Cool Roof Coatings Market Size, Share, Trends, Industry Analysis Report: By Product, Application (Low-Sloped and Steep-Sloped), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Mar-2025

- Pages: 128

- Format: PDF

- Report ID: PM1580

- Base Year: 2024

- Historical Data: 2020-2023

Cool Roof Coatings Market Overview

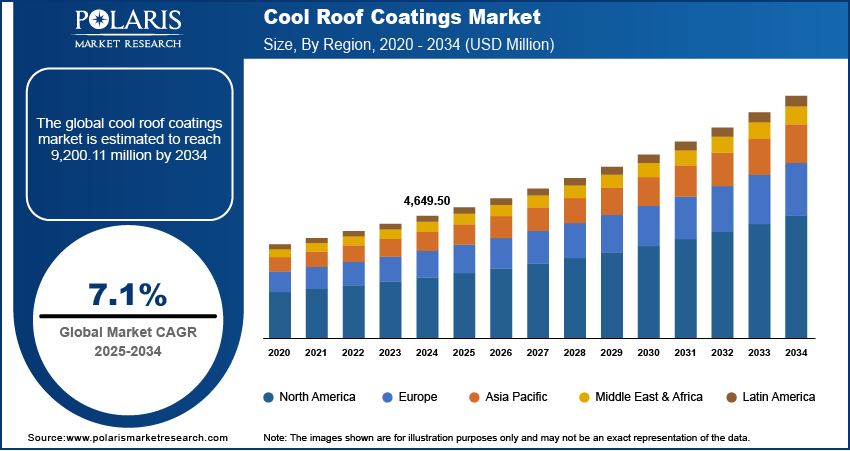

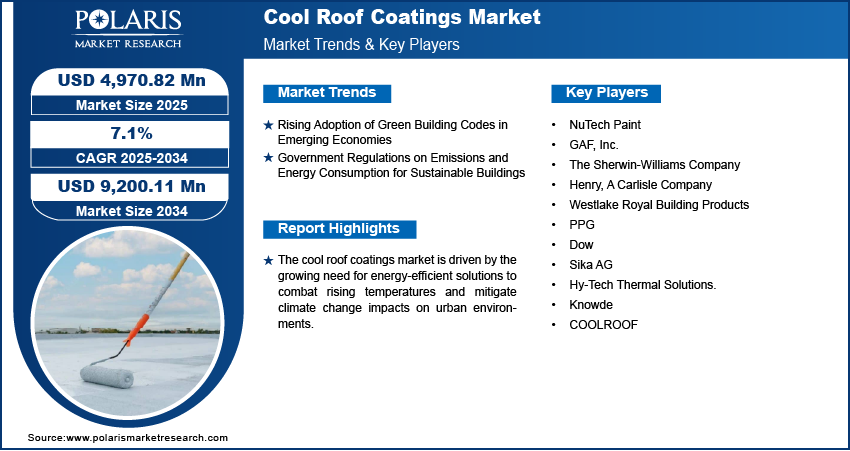

The cool roof coatings market size was valued at USD 4,649.50 million in 2024. The market is projected to grow from USD 4,970.82 million in 2025 to USD 9,200.11 million by 2034, exhibiting a CAGR of 7.1% during the forecast period.

Cool roof coatings are specialized materials applied to roofs to enhance their reflectivity and resistance to solar radiation. Typically made from silicone or acrylic, these coatings are suitable for various roof types and help mitigate heat absorption. The cool roof coatings market growth is largely driven by their energy-saving benefits, as they greatly reduce energy consumption by lowering indoor temperatures. Cool roof coatings include reflective tiles, sheet coverings, and 2k protective coatings that help maintain lower roof temperatures, thereby reducing the overall temperature of buildings. These coatings often feature white coatings or specially formulated reflective pigments that reflect sunlight and also protect roofs from ultraviolet radiation, water damage, rust, and chemical harm. The benefits of cool roof coatings, such as cost-effectiveness and high solar reflectivity, contribute to reduced heat buildup in commercial and residential spaces. This reduces dependency on air conditioning, resulting in energy savings and lower air pollution.

To Understand More About this Research: Request a Free Sample Report

Additionally, the growing consumer preference for energy-efficient solutions and supportive government policies, such as tax incentives for green building materials, are expected to further drive the cool roof coatings market demand in the coming years. For instance, a November 2024 IRS report states that homeowners can claim up to USD 3,200 annually for qualifying energy-efficient upgrades made from 2023 to 2032 through the Energy Efficient Home Improvement Credit. The credit covers 30% of eligible expenses, including windows, doors, insulation, and heating systems. Higher limits apply for heat pumps, biomass stoves, and boilers, allowing up to USD 2,000 annually.

Cool Roof Coatings Market Dynamics

Rising Adoption of Green Building Codes in Emerging Economies

The rising adoption of green building codes in emerging economies is driving the cool roof coatings market growth. These regulations emphasize energy efficiency and environmental sustainability in construction, encouraging the use of materials that reduce heat absorption and lower cooling energy consumption. For instance, a report from the Indian Green Building Council (IGBC) revealed that in May 2021, the Government of Gujarat's Climate Change Department launched a reimbursement program offering up to USD 3,497.79 or 50% of the IGBC certification fee, whichever is lower, for projects that achieve green building certification from IGBC. Additionally, cool roof coatings align with these goals by improving thermal performance and reducing the urban heat island effect. The demand for cool roof coatings has surged, driven by both regulatory requirements and growing awareness of environmental benefits as emerging economies prioritize sustainable urban development and energy conservation further boosting the market growth.

Government Regulations on Emissions and Energy Consumption for Sustainable Buildings

Government regulations on emissions and energy consumption are driving the demand for sustainable buildings, which in turn fuels the cool roof coatings market expansion. Stricter environmental laws aimed at reducing carbon footprints have led to an increased focus on energy-efficient construction practices. For instance, a November 2024 report from the European Environment Agency highlighted the need to reduce greenhouse gas emissions to mitigate climate change, highlighting a 37% drop in EU emissions by 2023. The EU has set more ambitious goals for a 55% reduction by 2030 and climate neutrality by 2050, requiring global cooperation and a transition to renewable energy, sustainable land use, and carbon capture. Cool roof coatings, which reflect more sunlight and absorb less heat, help reduce the need for air conditioning, lowering energy consumption and emissions. These regulations encourage the adoption of energy-saving technologies, making cool roof coatings a viable solution for meeting sustainability goals.

Cool Roof Coatings Market Segment Analysis

Cool Roof Coatings Market Assessment by Product Outlook

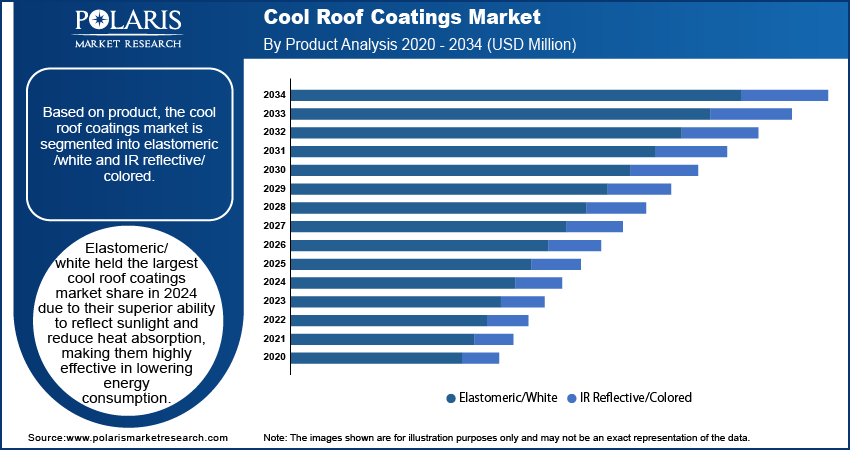

The global cool roof coatings market segmentation, based on product, includes elastomeric/white and IR reflective/colored. Elastomeric/white held the largest market share in 2024 due to their superior ability to reflect sunlight and reduce heat absorption, making them highly effective in lowering energy consumption. These coatings create a durable, weather-resistant surface that improves energy efficiency, especially in hot climates where cooling costs are high. The widespread use of elastomeric/white coatings in both residential and commercial buildings is driven by their cost-effectiveness and long-term energy savings. Additionally, their ability to improve indoor comfort and extend the lifespan of roofs contributes to their dominance in the market. This dominance is expected to continue as governments implement stricter energy regulations and the demand for sustainable building solutions rises.

Cool Roof Coatings Market Evaluation by Application Outlook

The global cool roof coatings market segmentation, based on application, includes low-sloped and steep-sloped. The steep-sloped segment is expected to witness the fastest cool roof coatings market growth due to the increasing adoption of cool roofing solutions in residential and commercial buildings with steep roof designs. These roofs, commonly found in regions with heavy rainfall or snow, benefit from cool roof coatings to improve energy efficiency, reduce cooling costs, and enhance building durability. Additionally, steep-sloped roofs are more exposed to sunlight, making the reflective properties of cool roof coatings even more critical in minimizing heat absorption and maintaining indoor comfort. The rising awareness of the benefits of energy-efficient buildings and government incentives for sustainable construction are driving m

Cool Roof Coatings Market Regional Insights

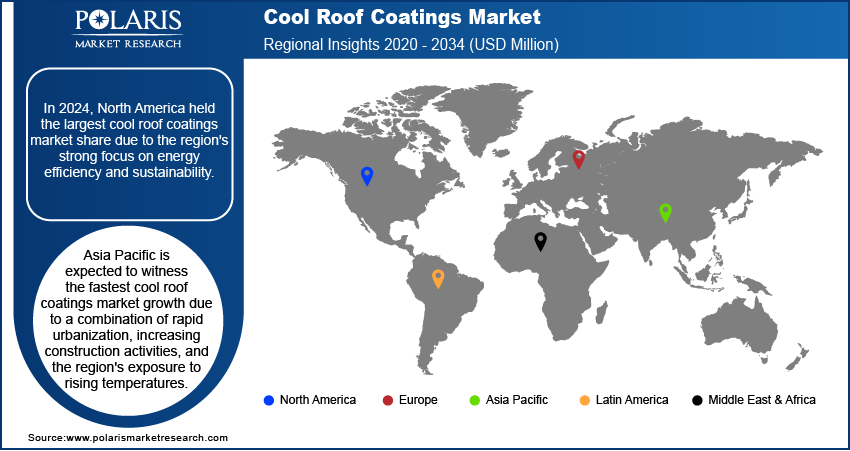

By region, the study provides cool roof coatings market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest cool roof coatings market share due to the region's strong focus on energy efficiency and sustainability. Strict building codes and government regulations encouraging the adoption of green technology and sustainability practices have driven the demand for cool roof coatings, particularly in commercial and residential sectors. For instance, in October 2024, US Representatives launched the Cool Roof Rebate Act (H.R. 9894) to provide rebates for reflective roofing products, aimed at reducing energy consumption and mitigating extreme heat, especially in vulnerable communities. The bill proposes USD 25 million in annual rebates from FY25-FY29, helping households lower cooling costs and improve energy efficiency, with backing from key health and environmental organizations. The growing emphasis on reducing carbon emissions and energy consumption, combined with the need for cost-effective cooling solutions in hot climates, further boosted the market. Additionally, technological advancements and the availability of innovative, high-performance cool roof coatings have contributed to North America's leadership. The region's well-established infrastructure and the presence of key industry players continue to support market growth.

Asia Pacific is expected to witness the fastest cool roof coatings market growth due to a combination of rapid urbanization, increasing construction activities, and the region's exposure to rising temperatures. Governments in countries such as India, China, and Japan are promoting energy-efficient building solutions to fight the urban heat effect and reduce energy consumption. Additionally, the growing adoption of green building standards, coupled with rising awareness about sustainability, is driving demand for cool roofing solutions. The region's expanding middle class and investment in smart city initiatives further contribute to the growing need for energy-efficient infrastructure, fueling the market expansion. For instance, a September 2024 report from the Ministry of Housing & Urban Affairs highlights the Smart Cities Mission, which aims to improve urban living through efficient services and sustainable infrastructure. The initiative focuses on transforming 100 cities with achievements such as smart roads, solar streetlights, and e-health centers. Over 90% of the projects were completed by September 2024, improving urban resilience and quality of life.

Cool Roof Coatings Market – Key Players and Competitive Analysis Report

The competitive landscape of the cool roof coatings market is characterized by global leaders and regional players aiming to capture market share through innovation, strategic alliances, and regional expansion. Prominent players such as Sherwin-Williams, PPG, and Sika AG leverage their strong R&D capabilities, extensive distribution networks, and advanced product portfolios to deliver high-performance cool roofing solutions. Cool roof coatings market trends indicate a rising demand for energy-efficient, reflective coatings driven by increasing awareness of environmental sustainability, reduced energy consumption, and cost savings. The market revenue is projected to grow, driven by government regulations promoting energy-efficient buildings and the growing need to mitigate urban heat. Regional companies cater to localized needs by offering cost-effective and customized products, especially in emerging markets such as Asia Pacific, which is expected to experience the highest CAGR. Competitive strategies include mergers and acquisitions, partnerships with construction firms, and the introduction of innovative, environmentally-friendly coatings. These developments highlight the role of technological advancements, regulatory support, and regional investments in driving the expansion of the cool roof coatings industry. A few key major players are NuTech Paint; GAF, Inc.; The Sherwin-Williams Company; Henry, A Carlisle Company; Westlake Royal Building Products; PPG; Dow; Sika AG; Hy-Tech Thermal Solutions; Knowde; COOLROOF.

Dow is a chemical manufacturing conglomerate with a wide range of products. Dow Inc. offers consumer care, construction, and industrial materials science solutions throughout the US, Canada, Latin America, Europe, Africa, India, the Middle East, and Asia Pacific. Dow maintains 113 production facilities in 31 countries. Coatings, durable goods, home and personal care, adhesives and sealants, and food and specialized packaging are among the applications served by the company. Dow's portfolio includes six global business divisions, structured into three functioning segments, including industrial intermediates & infrastructure, packaging & specialty plastics, and performance material & coatings. The industrial intermediates & infrastructure segment offers propylene oxide, ethylene oxides, aromatic isocyanates, and polyurethane systems, propylene glycol, polyether polyols, coatings, sealants, adhesives, composites, elastomers caustic soda, vinyl chloride monomers; ethylene dichloride, cellulose ethers, silicones, acrylic emulsions, and redispersible latex powders. The packaging & specialty plastics segment offers ethylene, polyolefin elastomers, propylene and aromatics products, ethylene propylene diene monomer rubbers, polyethylene, and ethylene-vinyl acetate. The performance materials and coatings segment offer industrial coatings and architectural paints that are used in maintenance and protective industries, thermal paper, metal packaging, wood, traffic markings, leather, standalone silicones, performance monomers and silicones, and home and personal care solutions

PPG is a leading supplier of paints, coatings, optical products, and specialty materials, catering to various sectors, including industrial, transportation, consumer products, and construction. Their extensive product range serves numerous industries, such as food and beverage, cosmetics, civil infrastructure, petrochemical, and marine. PPG Industries has developed ULTRA-Cool coatings to enhance building energy efficiency and aesthetic flexibility. Based on the Duranar PVDF system, these innovative coatings reflect solar heat, particularly reducing surface temperatures on roofs. For example, on a 90-degree day, a white roof treated with ULTRA-Cool can remain at 110°F, while traditional black roofs can heat up to 190°F. This thermal performance helps lower cooling costs and reduces urban heat island effects, benefiting the environment. The technology behind these coatings incorporates infrared (IR)-reflective pigments that absorb visible and ultraviolet light while reflecting a substantial portion of infrared energy. This innovative approach allows for a total solar reflectance (TSR) that can exceed 50%, compared to standard coatings that typically reflect only about 5%. The durability of these coatings is also noteworthy; they are designed to withstand harsh environmental conditions, reducing the need for frequent maintenance and extending the lifespan of the roofing materials.

Key Companies in Cool Roof Coatings Market

- NuTech Paint

- GAF, Inc.

- The Sherwin-Williams Company

- Henry, A Carlisle Company

- Westlake Royal Building Products

- PPG

- Dow

- Sika AG

- Hy-Tech Thermal Solutions.

- Knowde

- COOLROOF

Cool Roof Coatings Market Development

July 2024: Castagra Products launched its innovative Ecodur1 Cool Roof Coating, an eco-friendly, energy-efficient solution designed for commercial roofs. Made from renewable castor oil and gypsum, Ecodur1 offers high reflectivity, reducing energy consumption while meeting California Energy Commission (CEC) Title 24 standards.

June 2024: Everest Systems introduced Fluorostar, a 20-year durable roof coating made with Kynar Aquatec. It's suitable for various surfaces, including spray foam and metal.

Cool Roof Coatings Market Segmentation

By Product Outlook (Volume, Kilo Liters; Revenue, USD Million, 2020–2034)

- Elastomeric/White

- IR Reflective/Colored

By Application Outlook (Volume, Kilo Liters; Revenue, USD Million, 2020–2034)

- Low-Sloped

- Steep-Sloped

By End Use Outlook (Volume, Kilo Liters; Revenue, USD Million, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Volume, Kilo Liters; Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cool Roof Coatings Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,649.50 million |

|

Market Size Value in 2025 |

USD 4,970.82 million |

|

Revenue Forecast by 2034 |

USD 9,200.11 million |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilo Liters; Revenue in USD million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cool roof coatings market size was valued at USD 4,649.50 million in 2024 and is projected to grow to USD 9200.11 million by 2034

The global market is projected to register a CAGR of 7.1% during the forecast period.

The global cool roof coatings market is expected to grow at a CAGR of 7.1% during the forecast period.

A few key players in the market are NuTech Paint; GAF, Inc.; The Sherwin-Williams Company; Henry, A Carlisle Company; Westlake Royal Building Products; PPG; Dow; Sika AG; Hy-Tech Thermal Solutions; Knowde; COOLROOF.

Elastomeric/white held the largest cool roof coatings market share in 2024.

The steep-sloped segment is expected to witness the fastest cool roof coatings market growth.