Control Valve Market Size, Share, Trends, Industry Analysis Report: By Component, Type (Linear Valve and Rotary Valve), Material, Size, End-use, Industry and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 – 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5242

- Base Year: 2024

- Historical Data: 2020-2023

Control Valve Market Overview

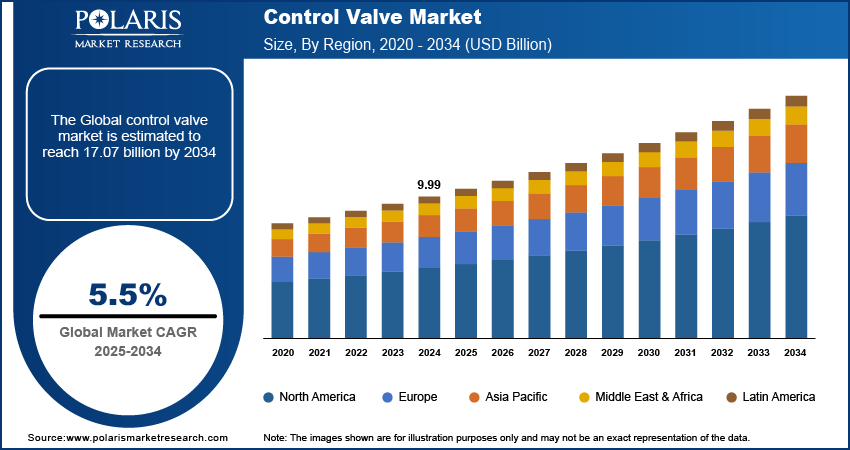

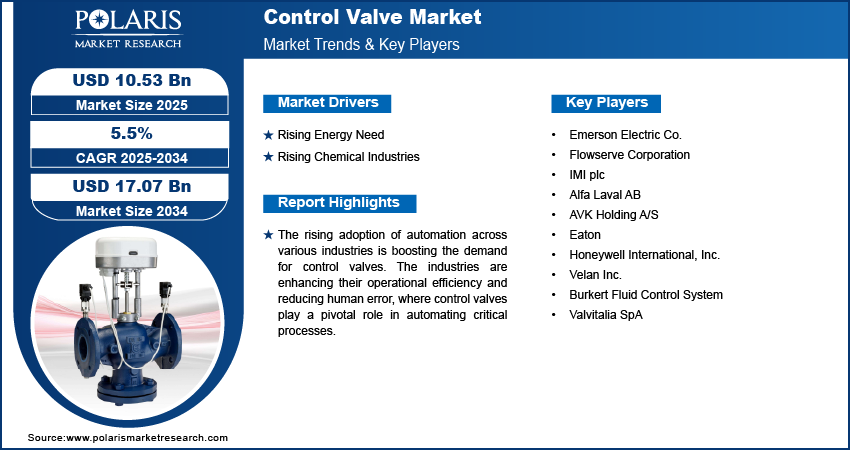

The global control valve market size was valued at USD 9.99 billion in 2024. The market is projected to grow from USD 10.53 billion in 2025 to USD 17.07 billion by 2034, exhibiting a CAGR of 5.5% during the forecast period.

Control valves regulate fluids and gases in process lines, controlling flow, pressure, temperature, or fluid levels with high accuracy. They are essential in industries such as chemical processing, oil and gas, and power. These valves operate on the principle of throttling, which adjusts the orifice size using an actuator, typically a diaphragm or piston.

The rising adoption of automation across various industries is boosting the demand for control valves. The industries are enhancing their operational efficiency and reducing human error, where control valves play a pivotal role in automating critical processes.

This shift towards automation is accelerating the integration of advanced control valves, thereby fueling market growth. Moreover, expanding infrastructure projects, particularly in water and wastewater treatment, are driving the need for advanced control valve systems. These projects demand high precision and reliability to manage complex fluid dynamics and ensure system efficiency. Thus, the rising infrastructure development is increasing the demand for control valves, further driving market growth.

To Understand More About this Research: Request a Free Sample Report

The increasing pharmaceutical industry is rising demand for control valves. Control valves are essential for ensuring precise control over the flow, pressure, and temperature of fluids during various processes. They are crucial in maintaining the quality and consistency of pharmaceutical products and managing critical operations such as mixing, blending, and filling. Thus, increasing focus on pharmaceutical innovation and manufacturing efficiency is driving the demand for control valves, thereby contributing to the growth of the control valve market in the pharmaceutical sector. Moreover, stringent environmental and safety regulations compel industries to meet rigorous standards for emissions, waste management, and operational safety. Precise control valves are essential for complying with these regulations, as they ensure accurate management of fluid and gas flow, pressure, and temperature. The increasing demand for precise control to meet regulatory requirements is driving the growth of the control valve market.

Control Valve Market Driver Analysis

Rising Energy Need

The surging energy demands across the oil and gas and power generation sectors are propelling the necessity for advanced flow control systems. The expanding global energy requires efficient flow control solutions to manage the complex processes involved in the extraction, transportation, and processing of hydrocarbons, as well as power generation. Additionally, the increase in oil and gas production has resulted in higher demand for control valves. For instance, in 2022, US oil production surged to 12.1 million barrels per day, and natural gas production reached 121.1 billion cubic feet per day by December 2022. Efficient flow control is particularly vital in the oil and gas sector to effectively oversee oil and gas extraction and distribution, maintain pipeline integrity, and optimize processing operations. This increase in production has driven the adoption of a control valve system, thereby boosting the market growth.

Rising Chemical Industries

The growing industrialization and infrastructure development in emerging markets are driving the demand for the chemicals industry. The expansion of chemical industries has led to an increased adoption of advanced control valve solutions. The rising trend towards greater automation in chemical manufacturing processes is increasing demand for advanced control valves. For instance, according to IBEF, India is the 6th largest producer of chemicals in the world and the 3rd in Asia, contributing 7% to India’s GDP. Its chemical sector, valued at USD 220 billion in 2022, is expected to grow to USD 300 billion by 2025 and USD 1 trillion by 2040. Therefore, the rising chemical industry has significantly contributed to the utilization of control valves, consequently fueling the growth of the control valve market.

Control Valve Market Segment Analysis

Control Valve Market Assessment by End-use Industry Insights

The global control valve market segmentation, based on the end-use industry, includes oil & gas, chemicals, energy & power, water & wastewater treatment, food & beverages, pharmaceuticals, and others. In 2024, the oil and gas segment accounted for the largest market share. This sector serves as a major energy source worldwide, necessitating the consistent operation of production, refining, and distribution infrastructure. Control valves play a pivotal role in optimizing and efficiently managing these processes, thereby meeting the industry's energy supply requirements. For instance, according to EIA, in 2022, 98 countries collectively produced approximately 80.75 million barrels of crude oil, with five countries contributing about 52% of the total production. The escalating crude oil production has subsequently fueled the demand for control valve systems, thereby propelling the control valve market.

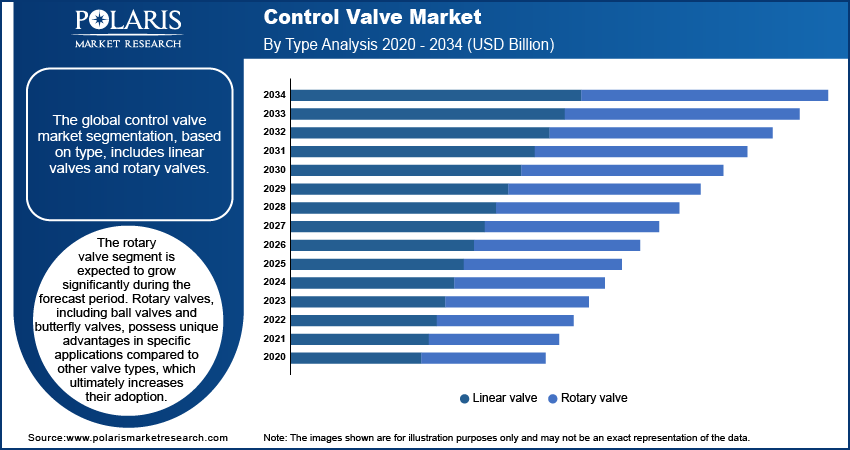

Control Valve Market Evaluation by Type Insights

The global control valve market segmentation, based on type, includes linear valves and rotary valves. The rotary valve segment is expected to grow significantly during the forecast period. Rotary valves, including ball valves and butterfly valves, possess unique advantages in specific applications compared to other valve types. They are leveraged for their rapid operation, tight shut-off capability, and suitability for high-pressure, high-temperature environments. The growth in oil and gas, chemical processing, and water treatment industries is driving higher demand for these specialized capabilities. Moreover, the launch of new rotary valve products incorporating enhanced features, improved performance metrics, and compatibility with modern control systems is spurring market growth.

For instance, in 2021, Frese launched the world’s most compact 3-way rotary control valve, the OMEGA Compact 3-way valve, designed for optimizing temperature control in marine cooling systems. Thus, the introduction of these technologically advanced rotary valves is expected to boost the market segment during the forecast period.

Control Valve Market Share by Region

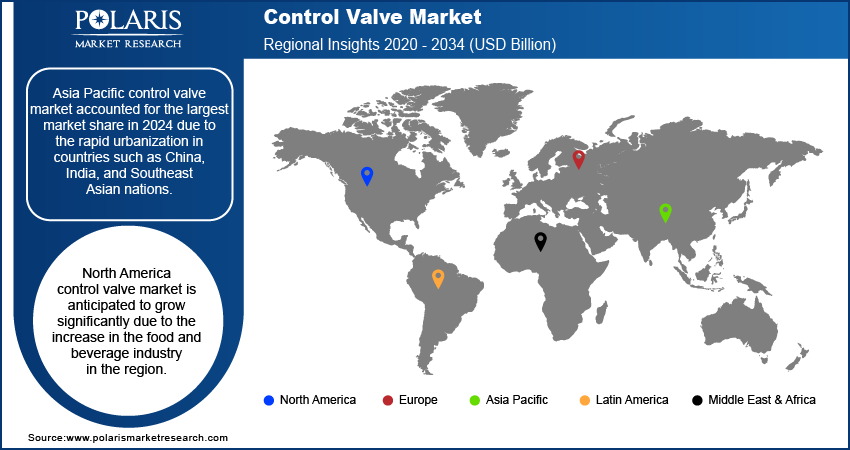

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific control valve market accounted for the largest market share in 2024 due to the rapid urbanization in countries such as China, India, and Southeast Asian nations has led to an increased demand for infrastructure development, particularly in buildings, transportation networks, and utilities. Control valves play a crucial role in HVAC systems, fire protection systems, and building automation, thereby contributing to the growth of the market. Asia Pacific is home to a diverse range of manufacturing industries, including automotive, electronics, food and beverage, and pharmaceuticals, all of which depend heavily on precise control of fluids and gases, leading to a growing demand for various types of control valves. For instance, the Indian pharmaceutical market is projected to reach a value of USD 130 billion by 2030, while the global market size of pharmaceutical products surpasses the USD 1 trillion mark in 2023. Consequently, the expanding pharmaceutical market is anticipated to adopt control valve systems, further driving market growth in Asia Pacific.

China's control valve market accounted for the largest market share in 2024 due to the significant industrial expansion across various sectors. Furthermore, China's increasing demand for electricity has led to a higher need for specialized control valves in the expanding thermal power generation sector, consequently driving market growth.

North America control valve market is anticipated to grow significantly due to the increase in the food and beverage industry in the region. For instance, the US is the largest food and beverage market worldwide, accounting for about 25% of the global market share. In 2020, the revenue in the US food and beverage industry accounted for USD 355.5 billion and is expected to reach a market value of USD 1.68 trillion by 2025. The growing food and beverage industry has driven the increased adoption of control valve systems, thereby significantly boosting the demand for the control valve market.

The US control valve market is anticipated to grow substantially due to the ongoing advancements in the oil and gas industry. The oil and gas sector in the US remains a major driver of economic activity, contributing significantly to energy production and infrastructure development. Control valves play a critical role in this industry by regulating the flow of crude oil, natural gas, and various fluids throughout exploration, production, refining, and distribution processes. The growing oil and gas industry has fueled heightened adoption of control valve systems, consequently driving the demand for the control valve market.

Control Valve Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their product lines, which will help the control valve market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the control valve industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global control valve industry to benefit clients and increase the market sector. In recent years, the control valve industry has offered some technological advancements. Major players in the market include Emerson Electric Co.; Flowserve Corporation; IMI plc; Alfa Laval AB; AVK Holding A/S, Eaton; Honeywell International, Inc.; Velan Inc.; Burkert Fluid Control System; and Valvitalia SpA.

Eaton is a power management company that operates across multiple segments, such as electrical systems and services, electrical products, vehicles, aerospace, and eMobility. The company's portfolio is broadly categorized into two main sections, including industrial and electrical. The industrial sector encompasses a diverse range of end markets, such as commercial vehicles, general aviation, and trucks. On the other hand, the electrical sector portfolio caters to utilities, data centers, and the residential end market, among others. In February 2024, Eaton launched the Bezares 500, 2500, and 3960 series power takeoff units, as well as APG and APSCO APV series directional hydraulic control valves, under its Mobility Group.

Emerson Electric Co. is a technology and software company that offers a range of solutions for industrial, commercial, and consumer markets across the America, Asia, the Middle East, Africa, and Europe. The company operates in six segments: control systems & software, final control, measurement & analytical, discrete automation, aspentech, and safety & productivity. In December 2022, Emerson launched the ASCO Series 209 proportional flow control valves, which feature pressure ratings, exceptional flow characteristics, precision, and energy efficiency in a compact, purpose-built design.

List of Key Companies in Control Valve Market

- Emerson Electric Co.

- Flowserve Corporation

- IMI plc

- Alfa Laval AB

- AVK Holding A/S

- Eaton

- Honeywell International, Inc.

- Velan Inc.

- Burkert Fluid Control System

- Valvitalia SpA

Control Valve Market Developments

June 2023: Aquana launched the Actuator Valve Serial as part of their Water IoT platform. This new remote cutoff valve, designed and manufactured in the US, functions as a remote disconnect ball valve with an IP68 rating. It is capable of seamless integration with any existing Advanced Metering Infrastructure (AMI) platform.

June 2023: Honeywell International, Inc. and Fokker Services have signed a memorandum of understanding for Fokker to offer pre-cooler control valve repair services as a channel partner and service center. This will provide more service options for airline operators.

January 2022: CIRCOR International, Inc. launched the Control Valve CIR 3100, which incorporates a cost-effective valve body offering multiple internal options tailored to accommodate a diverse range of applications within various industries.

Control Valve Market Segmentation

By Component Outlook (Revenue - USD Billion, 2020 - 2034)

- Actuators

- Valve Body

- Others

By Type Outlook (Revenue - USD Billion, 2020 - 2034)

- Linear valve

- Rotary valve

By Material Outlook (Revenue - USD Billion, 2020 - 2034)

- Stainless steel

- Cast Iron

- Alloy Based

- Others

By Size Outlook (Revenue - USD Billion, 2020 - 2034)

- Less than 1"

- Between 1" to 6"

- Between 6" to 25"

- Between 25" to 50"

- More than 50"

By End-use Industry Outlook (Revenue - USD Billion, 2020 - 2034)

- Oil & Gas

- Chemicals

- Energy & Power

- Water & Wastewater Treatment

- Food & Beverages

- Pharmaceuticals

- Others

By Regional Outlook (Revenue - USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Control Valve Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.99 Billion |

|

Market Size Value in 2025 |

USD 10.53 Billion |

|

Revenue Forecast in 2034 |

USD 17.07 Billion |

|

CAGR |

5.5% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global control valve market size was valued at USD 9.99 billion in 2024.

The global market is projected to grow at a CAGR of 5.5% during the forecast period, 2024-2032

Asia Pacific had the largest share of the global market

The key players in the market are Emerson Electric Co.; Flowserve Corporation; IMI plc; Alfa Laval AB; AVK Holding A/S; Eaton; Honeywell International, Inc.; Velan Inc.; Burkert Fluid Control System; and Valvitalia SpA.

The oil and gas category dominated the market in 2023.

The rotary valve segment had the highest share in the global market.