Conducting Polymers Market Share, Size, Trends, Industry Analysis Report, By Type (Electrically Conductive, Thermally Conductive); By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3993

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

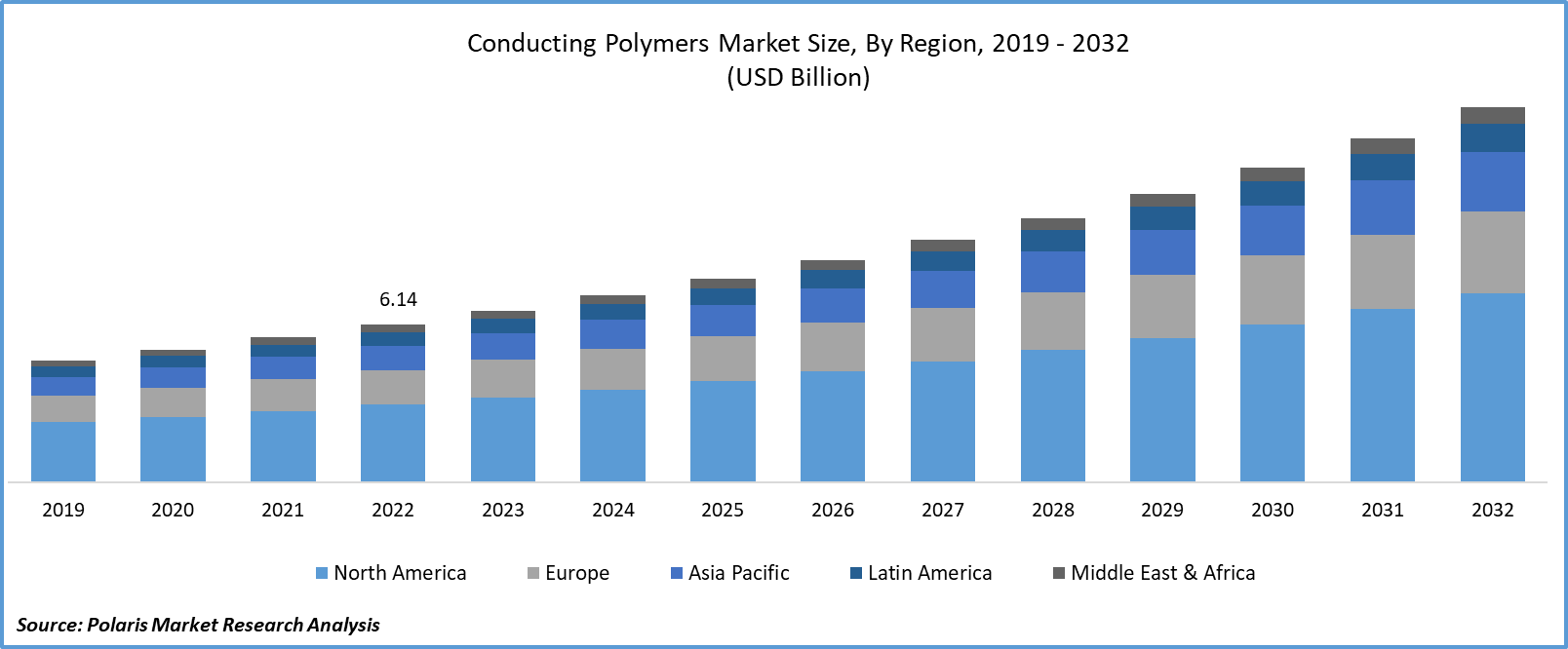

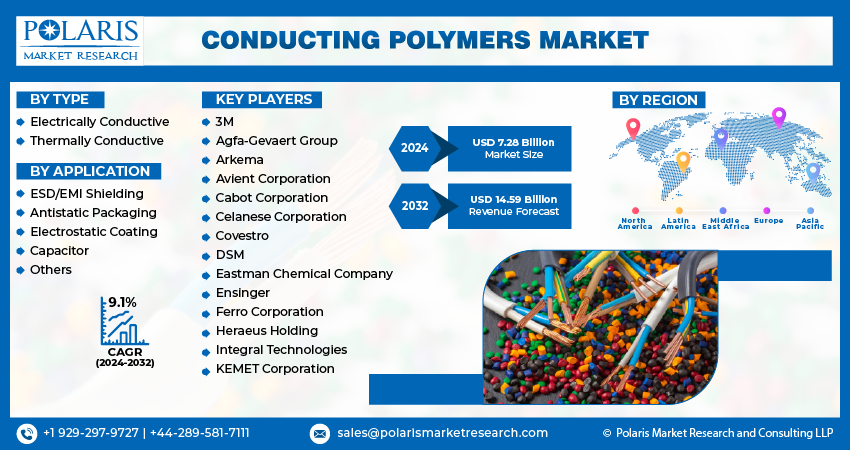

The global conducting polymers market was valued at USD 6.69 billion in 2023 and is expected to grow at a CAGR of 9.10% during the forecast period.

Conducting polymers (CP) are those that can transmit electrical charge, making them suitable for conductor roles. These materials combine the electric charge conduction properties of metal with the advantages of polymers. Conjugated connections, which are crucial for electron mobility, are present in the polymer backbone of all conducting polymers. Undoped polymers can function as insulators or semiconductors, and conductivity increases as contaminating substance concentrations decrease. Researchers are working effectively to find the various applications of conducting polymers and their ability to improve the performance of numerous appliances, fueling their demand in the future.

To Understand More About this Research: Request a Free Sample Report

- For instance, in March 2022, a study review published in Science Direct focused on finding the role of conducting polymers in improving the stability of perovskite solar cells. The use of conducting polymers in the perovskite solar cells as the composites, passivation, & charging transport materials has increased environmental stability & performance.

Moreover, conducting polymers are gaining traction as a replacement for metals due to their lightweight and less corrosive nature. This ongoing shift may further create new growth opportunities for conducting polymers in the coming years. It finds applications in the electronics industry, including conductive inks, printed circuit boards, and organic electronic devices. The miniaturization of electronic components and the demand for flexible electronics are driving the need for advanced conducting polymers.

These polymers are used in supercapacitors and batteries, where their high electrical conductivity and electrochemical properties enhance energy storage and delivery. With the growth of renewable energy sources and electric vehicles, the demand for high-performance energy storage systems is on the rise.

However, the need for more awareness about conducting polymers in industrial settings compared to traditional electricity conductors is hampering the adoption rate in the coming years. Furthermore, the huge cost pertaining to the production of conducting polymers can encourage consumers to drive demand for their substitutes.

Industry Dynamics

Growth Drivers

- The increase in research activities is widening the applications of conducting polymers.

The rising research studies are revealing new applications of conducting polymers, in a way, driving the expansion of the conducting polymers market. The creation and use of renewable energy sources are becoming more and more popular due to the quick depletion of fossil fuels and the rising global energy demand. However, adequate and effective energy storage technologies must be used in conjunction with the current renewable energy generation. A 2023 study review focused on the development of conducting polymer nanocomposites for supercapacitors.

Conducting polymers are used as electrode material in supercapacitors (SC) due to their many benefits, which include simplicity in production, good conductivity, & flexibility. However, using only CP-based electrodes leads to low specific capacitance & poor cycle stability because of their structure and characteristics. They can be enhanced by incorporating them with nanomaterials, including metal oxides & carbon forms. The study focused on recent developments in CPs, including poly-aniline, poly-pyrrole, & poly-thiophene. The ongoing research findings are promoting the use of conducting polymers in various disciplines.

There are many applications for polymeric materials. In energy applications like lithium batteries, ionic-conducting polymers are used. Conducting polymers are used in a variety of applications due to their outstanding electrochemical behavior, robust redox reactivity, efficient wave uptake, and electrical properties. Due to their ability to maintain a metal's receptivity, conducting polymers have drawn significant attention as essential components of corrosion-resistant coatings.

Report Segmentation

The market is primarily segmented based on type, application and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The electrically conductive segment is expected to witness the highest growth during the forecast period.

The electrically conductive segment is expected to witness the highest growth during the forecast period, mainly driven by rising innovations in more efficient electric components. A wide range of electroactive materials known as conducting polymers have been used in energy storage, energy conversion, sensing technologies, and other applications. They exhibit various charge transfer methods. The growing adoption of renewable energy will further create demand for power storage systems, driving demand for conducting polymers in the coming years.

The thermally conductive segment led the industry market with a substantial revenue share in 2022, largely attributable to its lightweight and versatility. Thermally conductive polymer composites, like thermal paste, are used in phones, laptops, and even batteries. Given the expansion of the electronics industry and the anticipated switch to electric vehicles, there will be a need for conductive polymers in the coming years.

By Application Analysis

- The ESD/EMI segment held the largest market share in 2022

In 2022, the ESD/EMI segment held the largest market share. In many different applications, including automotive fuel systems, electronic and electrical packaging and equipment, and other plastic uses, conductive plastics are used to prevent premature failure or damage caused by electrostatic discharge. Furthermore, conducting polymer-based composites, one of the many classes of composite materials created as EMI shielding materials, have attracted particular attention due to their distinctive qualities, including lightweight, processability, environmental stability, long life, durability, and less corrosiveness with tunability. These factors are contributing to the growth of the potential of conducting polymers for the market in the coming years.

The antistatic packaging segment is expected to grow at a significant rate over the next few years on account of its application in the aerospace industry. The development of an active pathway to disperse the accumulated static charges in conducting polymer & nano-composites for aerospace applications is the key goal of antistatic agents. These materials are now preferred for the building of various aircraft components due to their superior mechanical qualities, longevity, recyclable nature, and ability to be lighter than metal, among other factors. Furthermore, antiseptic packaging is highly used in protecting optical devices, including cameras and laser equipment, from damage. Rising demand for antistatic packaging is propelling the growth of the conducting polymer conducting polymers market.

Regional Insights

- North America region held the largest market share in 2022

In 2022, the North American region held the largest share of the global conducting polymers market, attributable to the energy transition towards cleaner energy in the region. According to the National Renewable Energy Laboratory's (NREL) estimation, solar energy could supply 45% of the electricity in the United States by 2050 if the energy system is fully decarbonized.

Photovoltaics (PV) and concentrating solar power are expected to continue growing rapidly, contributing to a reduction in energy costs in the future. With this rapid conversion from non-renewable to renewable energy, there will be a huge demand for conducting polymers as they are used in the manufacturing of solar panels. Furthermore, the growing research activities to improve solar technology with cost-effective and efficient solar panels will drive the need for conducting polymers as electrical components.

The Asia Pacific region witnessed the fastest growth with higher CAGR during the forecast period. The growing automotive industry in the region, primarily in China and India, along with the rapid shift from non-renewable energy resources to electric vehicles, is propelling the demand for the conducting polymer market. According to the International Energy Agency, 5.9 million electric vehicles will be sold in China in 2022, constituting 58% of the new EVs sold in the world. The prevalence of rising demand for electric vehicles may create new growth potential for conducting polymers in the coming years as they are used in power storage devices.

Key Market Players & Competitive Insights

The conducting polymers industry is witnessing a rapid surge in product launches fueled by growing collaborations, partnerships, mergers, and acquisitions among the key market players, attributable to rising concerns about expanding their market presence and increasing product availability to a wider audience.

Some of the major players operating in the global market include:

- 3M

- Agfa-Gevaert Group

- Arkema

- Avient Corporation

- Cabot Corporation

- Celanese Corporation

- Covestro

- DSM

- Eastman Chemical Company

- Ensinger

- Ferro Corporation

- Heraeus Holding

- Integral Technologies

- KEMET Corporation

Recent Developments

- In November 2022, a study published in ACS Publications focused on the development of battery technology. It introduced and assessed a solution-casting method for creating hybrid electrolytes made of surface-functionalized LATP particles and single-ion conducting polymers.

Conducting Polymers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.28 billion |

|

Revenue forecast in 2032 |

USD 14.59 billion |

|

CAGR |

9.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |