Confidential Computing Market Size, Share, Trends, Industry Analysis Report: By Component (Hardware, Software, and Service), Deployment, Enterprise Type, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5096

- Base Year: 2023

- Historical Data: 2019-2022

Confidential Computing Market Overview

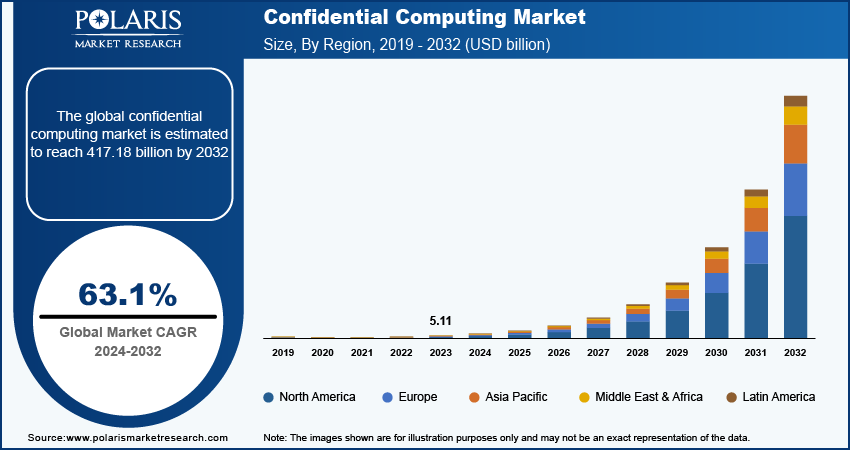

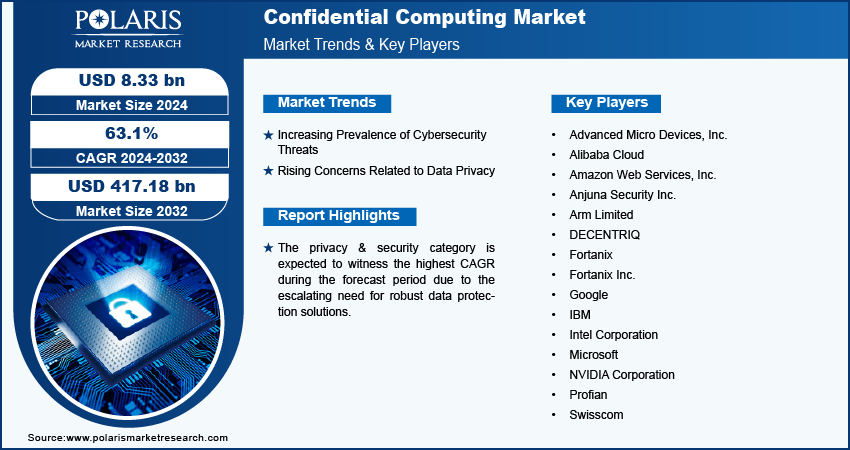

Global confidential computing market size was valued at USD 5.11 billion in 2023. The market is projected to grow from USD 8.33 billion in 2024 to USD 417.18 billion by 2032, exhibiting a CAGR of 63.1% during the forecast period.

Confidential computing is a technology that aims to protect data in use by conducting computation in a hardware-based TEE (Trusted Execution Environment). This secure area within a processor ensures that data remains encrypted and inaccessible even while being processed, offering an additional layer of security beyond traditional encryption methods that protect data at rest and in transit. Confidential computing is crucial for industries that handle sensitive information, such as finance, healthcare, and government, as it mitigates risks associated with data breaches and unauthorized access.

To Understand More About this Research: Request a Free Sample Report

The confidential computing market is experiencing robust growth driven by the increasing incidence of data breaches and cyberattacks has heightened the need for advanced security solutions. Confidential computing addresses this need by providing a secure environment for data in use, thus significantly reducing the risk of unauthorized access and data leaks. Furthermore, rising regulatory requirements and compliance standards are becoming more stringent across various industries, contributing to an increase in the demand for the confidential computing market.

The demand for confidential computing is growing as businesses and industries recognize the importance of protecting sensitive data during processing. In the financial sector, for instance, confidential computing is essential for secure transaction processing, fraud detection, and risk management. Banks and financial institutions leverage confidential computing to enhance their security posture, protect customer data, and ensure compliance with financial regulations. Also, companies across various industries, including manufacturing, technology, and retail, are investing in confidential computing to secure their data assets and gain a competitive edge which indicates the rising growth of the confidential computing market.

Confidential Computing Market Drivers and Trends

Increasing Prevalence of Cybersecurity Threats

The growing prevalence of cybersecurity threats is driving the confidential computing market. Digitalization and cyberattacks have become more advanced and frequent, posing significant risks to sensitive data and critical infrastructures. Confidential computing addresses these challenges by providing robust security measures that protect data even while it is being processed. The high-profile security incidents have highlighted the vulnerabilities in traditional data protection methods, where data is typically encrypted at rest and in transit but often remains exposed during processing. Hackers are increasingly exploiting these gaps, leading to significant financial losses, reputational damage, and regulatory penalties for affected organizations. By enabling secure data processing within TEEs, a confidential computing platform offers an additional layer of protection, effectively mitigating these risks. To overcome such risk, different key players develop the advancement in confidential computing solutions.

For instance, in November 2023, Anjuna Security, Inc. introduced Anjuna Seaglass, a universal confidential computing platform designed to create trusted execution environments across all major cloud providers. Such innovative platforms drive the confidential computing market revenue.

Rising Concerns Related to Data Privacy

The confidential computing market is experiencing significant growth, driven by the rising concern related to data privacy. This heightened awareness is driving the demand for confidential computing, a technology designed to protect data during processing by using hardware-based TEE. The proliferation of personal and sensitive data is being collected, processed, and stored by businesses across various sectors. Consumers and regulatory bodies are demanding greater transparency and stronger safeguards to protect the data. High-profile data breaches and incidents of data misuse have underscored the vulnerabilities inherent in traditional data protection methods, where data is often exposed during processing. As a result, there is a growing imperative for more robust security solutions that ensure data privacy throughout its entirety.

As organizations strive to safeguard their sensitive information, key players in the technology industry are innovating and advancing confidential computing platforms, thereby propelling market growth.

For instance, in September 2023, Intel announced the launch of an attestation service to enhance its confidential computing portfolio. This service offers a unified assessment of TEEs across various deployment modes, thereby strengthening Intel's position in the confidential computing market.

Confidential Computing Market Segment Insights

Confidential Computing Market Analysis by Component Insights

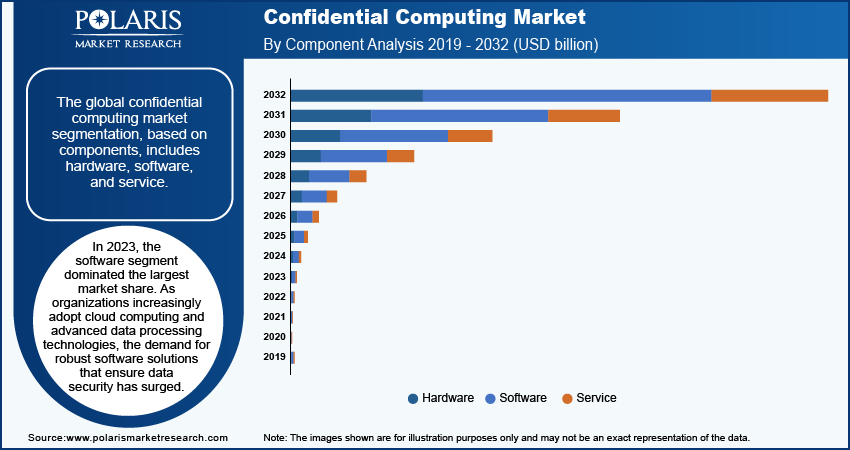

The global confidential computing market segmentation, based on components, includes hardware, software, and service. In 2023, the software segment dominated the largest market share. As organizations increasingly adopt cloud computing and advanced data processing technologies, the demand for robust software solutions that ensure data security has surged. Confidential computing software provides critical capabilities such as secure enclaves, data encryption, and remote attestation, enabling businesses to protect sensitive information during processing.

The integration of confidential computing features into major cloud platforms and enterprise applications has made these software solutions more accessible and essential for a wide range of industries. This widespread adoption and the company’s continuous innovation in software technologies have positioned the software segment at the forefront of the confidential computing market.

For instance, in May 2023, Intel and SAP SE announced a collaboration to deliver more sustainable and powerful SAP software in the cloud. Such initiative aims to provide customers with greater scalability, agility, and consolidation of their existing SAP software environments. The collaboration enhances Intel’s commitment to offering highly secure and powerful instances for SAP, powered by 4th Gen Intel Xeon Scalable processors. Such advanced software solutions significantly contribute to the growth of the confidential computing market.

Confidential Computing Market Analysis by Application Insights

The global confidential computing market segmentation, based on application, includes privacy & security, blockchain, multi-party computing, IoT & edge, high-performance computing devices, and other applications. The privacy & security category is expected to witness the highest CAGR during the forecast period due to the escalating need for robust data protection solutions. As cyber threats become increasingly advanced and frequent, organizations across various industries are prioritizing the safeguarding of sensitive information.

Stringent Regulatory and compliance requirements further drive the demand for enhanced privacy and security solutions, as businesses must adhere to stringent data protection laws. Additionally, the growing adoption of cloud services amplifies the need for secure environments to protect data from breaches and unauthorized access. This heightened focus on privacy and security companies as Inpher enhance confidential computation with new advancements.

For instance, in May 2024, Inpher, a player in privacy-enhanced computation, announced the general availability release of SecurAI, a groundbreaking solution designed to protect the privacy and security of user inputs on large language models. This enterprise-ready release leverages the NVIDIA H100 Tensor Core GPU to deliver optimal speed and performance. By integrating SecurAI with NVIDIA's confidential computing technology, Inpher enables organizations to utilize confidential GPUs, thereby enhancing data utility and boosting business productivity. Such models indicate the rising need for data privacy & security, resulting in increased confidential computing market growth.

Confidential Computing Market Analysis by Regional Insights

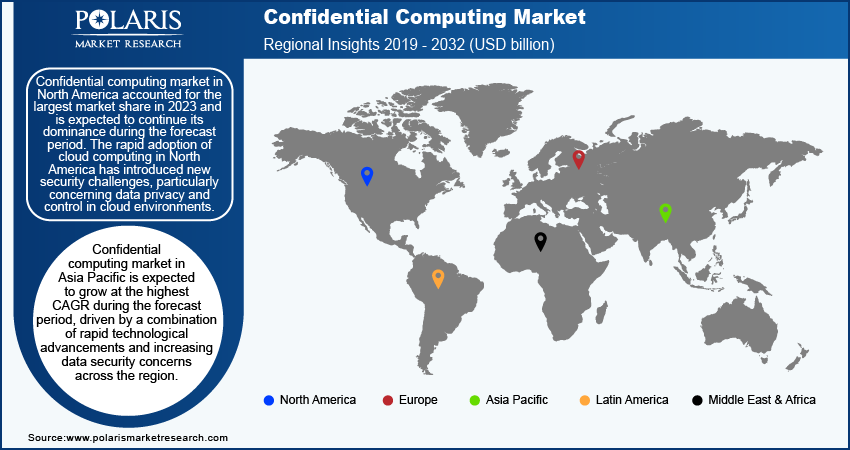

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Confidential computing market in North America accounted for the largest market share in 2023 and is expected to continue its dominance during the forecast period. The rapid adoption of cloud computing in North America has introduced new security challenges, particularly concerning data privacy and control in cloud environments. In addition, the presence of major companies such as Intel, Google, Microsoft, and IBM offering their services further strengthens the confidential computing market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

For instance, in November 2023, Microsoft announced the public preview of its DCesv5 and ECesv5-series confidential virtual machines (VMs). These VMs, powered by 4th Gen Intel Xeon Scalable processors with Intel Trust Domain Extensions, allow organizations to run confidential workloads in the cloud without needing to modify their applications. Designed for tenants with stringent security and confidentiality needs, these confidential VMs offer robust, hardware-enforced protection and a secure boundary for sensitive data. The increasing demand for such confidential computing solutions is a positive sign for the market, positioning North America as a major player in the market.

The US confidential computing market is expected to witness robust growth during the forecast period due to rising awareness of data privacy risks and stringent regulatory requirements. The growing emphasis on data privacy and regulatory compliance is prompting companies to adopt confidential computing solutions. This demand is driving innovation in the field of secure computing, with tech giants and cybersecurity firms collaborating to develop and refine confidential computing technologies.

For instance, in February 2022, IBM announced its acquisition of Neudesic, a prominent US cloud services consultancy with expertise in the Microsoft Azure platform and multi-cloud solutions. Such acquisition is set to significantly enhance IBM's hybrid multi-cloud and confidential computing services, further advancing the company's strategy in hybrid cloud and artificial intelligence.

Canada's confidential computing market held a significant market share due to the increasing adoption of cloud computing, which introduced new security challenges, particularly concerning data privacy and control in cloud environments. Also, as more organizations move their operations to the cloud, the demand for confidential computing solutions is rising to support secure and compliant cloud-based workloads.

Confidential computing market in Asia Pacific is expected to grow at the highest CAGR during the forecast period, driven by a combination of rapid technological advancements and increasing data security concerns across the region. China’s confidential computing market held a significant market share in 2023, driven by heightened awareness of the need to protect sensitive information from cyber threats and regulatory scrutiny.

Confidential computing market in Japan accounted for substantial growth due to rising major players expansion with their confidential computing solutions, reflecting the region's growing demand for enhanced data security and privacy.

For instance, in March 2024, Fortanix Inc., a major player in data-first cybersecurity and a pioneer in confidential computing, announced its expanded presence in the Japanese market. This move introduces its advanced data security solutions to enterprises as they navigate evolving data security needs driven by increased cloud migration.

Confidential Computing Key Market Players & Competitive Insights

Leading market players are shaping the landscape through innovative solutions and strategic initiatives. Rapid technological advancements and intense competition distinguish the confidential computing market. Key players are continuously developing and enhancing their solutions to address emerging security challenges and meet regulatory requirements. Companies are pursuing strategic partnerships, acquisitions, and investments in research and development to strengthen their market position.

Innovation is a crucial driver of competition, with firms focusing on integrating confidential computing into broader cloud and enterprise solutions. The market is also witnessing an increase in collaborations between technology providers and cybersecurity firms to deliver comprehensive data protection solutions. In recent years, the confidential computing market has offered some technological advancements.

Major players in the confidential computing market are Anjuna Security Inc.; Fortanix; Microsoft; Intel Corporation; IBM; Google; Advanced Micro Devices, Inc.; Alibaba Cloud; Amazon Web Services, Inc.; Arm Limited; Fortanix Inc.; Swisscom; Profian; DECENTRIQ; and NVIDIA Corporation.

Intel Corporation is an American multinational technology company that designs and manufactures computer processors, chipsets, and other semiconductor components. It produces various products and services, including microprocessors, system-on-chip (SoC) products, chipsets, and memory and storage solutions. The company's processors are used in multiple devices, from personal computers and laptops to servers and data centers. In May 2022, Intel unveiled Project Amber, a comprehensive trust assurance platform designed for both cloud and edge environments, as well as on-premises systems. This initiative offers a robust security foundation for confidential computing, ensuring secure and responsible AI operations and incorporating quantum-resistant cryptography to prepare for the quantum era.

Microsoft is a multinational technology company headquartered in Redmond, Washington offers various products and services, including operating systems, productivity software, gaming consoles, and cloud-based solutions. Its flagship product, Microsoft Windows, is the world's most widely used operating system. Other popular products include Microsoft Office, Skype, and the Xbox gaming console. The company also developed several AI-based products and services, including the Azure Machine Learning platform, which allows developers to build, deploy, and manage machine learning models at scale. In April 2023, Microsoft declared the expansion of its Confidential VM family with the introduction of the ECesv5-series and DCesv5-series, now available in preview. These new virtual machines enable organizations to move confidential workloads to the cloud effortlessly without requiring any modifications to their existing applications.

Key Companies in Confidential Computing Market

- Advanced Micro Devices, Inc.

- Alibaba Cloud

- Amazon Web Services, Inc.

- Anjuna Security Inc.

- Arm Limited

- DECENTRIQ

- Fortanix

- Fortanix Inc.

- IBM

- Intel Corporation

- Microsoft

- NVIDIA Corporation

- Profian

- Swisscom

Confidential Computing Industry Developments

July 2023: Fortanix partnered with Saudi Information Technology Company (SITE) introduced a groundbreaking multi-cloud SaaS data security solution to the Saudi Arabian market.

May 2023: Habu, a global player in data clean room software, announced a collaboration with Microsoft Azure. This partnership integrates Habu's Data Clean Room applications with Azure confidential computing, allowing enterprises to achieve insights from sensitive data without compromising on privacy, security, or performance.

April 2023: Intel introduced Intel TDX, a key confidential computing technology that brings new architectural components to deploy hardware-isolated Virtual Machines (VMs) known as TDs. Intel TDX is developed to separate these TDs from the virtual machine hypervisor/manager and other non-TD software on the platform, protecting them from a wide range of software attacks.

Confidential Computing Market Segmentation

By Component Outlook

- Hardware

- Software

- Service

By Deployment Outlook

- On premise

- Cloud

By Enterprise Type Outlook

- SMEs

- Large Enterprises

By Application Outlook

- Privacy & Security

- Blockchain

- Multi-party Computing

- IoT & Edge

- Personal Computing Devices

- Other Applications

By End Use Outlook

- BFSI

- Government & Defense

- Healthcare & Life Sciences

- IT & Telecommunications

- Manufacturing

- Retail & Consumer Goods

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Confidential Computing Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 5.11 billion |

|

Market Size Value in 2024 |

USD 8.33 billion |

|

Revenue Forecast in 2032 |

USD 417.18 billion |

|

CAGR |

63.1% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global confidential computing market size was valued at USD 5.11 billion in 2023 and expected to witness 417.18 billion in 2032.

The global market is expected to register a CAGR of 63.1% during the forecast period, 2023-2032.

The North America confidential computing market accounted for the largest market share in 2023, and is expected to continue its dominance during the forecast period.

The key players in the market are Anjuna Security Inc.; Fortanix; Microsoft; Intel Corporation; IBM; Google; Advanced Micro Devices, Inc.; Alibaba Cloud; Amazon Web Services, Inc.; Arm Limited; Fortanix Inc.; Swisscom; Profian; DECENTRIQ; and NVIDIA Corporation.

In 2023, the software segment dominated the largest market share

The privacy & security category is expected to witness the highest CAGR during the forecast period.