Connected Medical Devices Market Share, Size, Trends, Industry Analysis Report, By Device (Respiratory Devices, Vital Signs Monitoring System, Patient Monitors, Others); By Application; By End User; By Region; Segment Forecast, 2023- 2032

- Published Date:Dec-2023

- Pages: 118

- Format: PDF

- Report ID: PM3893

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

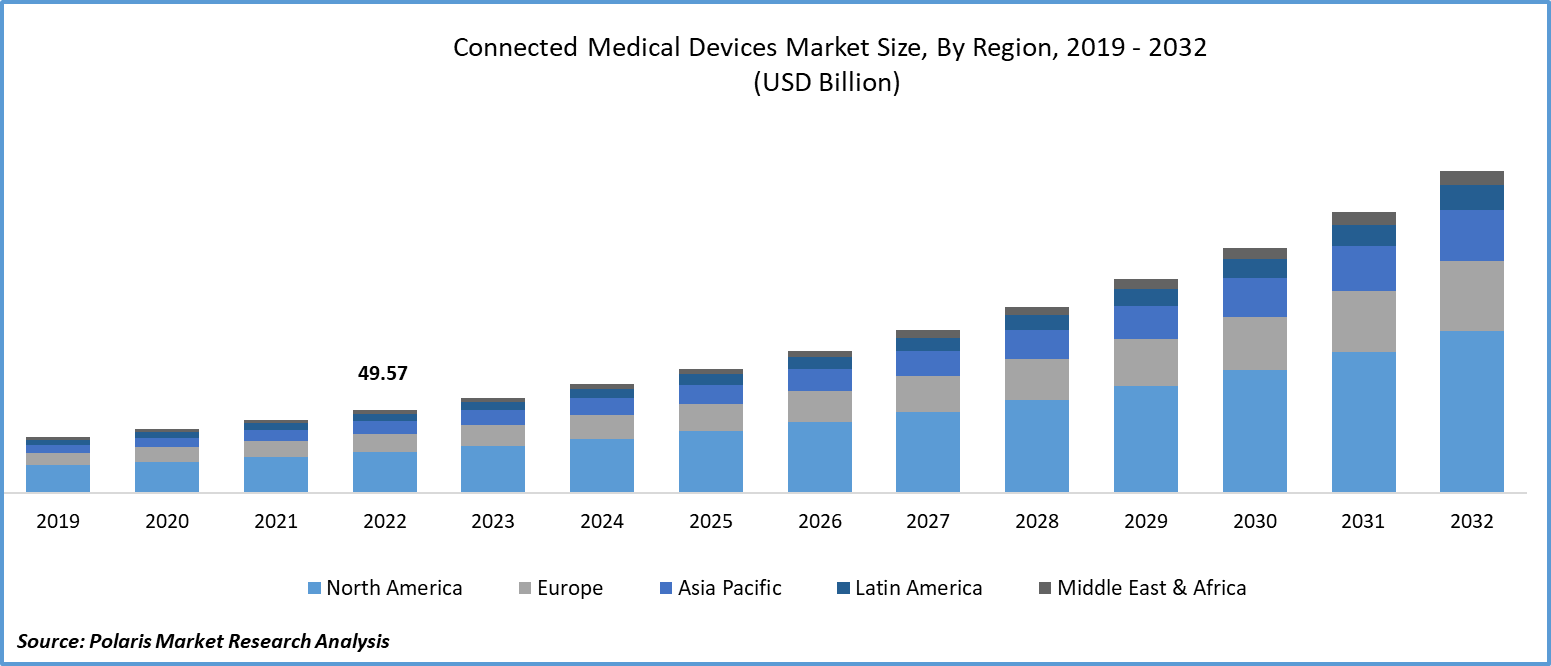

The global connected medical devices market was valued at USD 49.57 billion in 2022 and is expected to grow at a CAGR of 14.4% during the forecast period.

Connected medical devices empower individuals by granting them access to their health information. This active engagement in their well-being promotes enhanced adherence to treatment regimens and the cultivation of healthier lifestyles, leading to improved health outcomes. Furthermore, one of the most significant catalysts is the potential to reduce healthcare expenditures. These connected devices facilitate early interventions, reducing hospital readmissions and diminishing the necessity for in-person medical visits. This results in substantial cost savings for both healthcare systems and patients. The wearable health technology sector, inclusive of smartwatches and fitness trackers, continues to expand, placing equal emphasis on health monitoring alongside fitness tracking, thus fostering healthier lifestyles and the early detection of ailments.

Connected medical devices are medical gadgets that have the potential to connect to the internet through Wi-Fi, Bluetooth, or radio transference. These medical devices have digital potential further on the fundamental function of determining, tending, curing, or prohibiting illnesses, permitting them to merge with and combine to alternate frameworks and systems. Some electromechanical medical gadgets such as imaging instruments, clinician-observed apparel fitness trackers, and automated drug distribution gadgets are instances of connected health devices.

The benefits of connected medical devices include real-time patient observation. In this the attached medical gadgets can observe patient bearing in real time and communicate the data straight away to healthcare donors. The connected medical devices market size is expanding as this data tracking can take place in hospitals or home healthcare backdrops. Another benefit is that there is more customized care. In this, with compatible and precise patient data, physicians can render superior more individualized decisions about patient care.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the connected medical devices market are introducing new products to cater to the growing demand.

- For instance, in January 2022, Abbott introduced its range of consumer biowearables called Lingoi. These devices are engineered to interpret the distinct signals of user’s body, transforming them into practical information to aid in the tracking and assessment of general health and wellness.

Ongoing technological advancements, such as miniaturization, IoT connectivity, and more advanced sensors, have made connected devices more capable and affordable, widening their application in healthcare. The application of data analytics and artificial intelligence to connected device data offers insights into patient health, disease prediction, and personalized treatment plans. This data-driven approach is pivotal for improving healthcare.

The post-COVID-19 landscape has seen a significant transformation in the connected medical devices market. The pandemic accelerated the adoption of these devices, primarily in telehealth and remote patient monitoring. Patients and healthcare providers turned to these tools for virtual consultations, continuous health monitoring, and seamless data integration with electronic health records. There was a surge in innovation, with a focus on data accuracy and security. Wearable health tech gained prominence, not only for fitness tracking but also for early disease detection. Mental health monitoring devices emerged to address pandemic-related stress. The connected devices market remains robust, emphasizing remote care, data integration, and patient engagement.

Growth Drivers

- Aging population, expansion of telehealth services, and prevalence of chronic diseases is projected to spur the market demand

The global population is aging rapidly leading to increased need for healthcare services. Connected medical devices are crucial for monitoring and managing chronic conditions, ensuring the well-being of the elderly.

The prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and respiratory illnesses, is on the rise. This creates a substantial market for connected devices that allow continuous monitoring and management, reducing hospitalizations and healthcare costs.

The growth of telehealth, especially during the COVID-19 pandemic, has accelerated the demand for connected devices. These devices are vital for remote patient monitoring, virtual consultations, and sharing real-time health data with healthcare providers.

Report Segmentation

The market is primarily segmented based on device, application, end user, and region.

|

By Device |

By Application |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Device Analysis

- Vital signs monitoring system segment to experience significant growth during the forecast period

The vital signs monitoring system segment is expected to experience significant growth during the forecast period. Connected medical devices for vital signs monitoring systems are pivotal for providing real-time, comprehensive data on a patient's physiological parameters. These devices encompass a range of vital sign measurements, including blood pressure, pulse oximetry, glucose levels, body temperature, and respiratory rate. Implantable or wearable cardiac monitors ensure continuous cardiac health assessment. These systems promote telehealth connectivity by enabling patients to share data with healthcare providers, ultimately improving remote healthcare delivery. The integration of patient-generated data into electronic health records enhances the overall healthcare experience, while real-time alerts for irregular vital sign parameters enable timely interventions. These devices also find application in elderly care, chronic disease management, and cost-effective remote healthcare.

By Application Analysis

- Remote patient monitoring and telehealth is expected to experience significant growth during the forecast period

The remote patient monitoring and telehealth segment is expected to experience significant growth during the forecast period. Connected medical devices present a spectrum of innovative tools that empower patients and healthcare providers with real-time connectivity. These devices encompass a wide array of technological solutions, from wearable health trackers to digital stethoscopes. Patients can seamlessly track their vital signs, such as blood pressure and glucose levels, transmitting this critical data to healthcare professionals. This continuous data stream is invaluable for the ongoing management of chronic conditions. Telehealth consultations are now accessible via video conferencing, facilitated by cutting-edge devices like digital stethoscopes that elevate the quality of remote medical assessments. Smart medication dispensers enhance treatment adherence, while implantable devices allow for round-the-clock cardiac monitoring. These advancements not only offer convenience and accessibility but also significantly reduce the necessity for in-person medical visits, streamlining patient care.

By End User Analysis

- Hospitals and clinics held significant market revenue share in 2022

The hospitals and clinics segment accounted for a significant share in 2022. Connected medical devices are essential in today's hospitals, revolutionizing patient care and healthcare management. These devices enable remote patient monitoring, reducing the need for constant bedside supervision. They play a vital role in telehealth, allowing virtual consultations and remote healthcare access. In critical care settings, devices like ventilators and cardiac monitors provide real-time data to medical teams. Medication management is made more accurate and efficient with automated dispensing systems. Digital imaging devices offer instant access to diagnostic images, while surgical robotics facilitate precise and minimally invasive procedures. Data analytics and AI applications provide insights, and wearables engage patients. Overall, these devices enhance patient care, optimize hospital operations, and ensure data security and compliance.

Regional Insights

- Asia-Pacific is expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience significant growth during the forecast period. Asia's healthcare sector is experiencing substantial growth due to the increasing middle-class population, rising healthcare expenditure, and a surge in healthcare infrastructure development. This expansion in the healthcare sector is driving the demand for connected medical devices, particularly in countries like China and India. The rising prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and respiratory illnesses, in Asia-Pacific is fueling the adoption of connected medical devices. Emerging Asian markets, including India, Indonesia, Vietnam, and the Philippines, are considered significant growth opportunities. These countries, with their large populations and increasing healthcare infrastructure investments, are becoming key players in the connected medical devices market.

North America emerged as the largest region in 2022. The connected medical devices industry in the region demonstrates robust growth and innovation. Key trends include rapid integration of telehealth, especially during the COVID-19 pandemic, and the use of connected devices for chronic disease management. Diagnostic imaging and wearable health technology have gained prominence, while remote patient monitoring is advancing, aiding in cost-effective care and improved patient engagement. Data analytics and artificial intelligence play a pivotal role in data interpretation, enabling early disease detection. A dynamic regulatory environment, stringent health data security measures, and the rise of remote surgery are notable features, reflecting the industry's evolution and commitment to enhancing healthcare outcomes.

Key Market Players & Competitive Insights

The connected medical devices market is marked by its fragmented nature, anticipating increased rivalry owing to the abundance of industry participants. Key contenders in this market consistently introduce inventive offerings to strengthen their market foothold. These companies place significant emphasis on forming partnerships, improving products, and engaging in collaborative endeavors to establish a competitive edge over their peers and secure a substantial market share.

Some of the major players operating in the global market include:

- Abbott Laboratories

- AliveCor

- Becton, Dickinson and Company (BD)

- Boston Scientific

- Cerner Corporation

- General Electric (GE) Healthcare

- Honeywell Life Care Solutions

- Johnson & Johnson

- Masimo

- Medtronic

- Philips Healthcare

- ResMed

- Roche Diagnostics

- Siemens Healthineers

- Stryker Corporation

Recent Developments

- In March 2023, NVIDIA collaborated with Medtronic for development of AI in the healthcare system for integration of AI-based solutions into patient care.

Connected Medical Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 56.58 billion |

|

Revenue forecast in 2032 |

USD 190.63 billion |

|

CAGR |

14.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019-2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Device, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |