Contactless Biometrics Technology Market Share, Size, Trends, Industry Analysis Report, By Offering (Hardware, Software, Services); By Type; By End Use Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM1906

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

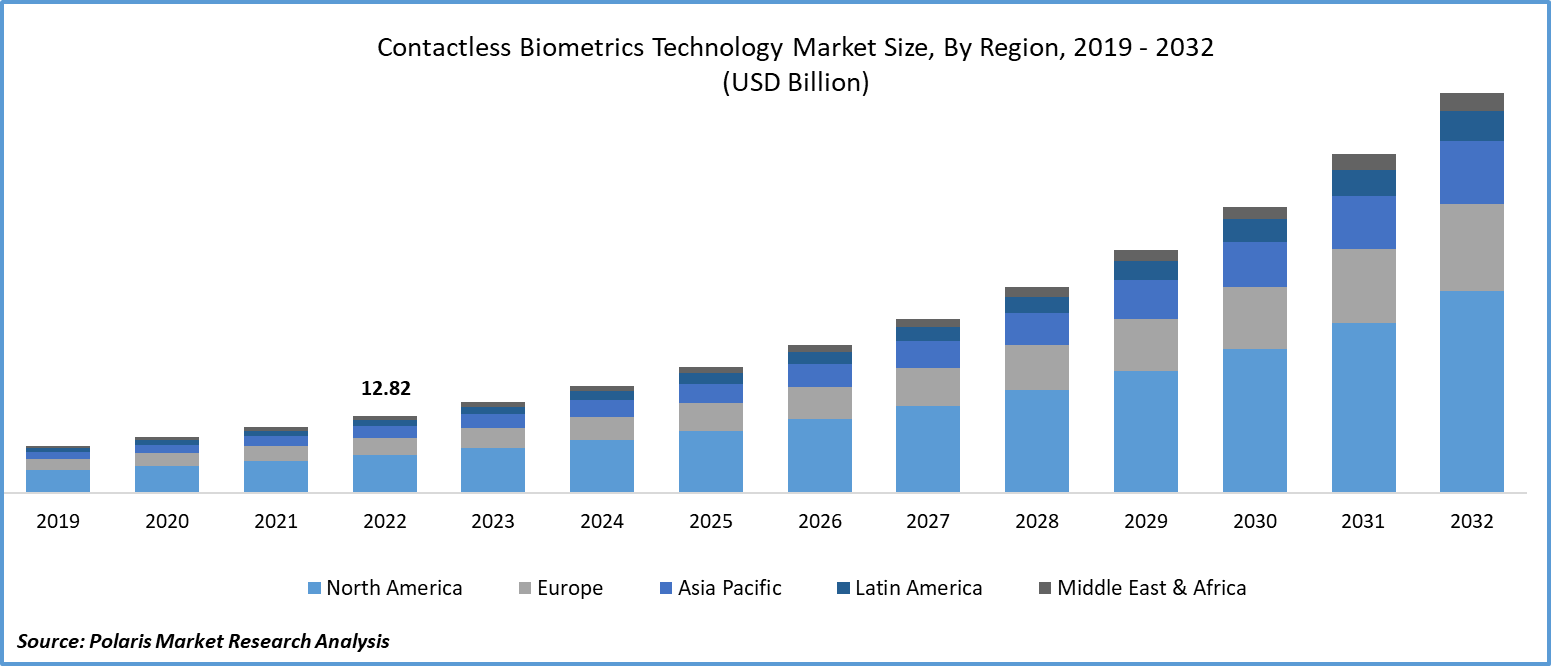

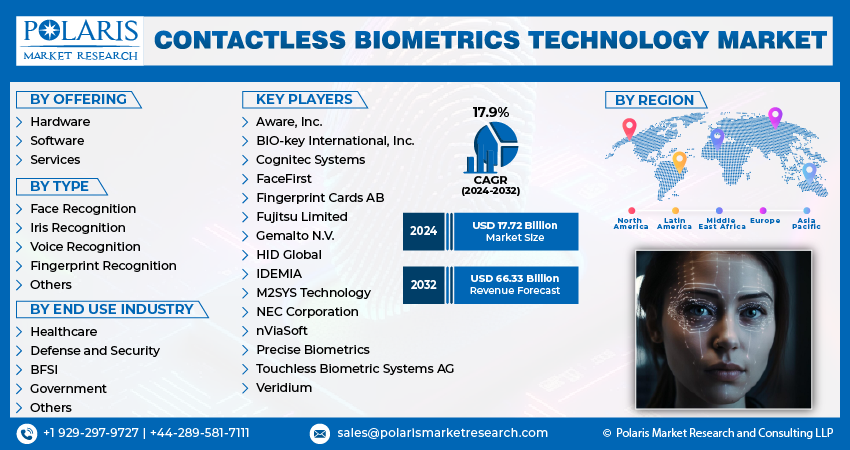

The global contactless biometrics technology market was valued at USD 15.07 billion in 2023 and is expected to grow at a CAGR of 17.9% during the forecast period.

The versatility of contactless biometrics spans diverse sectors, including finance, healthcare, government, and consumer electronics. This wide applicability unlocks growth opportunities across various industries. The integration of contactless biometrics into consumer electronics, such as smartphones, tablets, and laptops, presents an extensive market opportunity. Secure device access through biometric authentication is increasingly becoming the norm, expanding the market footprint.

To Understand More About this Research: Request a Free Sample Report

The financial sector is adopting contactless biometrics, particularly in secure transactions. Payment systems that rely on fingerprint or facial recognition are gaining traction, providing opportunities for further growth. The concept of smart cities leans on contactless biometrics for various aspects, including enhancing security, streamlining public services, and supporting urban planning and management.

In addition, several companies are expanding their offerings to cater to the growing consumer demand.

For instance, in March 2023, Idemia unveiled enhanced iterations of its biometric devices, namely OneLook Gen2 and MorphoWave TP. These offerings are engineered to expedite traveler identity verification procedures, prioritizing swifter, more robust, and seamless biometric verification.

Continuous enhancements in biometric algorithms, hardware, and software contribute to improved accuracy and efficiency. These technological strides make contactless biometrics more reliable and accessible for various industries. The growing emphasis on data privacy and regulatory compliance has led to the development of secure and compliant contactless biometric solutions. These measures address user concerns and align with legal requirements, further promoting adoption.

The pandemic accelerated the adoption of contactless biometrics as people sought hygienic, touchless solutions. In a post-COVID world, the demand for contactless options remains strong, with individuals and organizations keen to reduce physical contact and enhance safety. The need for secure remote authentication has grown significantly. Organizations are integrating contactless biometrics into their systems to ensure users can securely authenticate from anywhere.

Growth Drivers

Greater Security Concerns, Convenience and Enhanced User Experience, and Government Initiatives are Factors Projected to Spur the Market Demand

Heightened security concerns, particularly in sectors like finance and healthcare, fuel the demand for contactless biometrics. These systems offer a robust shield against identity theft, fraud, and unauthorized access, driving their adoption.

Contactless biometrics simplify the user authentication process, offering a convenient and user-friendly experience. Users no longer need to remember complex passwords or carry physical tokens, thus enhancing their satisfaction.

Governments worldwide are actively embracing contactless biometrics in applications like border control, national identification systems, and public safety. These initiatives create a robust contactless biometrics technology market framework and present significant growth opportunities.

Report Segmentation

The market is primarily segmented based on offering, type, end use industry, and region.

|

By Offering |

By Type |

By End Use Industry |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Offering Analysis

Software Segment Accounted for a Significant Share in 2022

The software segment accounted for a significant share in 2022. Contactless biometrics technology relies on a suite of critical software components to facilitate secure and efficient authentication processes. The biometric matching software is responsible for comparing captured biometric data, like facial features or fingerprints, against stored reference data for identity verification. Other software functionalities include data storage, encryption for user privacy, integration with access control systems, user management, ensuring permissions, user profiles, and compliance with privacy regulations. User interfaces provide feedback during the authentication process, fostering a positive user experience. Additionally, software can support remote and mobile access, data analytics for insights, and cloud-based solutions for centralized management, scalability, and performance optimization.

By Type Analysis

Face Recognition Emerged as the Largest Segment in 2022

The face recognition emerged as the largest segment in 2022. Facial recognition significantly enhances security by leveraging the uniqueness of an individual's facial features, reducing the risk of identity theft and fraud. Moreover, these solutions are touchless and hygienic, addressing heightened concerns regarding personal safety, especially in high-traffic areas. Advancements in facial recognition algorithms and hardware, integration with smart devices, and government initiatives have driven its adoption. The COVID-19 pandemic has further accelerated its usage due to its touchless nature. Moreover, ongoing efforts to address data privacy and regulation have made facial recognition solutions more secure and compliant. The competitive market landscape drives continuous innovation, improving the technology's accuracy and security. The cost-effectiveness and seamless integration with existing access control systems have also contributed to its growth.

By End Use Industry Analysis

Government Segment Held the Significant Market Revenue Share in 2022

The government segment accounted for a significant share in 2022. Governments worldwide, have embraced contactless biometrics technology across diverse sectors, demonstrating its versatility and effectiveness in enhancing security, improving efficiency, and providing citizens with convenient, secure access to government services. Contactless biometrics play a pivotal role in border control and immigration by swiftly and accurately verifying travelers' identities through facial recognition and fingerprint scans. Additionally, they are instrumental in the development of national identification systems, creating secure digital identities for citizens that facilitate access to government services, voting, and record-keeping. These technologies expedite criminal identification and background checks, ensuring public safety and aiding investigations. The issuance of passports and visas benefits from biometric data, enhancing document security and streamlining application processes.

Regional Insights

North America Emerged as the Largest Region in 2022

North America emerged as the largest region in 2022. The prevalence of contactless biometrics in the US can be attributed to their growing recognition for offering enhanced security and providing users with seamless experiences. This heightened adoption is a response to amplified security concerns across various sectors. In contrast to traditional authentication methods like passwords or PINs, contactless biometrics are perceived as a more secure alternative, especially in industries such as finance and healthcare.

Notably, government agencies in the US have expressed substantial interest in the multifaceted applications of contactless biometrics, encompassing border control and immigration. Federal initiatives and collaborative efforts have played pivotal roles in propelling market growth. Furthermore, the financial sector has been a pioneering force in the adoption of contactless biometrics for securing transactions. Fingerprint or facial recognition-based payment systems are progressively gaining prominence, bolstering both security and user experience.

Asia-Pacific is expected to experience significant growth during the forecast period. The COVID-19 pandemic has accelerated the adoption of these touchless technologies as they offer a way to minimize physical contact, reducing the risk of virus transmission. These solutions are increasingly sought after for their enhanced security, as biometric data, such as facial recognition or fingerprint scans, is unique to individuals, making it difficult to counterfeit. Moreover, contactless biometrics offer a seamless and convenient user experience, eliminating the need to remember passwords or carry physical tokens. Market competition fosters innovation, making companies continually strive to enhance security, accuracy, and user experience. The growing urbanization in Asian regions has led to increased demand for secure and efficient access control and identification solutions, while Asia's integration into the global economy further propels demand, especially in international travel and immigration scenarios.

Key Market Players & Competitive Insights

The contactless biometrics technology sector presents a fragmented landscape, with increasing competition driven by the engagement of various participants. Leading companies within this industry continuously implement inventive approaches to strengthen their market standing. These industry leaders prioritize tactics such as forging partnerships and cultivating collaborations to gain a competitive advantage over their counterparts and establish a noteworthy market foothold.

Some of the major players operating in the global market include:

- Aware, Inc.

- BIO-key International, Inc.

- Cognitec Systems

- FaceFirst

- Fingerprint Cards AB

- Fujitsu Limited

- Gemalto N.V.

- HID Global

- IDEMIA

- M2SYS Technology

- NEC Corporation

- nViaSoft

- Precise Biometrics

- Touchless Biometric Systems AG

- Veridium

Recent Developments

- In June 2022, Moqi launched new solutions crafted to facilitate contactless scanning, especially during a period marked by heightened apprehensions surrounding the transmission of COVID-19 and other contagions.

- In January 2021, Fujitsu Laboratories, Ltd. unveiled a multi-factor biometric authentication technology to create a new and secure shopping experience tailored for the ‘New Normal’ era. This technology combines non-contact biometrics that utilize facial data for verification with identification conducted through palm vein recognition

Contactless Biometrics Technology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.72 billion |

|

Revenue forecast in 2032 |

USD 66.33 billion |

|

CAGR |

17.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Offering, By Type, By End User Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Contactless Biometrics Technology Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Browse Our Top Selling Reports

Construction Equipment Market Size, Share 2024 Research Report

Biobanks Market Size, Share 2024 Research Report

Automotive Wrap Films Market Size, Share 2024 Research Report

Veterinary Active Pharmaceutical Ingredients Manufacturing Market Size, Share 2024 Research Report

Interposer and Fan-out Wafer Level Packaging Market Size, Share 2024 Research Report