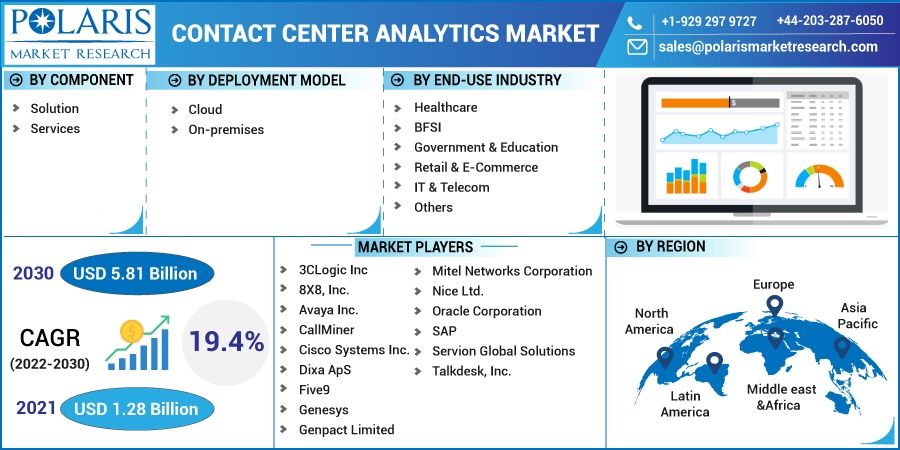

Contact Center Analytics Market Share, Size, Trends, Industry Analysis Report, By Component (Solution, Services); By Deployment Model; By End-Use Industry; By Region; Segment Forecast, 2022 - 2030

- Published Date:Aug-2022

- Pages: 118

- Format: PDF

- Report ID: PM2540

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

The global contact center analytics market was valued at USD 1.28 billion in 2021 and is expected to grow at a CAGR 19.4% during the forecast period. It is the method of gathering and evaluating customer data to excavate important information about an organization's performance.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the contact center analytics market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Know more about this report: Request for sample pages

It provides support such as consumer experience analysis, business intelligence analysis, data analysis, and others. Moreover, these are installed as both cloud-based and on-premises. Hence, the rise in demand for innovative client experience management impacts the contact center analytics market.

In the COVID-19 scenario, people are willing to work from home. Although there are challenges in completing work from home, therefore, to overcome such challenges, contact center analytic solutions are used to simplify collaboration, communication, and data access.

Moreover, owing to COVID-19, the contact center analytics market provided many opportunities for SME players operating in the industry. In addition, the greater need for remote working during the pandemic has resulted in increased demand for cloud-based solutions owing to affordability and access to a high volume of data.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Increased client satisfaction is the essential objective for any enterprise. It helps to recognize consumer trends and collaboration opportunities. Moreover, the cloud presents a massive opportunity for small-medium enterprises (SMEs) to test ideas and build businesses. It is more important that SMEs have access to easy-to-use cloud solutions that meet their unique needs.

Moreover, in recent years, an increase in the adoption cloud orchestration among SMEs has been witnessed, owing to advantages such as greater uptime, dependability, improved IT service, the flexibility of data access, and effective speed.

Report Segmentation

The market is primarily segmented based on component, deployment model, end-use industry, and region.

|

By Component |

By Deployment Model |

By End-Use Industry |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Services are expected to be the fastest growing segment during the forecast period

By component, the contact center analytics market is segmented into solutions and services. The services segment is expected to be the fastest growing segment during the forecast period.

Its services refer to services that are associated with solutions after delivering solutions to the respective vendors. It includes professional and managed services. Professional services include implementation, training and support, and consulting services. Implementation services ensure comprehensive planning, installation, and configuration of the software.

These services include all the components of the software package, in addition to a custom program designed to meet specific needs. Implementation or installation is a one-time process related to product configuration. Consulting services or advisory services comprise a unique combination of technology and domain expertise.

These services help organizations build a permanent roadmap for success and reduce organizational risks. Managed services help organizations protect infrastructure by discovering vulnerable systems and providing tools to manage risk in the infrastructure environment.

On-premises accounted for the largest market share

By deployment model, the contact center analytics market is segmented cloud and on-premises. Among these, on-premises is expected to be the largest market in contact center analytic.

This model is ideal for a specific type of data, such as confidential and internal private data, which entails large data transfers and prescriptive analytic. On-premises solutions are installed and operated from a client’s in-house server and computing infrastructure. The on-premises solution requires proper IT staff for maintenance and support; therefore, huge investments are required to install the on-premises solution.

On-premises applications help in flexibility and security, therefore, adding a supplement to the growth of the on-premise segment in the contact center analytics market. Moreover, the customization aspect of the on-premise deployment mode provides complete control of the data and processes. Furthermore, better maintenance of servers and continuous system security checks facilitate the implementation of on-premises tools.

IT & telecom segment accounted for a considerable market share

By end-use industry, the contact center analytics market is categorized into healthcare, BFSI, Government & Education, retail & e-commerce, IT & telecom, and others. IT & telecom is expected to account for a considerable revenue share in the contact center analytics market.

Its solutions are mostly used in the IT and telecom industry due to its comprehensive industry automation abilities. Moreover, retail includes the sale of products through stores and person-to-person platforms, whereas e-commerce involves the sale of products through internet platforms. The retail and e-commerce sector has invested heavily in digital technology such as contact center analytic.

Their solutions are generally used in the retail and e-commerce sector as these solutions address customer grievances smoothly and quickly. In addition, it keeps track of the customer's activity and data in the retail sector. So, consumer and retail companies are adopting this solution to provide a personalized experience to customers. These benefits of analytics drive the growth of the contact center analytics market in the retail and e-commerce sector.

Further, the travel and hospitality industry includes an organization that airlines, tourist boards, tour operators, travel consolidators, cruise lines, railroads, private transportation providers, car rental services, hotels, and many more.

Its solutions are majorly adopted in the travel & hospitality industry to enhance the resolution and review of customer requirements by providing information about travel and hospitality and enhancing customer experience.

North America region will lead the global contact center analytics market by 2030

The North American region is expected to account for a larger share in contact center analytics, as organizations across various industries in the North American region are swiftly implementing and advancing new technologies, such as cloud platforms, big data, and analytics. Moreover, there is a growth in this region in the efficiency and scalability of contact center analytics solutions.

Moreover, the major factors that contribute to the growth of the contact center analytics market are improved operational efficiency, enhanced productivity levels, and business outcomes. In addition, the surge in adoption of cloud and big data analytics drives the contact center analytics market, as there is a strong need among enterprises for customer satisfaction and enhancement of customer satisfaction.

Furthermore, the massive adoption of digital technologies such as AI and ML and the support of government organizations for automation are expected to boost the demand for contact center analytics solutions in the North American region.

Competitive Insight

Some of the major players operating in the global market include 3CLogic Inc, 8X8, Inc., Avaya Inc., CallMiner, Cisco Systems Inc., Dixa ApS, Five9, Genesys, Genpact Limited, Mitel Networks Corporation, Nice Ltd., Oracle Corporation, SAP, Servion Global Solutions, and, Talkdesk, Inc. These companies are developing new and innovative solutions to caterto the growing demand of the industry. Partnerships and collaborations provide opportunities for these companies to enhance their global presence.

Recent Developments

In November 2021, Google Cloud collaborated with NICE, to deliver enhanced and automated customer self-service systems. The collaboration is expected to provide businesses to engage customers across digital and voice touchpoints.

In October 2021, CallMiner announced the acquisition of OrecX to expand its portfolio of audio recording, analytics and machine-based solutions. The acquisition offers CallMiner a platform to feed conversation audio directly into its transcription services.

Contact Center Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.28 billion |

|

Revenue forecast in 2030 |

USD 5.81 billion |

|

CAGR |

19.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Deployment Model, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

3CLogic Inc, 8X8, Inc., Avaya Inc., CallMiner, Cisco Systems Inc., Dixa ApS, Five9, Genesys, Genpact Limited, Mitel Networks Corporation, Nice Ltd., Oracle Corporation, SAP, Servion Global Solutions, and, Talkdesk, Inc. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the contact center analytics market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.