Connected Worker Market Share, Size, Trends, Industry Analysis Report, By Component; By Technology; By Deployment; By End-Use (Manufacturing, Construction, Mining, Oil & Gas, Others); By Region; Segment Forecast, 2023 - 2032

- Published Date:May-2023

- Pages: 116

- Format: PDF

- Report ID: PM1554

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global connected worker market was valued at USD 5,250.12 million in 2022 and is expected to grow at a CAGR of 22.3% during the forecast period. Business organizations are adopting connected worker or smart worker solutions that help companies stay connected with their workers to increase productivity and achieve high-profit margins. The organizations' increasing utilization of these solutions to ensure workers' safety, track them remotely, and perform better regulatory compliance will boost the market demand over the forecast period.

Know more about this report: Request for sample pages

It has been a major test to guarantee field laborers' well-being, track them remotely, and accomplish better administrative consistence. Business organizations are continually hoping to execute the exercises of a modern or field specialist all the more viably while improving efficiencies, decreasing non-beneficial work, and giving a sheltered workplace. Combining modern worldwide frameworks with trend-setting innovations like wearables, low-cost sensors, and data analytics interface hardware with a centralized framework is driving the market growth.

The growing need for higher efficiency and productivity in manufacturing factories and other companies influences the smart worker market. Factors such as growing safety concerns due to the onslaught of the Covid-19 pandemic and stringent regulations regarding workforce safety impact the market growth. Digitalization, automation of tasks, increasing penetration of mobile devices, and growing adoption of BYOD have also fostered market growth. The increasing need to streamline operations to improve productivity and safety has increased market development.

The growing adoption of cloud-based technologies and the Internet of Things accelerates the adoption of a connected worker ecosystem. Other factors driving the market include technological advancements, an increasing need for a collaborative working environment, growing demand for mobility, and increasing requirements to improve workforce productivity and safety.

Almost all industries and sectors were impacted due to the advent of Covid-19, and the market was no exception. The pandemic caused several disruptions in the value chains of major industry participants leading to dwindling supplies in some parts of the globe. However, companies quickly adopted the guidelines issued by different governments and optimized their operations to suit these guidelines.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The increasing demand for 5G networks in industrial applications such as manufacturing facilities and logistics is anticipated to drive market growth over the forecast period. Furthermore, due to the rising adoption of Artificial Intelligence (AI) and digitalization of the industrial sector, there is a need for networks with improved connectivity. This is expected to drive the demand for private 5G networks across the globe.

5G technology offers an enhanced platform with built-in support for important critical capabilities, lower latency, increased reliability, and improved security which is expected to meet the business requirements. In addition, the need for essential wireless communication for industrial operations is also likely to provide novel opportunities for 5G networks over the forecast period.

In the industrial sector, a company can either opt for a public network to connect with or choose a private 5G network for its business operations. The business entity can purchase its infrastructure and depend on a 5G network provider for operational support. As a result, across the industrial sector globally, the adoption of private 5G networks is expected to witness growth, thus driving the market demand.

In addition, the Internet of Things (IoT) is experiencing rapid growth as companies worldwide connect thousands of devices daily. To fully leverage the disruptive potential of connected devices, platforms serve as the backbone of the IoT, enabling users to manage devices, analyze data, and automate workflow. IoT platforms offer a range of capabilities and features, which, when integrated, provide a comprehensive solution that facilitates the deployment of IoT projects and the development of applications in a more efficient, cost-effective, and integrated manner. These platforms act as a bridge, middleware, and solution to overcome challenges IoT applications face, enabling businesses to achieve their desired outcomes.

Report Segmentation

The market is primarily segmented based on component, technology, deployment, end-use, and region.

|

By Component |

By Technology |

By Deployment |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

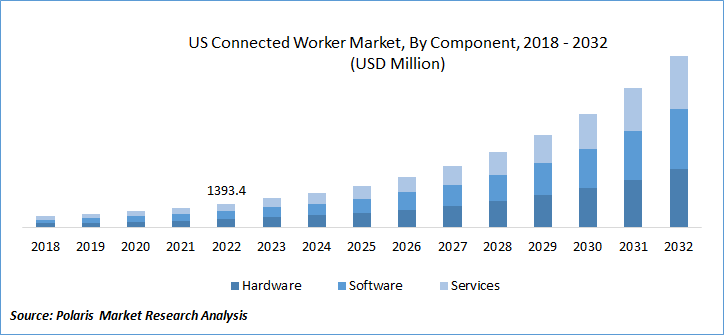

Hardware segment is expected to dominate the market during forecast period

The hardware segment is anticipated to dominate the market over the projected period. The hardware segment is driven by several COVID-19 risk mitigation schemes, productivity benefits, growing emphasis on real-time risk management, initiatives to engage frontline workers in safety and health, and the maturation of connected worker hardware technology. Key vendors benefitting the market include Aware360, Fatigue Science, GOARC, Guardhat, Interaptix, Librestream, RealWear, and Vuzix, among others.

Honeywell International Inc. is a key player in providing customized solutions for rugged hardware under the harnesses, belts, & accessories category. These products enhance productivity, workplace safety, and asset performance. Products offered by the company are distributed under the “Miller” brand. A key highlight of the products manufactured by Honeywell International Inc. is that many of these are lightweight, corrosion resistant, with aluminum components, extended life services, increased usability, improved padding, and versatile convenience, among others. The company has also provided several hardware solutions for labs during COVID-19 to solve delays concerning specimen results.

RFID Location Triangulation segment held the significant market revenue share

The RFID location triangulation segment held the significant revenue share of the market during forecast period. RFID location triangulation is especially vital in applications and end-uses where safety hazard risk is high, as the technology allows real-time tracking of workers and objects. Regarding safety, identity and location are vital information, and RDIF location triangulation helps to track the same effectively. And this factor has greatly propelled the segment growth in the recent past, and this trend is expected to continue over the forecast period.

Companies have effectively eliminated some of the restraints faced by the segment, such as harshly impaired signals in indoor environments as well as capability limitations of tags in harsh environments. The development of an advanced portfolio and manufacturers' active interest in developing customized products have resulted in bypassing this restraint.

One of the major reasons that companies prefer RFID location triangulation technology is its enhanced context awareness, which is a definitive trend in the connected worker market. The context awareness dimension has allowed companies to develop novel strategies that have revolutionized mobility control, networking, allocation of resources, security, service delivery algorithms, and process automation, among others.

Cloud segment dominated the market in 2022

The cloud segment dominated the market in 2022, and will continue its dominance over the projected period. The main advantage of a cloud-based system is that the risk of data loss is minimized as the data is stored on secure cloud servers. In addition, the data can be accessed from anywhere and from any device having an active internet connection. This enables the user to make any necessary changes online, thus giving them remote access to every operation and eliminating the need for physical presence.

The installation of these systems is cheap and hence is suitable for new entrants. The subscription-based model and little or no upfront fee make it an ideal choice. Also, the software can be updated without hassle and does not require physical presence as the entire process is automated and remote. Companies have made several advancements considering customer behavior and have introduced advanced products, thus resulting in the segment enjoying a higher growth rate.

Oil & gas segment is anticipated to hold highest CAGR during the forecast period

The oil & gas segment is expected to hold highest CAGR over the forecast period. Oil & gas organizations can closely monitor deployment and market developments with accessibility to connected worker services in their remote assets. The industry players prefer to set up connected worker solutions to address the connectivity & network challenges witnessed at their respective remote sites.

The oil & gas vertical is characterized by the presence of complex processes that are associated with high risks. Connected worker technology is being rapidly deployed in this sector to streamline the vertical. The capability offered by connected worker solutions enables companies to automate effectively, monitor as well as centralize their maintenance and engineering operations that are critical and complex.

In addition, real-time monitoring allows the company to achieve streamlining of operational resources, thus resulting in the reduction of costs. The technology is also expected to improve overall functional safety by enabling engineers to use VR headgear while undertaking high-risk, critical maintenance. Such trends are benefitting the overall market growth.

North America dominated the global market in 2022

North America dominated the market in 2022 and will expect to continue its dominance over the forecast period. North America is estimated to be a prominent consumer region considering the presence of several connected worker solution providers and the acceptance of the latest technologies by field workers. Additionally, the company of key end-users willing to incorporate hardware and software solutions has provided industry participants in the region with lucrative opportunities.

The US is one of the major countries with strong adoption of technology. The deployment of 5G infrastructure, implementation of IoT solutions, and support of Silicon Valley are key factors for the strong demand o connected worker solutions. DHL, one of the major logistics giants, recently supported wearable devices. The company observed that wearable watches support worker productivity and saw a 25% increase with the help of wearable devices.

Competitive Insight

Some of the key players operating in the global connected worker market include 3M Company, Accenture, Avnet, Inc., Fujitsu Ltd., Honeywell International Inc., Oracle Corp., Smart Track S.R.L, Tata Consultancy Services, TELUS, Vandrico Solutions Inc, Wearable Technology Limited, and Zebra Technologies.

Recent Developments

- In June 2022, Zebra Technologies Corporation has acquired Matrox Imaging, extending its product range in the rapidly growing sector of automation and vision technology solutions. This move comes after Zebra introduced its fixed industrial scanning and machine vision portfolio and its recent Adaptive Vision and Fetch Robotics takeovers.

- In August 2021, Duke Energy announced it is working with Accenture and Microsoft on the development of a new technology platform designed to measure actual baseline methane emissions from natural gas distribution systems.

Connected Worker Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 6,503.85 million |

|

Revenue forecast in 2032 |

USD 39,934.69 million |

|

CAGR |

22.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2018 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Component, By Technology, By Deployment, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

3M Company, Accenture, Avnet, Inc., Fujitsu Ltd., Honeywell International Inc., Oracle Corp., Smart Track S.R.L, Tata Consultancy Services, TELUS, Vandrico Solutions Inc, Wearable Technology Limited, and Zebra Technologies. |

FAQ's

The global connected worker market size is expected to reach USD 39,934.69 million by 2032.

Key players in the connected worker market are 3M Company, Accenture, Avnet, Inc., Fujitsu Ltd., Honeywell International Inc., Oracle Corp., Smart Track S.R.L, Tata Consultancy Services.

North America contribute notably towards the global connected worker market.

The global connected worker market expected to grow at a CAGR of 22.3% during the forecast period.

The connected worker market report covering key segments are component, technology, deployment, end-use, and region.