Containers as a Service Market Size, Share, Trend, Industry Analysis Report

By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Service Type, By Enterprise Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM2939

- Base Year: 2024

- Historical Data: 2020-2023

Overview

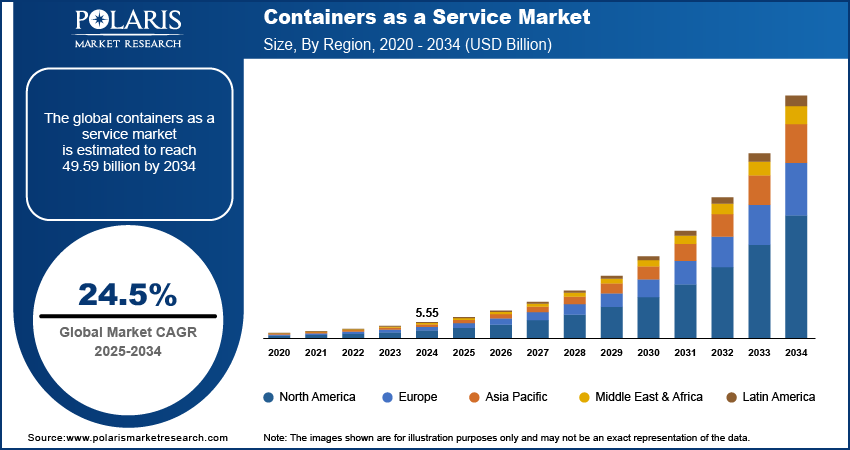

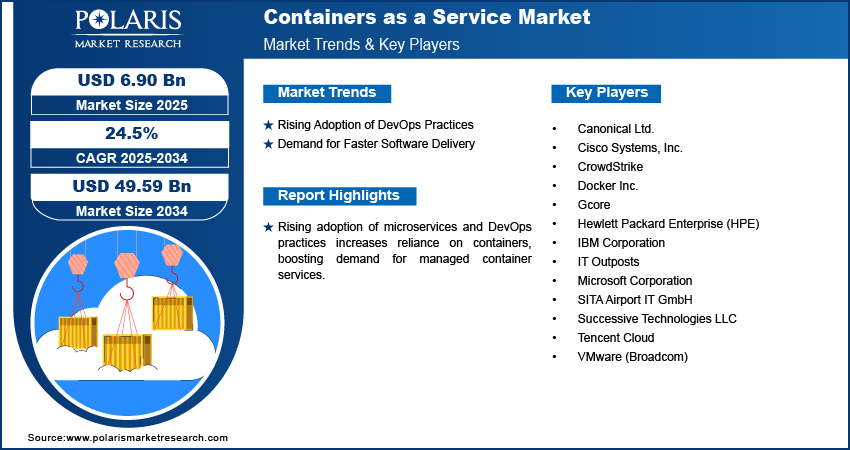

The global containers as a service (CaaS) market size was valued at USD 5.55 billion in 2024, growing at a CAGR of 24.5% from 2025 to 2034. Organizations are adopting multi-cloud and hybrid strategies to avoid vendor lock-in and improve resilience. CaaS simplifies container orchestration across multiple environments, enabling uniform deployment, resource optimization, and centralized management of containerized workloads.

Key Insights

- The orchestration platforms segment grew significantly in 2024 as complex containerized environments drove demand for tools managing deployment, scaling, and operations.

- The public cloud segment held ~45% of the market share in 2024, as enterprises favored scalable, cost-effective cloud platforms for container workloads.

- The large enterprises segment dominated in 2024 due to high-volume container adoption and complex, distributed application infrastructures.

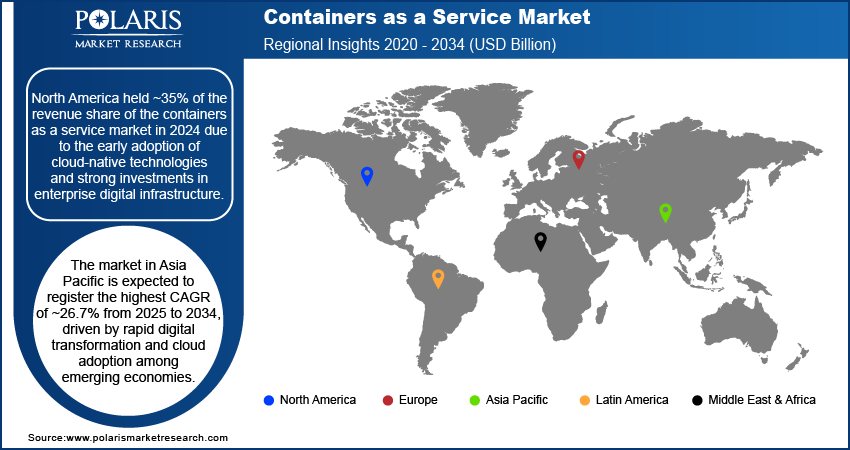

- North America captured ~35% of the market share in 2024, driven by early cloud-native adoption and strong digital infrastructure investments.

- The market in the U.S. is projected to grow rapidly from 2025 to 2034, fueled by rising container adoption in banking, telecom, and healthcare sectors.

- The market in Asia Pacific is expected to register the highest CAGR of ~26.7% from 2025 to 2034, supported by rapid digital transformation and cloud expansion.

- China’s market is growing due to aggressive enterprise IT modernization and strategic push for cloud infrastructure independence.

Industry Dynamics

- Growing demand for scalable, agile application deployment is driving enterprises to adopt container-based cloud services for faster development cycles.

- Rising adoption of microservices and DevOps practices increases reliance on containers, boosting demand for managed container services.

- Serverless container platforms reduce infrastructure management, enabling developers to focus on code and accelerate time-to-market for new applications.

- Limited standardization and vendor lock-in risks create challenges for seamless portability and integration across multi-cloud and hybrid environments.

Market Statistics

- 2024 Market Size: USD 5.55 billion

- 2034 Projected Market Size: USD 49.59 billion

- CAGR (2025–2034): 24.5%

- North America: Largest market in 2024

AI Impact on Containers as a Service Market Statistics

- AI-based orchestration enables self-healing, predictive scaling, and optimized load balancing across clusters, which assists in enhancing application resilience and streamlining operations.

- AI systems help manage container workloads easily across multi-cloud and hybrid setups, aiding in workload portability, interoperability, and vendor flexibility; they reduce lock-in risks.

- AI tools help enterprises balance performance with budget constraints.

- AI monitors infrastructure health, weather data, and geo-political risks, which predicts potential system failures.

The containers as a service market refers to a cloud-based service model that enables users to manage and deploy containerized applications using orchestration tools. It streamlines container lifecycle management, offering scalability, portability, automation, and reduced infrastructure complexity. The rising adoption of microservices architecture is allowing organizations to build scalable, decoupled applications effectively. Containers play a pivotal role in this paradigm by encapsulating services, which facilitates independent development, testing, and deployment processes. This trend is significantly boosting the demand for Container as a Service (CaaS) platforms, which enhance application lifecycle management by providing streamlined orchestration and management solutions for containerized applications.

DevOps encourages continuous integration and continuous delivery (CI/CD), requiring fast, consistent, and reliable environments. CaaS provides automation, orchestration, and container lifecycle management that align perfectly with DevOps workflows, making it integral to modern software development pipelines. Moreover, containers offer unmatched application portability across cloud, on-premise, and hybrid environments. CaaS enhances this flexibility by managing scaling and deployment seamlessly, appealing to enterprises seeking agility and consistent performance across dynamic IT environments.

Drivers & Opportunities

Rising Adoption of DevOps Practices: DevOps has become a core part of modern software development, promoting collaboration between development and operations teams to improve the speed and quality of software delivery. Continuous integration and continuous delivery (CI/CD) are key practices in DevOps, requiring consistent and scalable environments for building, testing, and deploying applications. It offers built-in support for these workflows through features such as container orchestration, lifecycle automation, and real-time monitoring. These capabilities enable teams to maintain efficiency and reliability throughout the development pipeline. CaaS fits naturally into DevOps ecosystems, helping organizations deliver better software faster while minimizing operational burdens.

Demand for Faster Software Delivery: Enterprises are under pressure to release software updates quickly to stay competitive and meet user expectations. Rapid innovation, evolving customer needs, and shorter product lifecycles demand fast and frequent deployment cycles. Containers as a Service enables this by streamlining the deployment and management of containerized applications. It automates key processes such as provisioning, scaling, and monitoring, allowing developers to focus on writing code rather than managing infrastructure. Teams build, test, and release applications faster and more reliably, reducing the time-to-market for new features. This speed and agility make CaaS a valuable asset for organizations embracing agile methodologies.

Segmental Insights

Service Type Analysis

Based on service type, the segmentation includes management & orchestration, security, monitoring and analytics, storage and networking, and others. The management & orchestration segment dominated the market with ~30% of the revenue share in 2024 as the rise of complex, containerized environments across enterprises created the need for robust orchestration platforms to handle deployment, scaling, and operational management. Tools such as Kubernetes have become essential for managing containers at scale, ensuring seamless application delivery and performance. Many organizations prioritized investments in orchestration to gain better control over containerized workloads, reduce downtime, and improve resource utilization.

The monitoring and analytics segment is expected to register the fastest CAGR from 2025 to 2034, driven by the increasing demand for real-time visibility into containerized applications. Organizations are relying on data-driven insights to detect performance issues, ensure compliance, and enhance application reliability. Advanced analytics tools integrated into CaaS platforms help detect anomalies, predict system failures, and optimize container performance. The need to maintain service-level agreements (SLAs) and improve incident response times has pushed enterprises to adopt intelligent monitoring systems. Growth in distributed, cloud-native applications further adds complexity, making advanced observability tools a key priority for future-ready infrastructure.

Deployment Analysis

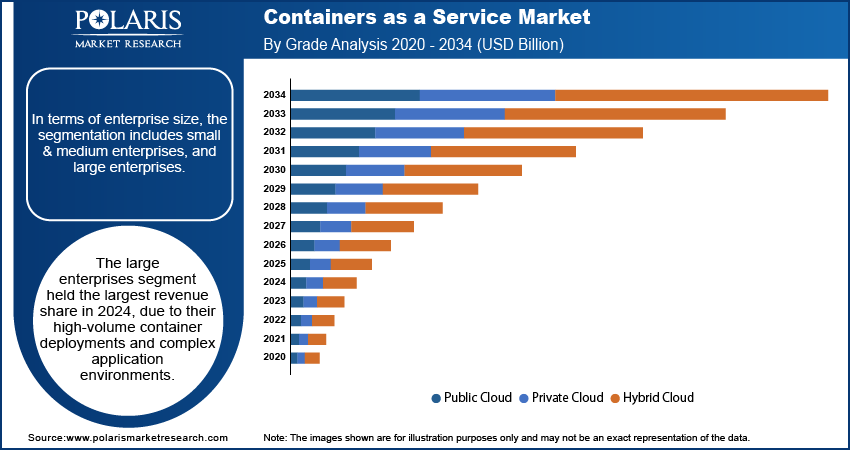

In terms of deployment, the segmentation includes public cloud, private cloud, and hybrid cloud. The public cloud segment held ~45% of the revenue share in 2024. Enterprises increasingly preferred public cloud providers for their container workloads due to the scalability, lower upfront investment, and broad ecosystem of services offered. Major players provided robust CaaS solutions with built-in orchestration, monitoring, and security features, enabling rapid deployment and minimal infrastructure management. The flexibility to manage fluctuating workloads without hardware constraints attracted both large organizations and startups. The trend toward cloud-first strategies and rapid digital transformation across industries further strengthened the dominance of public cloud-based container deployments.

The hybrid cloud segment is expected to register the highest CAGR from 2025 to 2034, driven by enterprises seeking greater flexibility, control, and data governance. Many organizations are integrating on-premise infrastructure with public cloud platforms to manage sensitive workloads while leveraging the cloud for scalability. CaaS plays a vital role in enabling seamless container orchestration across hybrid environments. The ability to deploy, monitor, and scale applications across multiple clouds and on-premise systems appeals to industries with regulatory concerns and data sovereignty requirements. Increased focus on workload portability, disaster recovery, and operational resilience continues to fuel this segment’s rapid expansion.

Enterprise Size Analysis

In terms of enterprise size, the segmentation includes small & medium enterprises, and large enterprises. The large enterprises segment held the largest revenue share in 2024 due to their high-volume container deployments and complex application environments. These organizations often operate across multiple geographies and require advanced orchestration and monitoring capabilities to ensure uptime and performance. The need for strong governance, security frameworks, and centralized management pushed large-scale businesses to adopt sophisticated CaaS platforms. Budget flexibility and existing investments in DevOps pipelines also contributed to wider adoption. Moreover, these enterprises are continuously optimizing infrastructure to improve operational efficiency, which has made them key adopters of automated container management tools.

The small & medium enterprises segment is expected to register a significant CAGR from 2025 to 2034, supported by growing interest in agile development and digital transformation. Many SMEs are adopting CaaS to simplify application deployment without investing heavily in infrastructure or personnel. Cloud-native development is becoming more accessible, enabling faster time-to-market and improved scalability for smaller firms. The flexibility of pay-as-you-go models, along with the availability of managed container services, allows SMEs to focus on product innovation rather than backend operations.

End Use Analysis

In terms of end use, the segmentation includes IT & telecommunication, BFSI, healthcare, retail, manufacturing, government, transportation & logistics, and others. The IT & telecommunication segment held the largest revenue share in 2024 due to its high demand for scalable, high-performance application infrastructure. Telecom providers and tech companies rely on containerized microservices to support dynamic services such as 5G, edge computing, and cloud platforms. These workloads require seamless orchestration and rapid deployment, which are well-supported by CaaS solutions. The sector also benefits from a mature DevOps culture and strong investments in automation. High levels of service delivery expectations, coupled with the need for efficient resource management, drove heavy adoption of CaaS platforms in this segment.

The retail segment is expected to register a significant CAGR from 2025 to 2034, fueled by the need for digital agility, personalized customer experiences, and real-time analytics. Retailers are leveraging CaaS to support eCommerce platforms, recommendation engines, and inventory systems that require continuous updates and fast scalability. Containerized applications help streamline omnichannel operations and improve backend integration across stores, warehouses, and digital touchpoints. Seasonal traffic spikes and changing consumer behavior demand a flexible infrastructure that CaaS can deliver. The ability to reduce deployment time and experiment with new services quickly makes container platforms particularly attractive for retail businesses.

Regional Analysis

The North America containers as a service market held ~35% of the revenue share in 2024 due to early adoption of cloud-native technologies and strong investments in enterprise digital infrastructure. Organizations across industries have integrated CaaS platforms into their DevOps workflows to enhance application scalability, performance, and speed of delivery. Leading cloud providers and tech giants based in the region have heavily influenced market maturity through innovation in orchestration and container lifecycle tools. High cloud penetration, widespread use of Kubernetes, and demand for CI/CD pipelines further strengthened North America's leadership in the CaaS market throughout the year.

U.S. Containers as a Service Market Insights

The market in the U.S. is projected to grow rapidly from 2025 to 2034 due to the rising demand for containerized solutions in banking, telecom, and healthcare sectors. These industries are shifting toward microservices-based architectures to improve application flexibility and service delivery. Government and defense entities are also investing in secure CaaS deployments to modernize IT systems. Expansion of hybrid cloud infrastructure and increased adoption of AI and machine learning applications further necessitate scalable, container-based environments. Strong collaboration between enterprises and CaaS platform providers is expected to continue fueling market growth across large and mid-sized businesses during the forecast period.

Asia Pacific Containers as a Service Market Outlook

Asia Pacific is expected to register the highest CAGR of ~26.7% from 2025 to 2034, driven by rapid digital transformation and cloud adoption among emerging economies. Startups and tech-driven enterprises in the region are turning to CaaS platforms to enhance time-to-market, reduce operational costs, and scale services efficiently. Growing investments in smart city projects, 5G rollout, and eCommerce ecosystems are increasing demand for flexible, containerized infrastructure. Technology hubs across countries such as India, Singapore, and Indonesia are promoting cloud-native development environments, which further encourages the use of scalable container solutions managed through CaaS offerings.

China Containers as a Service Market Trends

The China market is growing due to its aggressive push toward enterprise IT modernization and cloud independence. Leading domestic cloud providers are investing heavily in Kubernetes-based services and container lifecycle automation. Industries such as manufacturing, finance, and logistics are adopting containerized microservices to support digital platforms and improve service agility. The rise of artificial intelligence and big data applications has created a need for flexible, modular environments, which containers support effectively. Government-led initiatives promoting digital infrastructure and local cloud ecosystems have also encouraged widespread adoption of CaaS platforms across both state-owned and private enterprises.

Europe Containers as a Service Market Analysis

The market in Europe is growing significantly due to the increasing demand for compliance-driven cloud-native applications, especially in sectors such as BFSI and healthcare. The imposition of stricter data protection regulations such as GDPR requires robust infrastructure solutions that ensure security and operational transparency, both of which are supported by CaaS offerings. Enterprises across Germany, France, and the Nordics are deploying container solutions to enable seamless hybrid cloud environments while maintaining control over data flow. Growing reliance on automation, edge computing, and real-time analytics across industrial sectors is also creating new opportunities for container-based deployment models.

Key Players & Competitive Analysis

The competitive landscape of the containers as a service market is defined by intense innovation and evolving strategic priorities. Industry analysis indicates a strong focus on market expansion strategies, particularly through cloud-native service enhancements and differentiated orchestration capabilities. Key players are actively engaging in joint ventures and strategic alliances to strengthen their container ecosystems and expand their global footprint. Mergers and acquisitions continue to reshape the landscape, with post-merger integration focusing on unifying container management platforms and accelerating hybrid and multi-cloud offerings.

Technological advancements in areas such as serverless containers, edge deployment, and AI-based orchestration are further intensifying competition. Strategic partnerships are enabling vendors to integrate advanced analytics, security features, and monitoring tools into their offerings. The market is also witnessing increased vertical-specific customization, catering to industries with complex regulatory and operational needs. These collective efforts are positioning vendors to capture emerging opportunities across both established and developing digital infrastructure markets.

Key Players

- Canonical Ltd.

- Cisco Systems, Inc.

- CrowdStrike

- Docker Inc.

- Gcore

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- IT Outposts

- Microsoft Corporation

- SITA Airport IT GmbH

- Successive Technologies LLC

- Tencent Cloud

- VMware (Broadcom)

Containers as a Service Industry Developments

In March 2025: Triton International entered into an agreement for the acquisition of Global Container International LLC. According to Triton, the strategic move will improve its ability to provide exceptional service and support to its customers.

In February 2025: Akamai Technologies announced the launch of its Managed Container Service. The company stated that the new service will allow businesses to deploy cloud-native applications across a global network of more than 4,300 points of presence (PoPs).

In January 2025, Alibaba Cloud launched its Container Compute Service (ACS), a serverless container platform that simplifies deployment by eliminating the need to manage nodes or clusters, reducing cost and complexity.

In February 2024, Gcore introduced its Container as a Service (CaaS) solution, a serverless offering that allows users to run containerized applications without managing infrastructure, paying only for actual runtime.

Containers as a Service Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Management & Orchestration

- Security

- Monitoring and Analytics

- Storage and Networking

- Others

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Small & Medium Enterprises

- Large Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- IT & Telecommunication

- BFSI

- Healthcare

- Retail

- Manufacturing

- Government

- Transportation & Logistics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Containers as a Service Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.55 billion |

|

Market Size in 2025 |

USD 6.90 billion |

|

Revenue Forecast by 2034 |

USD 49.59 billion |

|

CAGR |

24.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.55 billion in 2024 and is projected to grow to USD 49.59 billion by 2034.

The global market is projected to register a CAGR of 24.5% during the forecast period.

North America held ~35% of the revenue share in 2024 due to early adoption of cloud-native technologies and strong investments in enterprise digital infrastructure.

A few of the key players in the market are Canonical Ltd; Cisco Systems, Inc.; CrowdStrike; Docker Inc.; Gcore; Hewlett Packard Enterprise (HPE); IBM Corporation; IT Outposts; Microsoft Corporation; SITA Airport IT GmbH; Successive Technologies LLC; Tencent Cloud; and VMware (Broadcom).

The management & orchestration segment dominated the market with ~30% of the revenue share in 2024 as the rise of complex, containerized environments across enterprises created the need for robust orchestration platforms to handle deployment, scaling, and operational management.

The public cloud segment held ~45% of the revenue share in 2024. Enterprises increasingly preferred public cloud providers for their container workloads due to the scalability, lower upfront investment, and broad ecosystem of services offered.