Connected Enterprise Market Size, Share, Trends, Industry Analysis Report: By Component (Solution and Service), Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5291

- Base Year: 2024

- Historical Data: 2020-2023

Connected Enterprise Market Overview

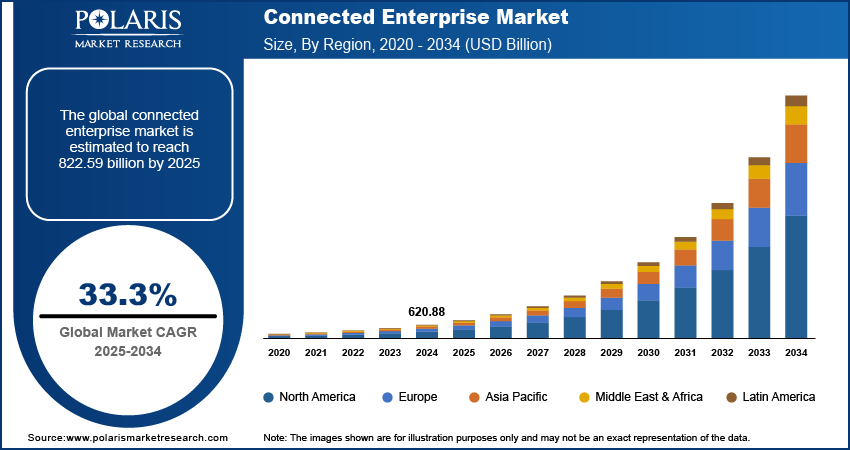

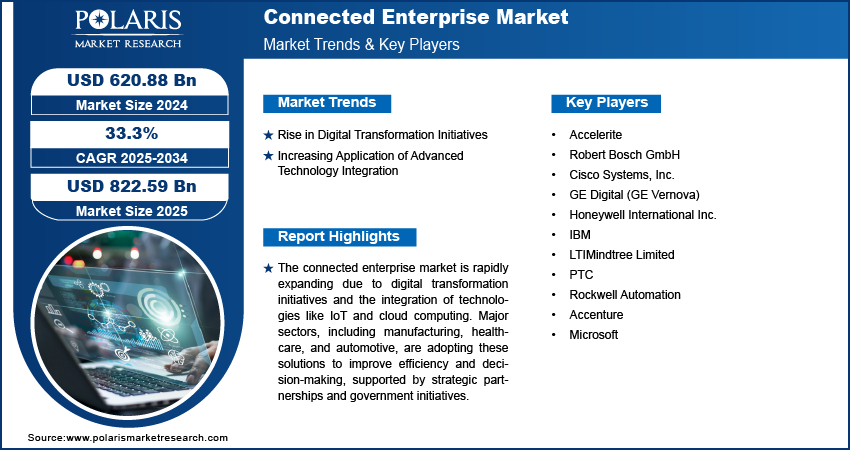

Global connected enterprise market size was valued at USD 620.88 billion in 2024 and is projected to grow from USD 822.59 billion in 2025, exhibiting a CAGR of 33.3% during the forecast period.

The connected enterprise market refers to the integration of people, processes, and technology through IoT (Information of technology), AI (Artificial Intelligence), and cloud solutions to enable real-time data exchange. It enhances decision-making and optimizes business operations across various industries by connecting systems and devices to improve efficiency, agility, and productivity.

The connected enterprise market is expanding rapidly, driven by the increasing adoption of digital transformation initiatives across industries such as BFSI and manufacturing, among others. The integration of advanced technologies, such as IoT, cloud computing, and AI, is allowing businesses to connect and optimize their operations. Furthermore, sectors including manufacturing, healthcare, and automotive are leveraging connected enterprise solutions to improve efficiency & decision-making and reduce costs. Thus, the market is benefiting from strategic partnerships, government support for smart infrastructure, and the push for real-time data analytics. Therefore, the competitive landscape is becoming more dynamic, with companies focusing on innovation and regional expansion.

For instance, in October 2023, Rockwell Automation and Microsoft collaborated to improve industrial automation through the integration of generative AI. The companies are leveraging their combined technologies to boost workforce productivity and reduce time-to-market for automation system development. The partnership introduced Microsoft's Azure OpenAI Service into Rockwell's FactoryTalk Design Studio, initiating industry-first capabilities aimed at speeding up the design and development process for industrial automation solutions.

To Understand More About this Research: Request a Free Sample Report

Connected Enterprise Market Dynamics

Rise in Digital Transformation Initiatives

The rise in digital transformation initiatives is driving the connected enterprise market demand as companies are increasingly adopting technologies such as IoT, Artificial Intelligence, and cloud computing to streamline operations and improve efficiency. In September 2023, Siemens Xcelerator launched an open business platform to boost digital transformation for all industry customers. The platform has witnessed significant global growth, with revenue from digital businesses reaching around USD 5.58 billion, marking a 15% year-on-year increase.

The introduction of new offerings, such as Industrial Operations X for production automation and Railigent X for rail asset management, are further fuelling the connected enterprise market growth. These initiatives allow real-time data sharing and automation, leading to better decision-making and improved customer experiences. The need for agile and integrated business processes across departments is pushing organizations to invest in connected solutions, further promoting market growth. Thus, digital transformation efforts are reshaping traditional business models, fostering more intelligent and collaborative enterprise ecosystems.

Increasing Application of Advanced Technology Integration

The global surge in digital transformation initiatives is a major market growth driver. Companies are increasingly adopting technology to improve agility and foster innovation, leveraging data to inform decisions and streamline operations. Additionally, insights derived from connected devices facilitate process optimization and predictive maintenance. The rising demand for IoT, cloud computing, and analytics across sectors such as manufacturing, healthcare, and finance further fuels this growth. Moreover, government-backed initiatives, including the Industrial Internet of Things (IIoT) and smart city projects, along with increased funding for digital transformation efforts, significantly contribute to the connected enterprise market expansion.

For instance, according to the European Commission, The Europe DIGITAL program is allotted a budget of €8.1 billion (approximately USD 8.5 billion). It aims to drive the digital transformation of society and the economy in line with the EU's 2030 Digital Compass. It focuses on improving digital skills, connectivity, and innovation to strengthen European digital sovereignty, investing in areas such as artificial intelligence, cybersecurity, and cloud computing.

Connected Enterprise Market Segment Insights

Connected Enterprise Market Assessment by Component Outlook

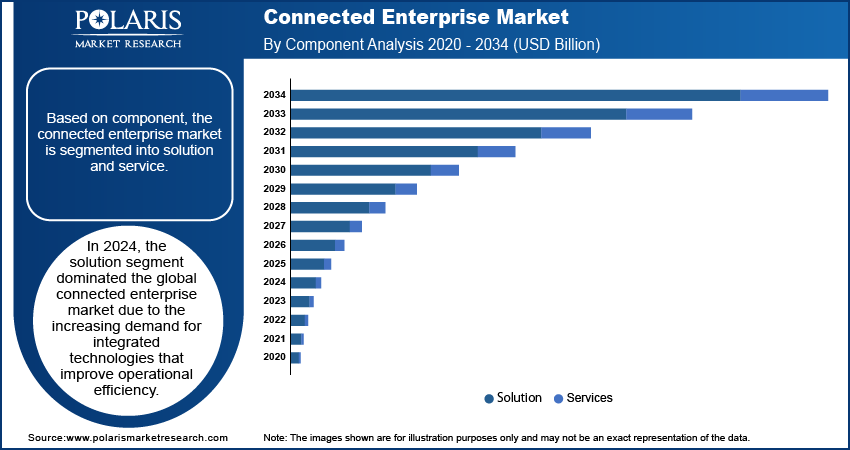

The global connected enterprise market segmentation, based on component, is bifurcated into solution and service. In 2024, the solution segment dominated the global market due to the increasing demand for integrated technologies that improve operational efficiency. Businesses are increasingly adopting software solutions such as AI, IoT, among others, that facilitate real-time data analysis and seamless connectivity among devices. Furthermore, the rise of IoT applications has led to a greater need for advanced solutions that support automation and data-driven decision-making. Thus, companies are prioritizing these solutions to streamline processes and gain a competitive edge, further driving market growth.

Connected Enterprise Market Assessment by Type Outlook

The global connected enterprise market segmentation, based on type, includes manufacturing execution system, customer experience management, enterprise infrastructure management, asset performance management, and remote monitoring system. The manufacturing execution system (MES) segment is expected to grow fastest during the forecast period due to the increasing need for real-time visibility and control over manufacturing processes, enabling companies to improve productivity and reduce downtime. The rise of Industry 4.0 initiatives such as IoT, cloud computing, and others is pushing manufacturers to adopt MES solutions for better integration with IoT devices and data analytics. Furthermore, the emphasis on automation and smart factories further supports the expansion of this segment. Thus, MES solutions are becoming essential for manufacturers seeking to optimize operations and improve efficiency.

Connected Enterprise Market Regional Insights

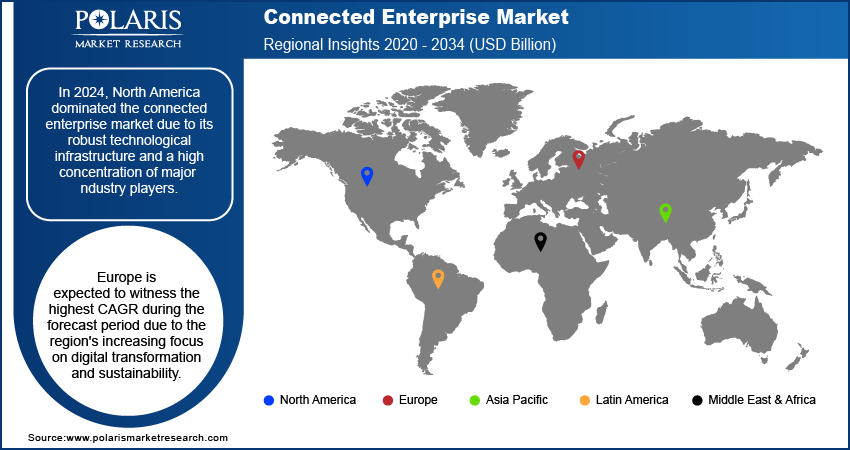

By region, the study provides connected enterprise market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to its robust technological infrastructure and a high concentration of major industry players. Additionally, the region benefits from significant investments in advanced technologies, such as IoT and cloud computing, which facilitate the implementation of connected enterprise solutions. Furthermore, the presence of a skilled workforce and strong government support for digital transformation initiatives further propels market growth, making North America a hub for innovation and technology adoption.

For instance, in April 2022, Cisco collaborated with General Motors to improve and automate the vehicle development process, specifically focusing on performance testing. This partnership utilizes Cisco’s advanced wireless network infrastructure at GM's Milford Proving Ground, enabling multiple test engineers to monitor hundreds of data channels in real-time during vehicle tests. This setup allows for immediate adjustments to the testing procedures, which accelerates the timeline for bringing commercially viable vehicles to market.

Europe is expected to witness the highest CAGR during the forecast period due to the region's increasing focus on digital transformation and sustainability. The European Union's initiatives, such as the Green Deal and various smart city projects, are fueling investments in connected technologies. Moreover, the growing focus on data privacy and regulatory frameworks improves the demand for secure, connected enterprise solutions, leading to accelerated growth across multiple industries. Thus, Europe's commitment to leveraging technology for sustainable development positions it as a major player in the connected enterprise market.

Connected Enterprise Market – Key Players and Competitive Insights

The competitive landscape of the connected enterprise industry is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Major companies in the connected enterprise sector, such as IBM, Microsoft, and Salesforce, utilize their extensive R&D capabilities to provide advanced solutions. These solutions cater to industries like telecommunications, healthcare, automotive, and industrial manufacturing, addressing their specific needs. These leading companies prioritize product innovation, focusing on improving connectivity, efficiency, and scalability to meet the demands of emerging applications such as IoT, smart manufacturing, and digital transformation initiatives.

In parallel, smaller regional firms are emerging with specialized connected enterprise products tailored to specific local markets, providing unique solutions and customized applications. Competitive strategies within this market include mergers and acquisitions, collaborations with technology firms, and the expansion of product portfolios to improve market presence in critical geographic areas. A few key major players are Accelerite; Robert Bosch GmbH; Cisco Systems, Inc.; GE Digital (GE Vernova); Honeywell International; IBM; LTIMindtree Limited; PTC; Rockwell Automation; Accenture.

Accenture is a provider of professional services focusing on digital, cloud, and cybersecurity solutions. The company offers strategy and consulting, interactive technology, and operations services, leveraging the world's largest network of Advanced Technology and Intelligent Operations centers. It is offering its expertise in innovative solutions to over 40 industries in more than 120 countries. In September 2021, Accenture formed a partnership with UiPath, a leading enterprise automation software company, to enhance automation capabilities and drive business transformation for clients worldwide.

Rockwell Automation, Inc., headquartered in the United States, focuses on industrial automation and digital transformation technologies, offering services to brands such as Allen-Bradley, FactoryTalk software, and LifecycleIQ Services. In 2021, the company restructured into three operational segments, software & control, lifecycle services, and intelligent devices, to streamline its offerings. In November 2021, Rockwell Automation expanded its capabilities by acquiring AVATA, aiming to enhance Kalypso, its subsidiary's IT/OT convergence services. This acquisition is expected to improve supply chain visibility and management across various industries significantly.

Key Companies in Connected Enterprise Market

- Accelerite

- Robert Bosch GmbH

- Cisco Systems, Inc.

- GE Digital (GE Vernova)

- Honeywell International Inc.

- IBM

- LTIMindtree Limited

- PTC

- Rockwell Automation

- Accenture

- Microsoft

Connected Enterprise Market Developments

October 2023: AMD acquired Nod.ai, a company specializing in open-source AI software. The acquisition aim is to enhance AMD's AI capabilities by integrating Nod.ai's advanced software technology, which streamlines AI solution deployment across AMD's hardware, including Instinct data center accelerators, Ryzen AI processors, Versal SoCs, EPYC processors, and Radeon GPUs. This initiative aligns with AMD's strategic focus on accelerating AI growth by fostering an open software ecosystem. It emphasizes providing accessible tools, libraries, and models designed to lower entry barriers and enhance customer engagement with AI technologies.

April 2021: Microsoft announced its plan to acquire Nuance Communications, an AI and cloud-based healthcare solutions provider, for USD 19.7 billion. The acquisition aimed to strengthen Microsoft's healthcare cloud offerings by integrating Nuance's advanced AI tools, such as speech recognition and clinical documentation solutions, with Microsoft's cloud services. This move will enhance Microsoft's position in the healthcare market and expand its total addressabe market to nearly USD 500 billion while also accelerating growth in AI-driven customer engagement solutions beyond healthcare.

Connected Enterprise Market Segmentation

Component Outlook (Revenue, USD Billion, 2020–2034)

-

- Solution

- Service

Type Outlook (Revenue, USD Billion, 2020–2034)

-

- Manufacturing Execution System

- Customer Experience Management

- Enterprise Infrastructure Management

- Asset Performance Management

- Remote Monitoring System

End User Outlook (Revenue, USD Billion, 2020–2034)

-

- Manufacturing

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Food & Beverage

Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Connected Enterprise Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 469.19 billion |

|

Market Size Value in 2024 |

USD 620.88 billion |

|

CAGR |

33.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global connected enterprise market size was valued at USD 620.88 billion in 2024 and is projected to grow to USD 822.59 billion by 2025.

The global market is projected to register a CAGR of 33.3% during the forecast period.

In 2024, North America held the largest share of the connected enterprise market due to its robust technological infrastructure and a high concentration of major industry players.

A few key players in the market are Accelerite; Robert Bosch GmbH; Cisco Systems, Inc.; GE Digital (GE Vernova); Honeywell International; IBM; LTIMindtree Limited; PTC; Rockwell Automation; Accenture.

In 2024, the solution segment dominated the global connected enterprise market due to the increasing demand for integrated technologies that improve operational efficiency.

The manufacturing execution system (MES) segment is expected to grow fastest during the forecast period. This is due to the increasing need for real-time visibility and control over manufacturing processes, which enables companies to improve productivity and reduce downtime.