Copper Tubes Market Share, Size, Trends, Industry Analysis Report, By Type (Straight lengths, Coils, Pancake or Flattened Tubes, U-Bends, Drawn Tubes, Others); By Thickness; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM4425

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

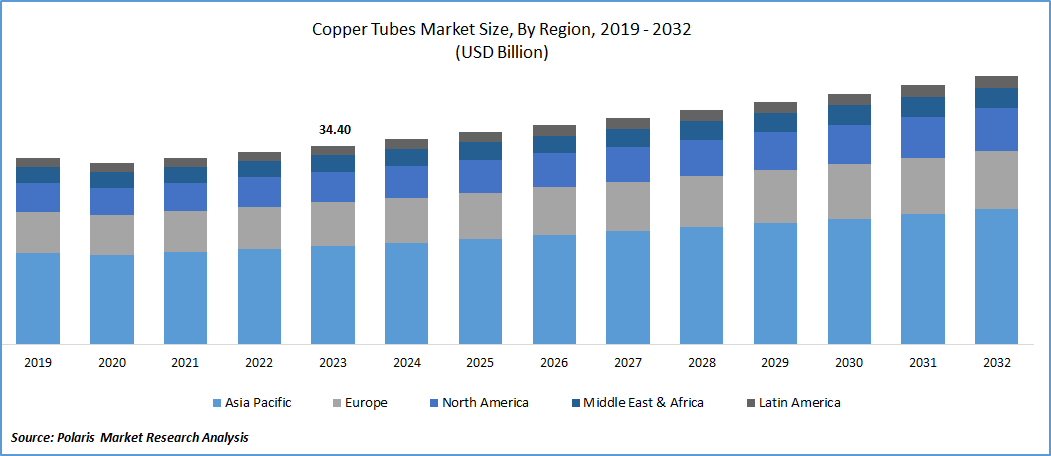

The global copper tubes market was valued at USD 34.40 billion in 2023 and is expected to grow at a CAGR of 3.4% during the forecast period.

Copper tubes are gaining traction nowadays with the rising adoption of smart homes in the global space. It is used in plumbing systems and water supply chains due to its longevity and conductivity. They are highly employed in chiller systems, ductable AC systems, and air handling units because of their thermal insulation. Furthermore, a rapid shift towards a sustainable economy is creating the adoption of renewable energy sources for energy and also solar water heaters. As copper tubes are used in heating systems, this transition is expected to stimulate market growth. The ongoing shift towards sustainable production processes among the companies is likely to positively influence the copper tubes market.

To Understand More About this Research:Request a Free Sample Report

For instance, in July 2023, Tianjin Mingtai Copper Tube Factory introduced its latest environmentally friendly copper tubes product line.

Moreover, the growing population at the global level is creating the need for food, water, and shelter. This is stimulating the demand for copper tubes as they are incorporated in houses to provide power by using tubes for wiring. Copper tubes play a prominent role in maintaining the water supply. These applications of copper tubes are likely to enhance demand in the coming years.

However, the higher costs of copper, along with the fluctuating metal prices, are likely to hamper the production of copper tubes among the manufacturers.

Growth Drivers

Rising HVAC Industry (heating, ventilation, and air conditioning systems)

The extreme climatic conditions globally are necessitating the adoption of HVAC systems in households, industrial, and commercial places. These systems utilised more copper tubes, attributable to their thermal energy transferability properties. Cooling is the fastest-growing use of power in buildings. According to the International Energy Agency, the space cooling requirement is likely to be tripled by 2050, indicating the total consumption of electricity by China and India.

Furthermore, the growing demand for copper is emphasizing the importance of this metal in numerous ways, including as copper tubes. The demand for copper is expected to double by 2035, attributable to the ongoing shift towards the green transition. Government initiatives are changing the global supply and demand for metals. As an example, in August 2023, the Zambian government announced its plan to triple its production to three million tonnes by 2030 from 760,000 tonnes in 2022. This will enhance the supply of copper, contributing to the increased accessibility of metals for manufacturing copper tubes.

Moreover, the significant rise in government policies addressing the development of infrastructure activities along with its astonishing properties is impacting copper demand, including copper tube tubes. The demand for copper in India in FY22 was 12.5 lakh tons compared to 9.78 lakh tons in FY21.

Report Segmentation

The market is primarily segmented based on type, thickness, application, and region.

|

By Type |

By Thickness |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

Coils Segment is Expected to Witness the Highest Growth During the Forecast Period

The coils segment will grow rapidly, due to its use in the plumbing, heating, ventilation, and air-conditioning industries. Its reliability, durability, lower maintenance costs, and efficient thermal conductivity compared to the other metals are contributing to the demand for coils. The pattern of demand in several applications is projected to continue in the future with increased economic activity globally.

The straight lengths segment led the industry market with a substantial revenue share in 2022, largely attributable to its ability to offer higher resistance to corrosion, making it a feasible option for supplying drinking water. It is also widely adopted in heating plants and the transportation of combustible liquids and gasses.

By Thickness Analysis

Thin Wall Gauge Segment Registered Largest Market Share in 2023

The thin wall gauge segment accounted for the largest share. These tubes are employed in generators, cables, transformers, busbars, switch boards, hot and cold-water systems, and more.

The capillary tube segment is expected to grow at the fastest rate over the next few years on account of the rapid increase in demand for luxury goods. Copper capillaries are gaining utility in controlling refrigeration gas in the manufacturing process of air conditioning units and refrigerators. They are usually known to have an outside diameter of less than 4mm.

By Application Analysis

Hvac Segment Held the Significant Market Revenue Share in 2023

The HVAC segment held a significant market share, which was highly accelerated due to the continuous rise in the need for comfortable houses driven by increasing consumer purchasing power. L copper tubes, which are thicker than M type, are frequently used in fire protection, interior plumbing, and HVAC applications. The rising awareness about the various types of copper tubes is likely to continue its utility in the market.

The plumbing segment is expected to contribute to the rising demand for copper tubes in the marketplace, which is attributable to their utility in drinking water and gas supply chain networks, with their higher potential for withstanding abnormal temperatures and pressure.

Regional Insights

Asia Pacific Region Registered the Largest Share of the Global Market in 2023

The Asia Pacific dominated the global market. The growth of the segment market can be largely attributed to the presence of a larger population and rapid progress in urbanization. This is contributing to the need for construction and infrastructure development activities in the region, facilitating a significant demand for copper tubes. According to the World Bank report, by 2050, nearly 2/3 of global households have an AC. The countries in Asia, primarily China, India, and Indonesia, will account for half of the total population. This trend is likely to foster market expansion in the region during the forecast period.

The North America region will grow with substantial pace, owing to the growing consumption of copper tubes for water supply. The existence of lead pipes for longer periods of time is driving the necessity to replace them with other materials, primarily plastic and copper, because of its ability to ensure water safety. In December 2023, the Department of Water Management, Chicago, announced funding to replace existing lead pipes with copper within Chicago city from the Environmental Protection Agency.

Key Market Players & Competitive Insights

The copper tubes market is consolidated and is anticipated to witness competition due to the presence of a few major players. The increasing mergers and acquisitions among the major players are likely to stimulate the expansion of the market. For instance, in August 2023, Wieland Group, a supplier of copper products, completed the acquisition of Small Tube Products, a producer of thin-wall specialty tubing made up of aluminium, copper, and copper alloys.

Some of the major players operating in the global market include:

- Cambridge - Lee Industries LLC

- CERRO Flow Products LLC

- KOBE STEEL, LTD.

- KME Group S.p.A

- LUVATA

- MM Kembla

- Mueller Streamline Co.

- Qindao Hongtai Copper Co., LTD

- Shanghai Metal Corporation

- Wieland Group

Recent Developments

- In August 2023, New London announced a lead pipe replacement project with an investment of $36 million to replace around 3,300 households lead service water pipes with new copper lines.

- In May 2023, Lawton Tubes, a producer and supplier of copper tubes, acquired Wardtec Ltd., a designer, manufacturer, and supplier of fittings for the water management industry.

- In March 2022, Wieland, a German copper tube manufacturer, acquired an Italian-based heat exchanger specialist firm, Provides Metalmeccanica Srl.

Copper Tubes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 35.51 billion |

|

Revenue forecast in 2032 |

USD 46.40 billion |

|

CAGR |

3.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Thickness, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Copper Tubes Market Size Worth $ 46.40 Billion By 2032.

The top market players in Copper Tubes Market include Cambridge - Lee Industries LLC, CERRO Flow Products LLC, KOBE STEEL.

Asia Pacific is the region contribute notably towards the Copper Tubes Market.

The global copper tubes market is expected to grow at a CAGR of 3.4% during the forecast period.

Copper Tubes Market report covering key segments are type, thickness, application and region.