Construction Adhesives Market Size, Share, & Industry Analysis Report

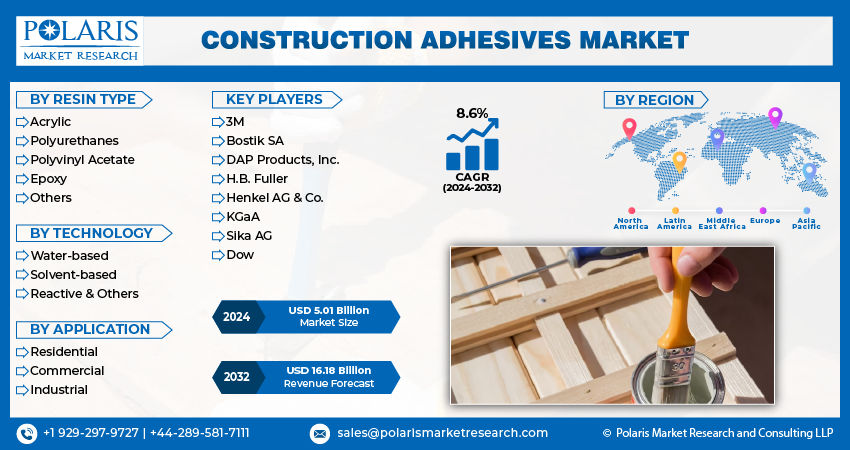

: By Resin Type (Acrylic, Polyurethanes, Polyvinyl Acetate, Epoxy, and Others), By Technology, By Application, and By Region– Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM3264

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The construction adhesives market size was valued at USD 10.98 billion in 2024. It is projected to grow from USD 11.49 billion in 2025 to USD 17.68 billion by 2034, exhibiting a CAGR of 4.9% during 2025–2034.

Various factors such as rapid urbanization across the world, technological innovation in adhesives, and sustainability concerns are fueling the demand for construction adhesives.

The construction adhesives market encompasses a variety of bonding agents utilized in diverse building and infrastructure projects. These adhesives are engineered to securely join different construction materials, including wood, concrete, metal, and plastics, playing a crucial role in both structural and non-structural applications. The definition centers on products that offer strong, durable bonds capable of withstanding various environmental conditions and stresses encountered in construction. These adhesives are increasingly preferred over traditional fastening methods due to their ability to distribute stress more evenly, offer enhanced aesthetic appeal, and sometimes expedite the construction process.

The increasing pace of urbanization and the subsequent rise in construction and infrastructure development activities globally are driving the demand for construction materials, including construction adhesives. Furthermore, advancements in adhesive technology are leading to the development of high-performance adhesives with improved strength, durability, and ease of application, thereby expanding their utility across different construction segments. The growing emphasis on sustainable construction practices and construction equipment is also fueling the demand for eco-friendly adhesives with low volatile organic compound (VOC) emissions, aligning with stricter environmental regulations and a greater focus on green building initiatives.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Increasing Investments in Infrastructure Development

Globally, there is a significant push toward infrastructure development, which directly fuels the demand for construction adhesives. Governments worldwide are undertaking massive projects to improve transportation networks, build smart cities, and enhance public utilities. According to a United Nations report on infrastructure in 2021, increasing investments in the infrastructure segment can add up to 0.6% to the global GDP. For instance, the Indian government has outlined plans to double its infrastructure investments in sectors such as communication, commercial infrastructure, energy, and water & sanitation over the next five years, as stated in a government release in 2021. This surge in infrastructure spending necessitates the use of reliable and high-performance construction adhesives for various applications, including bonding materials and construction chemicals in bridges, tunnels, airports, and other large-scale projects.

Growing Trend of Sustainable and Eco-Friendly Construction

The increasing awareness of environmental concerns and the implementation of stringent regulations regarding volatile organic compounds (VOCs) are driving the demand for sustainable and eco-friendly construction materials, including adhesives and self-healing construction materials. Governments and regulatory bodies are promoting green building initiatives and setting standards for reduced environmental impact. For example, agencies such as the European Commission (EC) and the Epoxy Resin Committee (ERC) in Europe control the manufacturing of solvent-borne products with high VOC content, as noted in a research article in 2021. This regulatory push, coupled with a growing preference for environmentally conscious building practices, is leading to a higher adoption of water-based and low-VOC adhesives in construction projects.

Rise in Prefabrication and Modular Construction Techniques

The construction industry is increasingly adopting prefabrication and modular construction techniques to enhance efficiency, reduce construction time, and improve quality control. These methods involve manufacturing building components off-site and then assembling them on the construction site. This approach heavily relies on the use of strong and durable adhesives to bond different materials in the prefabricated modules. The efficiency and speed offered by prefabrication are gaining traction globally, supported by government initiatives promoting modern construction technologies, which is boosting the demand trends for construction adhesives that facilitate these advanced building techniques.

Segment Insights

Market Assessment – By Resin Type

The construction adhesives market, by resin type, is segmented into acrylic, polyurethanes, polyvinyl acetate, epoxy, and others. The epoxy segment holds the largest share, owing to the exceptional bonding strength, durability, and resistance to various environmental factors offered by epoxy-based adhesives. Their versatility allows for application across a wide spectrum of construction activities, including structural bonding, flooring, and sealing. The robust performance characteristics of epoxy adhesives make them a preferred choice in critical applications where long-term reliability and high load-bearing capacity are essential, thus contributing to their significant penetration.

The polyurethane segment is expected to exhibit the highest growth rate during the forecast period, fueled by the increasing demand for flexible and high-performance bonding solutions in modern construction practices. Polyurethane adhesives offer excellent adhesion to a variety of substrates, along with good elasticity and resistance to impact and vibration. Their expanding applications in areas such as panel bonding, insulation, and sealing in building envelopes are driving their increased adoption. Furthermore, ongoing advancements in polyurethane technology are enhancing their properties and broadening their applicability, positioning this segment for substantial development in the coming years.

Market Evaluation – By Technology

The market, by technology, is segmented into water-based, solvent-based, and reactive & others. The water-based segment accounts for the largest share, driven by the increasing preference for environmentally friendly and low-VOC (volatile organic compound) products in the construction industry. Stringent environmental regulations and a growing awareness regarding health and safety concerns associated with solvent-based adhesives have propelled the demand for water-based alternatives. These adhesives offer a balance of performance and eco-friendliness for various construction applications, contributing to their substantial penetration.

The reactive & others technology segment is experiencing the highest growth rate during the forecast period. This rapid expansion is driven by the increasing adoption of advanced adhesive technologies such as polyurethane, epoxy, and cyanoacrylate that offer superior bonding strength, durability, and specific performance characteristics. The growing demand for high-performance adhesives in structural applications, prefabrication, building and construction sheets, and specialized construction projects is fueling the growth of this segment. Continuous innovations in reactive adhesive chemistries are expanding their application scope and making them an increasingly attractive option for demanding construction needs, indicating a strong development trajectory.

Market Evaluation – By Application

The construction adhesives market, by application, is segmented into residential, commercial, and industrial. The commercial segment holds the largest share, fueled by the extensive use of construction adhesives in a wide array of commercial building projects, including offices, retail spaces, educational institutions, and healthcare facilities. The sheer volume of construction activities in the commercial sector, coupled with the diverse bonding requirements for various materials and finishes, contributes significantly to the high penetration of construction adhesives in this segment.

The industrial application segment is witnessing the highest growth rate during the forecast period. This rapid growth is fueled by increasing infrastructure development and the expansion of manufacturing and processing facilities globally. The demand for high-performance adhesives in industrial construction, such as in factories, power plants, and warehouses, where strong and durable bonds are critical for structural integrity and operational efficiency, is on the rise. Furthermore, the growing adoption of prefabricated and modular construction techniques in the industrial sector is further boosting the demand for advanced adhesive solutions, indicating substantial development in this application area.

Regional Footprint

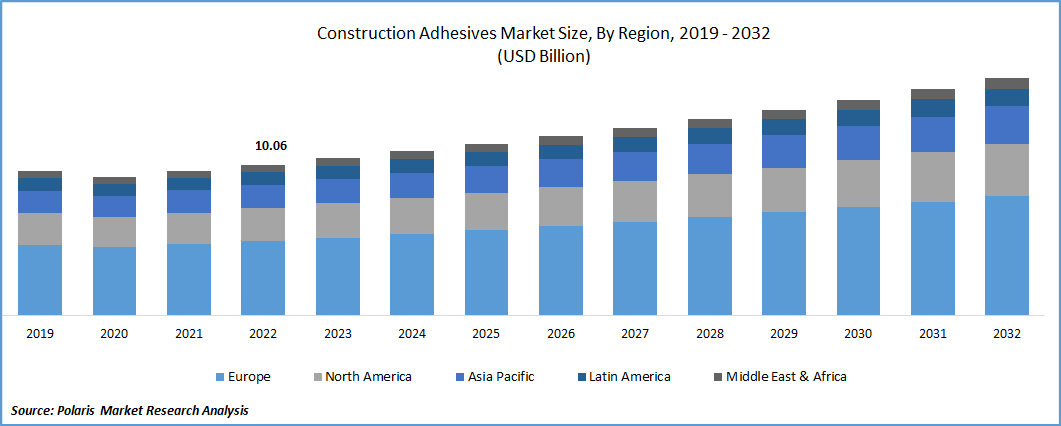

The construction adhesives market demonstrates varied penetration and growth across different geographical regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region's dynamics are influenced by factors such as the level of construction activity, economic development, regulatory landscape, and adoption of advanced construction technologies. While mature areas such as North America and Europe exhibit steady demand, emerging economies in Asia Pacific and Latin America present significant growth opportunities. The Middle East & Africa is also witnessing increasing adoption of construction adhesives, driven by infrastructure investments and urbanization.

Asia Pacific represents the largest share of the global market. This significant share is primarily attributed to the rapid urbanization and substantial investments in infrastructure development across countries such as China and India. The burgeoning construction sector in this region, encompassing residential, commercial, and industrial projects, necessitates a large volume of construction adhesives for various bonding and sealing applications. Furthermore, the increasing adoption of modern construction practices and the growing manufacturing sector in Asia Pacific contribute significantly to the dominant position of this region.

The Asia Pacific construction adhesives market is projected to record the highest growth rate during the forecast period. The continuous expansion of the construction industry, coupled with increasing government spending on infrastructure projects and a rising demand for high-performance and sustainable building materials, are key factors driving this growth. The region's dynamic economic growth and increasing adoption of prefabrication techniques further amplify the demand for advanced adhesive solutions. This robust growth trajectory in Asia Pacific signifies substantial potential and opportunities for construction adhesive manufacturers.

Key Players and Competitive Insights

A few major players active in the construction adhesives market are Sika AG, Henkel AG & Co. KGaA, H.B. Fuller Company, Bostik (Arkema Group), 3M Company, Illinois Tool Works Inc. (ITW), Wacker Chemie AG, Mapei S.p.A., Pidilite Industries Limited, DAP Products Inc. (RPM International Inc.), Tremco Incorporated (RPM International Inc.), and Ashland Inc.

The competitive landscape is characterized by a mix of global and regional players vying for market share. Competition is based on product innovation, performance, pricing, and the ability to cater to specific application requirements in the construction industry. Key insights reveal a focus on developing high-performance, sustainable, and easy-to-apply adhesive solutions. Strategic initiatives such as product launches, expansions, and collaborations are common among players to strengthen their penetration and address evolving demand trends.

Sika AG, headquartered in Baar, Switzerland, offers a comprehensive range of construction adhesives and sealants. Their product portfolio includes solutions for concrete repair, flooring, waterproofing, and structural bonding, making them highly relevant to diverse applications.

Henkel AG & Co. KGaA, based in Düsseldorf, Germany, provides a broad spectrum of adhesive technologies, including those specifically designed for the building and construction sector. Their offerings encompass tile adhesives, flooring adhesives, and sealants, catering to various needs in residential, commercial, and infrastructure projects, thus demonstrating significant relevancy.

List of Key Companies in Construction Adhesives Market

- 3M Company

- Ashland Inc.

- Bostik (Arkema Group)

- DAP Products Inc. (RPM International Inc.)

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc. (ITW)

- Mapei S.p.A.

- Pidilite Industries Limited

- Sika AG

- Tremco Incorporated (RPM International Inc.)

- Wacker Chemie AG

Construction Adhesives Industry Developments

- March 2025: Sika AG announced the full acquisition of HPS North America, Inc., a supplier of building finishing materials that distributes Schönox branded products (manufactured by Sika Germany) in the US market.

- February 2025: Henkel AG & Co. KGaA inaugurated a new Application Center in Busan, South Korea. This center represents a significant investment aimed at fostering innovation and collaboration with customers.

Construction Adhesives Market Segmentation

By Resin Type Outlook (Revenue – USD Billion, 2020–2034)

- Acrylic

- Polyurethanes

- Polyvinyl Acetate

- Epoxy

- Others

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Water-Based

- Solvent-Based

- Reactive & Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Construction Adhesives Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.98 billion |

|

Market Size Value in 2025 |

USD 11.49 billion |

|

Revenue Forecast by 2034 |

USD 17.68 billion |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The construction adhesives market has been segmented into detailed segments of resin type, technology, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Growth and marketing strategies are increasingly focused on innovation and sustainability. Companies are investing in research and development to create high-performance adhesives with eco-friendly attributes, such as low VOC content. Market penetration is being achieved through targeted marketing campaigns highlighting the benefits of these advanced adhesives to specific construction applications and end users. Collaborations with construction companies and distributors, along with digital marketing efforts, are crucial for expanding reach. Furthermore, emphasizing the cost-effectiveness and long-term durability of adhesive solutions compared to traditional fastening methods forms a key part of the driver. Providing technical support and training to applicators also enhances product adoption and development.

FAQ's

The market size was valued at USD 10.98 billion in 2024 and is projected to grow to USD 17.68 billion by 2034.

The market is projected to register a CAGR of 4.9% during the forecast period.

North America held the largest share of the market in 2024.

A few major players include Sika AG, Henkel AG & Co. KGaA, H.B. Fuller Company, Bostik (Arkema Group), 3M Company, Illinois Tool Works Inc. (ITW), Wacker Chemie AG, Mapei S.p.A., Pidilite Industries Limited, DAP Products Inc. (RPM International Inc.), Tremco Incorporated (RPM International Inc.), and Ashland Inc..

The water-based technology segment accounted for the largest share of the market in 2024.

Following are a few of the trends: ? Growing Demand for Sustainable and Low-VOC Adhesives: There is an increasing focus on environmentally friendly construction practices, driving the demand for adhesives with low or zero volatile organic compound (VOC) emissions. ? Rising Adoption of High-Performance and Specialized Adhesives: The need for strong, durable, and specialized bonding solutions for diverse construction materials and applications is increasing.

Construction adhesives are specialized bonding agents used in the building and infrastructure industries to join, seal, and secure various construction materials. These materials can include wood, concrete, metal, drywall, tiles, and plastics. Unlike traditional fasteners such as nails or screws, construction adhesives distribute stress more evenly across the bonded area and can offer enhanced flexibility, moisture resistance, and the ability to bond uneven surfaces. They play a vital role in a wide range of applications, from structural bonding to installing fixtures and finishes, contributing to the efficiency and durability of construction projects.