of cardiovascular health. The region is also benefiting from the adoption of advanced stent technologies and the increasing availability of skilled healthcare professionals. Government initiatives to improve healthcare access and infrastructure, particularly in emerging economies, are further fueling market expansion in Asia Pacific.

Coronary Stent Market – Key Players and Competitive Insights

The coronary stent market features several key players actively contributing to advancements in cardiovascular treatment. Notable companies include Abbott Laboratories; Medtronic; Boston Scientific Corporation; Terumo Corporation; B. Braun Melsungen AG; C. R. Bard, Inc. (a subsidiary of Becton, Dickinson and Company); Cook Medical Inc.; Biotronik SE & Co. KG; MicroPort Scientific Corporation; Biosensors International Group, Ltd.; Stentys SA; Lepu Medical Technology (Beijing) Co., Ltd.; Meril Life Sciences Pvt. Ltd.; SMT (Sahajanand Medical Technologies); and REVA Medical, Inc.

These companies are recognized for their contributions to the development and distribution of coronary stents, offering a range of products designed to address various clinical needs. For instance, Abbott Laboratories is known for its XIENCE series of drug-eluting stents, while Medtronic offers the Resolute Integrity and Resolute Onyx stents. Boston Scientific's SYNERGY stent is notable for its bioabsorbable polymer coating. Terumo Corporation provides the Ultimaster stent, and Biotronik offers the Orsiro stent, which has gained attention for its ultrathin strut design. These products reflect the companies' commitment to innovation in stent technology.

In the competitive landscape, companies differentiate themselves through continuous research and development, product innovation, and strategic partnerships. The focus on developing next-generation stents, such as bioresorbable scaffolds and drug-eluting stents with enhanced safety profiles, is evident among these key players. Additionally, expanding global reach and strengthening distribution networks are common strategies to increase market presence. Collaborations with healthcare providers and participation in clinical trials further enhance their competitive positions, enabling them to meet the evolving demands of the coronary stent market.

Abbott Laboratories is a prominent player in the coronary stent market, known for its range of coronary stents, including the XIENCE series. The company has a strong presence in global markets and focuses on developing advanced technologies to improve patient outcomes. Abbott’s stents are widely used in treating coronary artery disease, and the company continuously invests in innovation and clinical research.

Medtronic is another major player in the market, offering a wide range of coronary stents such as the Resolute Integrity and Resolute Onyx stents. Medtronic is focused on providing solutions to improve the treatment of cardiovascular conditions and has a significant footprint in both developed and emerging markets. The company’s products are used in hospitals and clinics worldwide.

List of Key Companies in Coronary Stent Market

- Abbott Laboratories

- Medtronic

- Boston Scientific Corporation

- Terumo Corporation

- B. Braun Melsungen AG

- C. R. Bard, Inc. (a subsidiary of Becton, Dickinson and Company)

- Cook Medical Inc.

- Biotronik SE & Co. KG

- MicroPort Scientific Corporation

- Biosensors International Group, Ltd.

- Stentys SA

- Lepu Medical Technology (Beijing) Co., Ltd.

- Meril Life Sciences Pvt. Ltd.

- SMT (Sahajanand Medical Technologies)

- REVA Medical, Inc.

Coronary Stent Industry Developments

- January 2024: Abbott announced the completion of a major clinical trial for its new generation drug-eluting stent. The trail aims to enhance long-term patient safety and improving procedural outcomes.

- December 2023: Medtronic launched an updated version of its Resolute Onyx stent, which includes enhanced technology designed to improve the outcomes for patients with complex coronary artery disease.

Coronary Stent Market Segmentation

By Type Outlook

- Bare-Metal Stents (BMS)

- Drug-Eluting Stents (DES)

- Bioabsorbable Stents

By Mode of Delivery Outlook

- Balloon-Expandable Stents

- Self-Expanding Stents

By End User Outlook

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Coronary Stent Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.54 billion |

|

Market Size Value in 2025 |

USD 13.45 billion |

|

Revenue Forecast by 2034 |

USD 25.78 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The coronary stent market has been segmented into detailed segments of type, mode of delivery, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy: The growth strategy for the coronary stent market focuses on innovation, expanding product portfolios, and enhancing clinical outcomes. Key players are investing heavily in research and development to introduce next-generation stents, such as bioresorbable and drug-eluting options, aimed at improving patient safety and long-term results. Strategic partnerships, acquisitions, and collaborations with healthcare providers and academic institutions are being pursued to expand market reach. Additionally, companies are focusing on expanding their presence in emerging markets, where there is increasing demand for advanced cardiac care. Strengthening distribution networks and improving customer engagement through educational initiatives are also key components of market growth strategies

FAQ's

The coronary stent market size was valued at USD 12.54 billion in 2024 and is projected to grow to USD 25.78 billion by 2034.

The market is projected to register a CAGR of 7.5% during the forecast period, 2024-2034.

North America had the largest share of the market.

Notable companies include Abbott Laboratories; Medtronic; Boston Scientific Corporation; Terumo Corporation; B. Braun Melsungen AG; C. R. Bard, Inc. (a subsidiary of Becton, Dickinson and Company); Cook Medical Inc.; Biotronik SE & Co. KG; MicroPort Scientific Corporation; Biosensors International Group, Ltd.; Stentys SA; Lepu Medical Technology (Beijing) Co., Ltd.; Meril Life Sciences Pvt. Ltd.; SMT (Sahajanand Medical Technologies); and REVA Medical, Inc.

The drug-eluting stents segment accounted for the larger share of the market in 2024.

The balloon-expandable stents segment accounted for the larger share of the market in 2024.

A coronary stent is a small, expandable tube inserted into narrowed or blocked coronary arteries to restore proper blood flow to the heart. It is typically used in patients undergoing percutaneous coronary intervention (PCI) to treat coronary artery disease (CAD), where plaque buildup restricts blood flow. The stent is usually deployed using a catheter and balloon to expand it at the site of the blockage. Coronary stents are commonly made of metal or, in some cases, bioabsorbable materials, and some are coated with medication (drug-eluting) to help prevent restenosis, or re-narrowing of the artery.

A few key trends in the market are described below: Advancement in Stent Technologies: Development of bioresorbable stents and drug-eluting stents with enhanced safety profiles and improved clinical outcomes. Minimally Invasive Procedures: Increasing preference for minimally invasive interventions, reducing recovery times and hospital stays. Focus on Patient-Centric Solutions: Growing demand for stents that offer better long-term outcomes, with a focus on reducing restenosis and thrombosis risks. Emerging Markets Growth: Expanding presence in emerging economies, driven by rising healthcare access and an increasing prevalence of cardiovascular diseases.

A new company entering the Coronary Stent market could focus on innovation in stent materials and design, particularly in the development of bioresorbable and next-generation drug-eluting stents that offer improved patient outcomes. Emphasizing long-term safety by addressing risks such as thrombosis and restenosis would differentiate the company from competitors. Additionally, targeting emerging markets with tailored products and affordable solutions could help capture a growing patient base. Building strong partnerships with healthcare providers and participating in clinical trials would also enhance credibility. Lastly, integrating digital health technologies to support precision medicine and real-time monitoring during procedures could offer a competitive edge in the market.

Companies manufacturing, distributing, or purchasing Coronary Stent and related products, and other consulting firms must buy the report.