Continuous Delivery Market Size, Share, Trends, Industry Analysis Report: By Deployment (On-Premise and Cloud), Enterprise Size, End-Use Industry, and Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5129

- Base Year: 2023

- Historical Data: 2019-2022

Continuous Delivery Market Overview

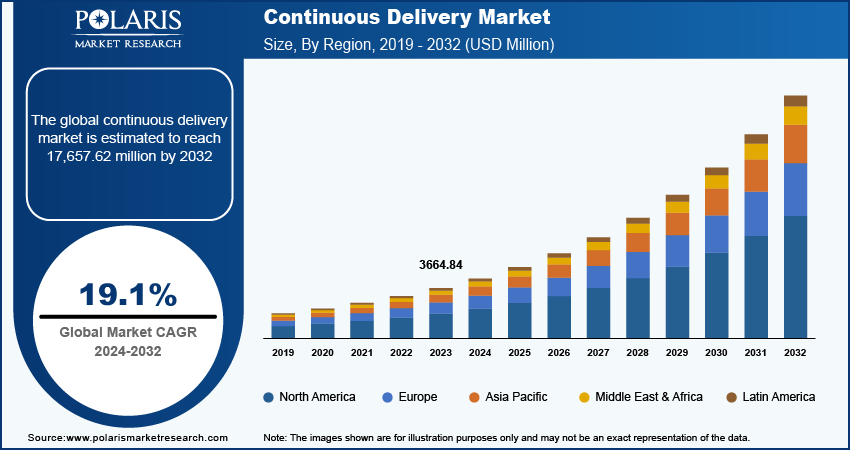

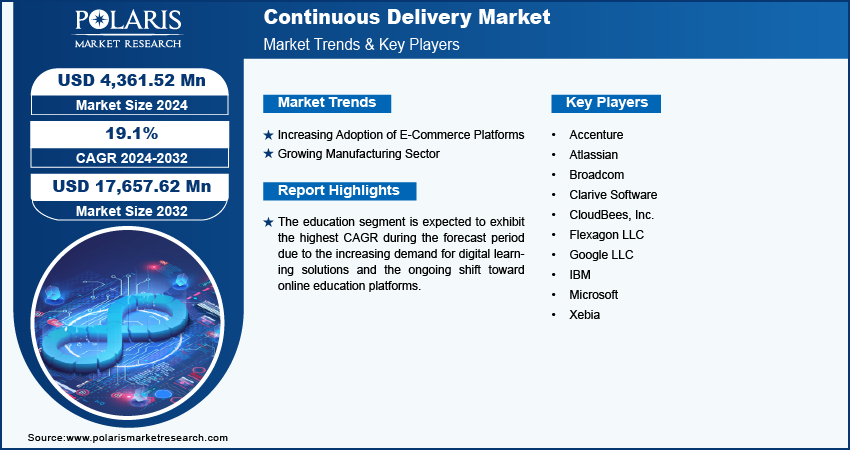

The global continuous delivery market size was valued at USD 3,664.84 million in 2023. The market is projected to grow from USD 4,361.52 million in 2024 to USD 17,657.62 million by 2032, exhibiting a CAGR of 19.1% during 2024–2032.

Continuous delivery (CD) is an advanced software development methodology that involves the automatic testing, integration, and preparation of code changes for deployment. The increasing use of cloud services has simplified infrastructure management and deployment processes, further driving demand for continuous delivery solutions. Additionally, the increasing volume of trading activities, particularly in dynamic markets such as cryptocurrency and stock trading, is significantly boosting the growth of the continuous delivery (CD) market.

To Understand More About this Research: Request a Free Sample Report

The rising need for faster software updates is driving the demand for continuous deployment (CD). Furthermore, the growing information technology (IT) industry is creating a greater need for Continuous delivery (CD). Continuous delivery is broadly utilized in IT departments to automate the process of software deployment, enabling quick delivery of applications and updates. This factor is further fueling the market expansion.

Continuous Delivery Market Trends

Increasing Adoption of E-Commerce Platforms

The adoption of e-commerce platforms is growing in the retail sector. According to the India Brand Equity Foundation, the Indian e-commerce market is projected to reach a valuation of USD 350 billion by 2030. E-commerce businesses strive to enhance customer experiences and maintain competitiveness. As a result, quick and efficient software deployment is essential for meeting evolving customer expectations and adapting to market changes. CD enables e-commerce businesses to rapidly implement new features, updates, and bug fixes. Thus, the rising adoption of e-commerce platforms is expected to drive the continuous delivery market growth in the coming years.

Growing Manufacturing Sector

The expanding manufacturing sector is creating a need for continuous delivery to improve operational efficiency and agility. According to the National Institute of Standards and Technology, in 2022, the sector contributed to USD 2.3 trillion, which accounted for 11.4% of the total US GDP. The increasing demand for consumer goods globally boosts the manufacturing sector. The companies aim to remain competitive by swiftly implementing changes and enhancements in their software systems, which are essential for optimizing production processes and effectively managing supply chains. Thus, the expanding manufacturing industry is projected to fuel the market growth during the forecast period.

Continuous Delivery Market Segment Insights

Continuous Delivery Market Breakdown by Deployment Insights

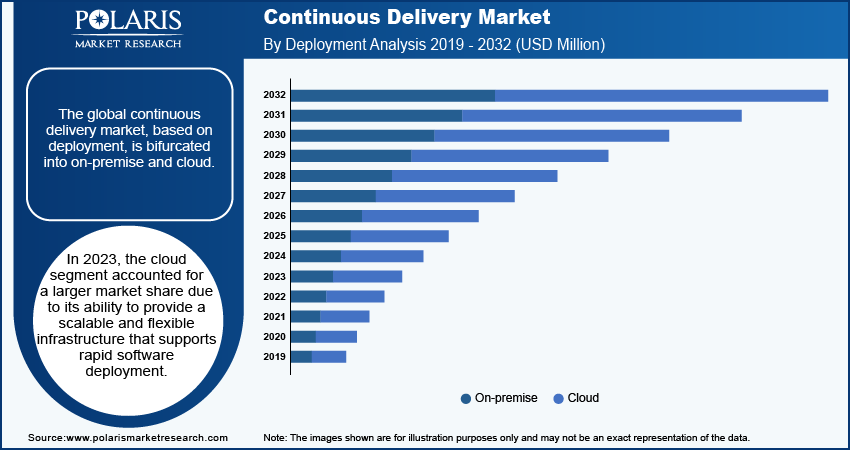

The global CD market segmentation, based on deployment, includes on-premise and cloud. In 2023, the cloud segment accounted for a larger market share due to its ability to provide a scalable and flexible infrastructure that supports rapid software deployment. Cloud services enable organizations to automate and streamline their deployment processes, facilitating continuous integration and delivery of applications. Additionally, the increasing adoption of cloud-native technologies and micro-services architecture allows for faster updates and enhancements, meeting the demands of a dynamic market.

Continuous Delivery Market Breakdown by End-Use Insights

The global continuous delivery market, based on end-use, is segmented into BFSI, education, healthcare, manufacturing, media & entertainment, retail & e-commerce, telecommunications, and others. The education segment is expected to register the highest CAGR during the forecast period due to the increasing demand for digital learning solutions and the ongoing shift toward online education platforms. According to Sedona Sky Academy, in 2024, online course enrollments witnessed a 45% increase as compared to 2023. Thus, educational institutions enhance teaching and learning experiences with the adoption of continuous delivery (CD) practices as they allow for rapid updates and improvements to learning management systems and other educational tools. Additionally, the increasing demand for personalized learning and immediate responses is driving the need for software to be developed and deployed quickly. This allows tailored learning experiences and instant responses to be provided more efficiently. Thus, the increasing trend of remote learning is supporting the education segment to register the highest growth rate during the forecast period.

Regional Insights

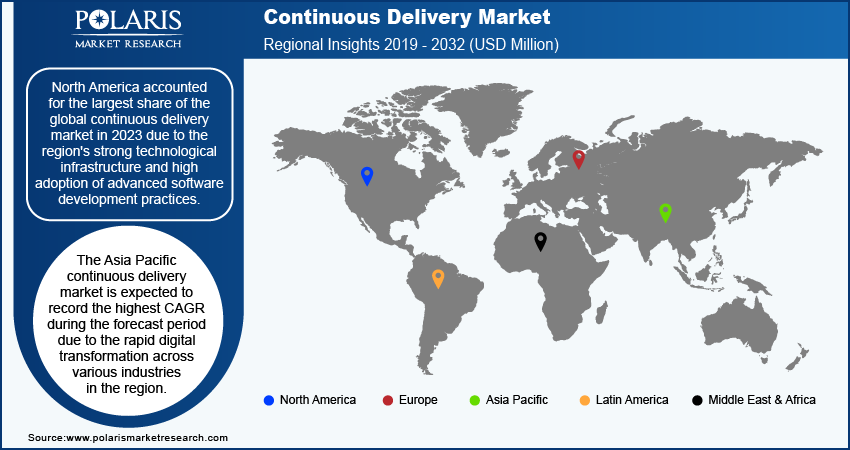

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the continuous delivery market in 2023 due to the region's strong technological infrastructure and high adoption of advanced software development practices. Major companies in North America are increasingly investing in continuous delivery to enhance their software deployment processes, improve operational efficiency, and accelerate time-to-market for new features and updates. In October 2023, the Microsoft Azure Incubations team launched Radius, a cloud-native application platform that facilitates collaboration between platform engineers and developers in managing and delivering cloud-native applications. Additionally, the presence of leading cloud service providers and a vibrant ecosystem of technology startups contribute to the rapid growth of the CD market in the region.

The US held the largest share of the continuous delivery market in North America in 2023 due to increasing demand for rapid software updates and the rising implementation of delivery practices among organizations to meet surging needs of compliance with regulatory standards.

The Asia Pacific continuous delivery market is expected to record the highest CAGR during the forecast period due to the rapid digital transformation across various industries in the region. Increasing investments in cloud infrastructure and the adoption of agile methodologies are driving organizations to implement continuous delivery practices to enhance software deployment efficiency. In October 2024, Oracle announced its plan to invest USD 6.5 billion in Malaysia to fulfill the growing demand for its cloud services and artificial intelligence (AI) by establishing a public cloud region in the country. Additionally, the rise of startups and tech companies in emerging markets is fostering innovation and demand for cloud-native solutions. Thus, the growing importance of improving operational efficiency and accelerating time-to-market for applications fuels the demand for continuous delivery in Asia Pacific.

The China continuous delivery market is expected to register the highest CAGR during the forecast period due to government support for technological innovation and local IT ecosystem expansion that is driving investments in continuous delivery practices.

Continuous Delivery Market – Key Players and Competitive Insights

The competitive landscape of the continuous delivery market is characterized by a dynamic mix of established technology giants, innovative startups, and specialized service providers. Key players such as Microsoft; Amazon Web Services (AWS); Google Cloud; and IBM dominate the market, leveraging their extensive resources, advanced technology, and strong brand recognition to offer comprehensive continuous delivery solutions. These companies often integrate continuous delivery practices with their broader cloud and DevOps services, enhancing their value propositions. Additionally, the number of emerging startups and niche providers are gaining traction by offering tailored solutions that address specific industry needs or focus on particular aspects of the continuous delivery process, such as automation, monitoring, and testing. This diversity fosters a competitive environment that drives innovation and pushes companies to enhance their offerings continuously. A few major market players are Accenture; Atlassian; Broadcom; Clarive Software; CloudBees, Inc.; lexagon LLC; Google LLC; IBM; Microsoft; and Xebia.

Broadcom Inc. is an American multinational company that specializes in designing, developing, and supplying a wide range of semiconductor and infrastructure software solutions. Headquartered in San Jose, California, Broadcom is engaged in the technology sector, particularly in the fields of data center networking, broadband, wireless communications, and enterprise software. The company's product portfolio is diverse, encompassing storage adapters, controllers, integrated circuits (ICs), and various wireless and wired connectivity solutions. Its offerings are integral to numerous applications, including telecommunications equipment, smartphones, data center servers, and broadband access devices. In August 2024, Broadcom Inc. launched VMware Tanzu Platform 10, a cloud native application platform that boosts software delivery and improves governance and operating efficiency for platform engineering teams while reducing effort and complexity for development teams.

Google LLC, a subsidiary of Alphabet Inc., provides search and advertising services on the Internet. The company, Google LLC, operates in two major reportable segments—Google Services and Google Cloud. The "Google Services" segment comprises a wide range of core products and platforms, including Android, Ads, Hardware, Chrome, Google Drive, Gmail, Google Photos, Google Maps, Google Play, YouTube, and Search. The segment's hardware products are Pixel 5a 5G, Pixel 6 phones, Chromecast with Google TV, the Fitbit Charge 5, Google Nest Cams, and Nest Doorbells. In August 2022, the company launched Google Cloud Deploy for Google Kubernetes Engine, offering declarative builds, support for external workflows, and robust security controls.

Key Companies in Continuous Delivery Market

- Accenture

- Atlassian

- Broadcom

- Clarive Software

- CloudBees, Inc.

- Flexagon LLC

- Google LLC

- IBM

- Microsoft

- Xebia

Continuous Delivery Industry Developments

In June 2023, Leapwork, a visual, AI-powered test automation platform, partnered with Microsoft to drive innovation and ensure quality across Microsoft Dynamics 365 and Power Platform.

In November 2023, Atlassian made significant enhancements to Jira Software and Bitbucket aimed at boosting continuous integration and delivery functionalities. Notable updates encompass refined integration between Jira and Bitbucket, enabling teams to directly associate pull requests with Jira issues, thereby fostering improved traceability and collaboration across the development lifecycle.

In March 2023, CloudBees launched the continuous delivery foundation, a new foundation that operates under the Linux Foundation.

Continuous Delivery Market Segmentation

By Deployment Outlook (Revenue – USD Million, 2019–2032)

- On-Premise

- Cloud

By Enterprise Size Outlook (Revenue – USD Million, 2019–2032)

- SMEs

- Large Enterprises

By End-Use Outlook (Revenue – USD Million, 2019–2032)

- BFSI

- Education

- Healthcare

- Manufacturing

- Media & Entertainment

- Retail & E-commerce

- Telecommunications

- Others

By Regional Outlook (Revenue – USD million, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Continuous Delivery Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 3,664.84 million |

|

Market Size Value in 2024 |

USD 4,361.52 million |

|

Revenue Forecast by 2032 |

USD 17,657.62 million |

|

CAGR |

19.1% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global continuous delivery market size was valued at USD 3,664.84 million in 2023 and is projected to grow to USD 17,657.62 million by 2032

The global market is projected to record a CAGR of 19.1% during the forecast period.

North America accounted for the largest market share in 2023 due to the region's strong technological infrastructure and high adoption of advanced software development practices.

A few key players in the market are Accenture, Atlassian, Broadcom, Clarive Software, CloudBees, Inc., lexagon LLC, Google LLC, IBM, Microsoft, and Xebia.

The cloud segment dominated the market in 2023 due to its ability to provide a scalable and flexible infrastructure that supports rapid software deployment.

The education segment is projected to register the highest CAGR during the forecast period due to the increasing demand for digital learning solutions and the ongoing shift toward online education platforms.